Oil Market Outlook: Demand Pressures and Key Support Levels

China’s Oil Demand: Struggling Amid EV Surge and Slower Economic Growth

China, the world’s largest crude importer, has experienced a noticeable shift in its oil demand dynamics. Electric vehicle (EV) sales are soaring, while diesel consumption has fallen sharply, highlighting a structural change in fuel usage. This has significantly impacted China's oil demand growth, which has been slower than initially anticipated. The International Energy Agency (IEA) noted that the rise of electric mobility, especially in China, caught OPEC off guard, leading to downward revisions in oil demand forecasts.

OPEC recently cut its global oil demand forecast for 2024, citing the weaker-than-expected demand from China, a critical market. Initially, OPEC expected China's oil demand to grow by 650,000 barrels per day (bpd) this year. However, the estimate was revised down to 580,000 bpd in its latest report, largely due to faltering economic activity, a slowdown in the construction sector, and increased adoption of liquefied natural gas (LNG) for heavy-duty trucks.

EVs and LNG’s Role in Shaping Future Oil Demand

The sharp increase in EV sales in China, where EV and plug-in hybrid sales jumped 50.9% year-over-year in September 2024, and now account for 52.8% of total vehicle sales, has dented gasoline demand. Additionally, LNG trucks, which now represent up to 30% of China's heavy-duty truck market, have replaced diesel vehicles, further reducing diesel consumption. Analysts believe that this trend will only strengthen in the coming years, shifting China’s energy landscape away from traditional oil-based fuels.

As a result of these developments, China's oil demand growth in August was only 83,000 bpd year-over-year, far lower than earlier projections, with diesel consumption particularly weak. This shift towards cleaner alternatives like LNG and EVs underscores China’s evolving energy market, pushing the nation toward reduced reliance on crude oil for transportation.

OPEC’s Long-Term Outlook: No Peak Oil Demand Yet

Despite the setbacks in China, OPEC remains optimistic about global oil demand over the long term. The cartel expects India to surpass China as the leading growth driver of global oil demand, supported by a rapidly expanding economy. OPEC's report emphasizes that, while the rise of electric mobility has disrupted forecasts, peak oil demand is not anticipated in the near future.

However, this contrasts with the IEA's projections, which expect global oil demand to peak by 2030, driven by the rapid adoption of EVs and growing investments in alternative energy sources. OPEC has criticized such forecasts, labeling them as dangerous and unrealistic, warning that premature predictions of peak oil could create energy volatility on an unprecedented scale.

Geopolitical Tensions and Oil Market Volatility

Geopolitical risks in the Middle East are another critical factor shaping oil markets. The ongoing conflict between Israel and Hezbollah, alongside broader instability in the region, has added upward pressure on oil prices as markets react to potential supply disruptions. Although oil prices dipped slightly in recent weeks due to softer demand forecasts, the situation remains volatile.

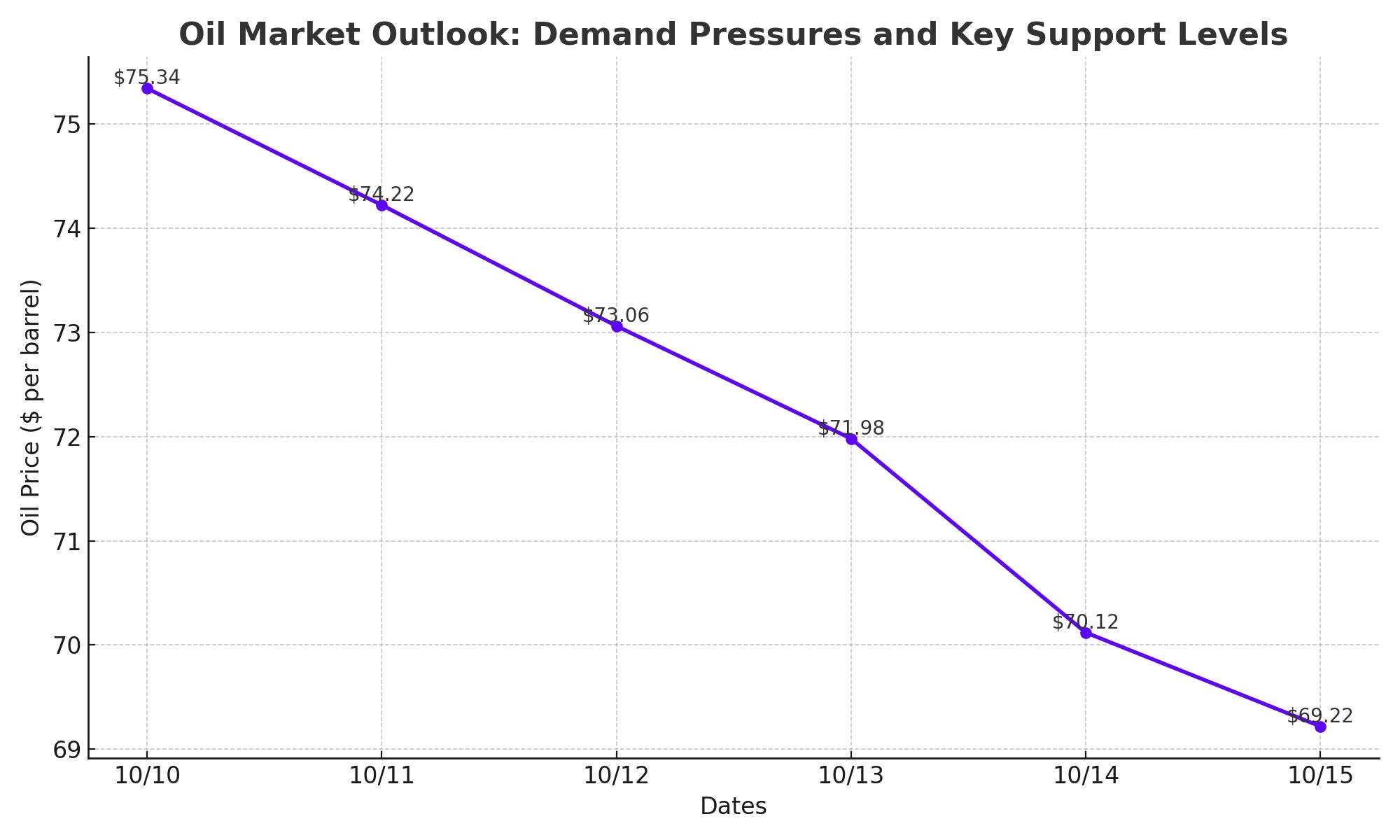

As of the latest trading session, Brent crude was priced at $73.06 per barrel, down 1.87%, while West Texas Intermediate (WTI) crude fell to $69.22 per barrel, a 2.05% drop. Both benchmarks marked their largest weekly declines since early September, driven by concerns over weakening demand in major markets like China and the broader slowdown in global economic growth.

Key Technical Levels and Market Sentiment

The oil market remains under pressure, with key technical levels in focus. WTI crude is testing critical support at $67.75, a level that could signal further declines if breached. Should prices fall below this support, the next downside target is at $66.80, followed by $65.27, which represents a major threshold for potential bearish trends. Resistance remains strong at $78.50, where bulls will need to push decisively through to reverse the current negative sentiment.

Technical indicators continue to reflect bearish momentum, with the recent 9.09% weekly decline highlighting the sustained selling pressure. While the geopolitical landscape could spark a short-term rally, the market outlook remains cautious amid weak demand and rising global inventories.

Heating Oil Prices and Shifting Energy Policies in Europe

Heating oil prices have also been in focus, particularly in Europe. In Greece, the average price of heating oil stood at 1.67 euros per liter in Athens and 1.77 euros per liter in Thessaloniki as of mid-October. The high prices reflect both local market dynamics and broader global supply concerns. The Greek government is promoting a shift away from fossil fuels, with subsidies for electric heating increasing to reduce the country’s dependency on oil.

This shift aligns with broader European Union goals to decarbonize the energy sector. The European market is seeing stronger investments in renewables, with growing emphasis on reducing reliance on fossil fuels, including oil, for heating and transportation. This trend could impact global oil demand over the next decade as alternative energy sources gain traction in key markets.

Conclusion: Navigating the Uncertain Oil Market

The global oil market is facing a complex array of challenges, from weaker-than-expected demand in China to rising geopolitical risks in the Middle East. The shift towards electric mobility and cleaner alternatives like LNG is reshaping energy demand, particularly in China, which has traditionally been a major driver of oil consumption growth. OPEC's revisions to its demand forecasts reflect these changing dynamics, although the cartel remains optimistic about long-term oil demand, particularly from emerging markets like India.

As oil prices hover around critical support levels, traders and analysts will continue to watch key factors, including China’s economic performance, EV adoption rates, and geopolitical developments. The balance between supply risks and weaker demand will determine the next phase for oil prices, but the current sentiment points to further downside risks unless bullish catalysts emerge.