On Holding AG's NYSE:ONON Dynamics and Growth Trajectory

A thorough examination of ONON's institutional investments, market performance, and financial outlook, revealing the potential and challenges in its journey ahead | That's TradingNEWS

Analyzing ONON: A Deep Dive into On Holding AG's Market Position and Future Prospects

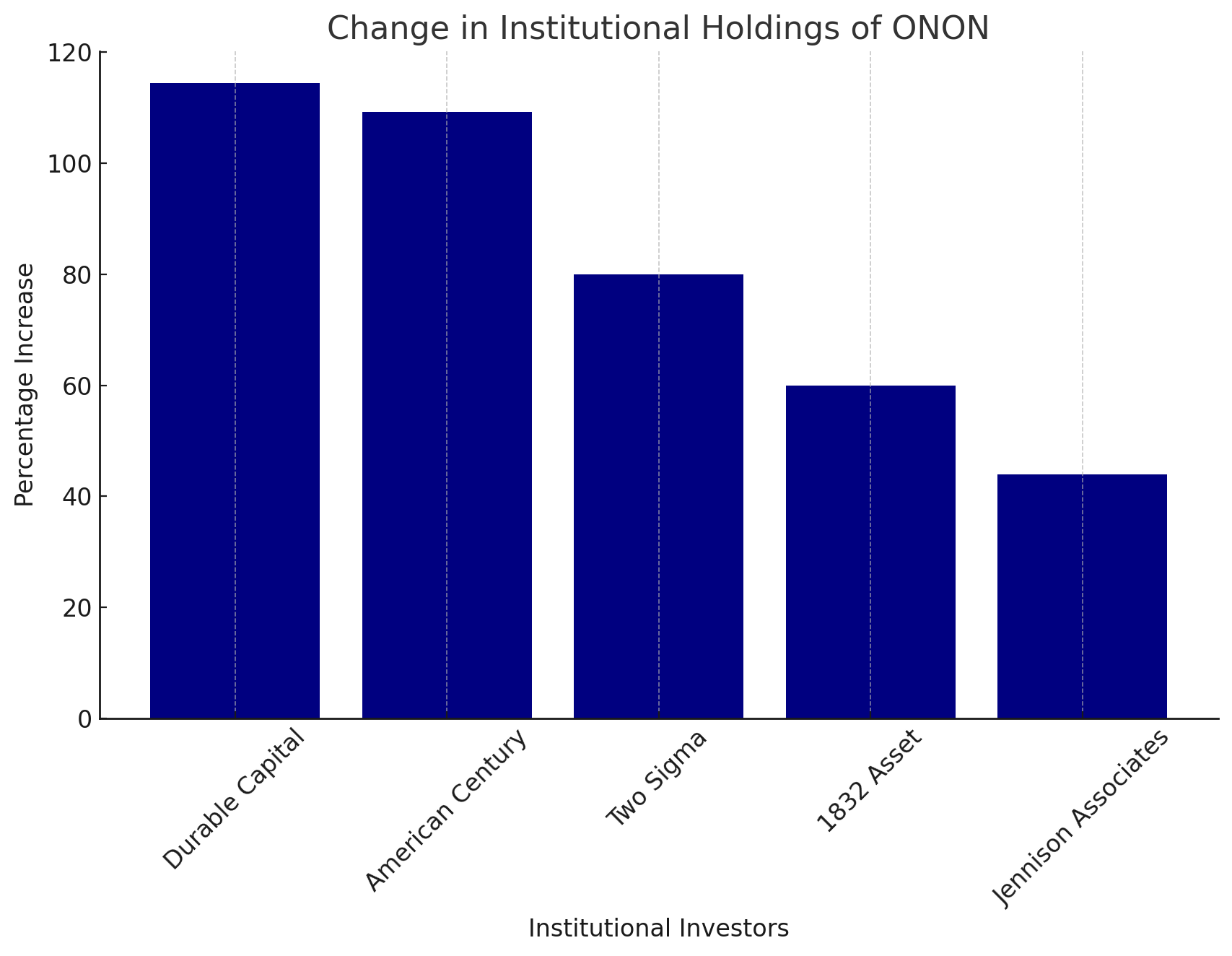

Institutional Investor Dynamics

Recent quarters have seen a dramatic shift in institutional holdings in NYSE:ONON. Durable Capital Partners LP increased their stake by a staggering 114.5%, now holding shares valued at approximately $278.3 million. American Century Companies Inc. followed suit with a 109.3% increase, owning stocks worth around $182.7 million. Similarly, Two Sigma Investments LP and 1832 Asset Management L.P. significantly augmented their holdings. Jennison Associates LLC also upped their investment by 43.9%, totaling about $242 million in stock. Collectively, these movements underscore a growing institutional confidence, with a cumulative ownership of 18.64%.

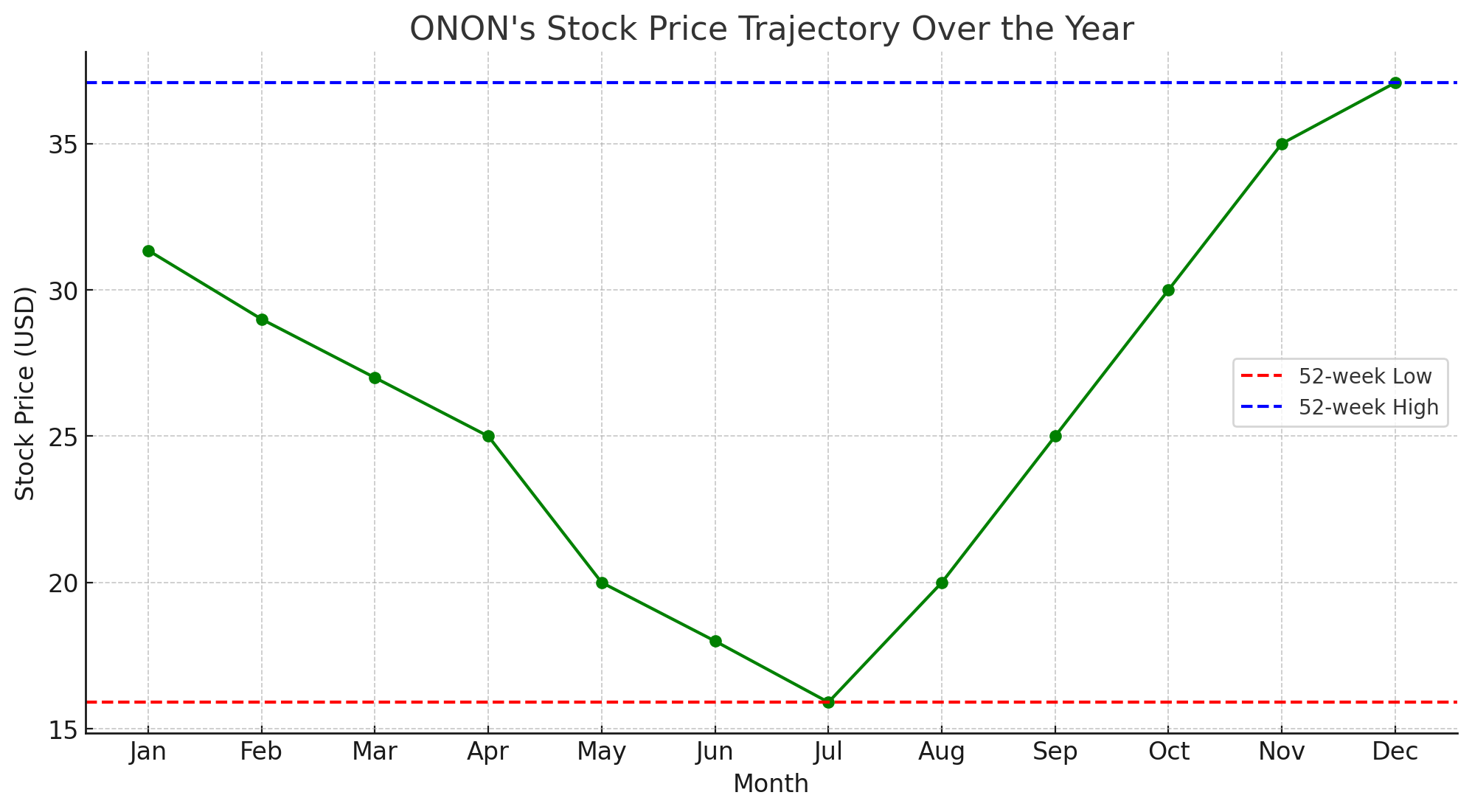

Market Performance Overview

ONON's stock trajectory presents an intriguing picture. Opening at $31.35, the stock oscillates between a 52-week low of $15.91 and a high of $37.08. Its market capitalization stands at $19.72 billion, framed by a P/E ratio of 111.96. These figures are augmented by a P/E/G ratio of 1.70 and a beta of 2.15, indicating substantial volatility. The 50-day and 200-day moving averages at $27.40 and $29.60, respectively, offer additional insight into its market behavior.

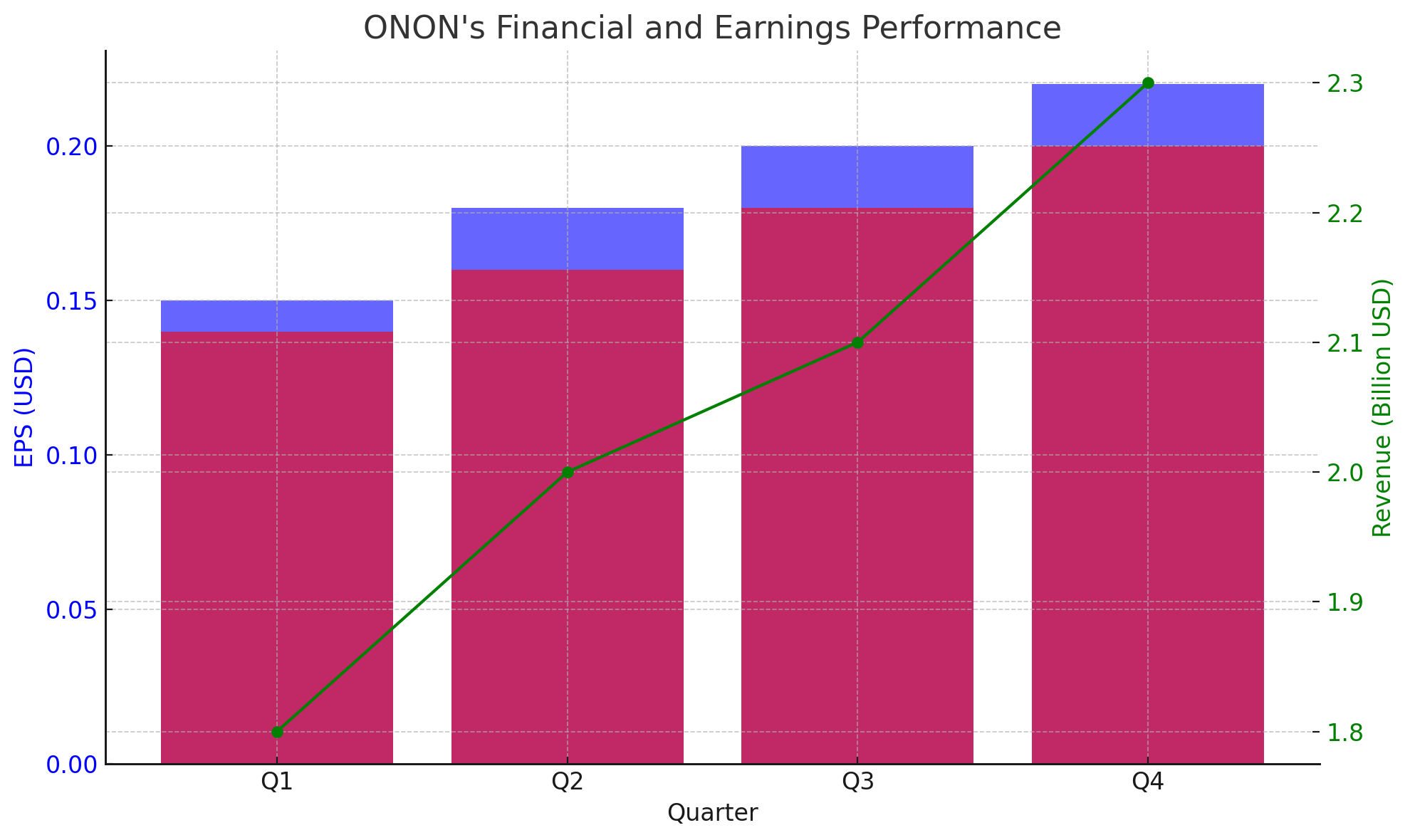

Financial and Earnings Performance

ONON's recent quarterly earnings outpaced expectations, posting $0.20 EPS against a forecasted $0.14. This performance, representing a 46.5% year-over-year revenue increase, signifies a robust growth trajectory. Analysts project a consistent upward trend, with anticipated earnings of $0.46 per share for the current year. Revenue forecasts for 2023 and 2024 stand at an impressive $2.1 billion and $2.71 billion, highlighting a potential sales growth of 54.30% and 29.30%, respectively.

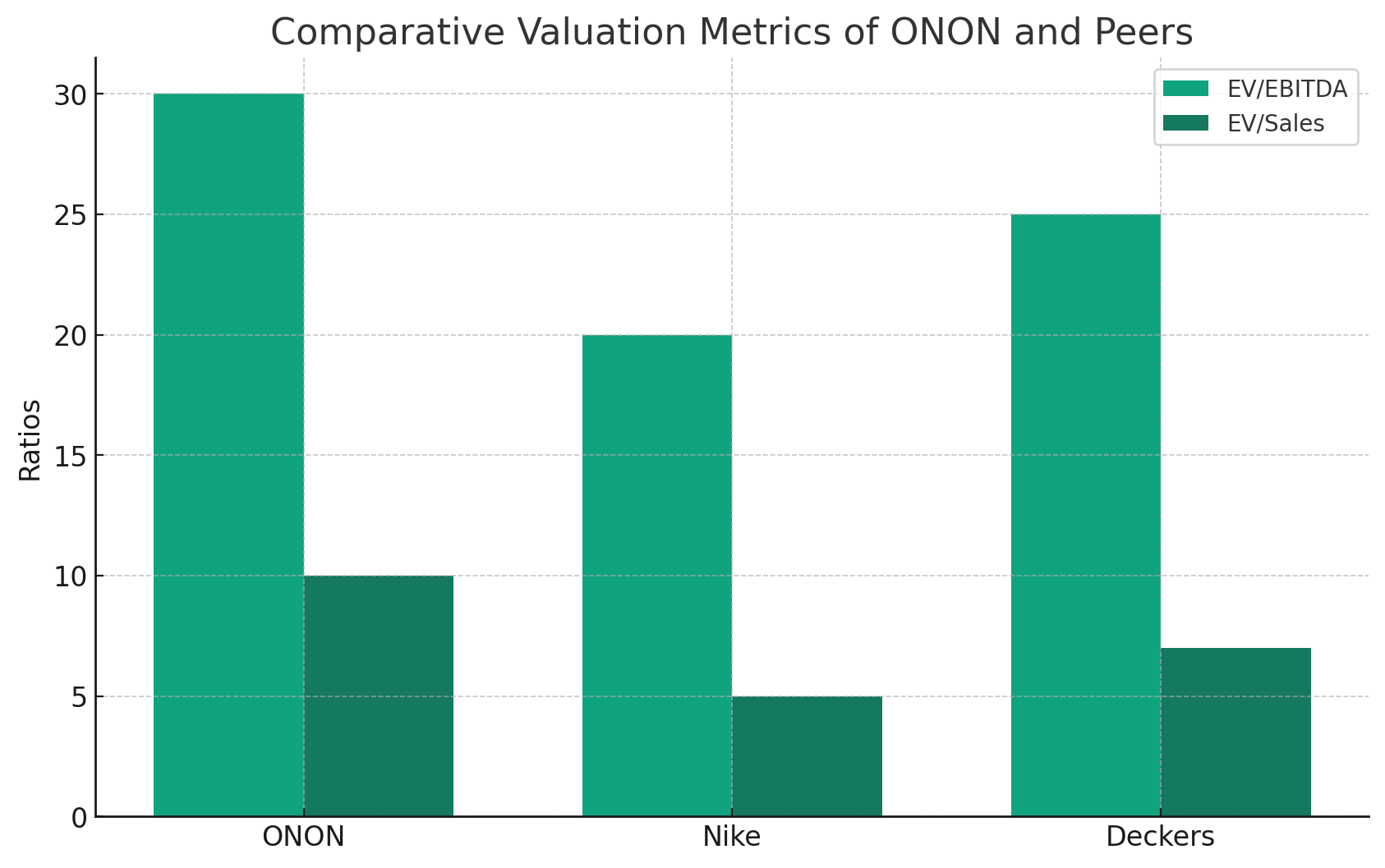

Valuation and Comparative Analysis

When juxtaposed with industry counterparts, ONON's valuation metrics reveal a premium positioning. The company's EV/EBITDA and EV/Sales ratios substantially exceed the industry average, drawing parallels with Nike and Deckers Outdoor Corporation. However, this elevated valuation invites scrutiny over its long-term sustainability in a fiercely competitive market.

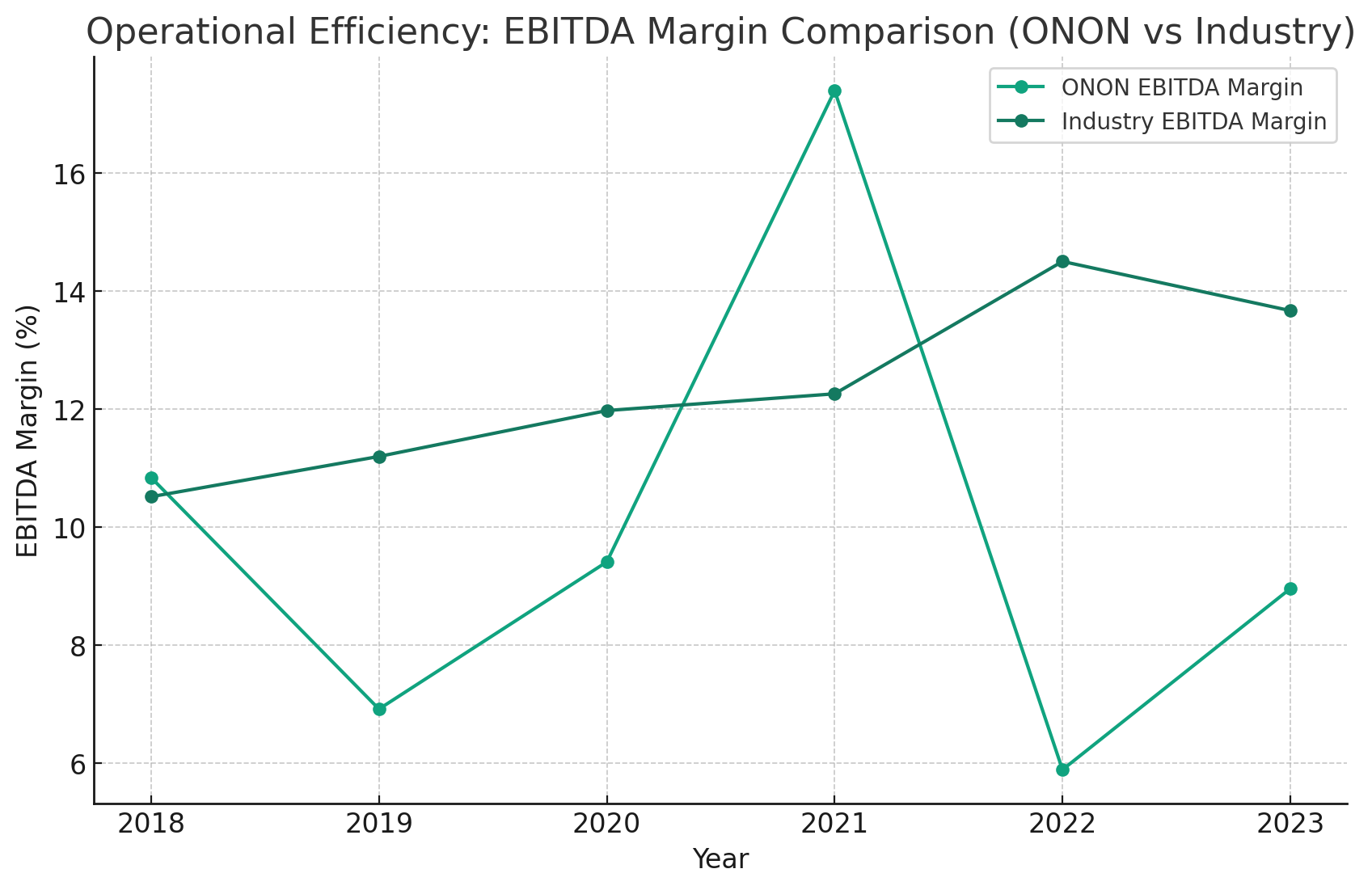

Operational Efficiency and Profitability

ONON's operational margins and profitability indicators provide a mixed view. While its EBITDA margin is on an upward trajectory, the discrepancy between reported and adjusted figures due to foreign exchange losses and share-based compensations warrants attention. The comparison with Nike and Deckers in terms of EBITDA margins offers a nuanced understanding of its operational efficiency.

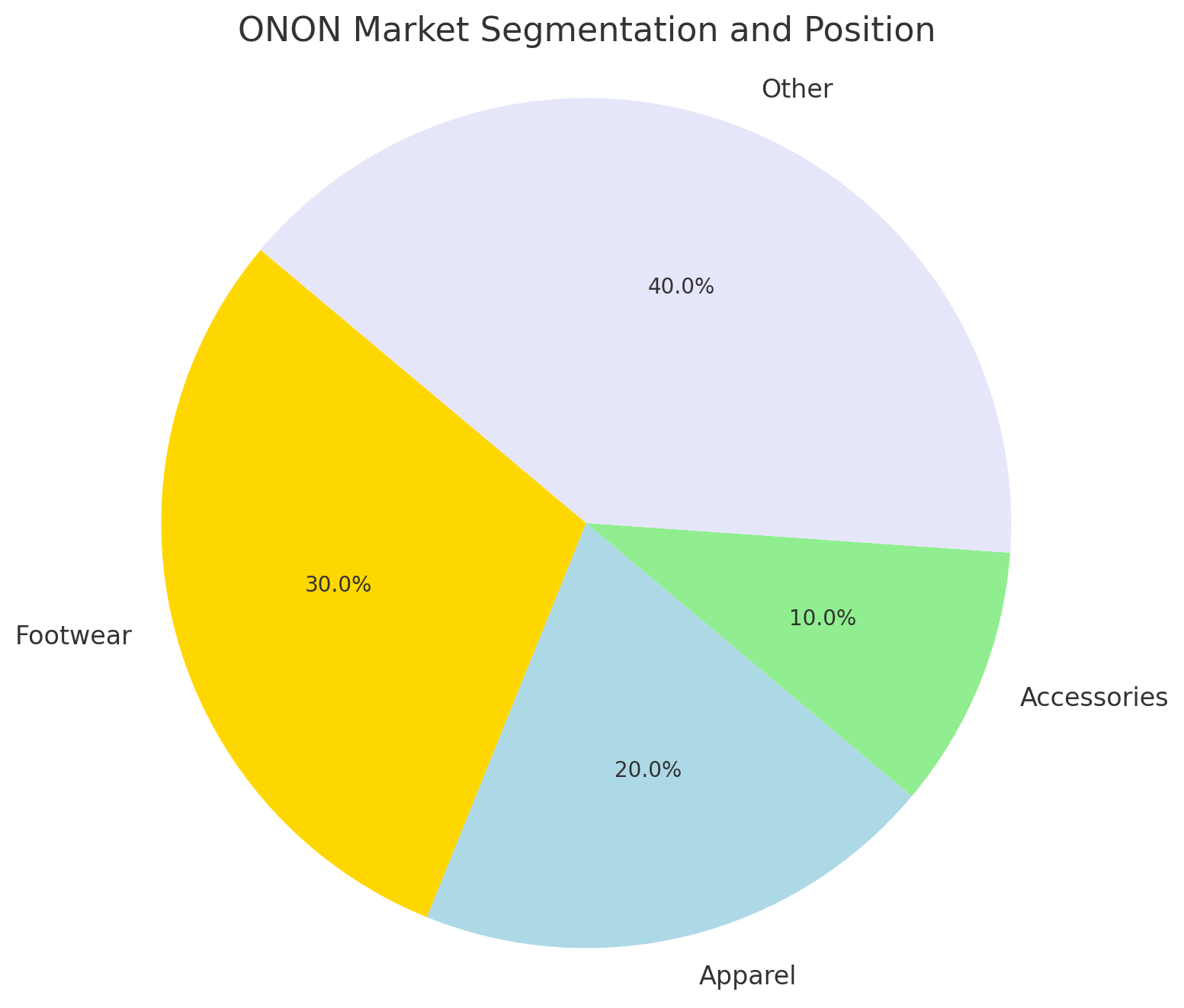

Growth and Expansion Challenges

ONON's ambitious expansion into apparel, while strategic, is fraught with challenges. The sports apparel market, dominated by giants like Nike, demands a significant shift in business strategy. Historical precedents from brands like Under Armour and Allbirds highlight the risks involved in diversifying from core product lines.

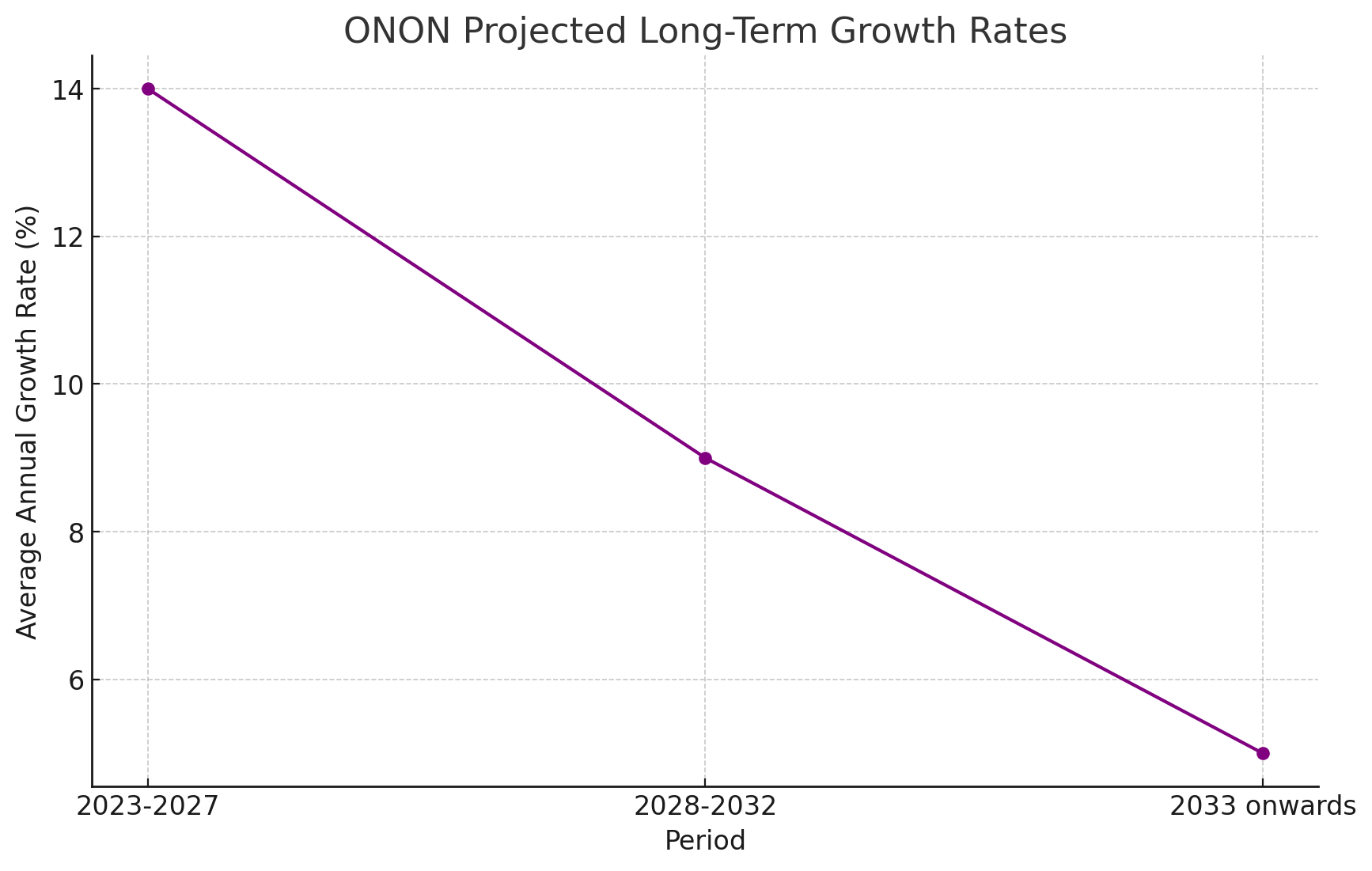

Analysis for Long-Term Growth

The initial phase (2023-2027) anticipates a higher growth rate, given ONON's current market momentum and expansion strategies. A conservative estimate would be a 12% to 15% annual growth during this period. As the market matures and competition intensifies, a moderated growth rate of 8% to 10% is projected for the subsequent phase (2028-2032). Finally, a steady-state growth rate of 4% to 6% is applied from 2033 onwards, aligning with broader industry growth trends.

These staggered growth rates provide a more realistic projection, acknowledging that high initial growth rates are often unsustainable in the long term as market saturation and competitive pressures increase.

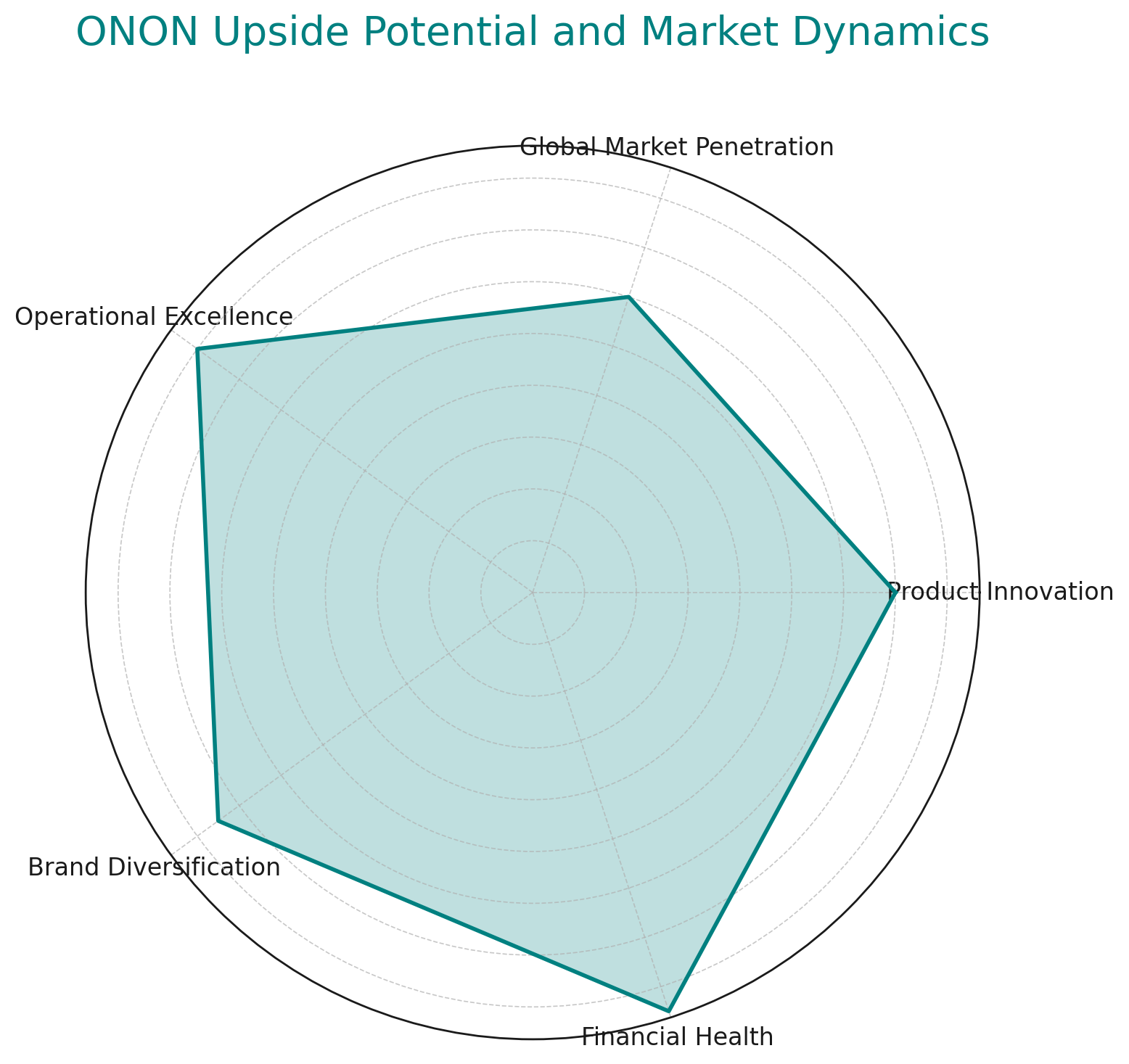

Evaluating Upside Potential and Market Dynamics

While maintaining a cautious approach, it's crucial to explore scenarios where ONON outperforms market expectations. Key factors that could drive such an outcome include:

-

Innovative Product Development: ONON's continued focus on technological innovation in footwear could lead to breakthrough products, propelling market share growth beyond current projections.

-

Global Market Penetration: Aggressive expansion into emerging markets, particularly in Asia and South America, could significantly boost ONON's revenue streams.

-

Operational Excellence: Enhanced supply chain efficiencies and inventory management could improve profit margins, making ONON a more attractive investment.

-

Brand Diversification and Endorsements: Strategic marketing and high-profile endorsements could strengthen the brand's appeal, enhancing its market positioning as a lifestyle brand alongside its athletic identity.

Financial Health and Market Valuation

An in-depth analysis of ONON's financials reveals a company at a pivotal growth stage. Despite a high P/E ratio indicative of investor optimism, ONON's P/E/G ratio suggests potential for future earnings growth. The Beta value of 2.15 highlights market volatility, which is not unusual for companies in rapidly evolving sectors.

Market capitalization and moving averages provide additional layers of insight. A market cap of $19.72 billion signals strong market confidence, while the 50-day and 200-day moving averages indicate recent performance trends and longer-term market perceptions.

Revenue and Earnings Outlook

ONON's revenue and earnings prospects are framed within the context of its sector's dynamics. The reported EPS of $0.20, surpassing consensus estimates, reflects operational efficiency and market resonance. Revenue growth forecasts of over 54% in the current year and 29% in the next underscore ONON's upward trajectory. However, these figures must be balanced against industry-wide challenges, including market saturation and consumer behavior shifts.

Insider Transactions and Stock Profile Insights

For a deeper understanding of ONON's stock dynamics and insider perspectives, refer to ONON Insider Transactions and ONON Stock Profile for comprehensive insights.

Conclusion

This analysis paints a picture of ONON as a company with robust growth potential, buoyed by innovative strategies and strong market presence. However, it's crucial to monitor market dynamics and internal operational efficiencies closely. The outlined forecasts and scenarios provide a framework for investors to gauge ONON's future performance in the competitive landscape of athletic footwear and apparel.

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex