Oil Prices: The Interplay of U.S. Politics, Federal Rates, and OPEC+ Actions

Analyzing the direct influence of U.S. presidential changes and economic policies on the global oil market trends for 2024 | That's TradingNEWS

Current State of Oil Prices: Immediate Influences and Speculative Moves

Impact of U.S. Political Developments on Oil Prices

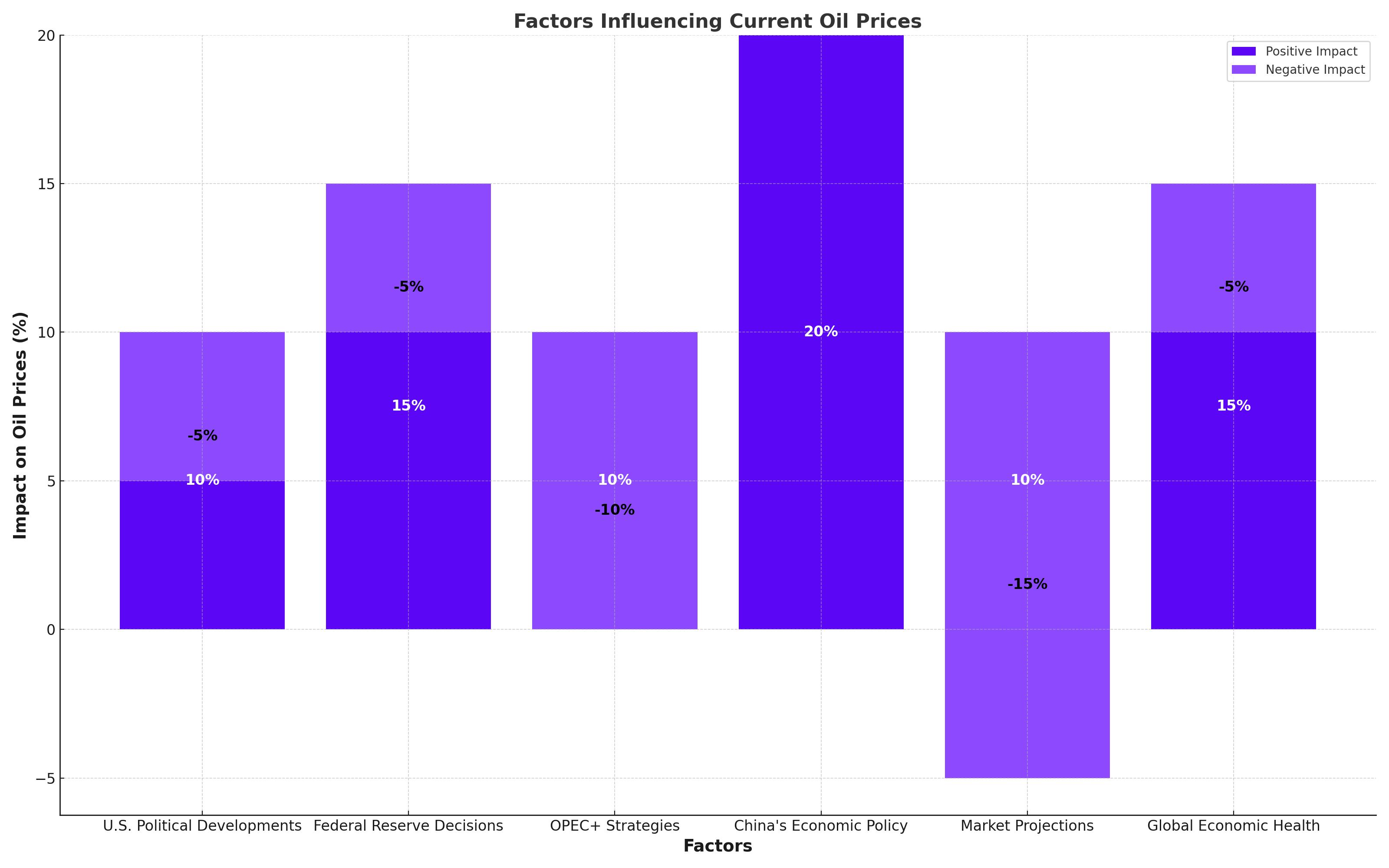

Oil prices experienced a slight downturn following President Joe Biden's announcement that he will not seek a second term. This political shift briefly stirred the markets, with Brent crude dipping to $82.18 per barrel and West Texas Intermediate (WTI) dropping to $79.62. The initial reaction was a testament to the transient impact of political news on commodity prices, which often quickly rebalance based on broader economic indicators and supply dynamics.

Federal Reserve's Role in Shaping Oil Market Expectations

As the market absorbs the implications of U.S. political changes, all eyes are on the Federal Reserve's upcoming decisions. The central bank's meeting at the end of July is anticipated to maintain the status quo on interest rates. However, the speculation of a potential rate cut in September is building, influenced by the latest inflation data and labor market trends. A reduction in rates could decrease the attractiveness of the dollar, potentially making dollar-priced oil cheaper for foreign buyers and supporting oil prices.

Long-Term Influences: OPEC+ Strategies and Global Economic Health

OPEC+'s Production Strategy Amidst Shifting U.S. Policies

The OPEC+ alliance has been a critical player in stabilizing oil prices through production cuts. Yet, the potential for increased U.S. production under a future Trump administration could counterbalance these efforts. Trump’s energy policies might favor expansive oil production and reduced environmental regulations, potentially increasing supply and applying downward pressure on prices.

China's Economic Policy Adjustments and Their Global Impact

China’s recent reduction of key policy rates to stimulate its slowing economy adds another layer of complexity. As the world's second-largest oil consumer, any significant shift in China's economic health directly influences global oil demand and pricing strategies. The Chinese government’s maneuvers to invigorate economic activity could bolster oil demand, offsetting some bearish trends in the global market.

Analytical Forecast: Market Projections and Strategic Considerations

Expert Forecasts and Market Sentiments

Financial analysts are projecting a softening of oil prices into the mid-$70s by next year, anticipating a market surplus driven by increased production from both OPEC+ and non-OPEC countries. Morgan Stanley's analysis suggests that while the market currently justifies prices in the $80s, a shift is expected as seasonal demand wanes and supply dynamics evolve. This projection aligns with the cyclical nature of oil markets, where supply adjustments often lag behind immediate demand shifts.

Strategic Implications for Market Participants

Investors and market strategists should consider the multifaceted influences on oil prices, from geopolitical developments to central bank policies and industry-specific trends. The potential volatility highlights the need for a nuanced approach to commodity trading, where strategic positions may need to be adjusted rapidly in response to new economic data or political developments.

Conclusion: Navigating a Complex Market Landscape

The global oil market remains at the mercy of a complex interplay of factors, including geopolitical instability, economic policy shifts, and sector-specific supply and demand dynamics. For stakeholders in the oil market, staying informed and agile in response to these changes is crucial for capitalizing on opportunities and mitigating risks. As we move forward, continuous monitoring and analysis will be key to understanding and navigating the future movements in oil prices.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex