Palantir Technologies (NYSE: PLTR) Poised for Massive Growth: AI Expansion and Strong Government Contracts

With surging commercial revenue and expanding government contracts, Palantir (NYSE: PLTR) positions itself as a leader in AI and data analytics. Is this stock the next big opportunity? Here's a deep dive into its potential | That's TradingNEWS

Palantir Technologies Inc. (NYSE: PLTR) - Riding the AI Wave to New Heights

Palantir Technologies Inc. (NYSE: PLTR) is rapidly becoming one of the most intriguing players in the data analytics and artificial intelligence space. With a focus on serving both government and commercial clients, the company has built its reputation on providing cutting-edge AI and data solutions that address complex problems at scale. Palantir’s recent expansion into AI applications through its Artificial Intelligence Platform (AIP) is setting the stage for future growth and innovation across a wide range of industries.

Palantir's Strong Growth Trajectory: AIP Driving Commercial Success

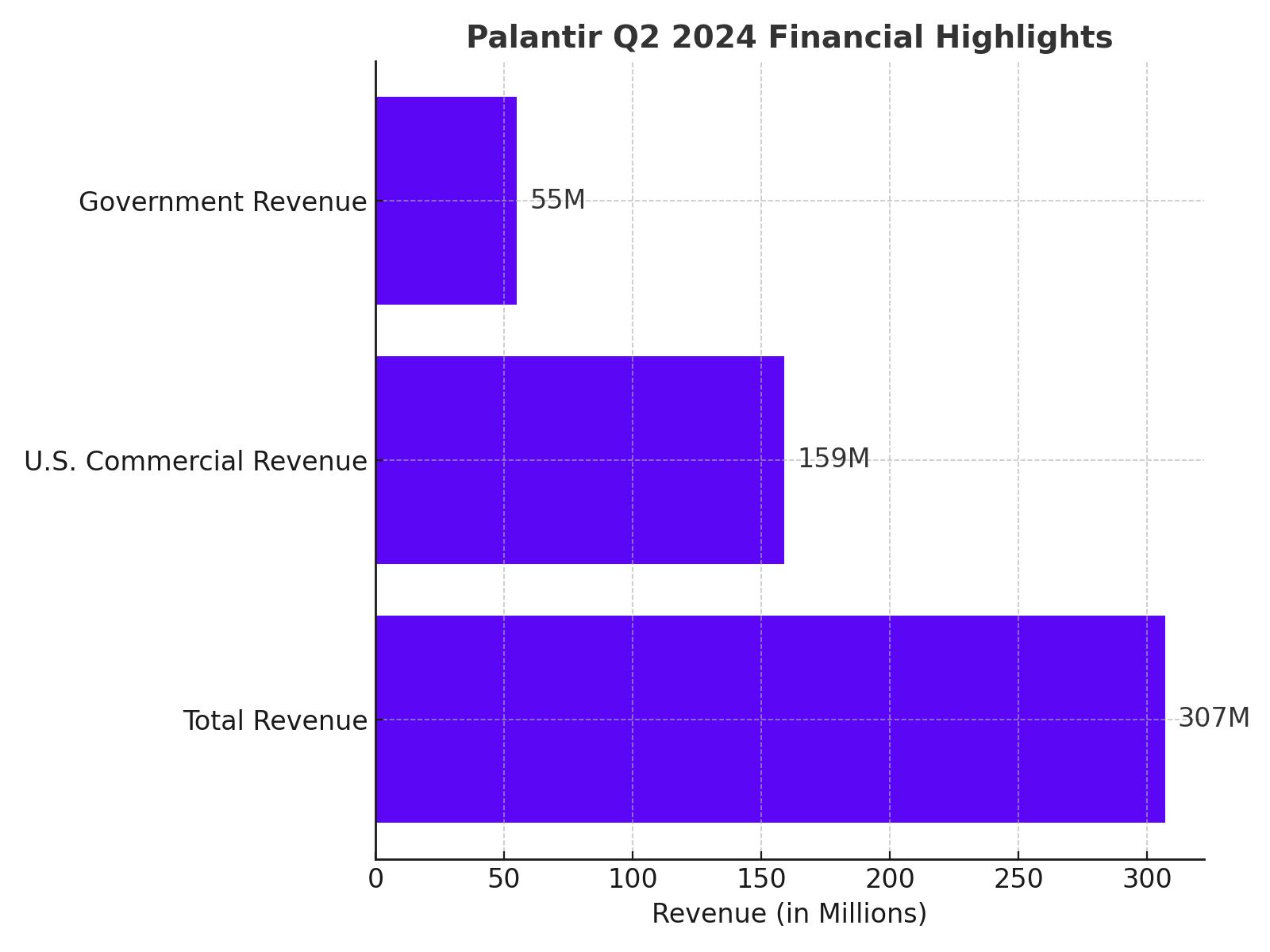

Palantir’s latest innovation, the Artificial Intelligence Platform (AIP), is gaining substantial traction among commercial clients, driving significant growth. In Q2 2024, the company's commercial revenue jumped by 33% year-over-year to $307 million, while U.S. commercial revenue surged by 55% to $159 million. AIP, which allows users to build AI applications, actions, and workflows, is proving to be a valuable tool for businesses seeking to solve complex challenges.

The company’s go-to-market strategy revolves around using boot camps to demonstrate AIP’s capabilities to prospective clients. This approach has helped Palantir rapidly expand its U.S. commercial customer base, which grew by 83% year-over-year, reaching 295 customers. As Palantir transitions new clients from prototype to production stages, the company is focusing on a "land-and-expand" strategy that emphasizes deepening relationships with existing clients—a key driver of its 114% net dollar retention.

Government Contracts Remain a Key Revenue Pillar

Palantir's government segment continues to be a reliable source of growth, contributing 55% of the company's total revenue. In Q2 2024, U.S. government revenue climbed 23%, up from 14% growth in the previous year. The company has secured several significant contracts this year, including a $100 million deal to expand its Maven Smart System access across the U.S. military and a $153 million contract to deploy AI-enabled systems within the Department of Defense.

Palantir’s collaboration with Microsoft to integrate its solutions into Microsoft's government and classified cloud environments also positions it to accelerate the adoption of AI offerings within the public sector, further strengthening its government business.

Financial Strength and Flexibility: A Cash-Rich, Debt-Low Company

One of Palantir’s most compelling strengths is its solid financial position. As of June 2024, the company held $4 billion in cash and only $260 million in debt, providing it with significant financial flexibility to explore strategic investments and acquisitions. This robust cash flow allows Palantir to continue investing in product development and expanding its footprint in both the commercial and government sectors.

Growth in Operating Income and EBITDA: Strong Correlation with Revenue Growth

Palantir’s operating income and EBITDA growth have mirrored its revenue growth, signaling efficient management and operational leverage. The company’s ability to convert revenue into profits underscores its strong business model, where higher revenues directly translate into more value for shareholders. With a 114% net dollar retention rate and solid RPO (remaining performance obligation) growth, Palantir is well-positioned to maintain its growth trajectory in the coming years.

The AI Revolution: A Long-Term Secular Trend

Palantir is riding the AI wave, benefiting from the broader market’s appetite for artificial intelligence and machine learning solutions. According to Verified Market Research, the global AI software market is projected to reach $2.7 trillion by 2031, growing at a 20.4% CAGR. Palantir’s AI-focused offerings like AIP and its flexible pricing and modular sales strategies make it well-positioned to capitalize on these favorable industry trends.

Insider Transactions: What Does It Mean for Investors?

Despite the company's impressive performance, recent insider selling has raised questions. Notably, co-founder Peter Thiel sold approximately 16 million shares this year, netting $600 million in gross proceeds. While insider sales can be a concern for investors, it’s important to note that Thiel still retains a significant stake in Palantir, holding 110 million shares, or about 5% of the company. Additionally, CEO Alex Karp has also been selling shares but continues to hold valuable stock options.

Although large insider sales often raise red flags, these transactions were conducted under pre-established trading plans, known as 10b5-1 plans, designed to prevent insider trading accusations. Moreover, these sales may not necessarily indicate a lack of confidence in the company’s future, especially considering the strong fundamentals Palantir has demonstrated.

You can track more insider transactions here.

Palantir’s Future Growth and Market Valuation: Overvalued or Justified?

Palantir has been a topic of debate among investors due to its lofty valuation. With the stock trading at around $37, many argue that it is overvalued, particularly when traditional valuation metrics like P/E ratios are applied. However, Palantir’s unique position in the AI and data analytics industry may justify a premium. Using a discounted cash flow (DCF) analysis, the intrinsic value of Palantir could hover around $30 per share over the next 12 months, suggesting a potential 20% correction.

Despite this, Palantir’s growth story remains compelling, especially with the potential for long-term growth in AI and data-driven solutions. The company's ability to secure government contracts and expand into the commercial sector with AI applications positions it for sustained success.

Technical Indicators and S&P 500 Inclusion: A Stock on the Rise

Palantir's inclusion in the S&P 500 has been a major catalyst for the stock, driving up its share price and attracting institutional investors. The stock’s YTD gain of 115% reflects strong market confidence, and while a pullback is possible, Palantir’s long-term potential keeps it on the radar for growth investors.

From a technical standpoint, Palantir’s stock has broken through key resistance levels, supported by strong earnings growth and revenue momentum. Analysts suggest that the company’s ability to sustain this growth, particularly with AI solutions like AIP, could propel the stock even further.

Investment Outlook: Buy, Hold, or Sell?

Given the strong growth prospects, favorable industry trends, and robust financials, Palantir (NYSE: PLTR) remains a Buy for long-term investors. While short-term volatility and insider sales may create temporary headwinds, the company’s strategic positioning in the AI and data analytics space provides a compelling case for holding or even increasing exposure. Investors should be prepared for potential pullbacks, especially if the stock approaches the $30 range, but long-term growth remains intact.

For real-time updates and to track Palantir’s performance, view the stock here.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex