Oil Prices Surge as Fed Slashes Rates – But Geopolitical Risks and Demand Fears Cloud the Horizon

With Middle East tensions escalating and economic uncertainty looming, the oil market sees volatile gains fueled by global supply concerns and weakening demand from China | That's TradingNEWS

Oil Prices Under Pressure: Volatility Amid Fed Rate Cuts and Geopolitical Tensions

Fed’s Jumbo Rate Cut and Chinese Demand Concerns Drive Oil Prices

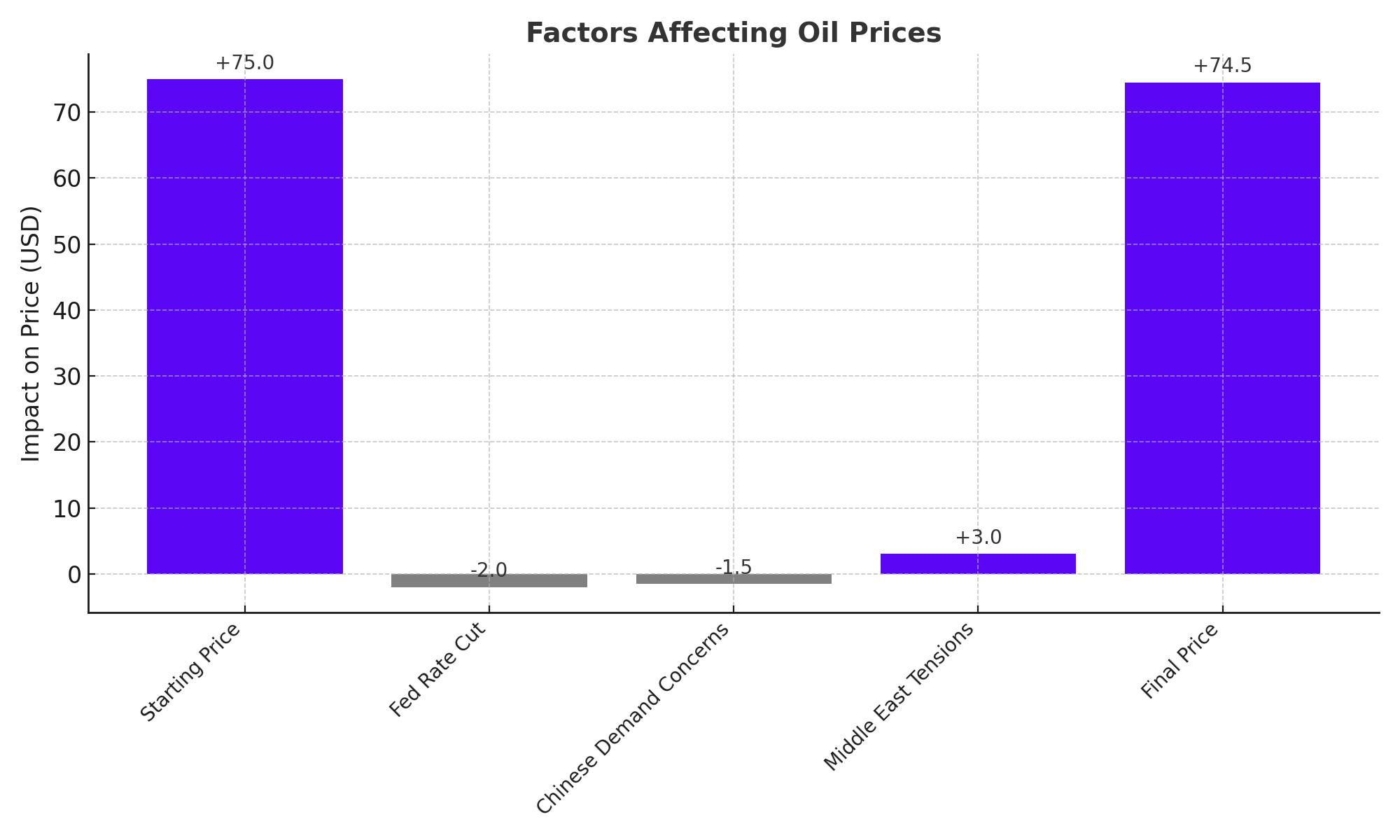

Crude oil prices saw a volatile start this week, with Brent and West Texas Intermediate (WTI) spiking initially before easing back. The recent price action follows a string of macroeconomic events, notably the Federal Reserve's decision to cut interest rates by 0.50%. This marked the steepest cut since April and sparked renewed optimism in the oil markets. Additionally, Beijing’s commitment to stimulus efforts has provided some support to crude, although concerns over Chinese demand linger, especially with the country's economic indicators still soft.

Despite these initial gains, traders remain cautious. The effectiveness of China’s stimulus on oil demand is still questioned, and European refiners have reportedly cut run rates due to low margins, exacerbating the uncertainty. Brent crude has risen 9% since hitting a three-year low earlier this month, trading at $74.69 per barrel as of September 20. However, market participants remain wary of prolonged sluggish demand.

Middle East Tensions Add to Crude Oil Price Movements

Geopolitical tensions in the Middle East have resurfaced, adding another layer of complexity to the oil price narrative. The exchange of missile strikes between Israel and Hezbollah has heightened concerns of a broader regional conflict, potentially disrupting supply lines in one of the world’s most critical energy-producing regions. Oil markets have been somewhat resilient, with price gains more measured this time, suggesting that the potential impact on oil supplies has not yet fully materialized.

In the past, such tensions would have caused a sharper spike in prices, but analysts believe that the conflict’s protracted nature and limited disruptions thus far are keeping gains in check. Still, the situation remains fluid, and oil could see further support if the conflict intensifies.

Impact of Crude Price Decline on India and Global Oil Demand

The recent slide in oil prices, with Brent crude falling below $70 per barrel earlier in September, brought relief to major importers like India. India, which imports over 85% of its crude oil, is set to benefit from lower prices as it helps reduce the country’s massive import bill, which totaled $180 billion in FY24. This relief could ease the pressure on the rupee and assist in managing inflationary pressures in the domestic economy.

However, for Indian consumers to truly benefit, the central and state governments would need to pass on the lower oil prices in the form of reduced fuel taxes. Whether this will happen remains uncertain, particularly with upcoming elections in key states like Maharashtra and Haryana.

China’s Slowdown and Its Impact on Global Oil Demand

One of the largest drivers of crude oil demand is China, the world’s second-biggest consumer of oil. Recent economic data from China has been disappointing, raising concerns of a broader economic slowdown. Chinese exports grew by only 7% in July, significantly lower than expected, and oil imports have declined for the first time in two decades. This, combined with China’s rapid adoption of electric vehicles (EVs), has tempered expectations for strong oil demand growth from the country.

In 2023, one in five cars sold globally was electric, with China accounting for nearly 60% of new EV registrations. As the world transitions to renewable energy, oil demand is expected to face additional headwinds, particularly from the transportation sector. The International Energy Agency (IEA) reports that 14 million EVs were sold last year, and the trend shows no signs of slowing down.

US Economic Data and Its Influence on Oil Prices

Meanwhile, in the U.S., the economy continues to send mixed signals, putting additional downward pressure on oil prices. Non-farm employment grew by 142,000 in August, but the manufacturing sector has now contracted for seven consecutive months. The recent rate cut by the Federal Reserve could provide some temporary relief to oil markets, as it weakens the dollar and supports higher prices for dollar-denominated commodities like crude.

However, the sustainability of these price gains remains uncertain. ING commodity analysts have cautioned that the market may enter a holding pattern, consolidating recent gains before resuming its downward trajectory.

OPEC Supply Cuts and Market Sentiment

The Organization of Petroleum Exporting Countries (OPEC) has also contributed to the current oil price dynamics. Earlier this year, OPEC revised down its oil demand forecast for 2024 and 2025, reducing the expected increase in demand by roughly 80,000 barrels per day. While this may seem like a small adjustment, the market reacted sharply, pushing prices below $70 per barrel. The cuts were implemented to help stabilize prices, but with global demand looking increasingly fragile, it remains to be seen whether these measures will have their desired effect.

Outlook for Crude Oil and Energy Transition

Looking ahead, the future of oil demand appears increasingly uncertain, particularly as the energy transition gains momentum. According to India’s petroleum minister Hardeep Puri, India is expected to drive 35% of the growth in global energy demand over the next two decades. While this is a significant figure, India is also keen on ensuring a successful energy transition, balancing its dependence on fossil fuels with green energy initiatives.

On the supply side, companies like Shell have been closely monitoring potential disruptions in their operations. Shell recently announced the evacuation of personnel from its Gulf of Mexico platforms as a precautionary measure against Tropical Disturbance 35, highlighting the persistent risks faced by energy producers from natural events.

Buy, Sell, or Hold: The Verdict on Crude Oil

With so many variables in play—from geopolitical tensions to economic uncertainties—investors are faced with a challenging decision on whether to buy, sell, or hold oil stocks. The recent price rally, driven by the Fed’s jumbo rate cut and the stimulus hopes from China, may provide a temporary lift to prices. However, underlying demand concerns from key markets like China and Europe continue to cast a shadow over long-term prospects.

For now, oil prices are expected to remain volatile, with potential upside if the Middle East situation worsens. On the downside, a global economic slowdown or further growth in EV adoption could dampen demand significantly, making crude oil a cautious hold at best.

Investors should continue to monitor key economic data and geopolitical developments, as the path forward for crude remains as uncertain as ever.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex