Despite Oracle’s Q2 earnings miss, the broader narrative of sustained growth and innovation remains solid. Trading at approximately $110 per share, the company’s dominance in AI-driven cloud infrastructure and its track record of adapting to market demands position it as a compelling investment opportunity. Oracle’s robust expansion in cloud services and strategic partnerships with major players like Meta and NVIDIA reinforce its leadership in a rapidly growing sector. For investors seeking long-term value, Oracle's current price levels present a well-timed entry point. Monitor Oracle’s performance and access its real-time chart here.

Oracle (NASDAQ:ORCL) at $110: A Prime Opportunity for Long-Term Growth

Strong AI Leadership and Undervalued Potential Make Oracle a Top Pick in Tech | That's TradingNEWS

1/3/2025 7:42:51 PM

Oracle Corporation (NASDAQ:ORCL): Strong Fundamentals Amid Earnings Misses and Long-Term Growth Prospects

Oracle Corporation (NASDAQ:ORCL) experienced a notable decline following its recent Q2 earnings release, which missed both revenue and EPS expectations. Despite these setbacks, Oracle’s fundamentals and strategic positioning, particularly in cloud computing and artificial intelligence (AI), remain robust. The stock is trading around $110, a 9% decline post-earnings, but this presents a potential entry point for investors confident in the company’s long-term prospects.

Q2 Earnings Miss: Temporary Setback, Not a Trend

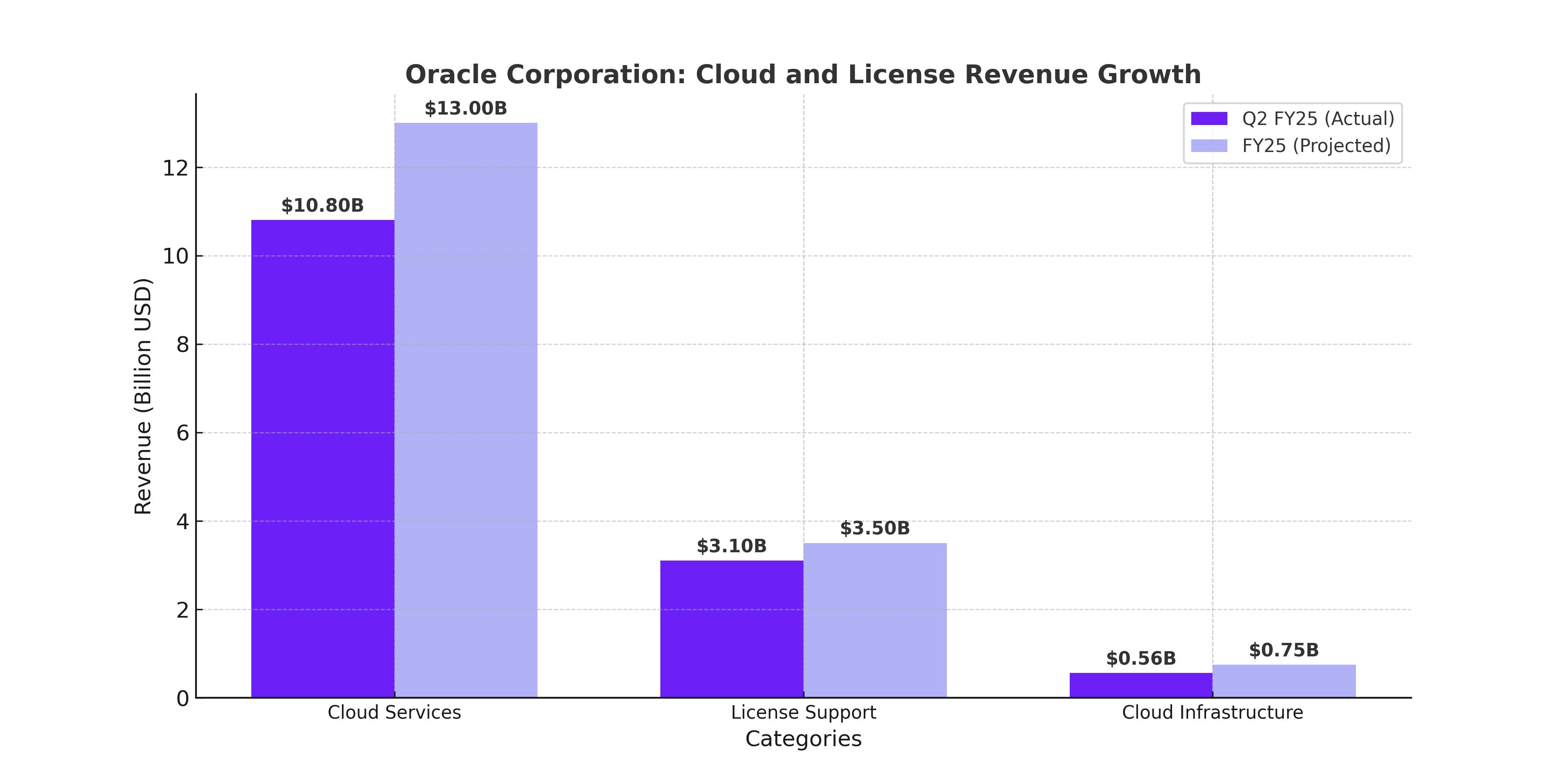

Oracle’s Q2 results reported revenue of $14.06 billion, reflecting an 8.64% year-over-year increase but missing consensus estimates by $63.95 million. EPS came in at $1.47, just shy of the expected $1.48. While Wall Street punished the stock for these misses, it’s crucial to note that Oracle’s cloud services and license support, which make up 77% of total revenue, grew at a robust pace. This segment’s annualized revenue is projected to exceed $25 billion by fiscal year-end.

CEO Safra Catz emphasized that Oracle’s cloud is uniquely positioned for cost efficiency and scalability, especially for AI workloads. The cloud infrastructure segment alone posted a 52% year-over-year growth, with GPU consumption skyrocketing 336%, driven by demand from AI applications.

Strategic Wins in AI and Cloud

Oracle has established itself as a leader in cloud infrastructure tailored for AI workloads. Recent partnerships with companies such as Meta Platforms for its Llama models and NVIDIA for supercomputing clusters reinforce Oracle’s pivotal role in supporting AI development. Oracle’s deployment of a 65,000 GPU supercomputer positions it as a premier provider of large-scale AI training environments.

Cloud applications, including Fusion Cloud ERP and NetSuite, also demonstrated strong performance, with 18% and 19% year-over-year growth, respectively. The growth trajectory in these areas underscores Oracle’s ability to leverage AI and cloud demand effectively.

Valuation Analysis: A Compelling Entry Point

Oracle’s forward P/E ratio of 25.97x is slightly above the tech sector average, reflecting its growth premium. Analysts project FY25 EPS to reach $6.18, which aligns with Oracle’s consistent double-digit growth in key segments. A recalibrated forward P/E of 31.94x would imply a price target of $197, representing an upside of approximately 13.6% from current levels.

The company’s return on invested capital (ROIC) of 11.3% and strong operating margins provide a solid foundation for long-term profitability, even as it ramps up capital expenditures to scale its cloud infrastructure.

Conclusion: A Long-Term Buy Opportunity

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Bitcoin (BTC-USD) Surges to $113K as $340M ETF Inflows Signal Institutional Comeback

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex