Paramount Global NASDAQ:PARA Financial and Strategic Business Analysis

Assessing PARA's Market Position, Insider Transactions, and Strategic Moves Amidst Potential Acquisition Talks | That's TradingNEWS

In-Depth Financial Analysis of Paramount Global (NASDAQ:PARA)

Introduction: Assessing Paramount Global's Market Position

Paramount Global (NASDAQ:PARA), a prominent player in the media industry, has seen a fluctuating performance, particularly in 2023, with its stock trading at $14.00 amidst speculation of a potential acquisition. Despite previous stagnation around $11, PARA experienced a surge in interest following rumors about Skydance Media's involvement in a potential deal.

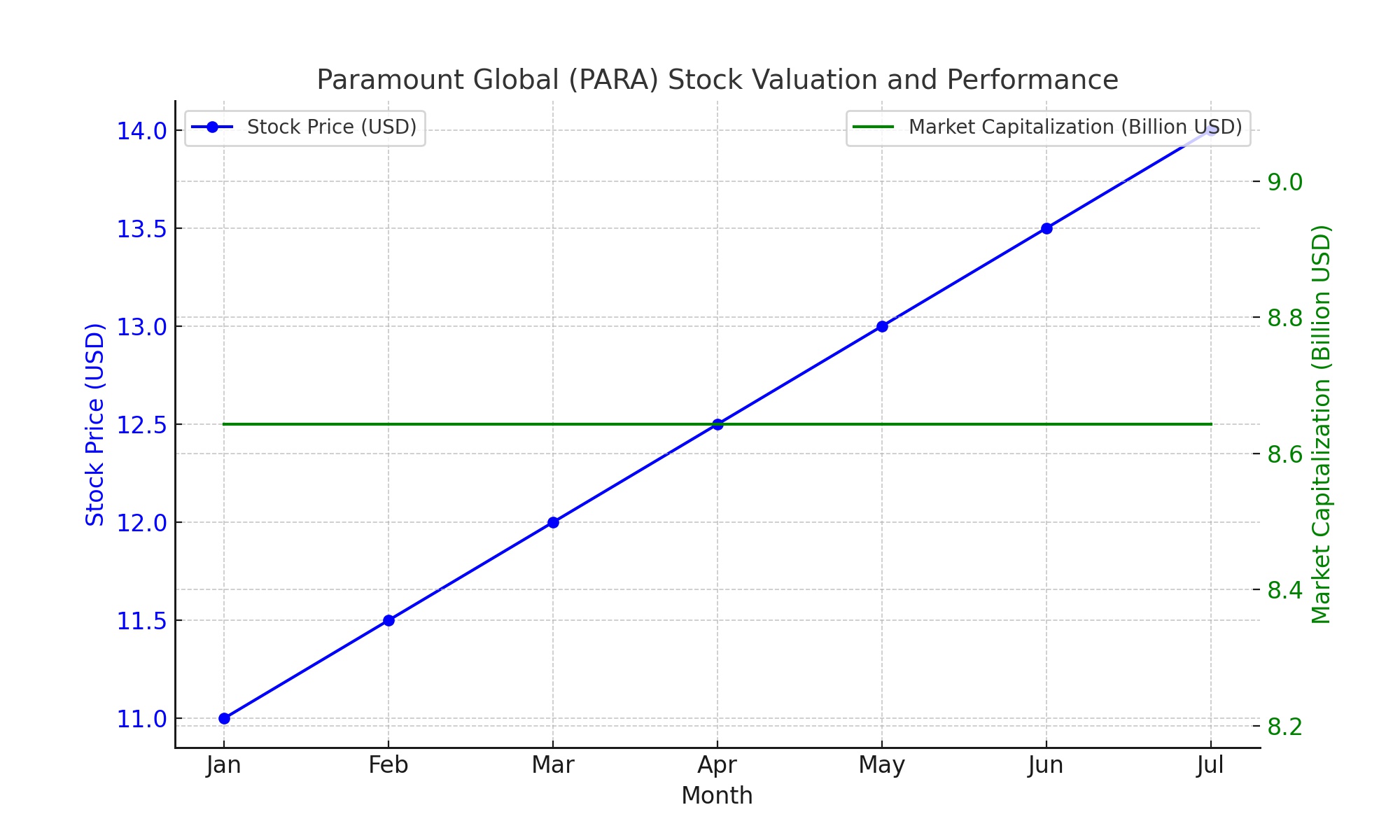

Stock Valuation and Performance

As of late, Paramount Global's stock has exhibited volatility, influenced by both market speculations and its financial performance. The stock, which had seen lows and highs from $11 to around $14, reflects investor reactions to ongoing merger and acquisition talks. The company's market capitalization stands at approximately $8.643 billion, with a trading volume that underscores its active presence in the market.

Strategic Business Moves and Rumors

The circulating rumors regarding Skydance Media's interest in Paramount have significantly impacted the stock's trajectory. The speculation of an all-cash deal to acquire Paramount's controlling stake and subsequent asset sales has created a buzz in the financial community. This strategy resembles previous transactions in the media industry, where companies acquired specific assets and offloaded others to streamline their operations and financial commitments.

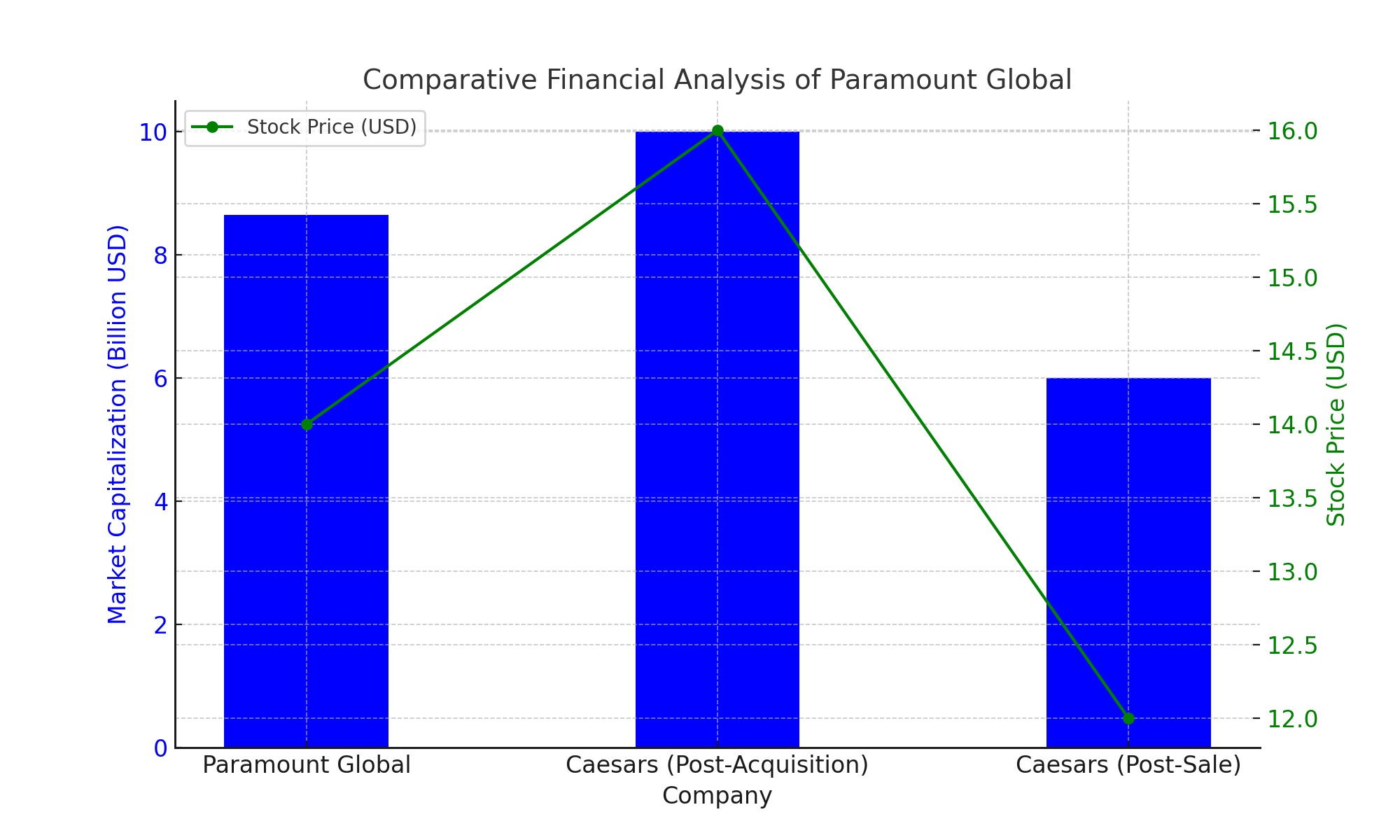

Comparative Financial Analysis

Paramount Global's financial situation can be understood better by comparing its performance to similar transactions in the industry. For instance, Caesars' acquisition of William Hill's U.S. operations for $4 billion, followed by the sale of its non-U.S. assets for approximately $2 billion, offers a parallel in terms of strategic asset reallocation. Such moves can significantly alter a company's financial trajectory and market valuation.

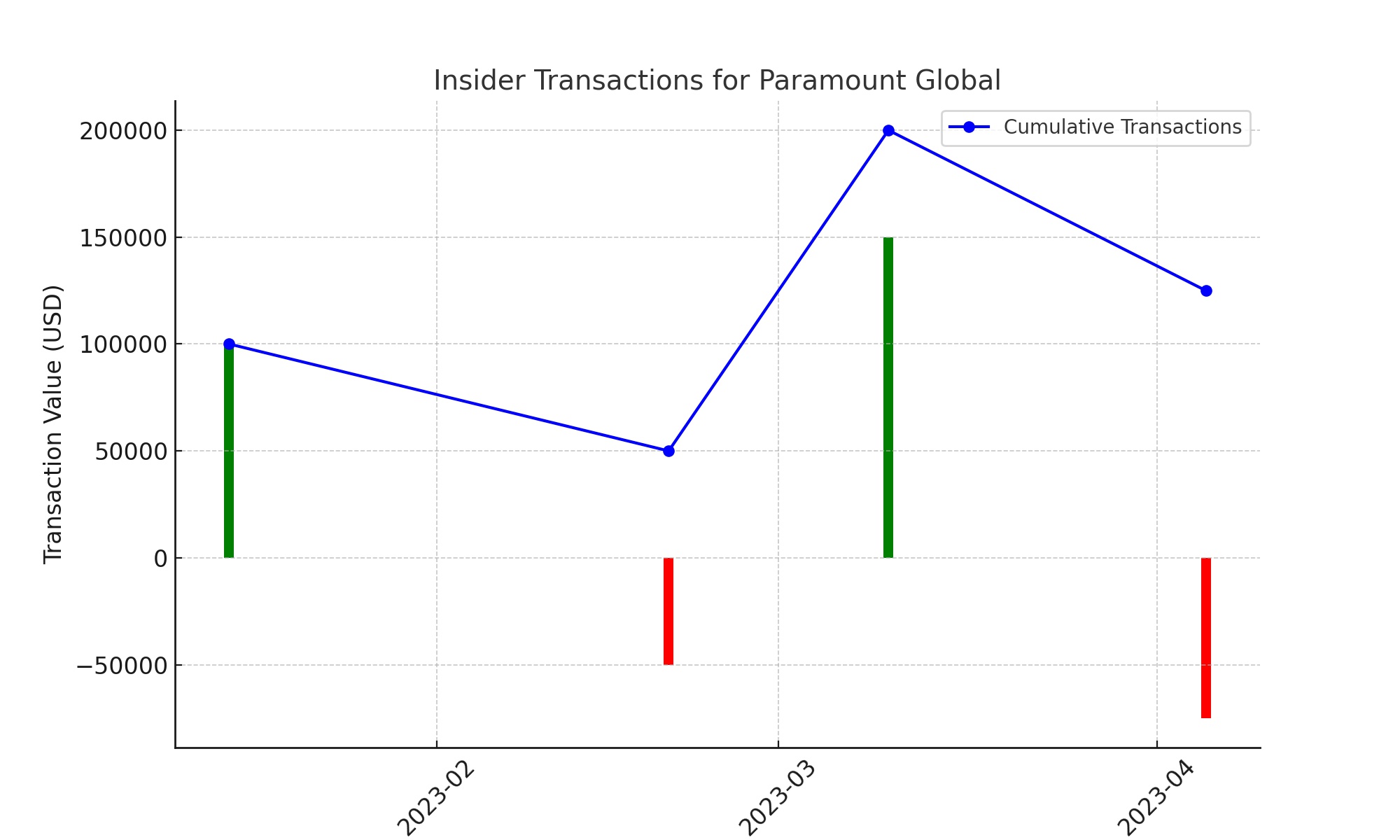

Insider Transactions and Shareholder Impact

Given the potential changes in Paramount's ownership and structure, insider transactions become a critical area of focus. The involvement of key financial players, like KKR and Tencent, in the speculated transaction could indicate significant strategic shifts. Shareholders need to be aware of these developments, as they could substantially impact the value of their investments. Keeping abreast of insider transactions is crucial for a comprehensive understanding of Paramount's financial health and future prospects. For detailed insider transaction information, visit Paramount Insider Transactions.

Paramount's Future Outlook: Streaming Business and Debt Management

Paramount's strategies in managing its streaming business, such as the launch of Paramount+ and its global expansion, are key factors in its future growth. The company's focus on reducing its debt, as evidenced by its use of proceeds from the sale of Simon & Schuster and the $1 billion tender offer, are pivotal in shaping its financial health. These strategic decisions could significantly influence the company's ability to maintain momentum and achieve profitability in the highly competitive streaming market.

Potential Mergers and Acquisitions: A Game-Changer

The rumors surrounding potential mergers or acquisitions involving Paramount, such as the interest from Apple (AAPL) in bundling its streaming service with Paramount+ and talks with Warner Bros. Discovery (WBD), add another layer of complexity to the company's future. These possibilities, if realized, could lead to a reshaping of the media landscape and potentially increase Paramount's market valuation.

DCF Valuation and Share Price Projections

A Discounted Cash Flow (DCF) analysis suggests that Paramount's fair value per share could be significantly higher than its current trading price, offering a substantial upside potential. This valuation is contingent on the company's performance and the realization of speculated deals, which could lead to a reevaluation of the stock's worth.

Conclusion: Paramount's Strategic Path Forward

In conclusion, Paramount Global stands at a critical juncture, with potential deals and strategic business decisions set to shape its future. Investors and stakeholders should closely monitor these developments, as they will play a crucial role in determining the company's financial performance and stock valuation. For real-time stock analysis and charting, visit Paramount Stock Analysis.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex