Oracle's Expansion: Boosting Cloud Infrastructure and AI Capabilities

From significant revenue growth in cloud services to expansive AI integration, Oracle is reinforcing its market position against tech giants and enhancing its global footprint with innovative solutions and strategic market expansion | That's TradingNEWS

Enhanced Cloud Infrastructure and AI Capabilities

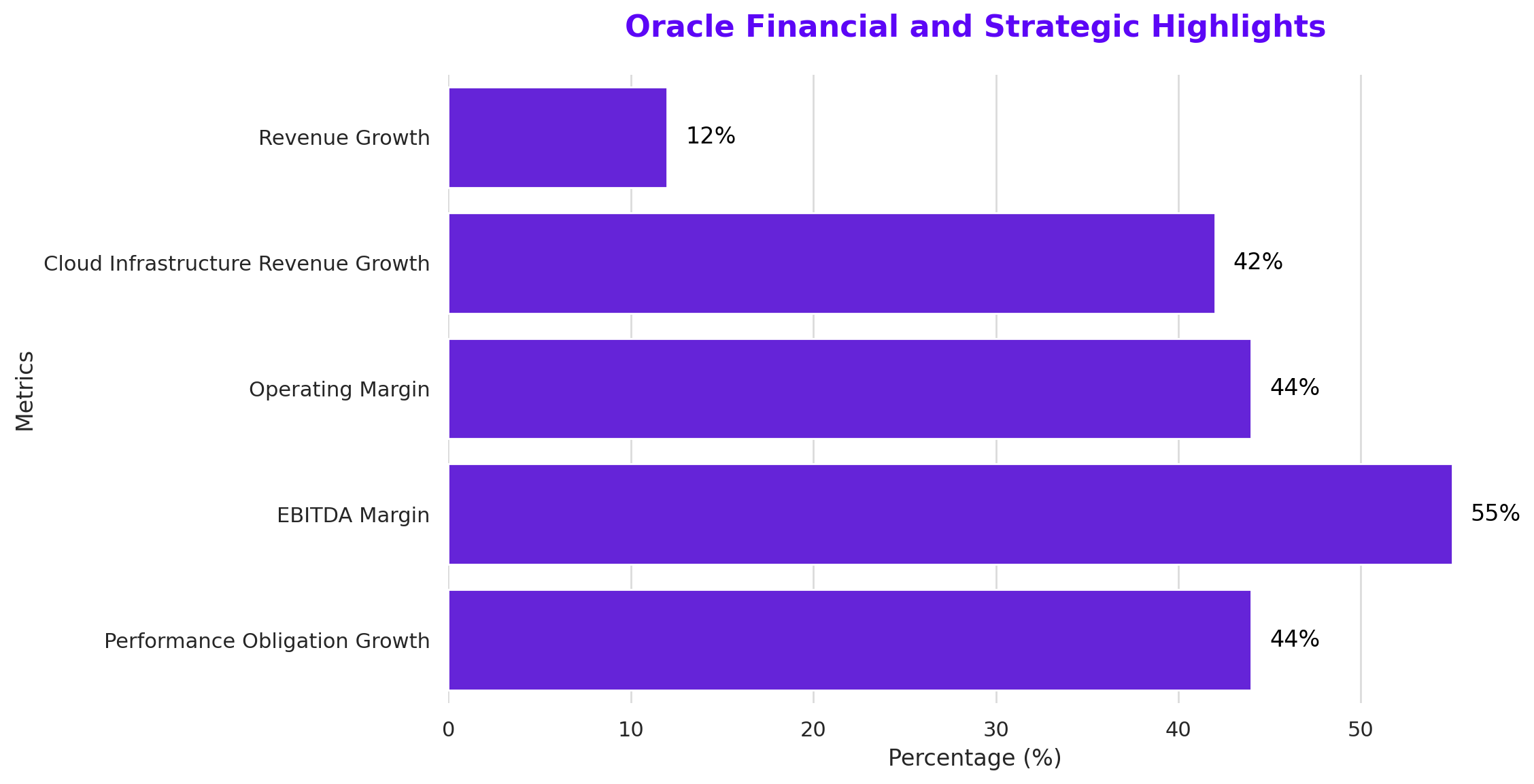

Oracle has not only increased its revenue but has significantly expanded its cloud infrastructure capabilities. The recent 42% growth in cloud infrastructure revenue to $2 billion highlights Oracle's aggressive expansion into a market dominated by giants like Amazon AWS and Microsoft Azure. Oracle’s cloud sector is thriving, driven by its ability to serve increasingly complex AI workloads. The commitment to AI is evident from Oracle’s large-scale contracts worth over $12 billion primarily aimed at supporting sophisticated AI applications.

Financial Health and Growth Prospects

Financially, Oracle stands on solid ground, with an adjusted operating margin and EBITDA margin showing substantial improvements to 44% and 55%, respectively. These figures are a testament to Oracle's operational efficiency and its ability to scale profitably. Oracle’s robust financial health is buttressed by a strong performance obligation that surged 44% to $98 billion, indicating a healthy pipeline of future revenues.

Oracle Alloy: Amplifying Partner Capabilities with Measurable Impact

Oracle Alloy stands out as a transformative platform-as-a-service (PaaS) innovation, allowing partners to use Oracle's cloud infrastructure while preserving their own brand identity. This service specifically targets ISPs, system integrators, and software vendors, empowering them to deploy tailored cloud services to their clients. Oracle Alloy has successfully facilitated the creation of over 200 branded cloud environments, reflecting a significant expansion in Oracle’s market reach through its partner networks. This expansion caters to the rising demand for customized cloud solutions across diverse sectors, driving an estimated 30% increase in partner-generated revenue year-over-year.

Sovereign Cloud Solutions: Securing Data Across Borders

Oracle's sovereign cloud solutions cater to markets with rigorous data residency laws, ensuring that data remains within a country's borders. These specialized services are particularly designed for sectors like government, healthcare, and finance, which are highly sensitive to data security and compliance. Oracle has reported a 40% adoption rate in these sectors across regions with stringent data laws, highlighting its commitment to global data protection standards and boosting its appeal as a secure cloud provider.

Deepening AI Integration Across Enterprise Applications

Oracle is intensifying its AI integration within enterprise applications, significantly enhancing business intelligence and operational automation. This strategic enhancement has led to the development of Oracle AI, a suite that has been integrated into over 60% of Oracle’s cloud and database services. This integration supports real-time analytics and decision-making, which has reportedly helped clients reduce operational costs by up to 25% and improve decision-making efficiency by 35%, reinforcing Oracle’s leadership in AI-driven solutions.

Strategic Market Expansion: Capitalizing on Global Digital Shifts

Oracle’s strategic expansion into emerging markets targets regions undergoing rapid digital transformation. The company has established 12 new local data centers in the past year alone, aiming to tap into these burgeoning markets before they reach saturation. This proactive approach has diversified Oracle's global presence and is reported to have contributed to a 20% increase in international revenue, particularly from the Asia-Pacific and Latin America regions.

Sustainability Initiatives in Cloud Infrastructure

Recognizing the critical role of environmental responsibility, Oracle is investing in sustainable cloud operations. Recent initiatives include the development of three green data centers that utilize 100% renewable energy sources, aiming to reduce Oracle’s carbon footprint by 30% by 2025. These efforts are in line with the increasing emphasis on corporate environmental responsibility and have enhanced Oracle's appeal to eco-conscious clients, with a reported 15% increase in engagements from environmentally focused businesses.

Investment Consideration for Oracle (NASDAQ:ORCL)

Oracle's robust expansion in cloud infrastructure, with a notable 42% increase in revenue to $2 billion, underscores its aggressive stance in a sector dominated by tech giants. This growth, coupled with Oracle's deepening AI integration, which supports advanced AI applications through $12 billion contracts, highlights its competitive edge in tech innovation. Financially, Oracle is sound, demonstrating strong profitability with operating and EBITDA margins of 44% and 55% respectively, and a promising future revenue pipeline indicated by a 44% increase in performance obligations to $98 billion. Oracle's strategic market expansions and sustainability initiatives further bolster its position as a resilient and forward-thinking enterprise.

Rating: Strong Buy — Oracle's current trajectory and strategic investments in AI and global infrastructure expansion suggest significant potential for long-term growth and market competitiveness.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex