OIL Prices Poised for Volatility Amid Global Supply Disruptions and Demand Concerns

U.S. Production Halts Fuel Oil Price Spike

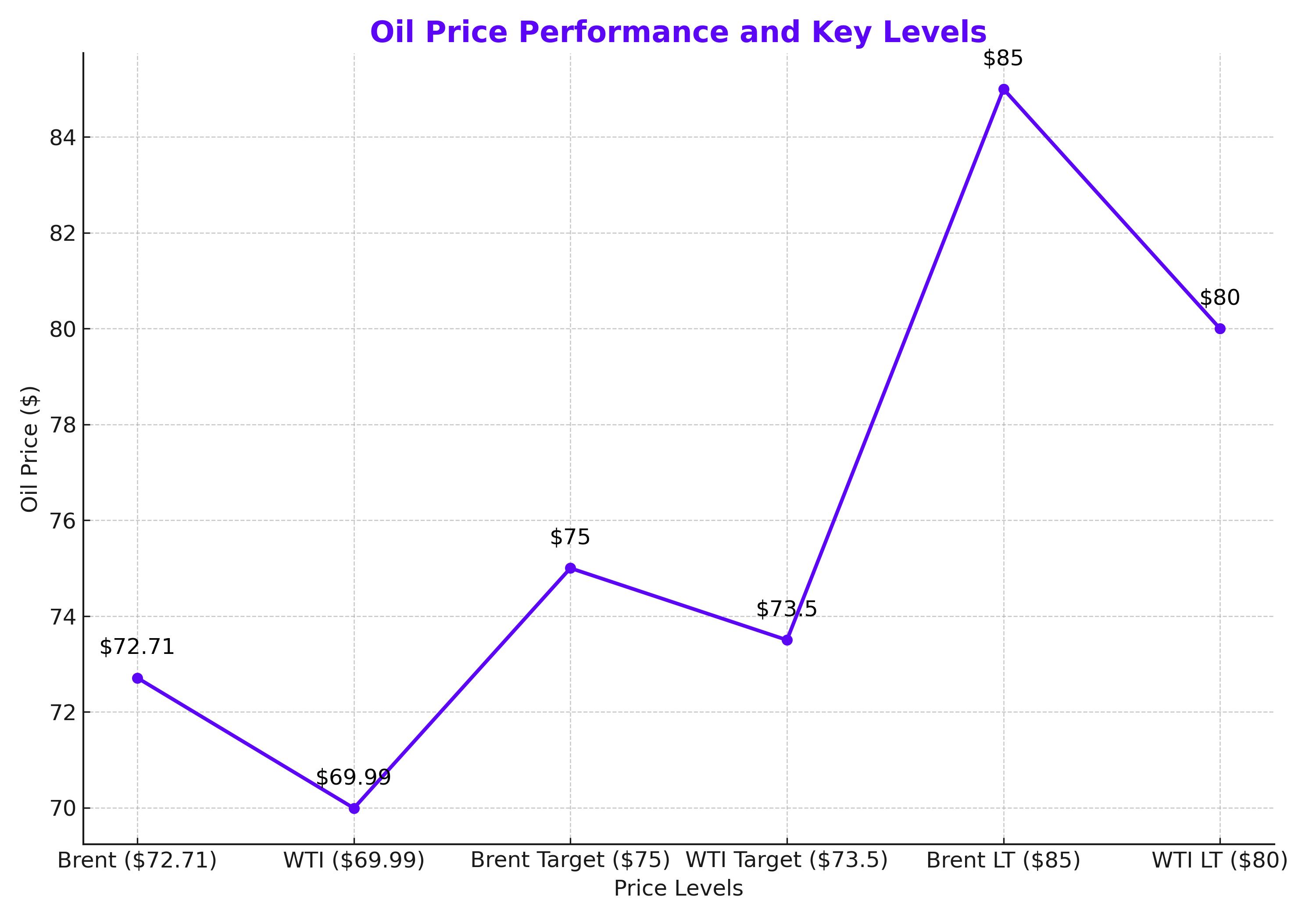

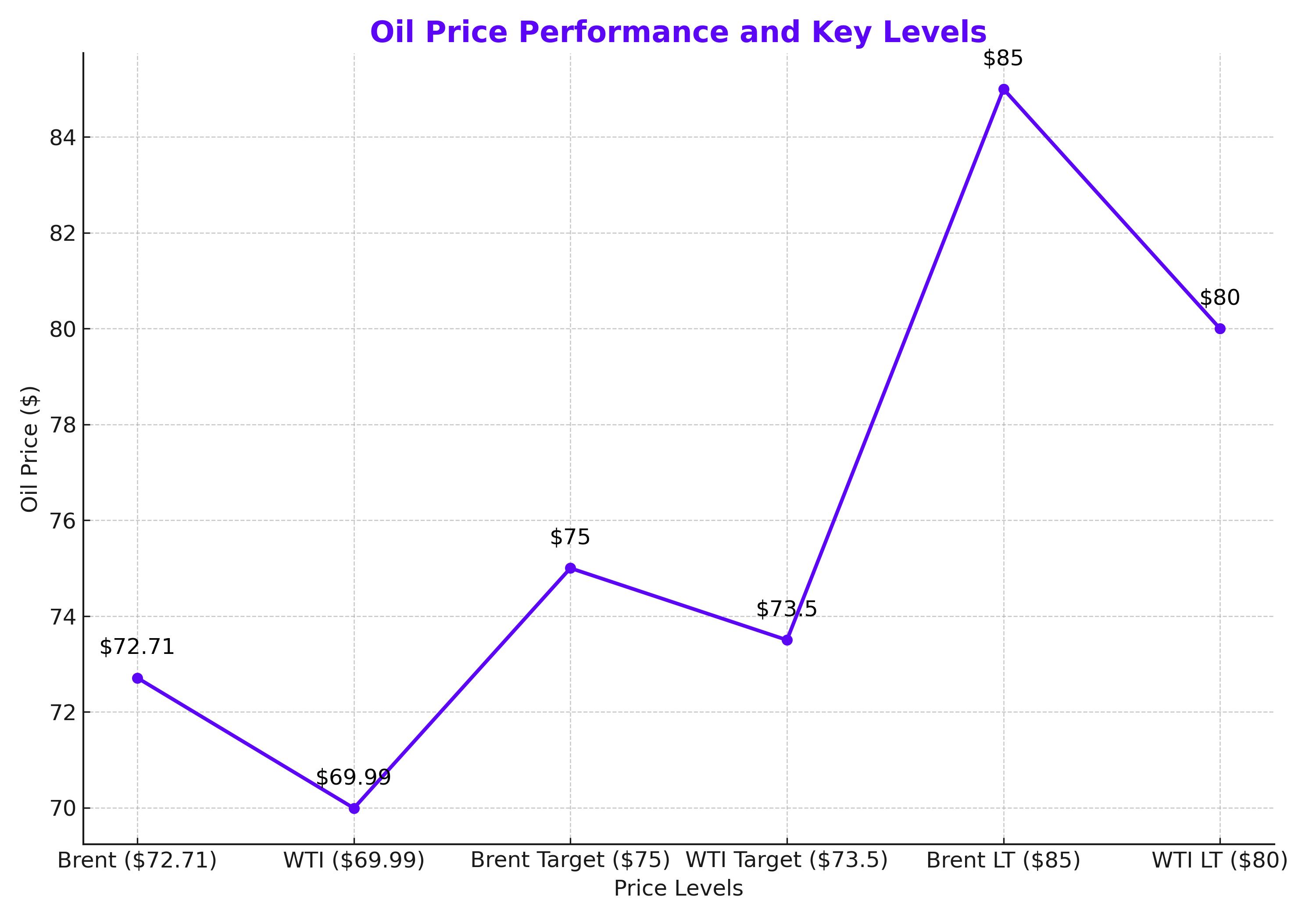

Oil prices experienced a sharp rally following significant disruptions in the U.S. Gulf of Mexico due to Hurricane Francine. Brent crude futures rose 1%, hitting $72.71 per barrel, while West Texas Intermediate (WTI) surged 1.5%, closing at $69.99 per barrel. This marked a weekly increase of 2.4% for Brent and 3.4% for WTI, driven largely by the shutdown of approximately 42% of Gulf production, equating to roughly 730,000 barrels per day. UBS analysts, however, estimate the total impact to be closer to 1.5 million barrels per day, adding to the bullish momentum.

The disruptions were further exacerbated by supply issues in Libya, contributing to a tighter global oil market. Analysts from UBS emphasized that these supply cuts are likely to support prices in the near term. Yet, the market remains cautious, with concerns that production delays may be short-lived, potentially reversing gains once operations resume.

Global Demand Weakness Weighs on Long-Term Outlook

While short-term supply disruptions have temporarily boosted prices, the longer-term outlook for oil remains clouded by concerns over weakening global demand, particularly from China. The International Energy Agency (IEA) recently revised down its global oil demand growth forecast by 70,000 barrels per day to 900,000 barrels per day, citing softer-than-expected economic activity in China. This revision follows a similar downward adjustment by OPEC earlier this week, further dampening sentiment in the market.

China, one of the largest consumers of crude oil, saw a 7% year-over-year decline in imports in August, exacerbating fears of slowing demand. These concerns were echoed by Commonwealth Bank of Australia analyst Vivek Dhar, who noted that weaker Chinese demand, combined with OPEC+’s strategy to defend market share, could weigh heavily on oil prices moving forward.

Hurricane Francine's Impact and the Potential for Short-Term Gains

Despite the bearish demand outlook, the short-term market dynamics present a more bullish picture. Oil prices found support as traders priced in the disruptions caused by Hurricane Francine, which temporarily halted significant production in the Gulf of Mexico. As of Thursday, nearly half of the region’s oil production remained offline, supporting higher prices. However, the extent of the damage and the time required for producers to resume full operations will play a critical role in determining whether these gains hold.

UBS analyst Giovanni Staunovo noted that while production delays are bolstering prices now, the recovery of Gulf output could reverse these gains if disruptions are resolved quickly. Nonetheless, the short-term supply cuts have provided a much-needed breather for oil prices, which had faced a three-week losing streak prior to the storm.

Saudi Arabia's Influence on OPEC+ Strategy

On the supply side, OPEC+ continues to play a pivotal role in balancing the market. Saudi Arabia, a key member of the cartel, remains committed to managing production levels to prevent a significant price decline. However, with non-OPEC producers such as Brazil, Canada, and the U.S. increasing output, OPEC+ faces the challenge of maintaining market share without exacerbating the oversupply issue.

Saudi Arabia recently reduced its official selling price (OSP) for Asian buyers to a near three-year low, signaling potential challenges in demand from the region. This move highlights the delicate balancing act that OPEC+ must perform to stabilize the market. The coalition may need to implement deeper production cuts in the coming months to prevent further price declines, though this strategy risks internal disagreements and compliance issues among member nations.

Australia's Push for Green Hydrogen and the Impact on Global Energy Markets

While traditional oil markets grapple with supply and demand challenges, Australia is positioning itself as a leader in the transition to cleaner energy. The Australian government unveiled its National Hydrogen Strategy, outlining plans to invest up to $15 billion over the next decade to become a global green hydrogen superpower. This initiative includes a $5.4 billion allocation in this year’s Federal Budget to support the green Hydrogen Production Tax Incentive program and the expanded Hydrogen Headstart program.

Australia’s hydrogen strategy aims to unlock $33.6 billion in private sector investment by 2030, with the country’s production capacity expected to exceed 1 million tons of green hydrogen annually by the end of the decade. By 2050, the government anticipates production could reach 15 million tons annually. Australia’s focus on hydrogen aligns with the global push for cleaner energy sources and offers a glimpse into the future of energy markets beyond oil.

The Path Ahead for Oil Prices: Risk of Further Decline?

Despite the recent rally, the broader outlook for oil prices remains bearish. A confluence of factors, including weaker demand growth, oversupply concerns, and macroeconomic headwinds, points to further downside risks for crude prices. The IEA, OPEC, and the U.S. Energy Information Administration (EIA) have all revised their global demand forecasts downward for 2024 and 2025, signaling a shift in sentiment from earlier, more optimistic projections.

Additionally, major Wall Street banks, including Goldman Sachs and Morgan Stanley, have lowered their Brent crude price targets for the coming months. Analysts at BCA Research warn that the worst may not be over for oil, citing the potential for a further decline in prices over the next six to nine months.

While the possibility of a short-term rally exists, driven by technical factors and supply disruptions, the absence of strong fundamental demand growth suggests that any price recovery will likely be temporary. Historically, oil prices tend to weaken during the fourth quarter as demand declines following the summer driving season, and refineries undergo maintenance, leading to a buildup in crude inventories.

Fed Rate Cuts and Their Impact on Oil Prices

Another factor influencing the oil market is the U.S. Federal Reserve's monetary policy. There is growing speculation that the Fed may start cutting interest rates at its next meeting in September, providing further support for oil prices. Lower interest rates typically weaken the U.S. dollar, making dollar-denominated commodities such as oil cheaper for holders of other currencies.

However, some analysts caution that an aggressive rate-cutting cycle could signal deeper concerns about the health of the global economy. If the Fed’s rate cuts are perceived as a response to slowing economic growth, oil demand could decline further, placing additional downward pressure on prices.

Conclusion: Oil's Uncertain Future Amid Mixed Signals

The oil market is at a crossroads, facing both short-term bullish factors, such as supply disruptions, and longer-term bearish pressures, including weakening demand and oversupply concerns. While Hurricane Francine has provided a temporary boost to prices, the broader outlook remains uncertain, with key indicators suggesting that the market may face further declines in the months ahead.

OPEC+ will play a crucial role in shaping the future of oil prices, with Saudi Arabia and its allies likely to continue managing production levels to prevent a significant price collapse. However, the group will need to navigate internal challenges and external competition from non-OPEC producers to maintain its influence over the market.

In the near term, traders should keep a close eye on production developments in the Gulf of Mexico and the outcome of the Federal Reserve’s upcoming meeting, both of which could have a significant impact on oil prices. Ultimately, the path forward for oil remains fraught with uncertainty, and investors should prepare for continued volatility in the months to come.

That's TradingNEWS