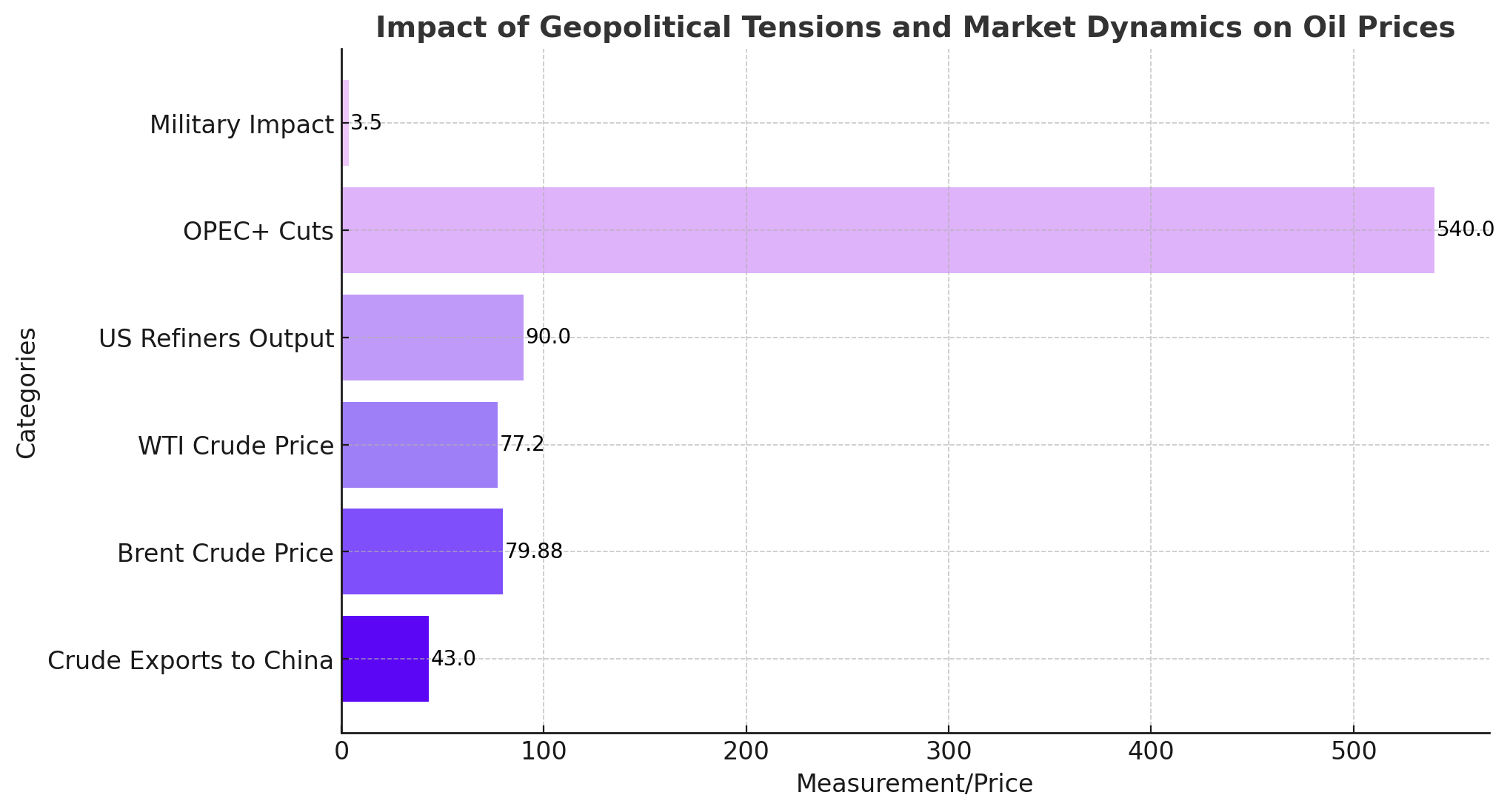

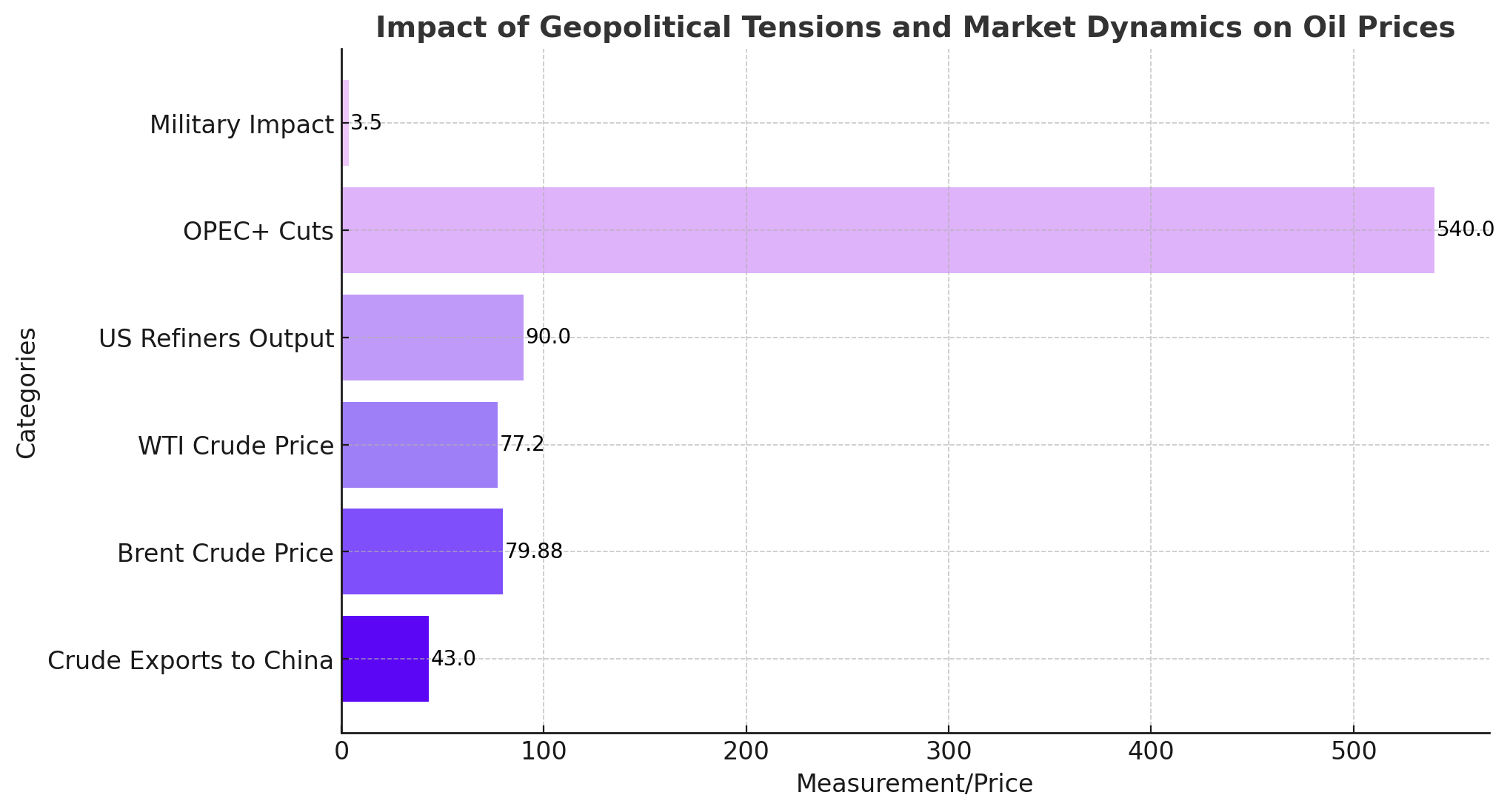

Saudi Arabia’s Crude Oil Export to China

Saudi Arabia, the world’s largest crude oil exporter, is expected to reduce its crude oil shipments to China next month. September allocations indicate a decline to 43 million barrels, down from 46 million barrels in August. This decrease follows the Kingdom's decision to raise its official selling price (OSP) for Arab Light crude in Asia for the first time in three months. Despite the price hike, which sets Arab Light at $2 per barrel above the Oman/Dubai average, the increase was smaller than anticipated. Asian refiners had expected a more substantial hike, reflecting the sluggish demand for gasoline and diesel in China, compounded by lower-than-expected GDP growth and ongoing issues in the property sector. The raised prices make Saudi crude more expensive under term agreements, potentially driving Chinese buyers toward alternative Middle Eastern grades available on the spot market.

Brent and WTI Crude Prices Gain Amid Middle East Tensions

Oil prices have continued their upward trajectory, fueled by escalating tensions in the Middle East. Brent crude for October delivery climbed to $79.88 per barrel, while West Texas Intermediate (WTI) futures for September rose to $77.20 per barrel. This marks the fifth consecutive session of gains for both benchmarks, reflecting market concerns over potential supply disruptions. The Middle East, a critical hub for global oil production, remains volatile following the assassination of key figures within Hamas and Hezbollah, raising fears of retaliatory attacks on oil infrastructure. These geopolitical risks have added a premium to crude prices, overshadowing concerns about weaker demand from China and potential oversupply in the market.

U.S. Refiners Reduce Output Amid Shrinking Margins

Major U.S. refiners, including Marathon Petroleum, PBF Energy, Phillips 66, and Valero Energy, are scaling back operations due to shrinking refining margins. Marathon, the owner of the largest U.S. refinery, plans to operate its 13 plants at an average of 90% capacity this quarter, the lowest since 2020. Similarly, PBF Energy and Phillips 66 have announced plans to reduce processing, citing weaker margins as the primary reason. These reductions come at a time when the global fuelmaking complex is showing signs of faltering, with consumption stalling and profit margins shrinking. The International Energy Agency (IEA) had estimated that global refiners would process 900,000 barrels more daily this year, but these recent developments suggest a potential oversupply of crude, limiting oil prices' upward momentum.

Potential Oversupply Looms Despite OPEC+ Cuts

The possibility of a global crude oversupply is becoming increasingly likely as major refiners reduce their output, even as new refining capacity comes online. The U.S. has managed to ship some of its surplus crude to Nigeria’s Dangote refinery and Mexico’s Dos Bocas refinery, which are expected to ramp up production later this year. Additionally, global supplies are anticipated to rise with Guyana's production ramping up and OPEC+ planning to bring back 540,000 barrels of daily output in the fourth quarter. This potential oversupply is expected to weigh on oil prices, despite the geopolitical risks currently supporting them.

U.S. Military Presence in the Middle East and Its Impact on Oil Prices

The U.S. Defense Secretary's announcement of deploying a guided missile submarine to the Middle East has further fueled oil price gains. This move is seen as a response to escalating tensions following the assassination of high-profile figures in Hamas and Hezbollah. Brent crude saw a 3.5% increase last week, while WTI posted gains of over 4%, as traders anticipate potential disruptions to Iran’s oil supply. Analysts predict that Brent oil could trade between $75 and $85 per barrel in the short term, with a significant price spike if the conflict escalates. However, the potential for increased supplies later in the year, coupled with the prospect of an interest rate cut by the U.S. Federal Reserve, could mitigate these gains.

Shell and PetroChina’s Investment in Australian LNG Project

In a significant development in the LNG sector, Shell and PetroChina have announced their investment in the second phase of a coal seam gas project in northeast Australia. The project, operated by Arrow Energy, a joint venture between Shell and PetroChina, aims to boost supply to domestic customers and long-term LNG shipments. The project is expected to contribute approximately 22,400 barrels of oil equivalent per day at peak production, with first gas anticipated in 2026. This investment comes at a time when Australia’s east coast faces potential natural gas shortages by 2027, highlighting the importance of new supply projects to meet future demand.

Conclusion

The global oil market is currently navigating a complex landscape of geopolitical tensions, potential oversupply, and fluctuating demand. While prices have risen recently due to concerns over supply disruptions, particularly in the Middle East, the possibility of an oversupply later in the year could temper these gains. The investment in new LNG projects and the scaling back of refinery operations in the U.S. further add to the market's uncertainty. As the situation evolves, the balance between supply and demand will be crucial in determining the future direction of oil prices.

That's TradingNEWs