Oil Prices Skyrocket Amid Major Libyan Supply Disruptions

Global Oil Markets React to Libyan Production Halts and Rising Geopolitical Risks, Pushing Prices Toward Key Resistance Levels | That's TradingNEWS

Supply Disruptions in Libya: Impact on Oil Markets

Crude oil prices have seen an uptick, reversing the losses of the previous sessions as geopolitical tensions in Libya once again threaten global oil supplies. Libya, a key OPEC member, has been plunged into deeper political turmoil, leading to the shutdown of several crucial oil fields. The eastern government, not recognized internationally, has halted all oil production and exports, significantly impacting the country's output. As of July, Libya was producing approximately 1.18 million barrels per day (bpd), but recent disruptions have slashed this figure by about 700,000 bpd, according to industry estimates.

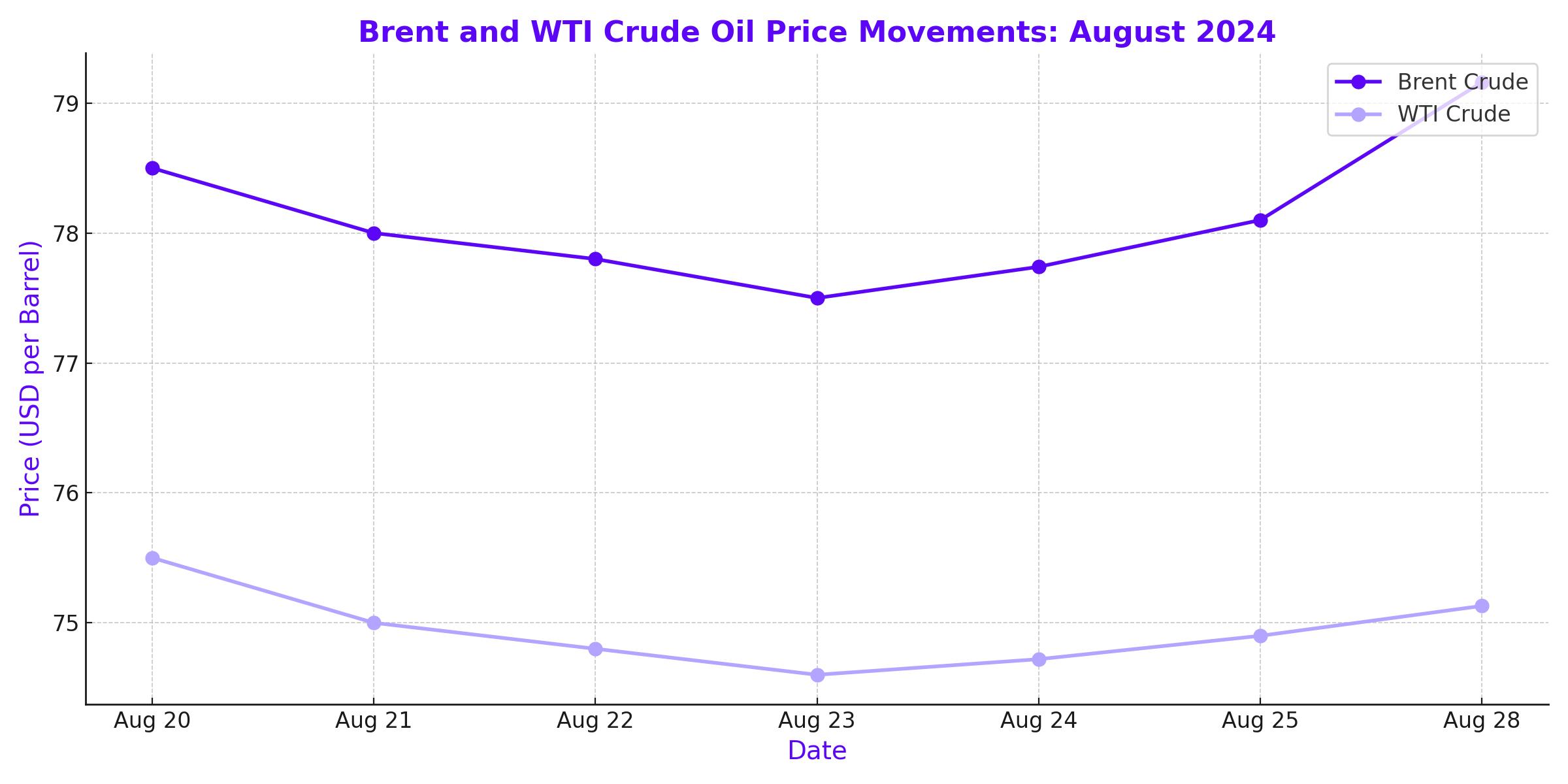

This sharp decline in Libyan output comes at a critical time for global oil markets, which are already grappling with supply concerns. The ongoing political strife in Libya, particularly the battle over control of the Central Bank, has forced the declaration of "force majeure" on the country's oil fields and ports, exacerbating fears of a prolonged supply shortage. This situation has provided some upward pressure on oil prices, with Brent crude futures rising by 0.7% to $79.16 per barrel, and West Texas Intermediate (WTI) climbing 0.8% to $75.13 per barrel as of the latest trading session.

U.S. Crude Inventories and Their Role in Price Movements

Adding to the complex dynamics of the oil market, the latest data from the U.S. Energy Information Administration (EIA) reported a modest draw in crude oil inventories. U.S. crude stocks fell by 846,000 barrels to 425.2 million barrels last week, a figure significantly lower than the anticipated draw of 2.3 million barrels forecasted by analysts. Despite this being the second consecutive weekly draw, the smaller-than-expected reduction failed to provide substantial support for oil prices, reflecting ongoing concerns about demand in key markets.

This inventory data is crucial as it highlights the tepid demand in the U.S., the world's largest oil consumer, which has been struggling with sluggish economic growth. Moreover, the combination of lower-than-expected inventory draws and increasing supply disruptions in Libya presents a mixed outlook for the oil market, where short-term volatility is expected to persist.

China's Economic Slowdown: A Dampener on Oil Demand

The global oil market is also facing headwinds from China, the world's largest oil importer. Recent economic data from China has been disappointing, with weaker-than-expected growth figures triggering concerns about the country's oil demand. This slowdown in Chinese economic activity has weighed heavily on global oil prices, offsetting some of the gains driven by supply concerns.

China's demand for oil is a critical factor for global markets, and any significant downturn in its economy can lead to a reduction in crude imports, further complicating the supply-demand balance. The recent softness in Chinese economic indicators has kept Brent crude prices below the $80 mark, despite supply disruptions in other parts of the world.

Geopolitical Tensions: Russia-Ukraine Conflict Adds to Supply Risks

In addition to the situation in Libya, ongoing geopolitical tensions between Russia and Ukraine continue to pose significant risks to global oil supply chains. The conflict has led to targeted attacks on critical energy infrastructure, further destabilizing the market. Most recently, a Ukrainian drone attack caused a fire at an oil facility in Russia's Kirov region, marking an escalation in the conflict's impact on energy supplies.

These developments have heightened market fears of potential supply disruptions, particularly as Russia remains a major player in global energy markets. The uncertainty surrounding the conflict, combined with the already tense situation in Libya, is likely to keep oil prices volatile in the coming weeks.

Federal Reserve's Monetary Policy: A Key Driver for Oil Prices

The U.S. Federal Reserve's monetary policy also plays a significant role in shaping oil prices. Recent comments from Federal Reserve Bank of Atlanta President Raphael Bostic suggested that the central bank might soon begin cutting interest rates, with inflation showing signs of easing and unemployment rising more than expected. Such a move could support higher oil prices by lowering the cost of capital and boosting economic activity, thereby increasing demand for oil.

However, the potential rate cuts are also a double-edged sword. While they could stimulate demand, they also signal underlying economic weaknesses, particularly in the U.S., which could dampen overall consumption. Traders are closely watching for further economic data, including the upcoming U.S. Gross Domestic Product (GDP) figures and the Personal Consumption Expenditures (PCE) Price Index, which could provide additional clues about the Fed's next steps.

Technical Outlook: Brent and WTI Prices Near Key Levels

From a technical perspective, both Brent and WTI are trading below the critical $80 per barrel level, which has been a significant resistance point in recent sessions. Brent crude has been fluctuating around $77.74 per barrel, while WTI has been hovering near $74.72 per barrel. These prices reflect the ongoing tug-of-war between supply concerns and demand uncertainties.

The immediate resistance for Brent is seen at $80, a level it briefly surpassed following the Libyan government's announcement to suspend oil production. On the downside, support is likely to be found near $75 for Brent and $72 for WTI, levels that could be tested if bearish factors such as weaker demand or higher-than-expected U.S. crude inventories persist.

Market Sentiment and Future Outlook

Investor sentiment in the oil market remains cautious, with traders balancing the bullish supply-side risks against bearish demand-side concerns. The market is currently navigating a complex landscape, where geopolitical tensions, economic data, and central bank policies all play crucial roles in determining the direction of oil prices.

In the short term, oil prices are likely to remain volatile, with potential upside if supply disruptions continue or if the Fed signals more aggressive rate cuts. However, any signs of weakening demand, particularly from major economies like China and the U.S., could quickly reverse the gains and push prices lower.

Should You Buy, Sell, or Hold Oil?

Given the current market environment, the outlook for oil is mixed. Supply disruptions in Libya and ongoing geopolitical tensions provide strong support for prices, suggesting potential upside. However, the demand outlook remains uncertain, particularly with weak economic data from China and the U.S. For investors, it may be prudent to adopt a cautious approach, focusing on short-term trades that capitalize on volatility while keeping a close eye on macroeconomic developments.

In conclusion, while the long-term fundamentals for oil remain robust, the current market dynamics warrant a more nuanced approach. Investors should be prepared for continued volatility and should consider both the risks and opportunities presented by the ongoing geopolitical and economic uncertainties.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex