Oil Prices Slide Amid Rising U.S. Crude Inventories and Rate Concerns

Market Awaits OPEC+ Meeting as Crude Prices Remain Under Pressure | That's TradingNEWS

Oil Prices Decline for Third Straight Session

Crude oil futures have fallen for a third consecutive session, continuing this week's losing streak. West Texas Intermediate (WTI) for July delivery decreased by 62 cents, or 0.79%, to $78.01 a barrel. Brent crude futures for July dropped by 76 cents, or 0.92%, to $81.12 a barrel. Year-to-date, U.S. crude oil has gained 8.8%, while Brent has risen 6.6%.

Rising U.S. Crude Inventories

U.S. commercial crude oil stockpiles saw an unexpected build of 1.8 million barrels last week, according to the Energy Information Administration (EIA). Analysts had expected a decrease of 2.5 million barrels. Gasoline stockpiles fell by 910,000 barrels, exceeding the expected drop of 729,000 barrels. Refinery processing rates increased to 91.7%, up 1.3%, indicating robust operational activity despite the stockpile build.

Impact on Gulf Economies

Oil prices significantly impact Gulf economies, influencing their stock markets. Brent futures fell 1.36% to $81.75 per barrel, leading to declines across several Gulf stock indices. Abu Dhabi’s benchmark stock index dropped 0.4%, with Aldar Properties and Alpha Dhabi Holding falling 2.3% and 2.6%, respectively. Dubai’s index slipped 0.3%, with finance, real estate, and industry sectors all declining. Qatar's index edged lower by 0.1%, led by United Development Co's 1.3% fall and Qatar Navigation's 1.1% decline. Saudi Arabia's market remained mostly flat, with notable movements including Etihad Etisalat and Saudi Electricity both dropping over 2%, while ACWA Power and Savola Group recorded gains.

Anticipating the Federal Reserve's Next Move

Investors are closely watching the Federal Reserve's upcoming policy meeting minutes for clues on the timing of potential rate cuts. Fed officials have indicated that they might wait a few more months before considering rate cuts to ensure inflation is on a downward trajectory. Given that most Gulf currencies are pegged to the dollar, changes in U.S. monetary policy are likely to be mirrored by Saudi Arabia, the UAE, and Qatar, significantly influencing their markets.

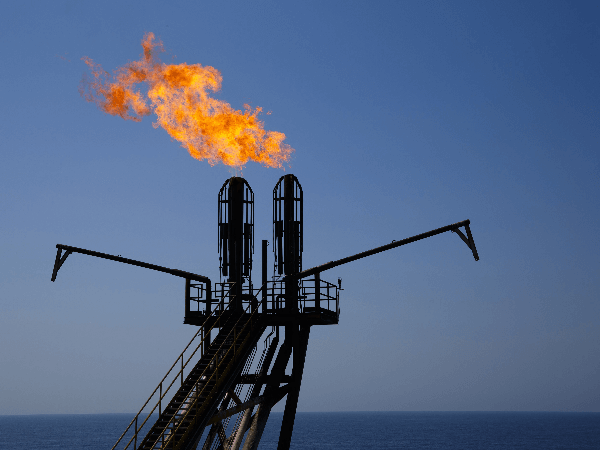

OPEC+ Meeting and Production Policy

OPEC and its allies, led by Russia, are set to hold a crucial meeting to review production policy. The broader OPEC+ coalition, which is currently cutting 2.2 million barrels per day, is likely to extend these cuts to support prices amid the current market softness. Analysts suggest that these production cuts have been instrumental in maintaining oil prices this year.

Geopolitical and Economic Factors

Oil prices are also influenced by broader geopolitical and economic factors. The perception of weakening demand, driven by high interest rates and inflation, continues to weigh on prices. Rising refinery capacity has not been matched by an expected increase in demand, particularly as consumers feel the pressure from inflation and higher interest rates. This sentiment is echoed by analysts like Ole Hansen of Saxo Bank, who noted that the lack of rising demand despite increased capacity is keeping prices in check.

The Role of Interest Rates

Interest rates have become a central focus for analysts when explaining oil price movements. Higher rates, intended to tame inflation, have not been entirely successful, and central banks like the Federal Reserve and the European Central Bank are cautious about cutting rates too soon. Fed Chairman Jerome Powell's recent statements emphasized the need for more progress in reducing inflation, which has put additional pressure on oil prices.

Supply and Demand Dynamics

Despite current market challenges, demand for crude oil is still on a growth path. Rystad Energy's recent report suggests that demand growth remains robust due to the lack of sufficiently developed low-carbon alternatives. The start of the driving season in the northern hemisphere typically increases demand, although this year's increase may be tempered by economic headwinds.

Future Outlook and Potential Rate Cuts

The European Central Bank has hinted at potential rate cuts in the eurozone to avoid a significant slowdown in economic growth. However, the U.S. Federal Reserve appears unlikely to cut rates in the near term, as indicated by Powell's latest comments. This cautious stance on rate cuts suggests that oil prices may remain subdued for longer than previously expected.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex