Oil Prices Struggle as Global Demand Weakens and Geopolitical Tensions Simmer

Brent and WTI Navigate Economic Slowdowns, OPEC+ Decisions, and Federal Reserve Signals | That's TradingNEWS

Economic Indicators Weigh Heavily on Oil Prices

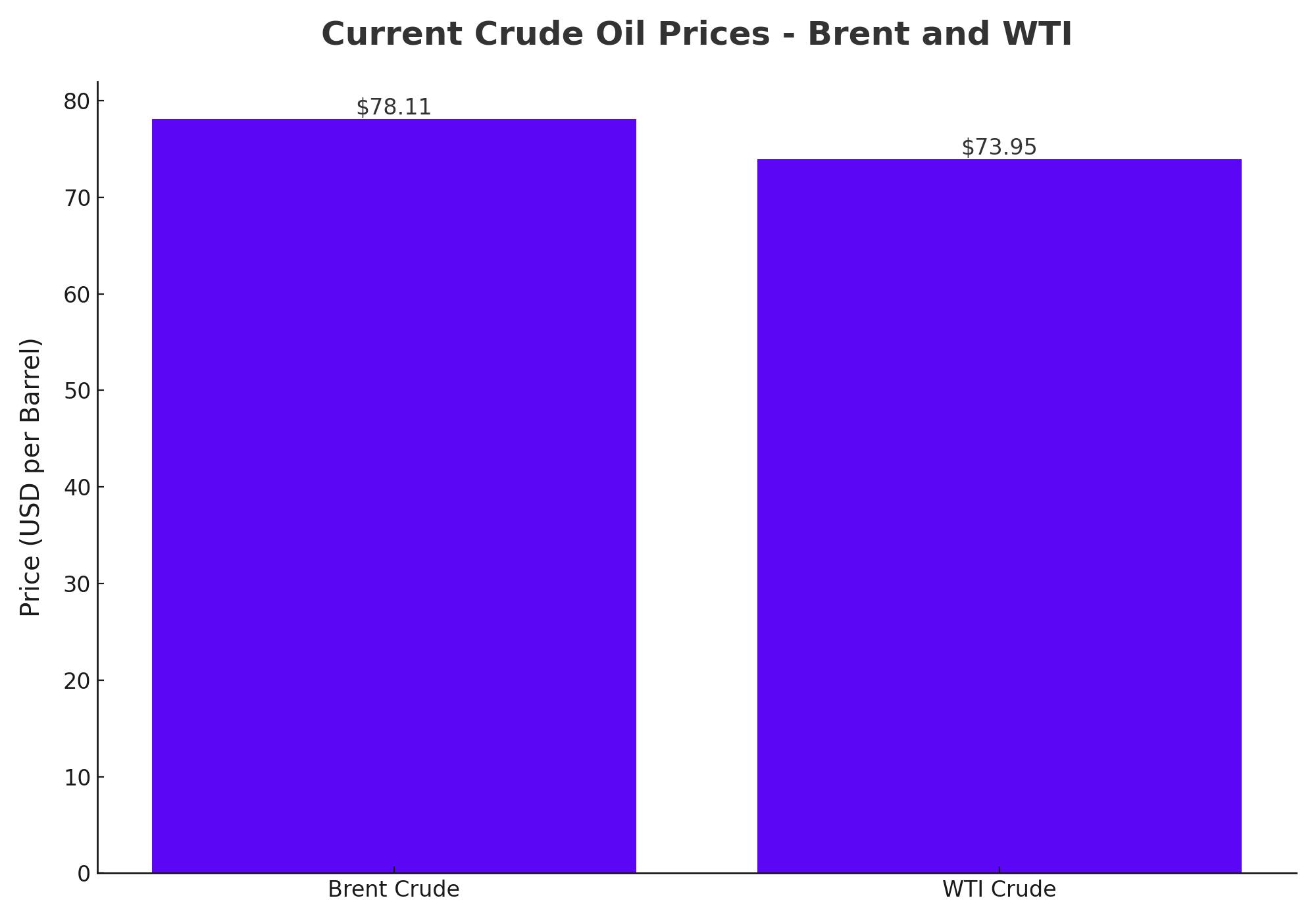

Crude oil markets are currently under significant pressure as a confluence of economic indicators continues to paint a bleak picture for global demand. Brent crude and West Texas Intermediate (WTI) have both experienced downward trends, with Brent crude hovering around $78.11 per barrel and WTI trading at approximately $73.95 per barrel as of the latest session. This marks a decline of around 2% and 2.1% for the week, respectively, a continuation of a bearish trend driven by disappointing economic data from major markets such as the U.S., Europe, and China.

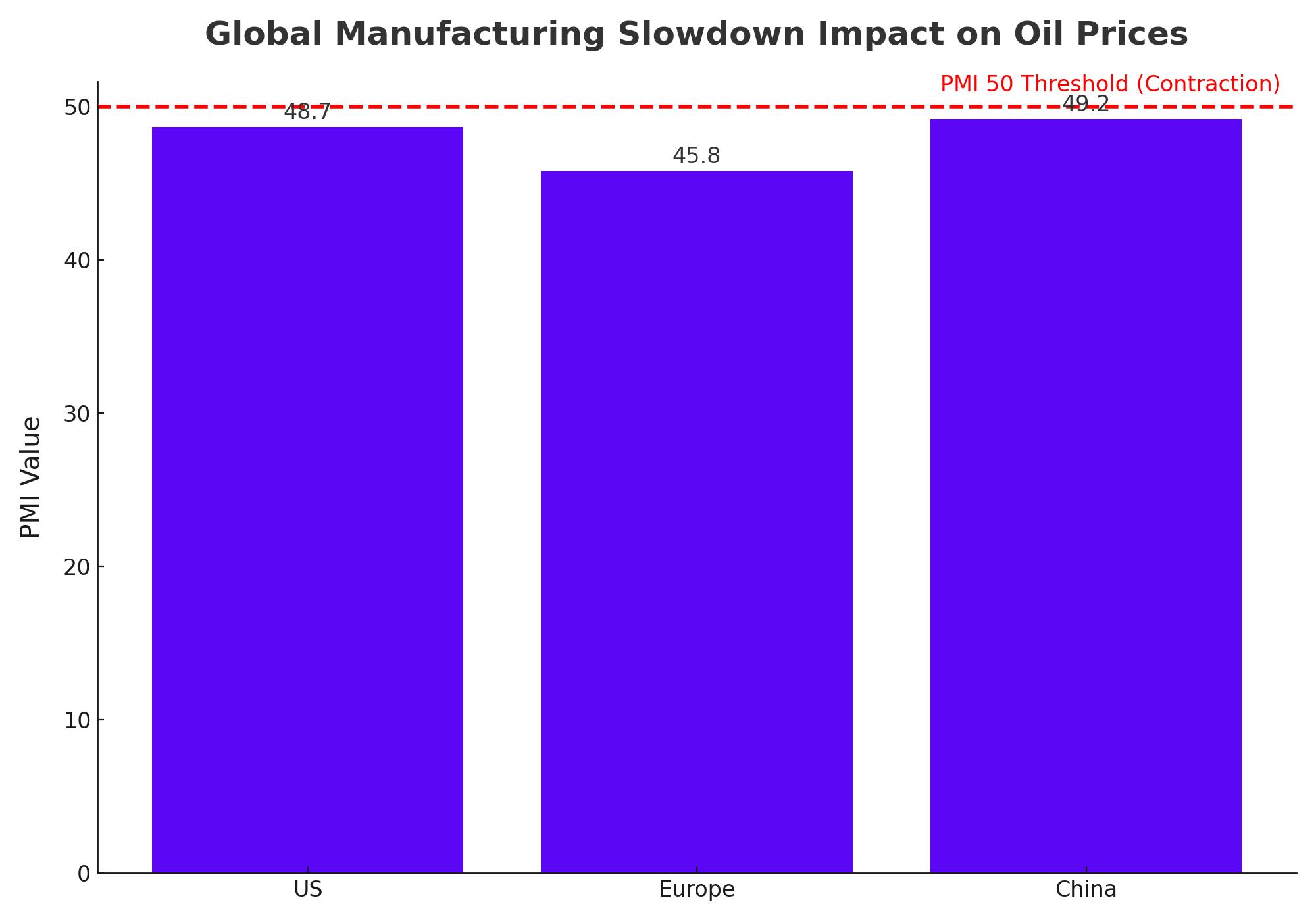

Impact of Global Manufacturing Slowdown

Recent manufacturing data from key regions has exacerbated concerns over oil demand. The U.S. Purchasing Managers’ Index (PMI) for July reached its lowest point in eight months, signaling a significant slowdown in economic activity. Similarly, Europe’s PMI extended its contraction trend to two years, while China’s PMI dropped below the critical 50 threshold, indicating a contraction in the manufacturing sector. This slowdown directly translates to lower demand for energy, particularly crude oil, as industrial activity wanes.

Revised U.S. Employment Data Adds to Bearish Sentiment

In addition to weak manufacturing data, the U.S. Labor Department recently revised its employment figures, revealing that the number of new jobs added over the past year was over 800,000 fewer than initially reported. This revision has fueled concerns about the robustness of the U.S. economy, which is the world’s largest consumer of oil. The combination of disappointing employment data and sluggish industrial activity has contributed to a pessimistic outlook for oil demand, further pressuring prices.

OPEC+ and Market Reactions

OPEC+ has found itself in a challenging position as the group’s previous plans to gradually increase oil supply in the fourth quarter may need to be reconsidered. With current market conditions, analysts from ING and other institutions suggest that OPEC+ may have to scrap these plans to prevent further downward pressure on prices. The market has already priced in some of these potential adjustments, but any official announcements from OPEC+ could lead to increased volatility in oil prices.

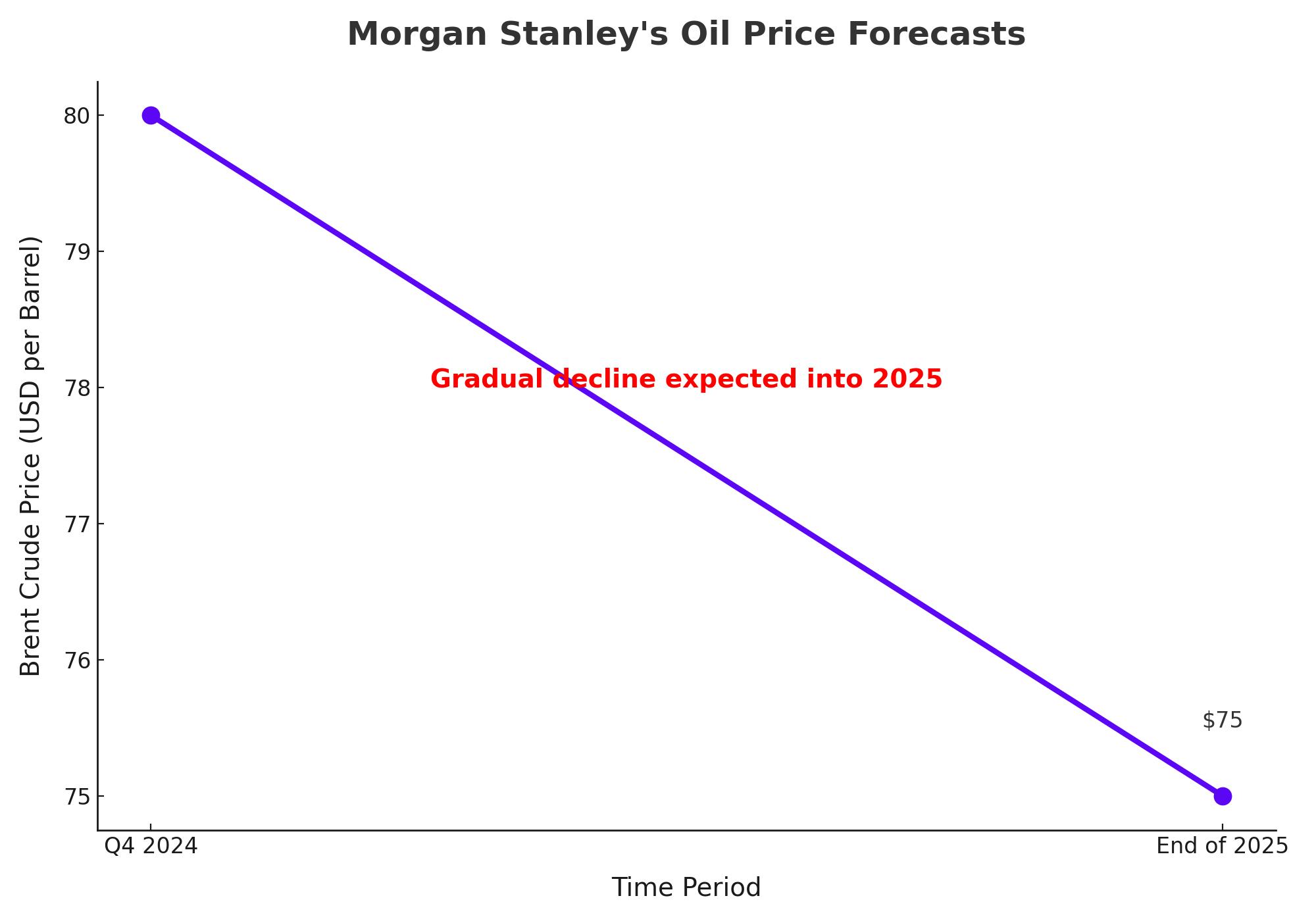

Morgan Stanley’s Outlook on Oil Prices

Morgan Stanley has revised its oil price forecasts downward, reflecting the market’s anticipation of additional supply from OPEC+ and other non-OPEC producers amidst weakening demand. The firm now expects Brent crude to trade at around $80 per barrel in the fourth quarter of this year, down from its previous estimate of $85. Looking further ahead, Morgan Stanley anticipates a gradual decline to $75 per barrel by the end of next year.

The lower demand growth outlook is particularly tied to China’s economic performance, where a sharp increase in sales of LNG-powered trucks, rising electric vehicle adoption, and slower petrochemical feedstock demand have all contributed to a less optimistic forecast for oil consumption.

War Premium and Geopolitical Risks

Despite the bearish market sentiment, the geopolitical risk premium remains a factor supporting oil prices. The ongoing conflict in Gaza and the challenges surrounding ceasefire negotiations continue to inject uncertainty into the market. Israel’s insistence on keeping troops in Gaza post-ceasefire has complicated discussions, which has prevented any meaningful de-escalation. This geopolitical uncertainty provides some support to oil prices, preventing them from falling further in the face of weak demand data.

Future Market Drivers and Federal Reserve Influence

The broader market’s attention is also focused on the upcoming speech by Federal Reserve Chair Jerome Powell at the Jackson Hole Symposium. Traders are closely watching for any hints on the Fed’s future policy direction, particularly regarding interest rate cuts. Market expectations are already skewed towards a 25 basis point cut in September, with a smaller possibility of a 50 basis point reduction. The outcome of this speech could have significant implications for risk assets, including oil, as rate cuts generally lead to increased liquidity and higher demand for commodities.

Renewable Energy and Oil Alternatives

In parallel to the dynamics of traditional oil markets, the focus on sustainable alternatives is intensifying. For instance, BP’s recent acquisition of a 15% stake in a Chinese sustainable aviation fuel (SAF) developer highlights the ongoing shift towards greener energy solutions. This investment reflects broader industry trends, where major oil companies are diversifying their portfolios to include biofuels and SAFs, despite the current challenges in scaling production. The International Energy Agency (IEA) has emphasized the need for significant investment in SAF production to meet climate goals, a sentiment echoed by industry stakeholders.

Market Implications and Strategic Considerations

Given the current landscape, the oil market faces a delicate balance between supply-side adjustments from OPEC+ and demand-side pressures from global economic slowdowns. Traders and investors should remain vigilant as the market navigates these complex factors, with potential volatility on the horizon. Whether OPEC+ decides to adjust its supply strategy or the Federal Reserve signals a more aggressive rate cut, these developments will likely shape the future direction of oil prices.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex