Oil Prices Slip Below $70 as OPEC+ Sparks Uncertainty

WTI steadies at $68.65 while geopolitical risks and OPEC+ production cuts leave markets on edge | That's TradingNEWS

Crude Oil Prices Face Uncertainty Amid OPEC+ Decisions and Geopolitical Shifts

Oil Prices and Recent Movements

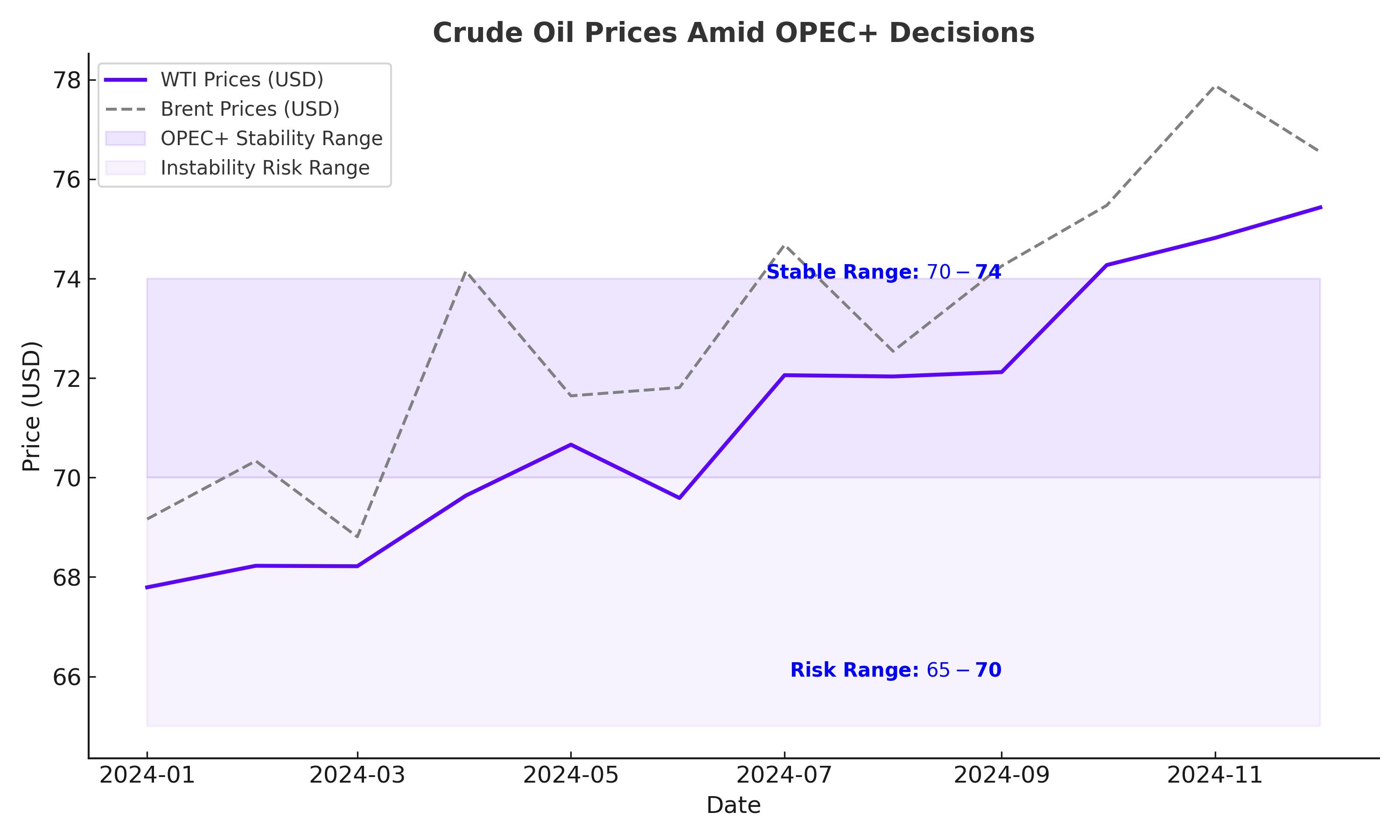

Crude oil prices continue to experience fluctuations, with West Texas Intermediate (WTI) trading at $68.65 per barrel and Brent crude hovering around $72.70. A mix of geopolitical developments, inventory data, and OPEC+ policy uncertainty has contributed to this volatility. U.S. crude oil stocks fell by 1.844 million barrels last week, surpassing market expectations of a 1.3 million barrel draw. However, a significant build in gasoline inventories, up by 3.3 million barrels, has tempered optimism about a tight supply-demand balance.

OPEC+ Policy Challenges and Market Impact

OPEC+ remains the critical driver of oil market sentiment. The group has repeatedly delayed supply increases, with the next meeting rescheduled to December 5. The alliance faces pressure to maintain production cuts amid weak prices and demand concerns. Saudi Arabia has hinted at extending cuts into April 2025, a longer timeline than initially anticipated. Analysts suggest that any premature production hike could exacerbate oversupply, especially with Brent crude prices consistently struggling to break above $75 per barrel.

OPEC+ producers Iraq, Russia, and Saudi Arabia recently emphasized the need for price stability in a Baghdad meeting. With Brent crude trading $20 below the $95 target often associated with OPEC+ aspirations, member states are finding it challenging to balance market conditions and fiscal needs.

Geopolitical Dynamics Shaping Oil Markets

Geopolitical developments remain pivotal for oil prices. The ceasefire agreement between Israel and Lebanon's Hezbollah has removed some geopolitical risk premium from prices. However, market participants remain cautious about its longevity. At the same time, the conflict in Ukraine and U.S. sanctions on Iran continue to influence supply dynamics. Iran's potential to add up to 1 million barrels per day to global markets if sanctions are eased adds an element of uncertainty to the supply outlook.

Demand Weakness in Asia and Global Implications

Asia, the world’s largest crude oil-importing region, has shown disappointing demand trends. Data from LSEG Oil Research indicates that Asian crude imports in 2024 are on track to decline compared to 2023, with an average of 26.52 million barrels per day, down 370,000 barrels per day year-on-year. China, a key driver of global oil demand, has reduced its growth outlook, with OPEC slashing its forecast for Chinese demand growth in 2024 to 450,000 barrels per day. The shift in demand patterns has pressured prices further, as private refiners in China, the so-called teapots, diversify their sourcing amid narrowing discounts on Iranian crude.

Institutional Forecasts and Long-Term Perspectives

Goldman Sachs has revised its projections, suggesting OPEC+ production cuts will likely extend until April 2025 to counter weak prices. The bank remains optimistic about a gradual recovery in oil prices once global inventories stabilize. Meanwhile, ING analysts highlight the challenge of maintaining current price levels given subdued demand and potential oversupply risks.

U.S. Economic Signals and Oil Demand

The latest economic data from the U.S. indicates slowing progress in curbing inflation, which has affected expectations for Federal Reserve rate cuts. A slower pace of rate reductions could sustain higher borrowing costs, potentially dampening economic activity and, consequently, oil demand. With markets now pricing in a 66.5% chance of a quarter-point rate cut by December, the economic backdrop adds another layer of complexity for oil traders.

China’s Role in Shaping Market Sentiment

China remains a focal point for oil demand. November saw a rebound in Chinese crude imports, primarily driven by low prices rather than a surge in demand. Private refiners have increasingly turned to West Africa and the Middle East for supplies, reflecting adjustments in trade dynamics. However, over the broader January-November period, Chinese imports show a decline, aligning with OPEC’s reduced growth forecasts for the region.

Conclusion: Oil Markets in Transition

Crude oil markets are navigating a complex landscape marked by geopolitical developments, OPEC+ strategies, and evolving demand patterns. While the recent inventory draw in the U.S. has offered some support, the broader outlook remains uncertain. Key factors such as Asia’s demand trajectory, OPEC+ policy decisions, and geopolitical stability will continue to shape oil prices in the coming months. Whether prices can sustain a recovery above current levels will depend on the delicate balance between supply adjustments and demand recovery across key global markets.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex