Oil Prices Surge as Israel-Iran Tensions Escalate: Global Supply Risks and 150$ Per Barrel Forecast

Rising Middle East conflict could disrupt global oil supply, pushing prices higher. Experts warn of potential market volatility and economic consequences if key infrastructures are targeted | That's TradingNEWS

Oil Price Outlook Amid Escalating Geopolitical Risks and Economic Uncertainty

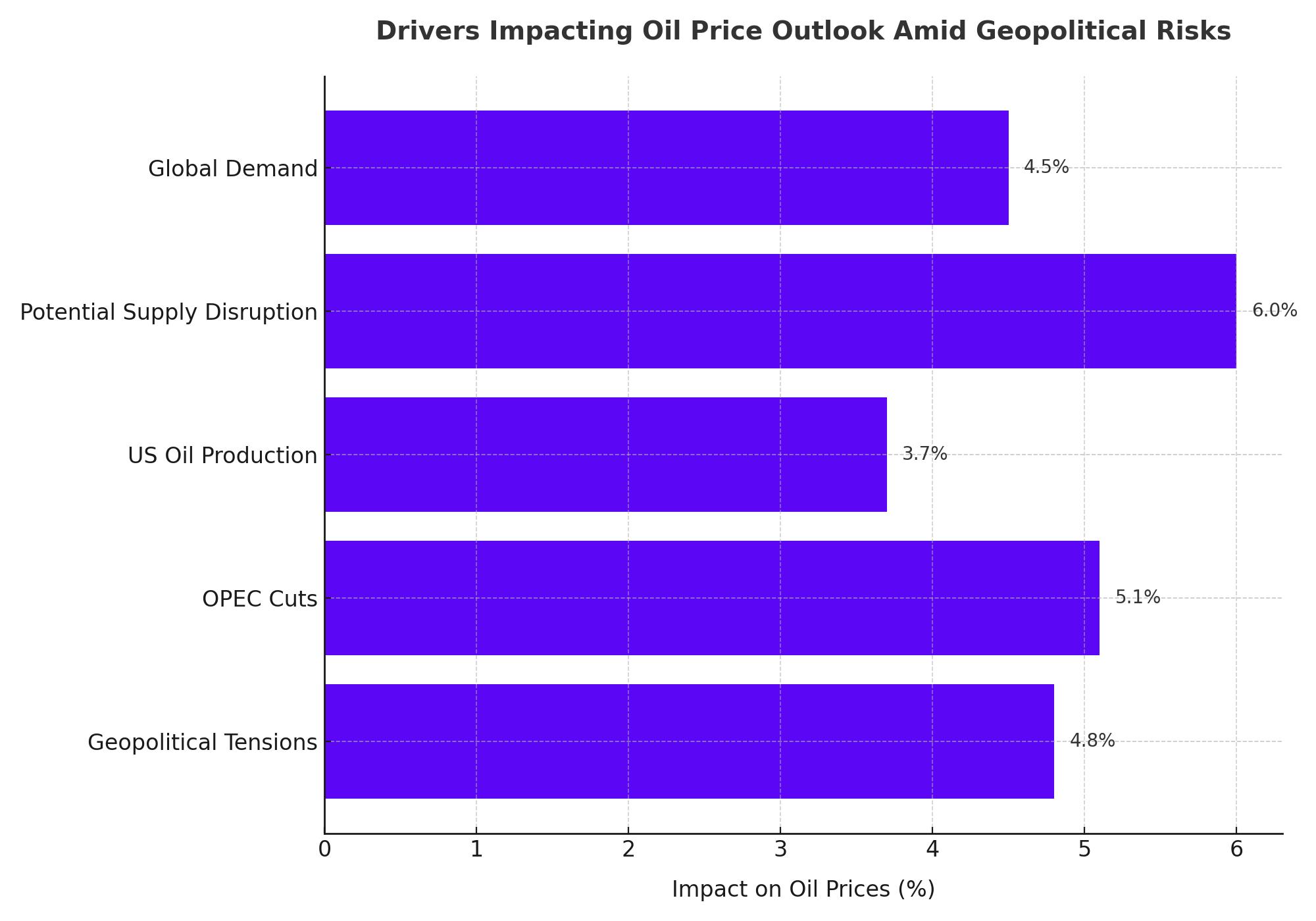

As tensions between Israel and Iran continue to escalate, the global oil market has seen significant shifts, with traders and investors reacting to heightened geopolitical risks. The price of Brent crude surged by 4.8% to $77.4 per barrel for November delivery, while West Texas Intermediate (WTI) crude increased by 5.1% to $73.6 per barrel on October 3, 2024. These price movements reflect the growing uncertainty surrounding oil supply, particularly in the context of potential disruptions in the Middle East—a region that is pivotal to global energy security.

Geopolitical Tensions in the Middle East

The conflict between Israel and Iran has intensified following missile strikes and retaliations from both sides. Tehran's missile barrage in response to Israeli attacks in Gaza and Lebanon has raised concerns over the possibility of a more severe conflict. If Israel were to target Iran's oil infrastructure in response, as reports suggest, the global oil supply could be significantly affected, potentially removing up to 1.5 million barrels per day from the market. This scenario would likely drive prices even higher, exacerbating supply constraints and pushing crude oil towards levels not seen since the early days of the Ukraine war.

Iran’s current oil output stands at around 3.7 million barrels per day, the highest in six years, which makes any potential disruption from military action in the region even more critical for the global energy markets. Market analysts estimate that a direct strike on Iran's energy infrastructure could push oil prices up by $20 per barrel, while a closure of the Strait of Hormuz could send prices soaring by as much as $28 per barrel. The strategic waterway accounts for roughly one-third of the world’s seaborne oil trade, making it a crucial chokepoint for global energy flows.

Oil Fuel Fund and Domestic Impacts

The rising oil prices have also caused concerns about the financial health of Thailand's Oil Fuel Fund (Offo), which is struggling to reduce its debt. The Offo had initially planned to repay its debt by 2028, buoyed by falling global oil prices in August. However, with prices now climbing back up, this timeline may no longer be feasible. As of October 1, 2024, the fund posted losses of 99 billion baht, and higher oil prices will likely exacerbate the situation. Any increase in global oil prices would lead to higher domestic subsidies and could limit the government’s ability to collect levies from oil users, further straining the fund.

The Broader Economic Impact of Rising Oil Prices

Higher crude oil prices have wide-reaching economic implications. With the price of crude oil rising almost 10% to around $78 per barrel in a matter of days, the impact is being felt globally. Oil is a fundamental input for many industries, from transportation to manufacturing, and any increase in its price trickles down to consumers. The price of gasoline and diesel at the pump is likely to rise, just as prices had recently hit their lowest levels in three years. This could reignite inflationary pressures, which had begun to ease following the COVID-19 pandemic and the Russia-Ukraine war.

The conflict has the potential to affect not only fuel prices but also the cost of goods, as transportation becomes more expensive. Everything from groceries to consumer goods could see price hikes as companies pass on higher transportation costs to customers. This inflationary trend could affect central banks' monetary policies, including the Bank of England, which has warned of the "serious" economic implications of the Middle East conflict.

Central Banks and Interest Rates

The rise in oil prices has coincided with better-than-expected U.S. employment data, which has led to a stronger dollar. While the U.S. labor market continues to demonstrate resilience, the increase in oil prices could complicate the Federal Reserve’s plans for monetary policy. Currently, the market expects a 25 basis points rate cut from the Fed, but a continued rise in inflation driven by higher energy prices could limit the central bank's ability to ease rates. Rising energy costs could force central banks to keep interest rates higher for longer, further impacting economic growth and consumer spending.

At the same time, emerging markets such as China and India, which are large consumers of oil, are particularly vulnerable to higher energy prices. China, a major buyer of Iranian oil, could face energy shortages if Iran's exports are disrupted. Moreover, China's ongoing economic recovery, supported by recent stimulus measures, could be undermined by rising oil costs.

Supply Constraints and Potential Disruptions

The potential supply disruption from the Middle East is not the only concern. The oil market is already facing tight supplies due to OPEC's production cuts. The organization has kept its production levels unchanged but plans to increase output starting in December. However, these plans could be derailed if the geopolitical situation worsens. OPEC members may find themselves under pressure to increase production sooner than planned to offset any losses from the Middle East.

Furthermore, the possibility of Iran attempting to block the Strait of Hormuz poses a major threat to global oil supplies. This narrow waterway is vital for the transport of oil from key producers such as Saudi Arabia, the United Arab Emirates, and Kuwait. A blockade would significantly reduce the flow of oil, leading to further price hikes. With so much of the world’s energy supply dependent on this region, the potential for a disruption would send shockwaves through the global economy, affecting everything from fuel prices to stock markets.

U.S. Vulnerability to Oil Price Shocks

Despite being the world’s largest oil producer, the United States remains vulnerable to global oil price shocks. The U.S. pumps approximately 13 million barrels of oil per day but consumes about 20 million barrels daily, making it a net importer of oil. This imbalance, combined with a depleted Strategic Petroleum Reserve (SPR) at a 40-year low, leaves the country exposed to external supply disruptions. The Biden administration had drawn heavily from the SPR to tame prices in 2022 but has been slow to refill the reserves due to high prices.

Continental Resources founder Harold Hamm recently pointed out the U.S.’s vulnerability, noting that the country’s low inventory levels and heavy reliance on global supply chains leave it in a precarious position. If the Middle East conflict were to disrupt oil supplies significantly, the U.S. could face soaring energy prices, which would be a major blow to an economy that has only just started to show signs of recovery.

Conclusion: Uncertainty Reigns in Oil Markets

The future of oil prices remains uncertain, with much depending on how the conflict between Israel and Iran unfolds. If tensions continue to escalate and lead to significant supply disruptions, particularly through the Strait of Hormuz, oil prices could spike to $150 or higher. On the other hand, if the conflict de-escalates or if OPEC increases production to compensate for lost Iranian oil, prices could stabilize.

For now, investors and policymakers alike are watching developments closely. Oil remains a critical factor in the global economy, and any significant price movements will have ripple effects across industries and markets. Given the current trajectory, it’s clear that oil prices are likely to remain elevated in the short term, with geopolitical risks keeping the market on edge.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex