PayPal Stock (NASDAQ: PYPL) Soars To 52-Week High: Factors Behind the Rally

From strategic partnerships to robust financial health, PayPal (NASDAQ: PYPL) is on a winning streak. Here’s what’s powering the stock’s impressive rise and why it matters for investors | That's TradingNEWS

PayPal’s Recovery Signals a New Era of Growth and Strategic Execution

PayPal’s Stock Performance and Market Confidence

PayPal Holdings Inc. (NASDAQ:PYPL) has recently marked a significant milestone by reaching a 52-week high, with its stock trading at $70.69. This achievement reflects a remarkable 17.51% surge in its stock price over the past year, signaling a robust recovery for the digital payments giant. After a period of stagnation and challenges, PayPal’s resurgence underscores renewed investor confidence driven by strategic moves, solid financial performance, and an effective leadership transition.

This turnaround has been particularly notable in light of the broader market conditions. Despite the S&P 500 Index (SPX) declining by 0.20% and the Dow Jones Industrial Average (DJIA) falling by 0.15%, PayPal’s stock has defied the market trend, closing at $71.89 on Tuesday, reflecting a 3.54% increase for the day. This marks the sixth consecutive day of gains for PayPal, a testament to the growing optimism surrounding the company’s future.

Strategic Partnerships and Expanding Market Reach

One of the key drivers behind PayPal’s recent success has been its strategic partnership with global financial technology platform Adyen. The recent expansion of this partnership includes the rollout of Fastlane by PayPal, a new guest checkout experience designed to streamline the online shopping process. Fastlane has already shown to reduce checkout times by 32% compared to traditional methods, which is a significant improvement aimed at enhancing consumer satisfaction and increasing conversion rates.

This partnership is expected to bolster PayPal’s market position by making its payment solutions more accessible and attractive to enterprise and marketplace customers in the U.S., with plans for a global rollout in the near future. According to Alex Chriss, PayPal’s President and CEO, “Adyen’s customer base and relationships with enterprises make them the ideal first Fastlane payment processing partner. This strategic partnership aligns with our goal to make PayPal available everywhere customers shop globally.”

Analysts have responded positively to these developments. JPMorgan analyst Tien-Tsin Huang has maintained an Overweight rating on PayPal, raising the price target from $77 to $80, reflecting confidence in PayPal’s growth trajectory and its ability to capitalize on these strategic partnerships.

Financial Performance: Robust Metrics and Shareholder Returns

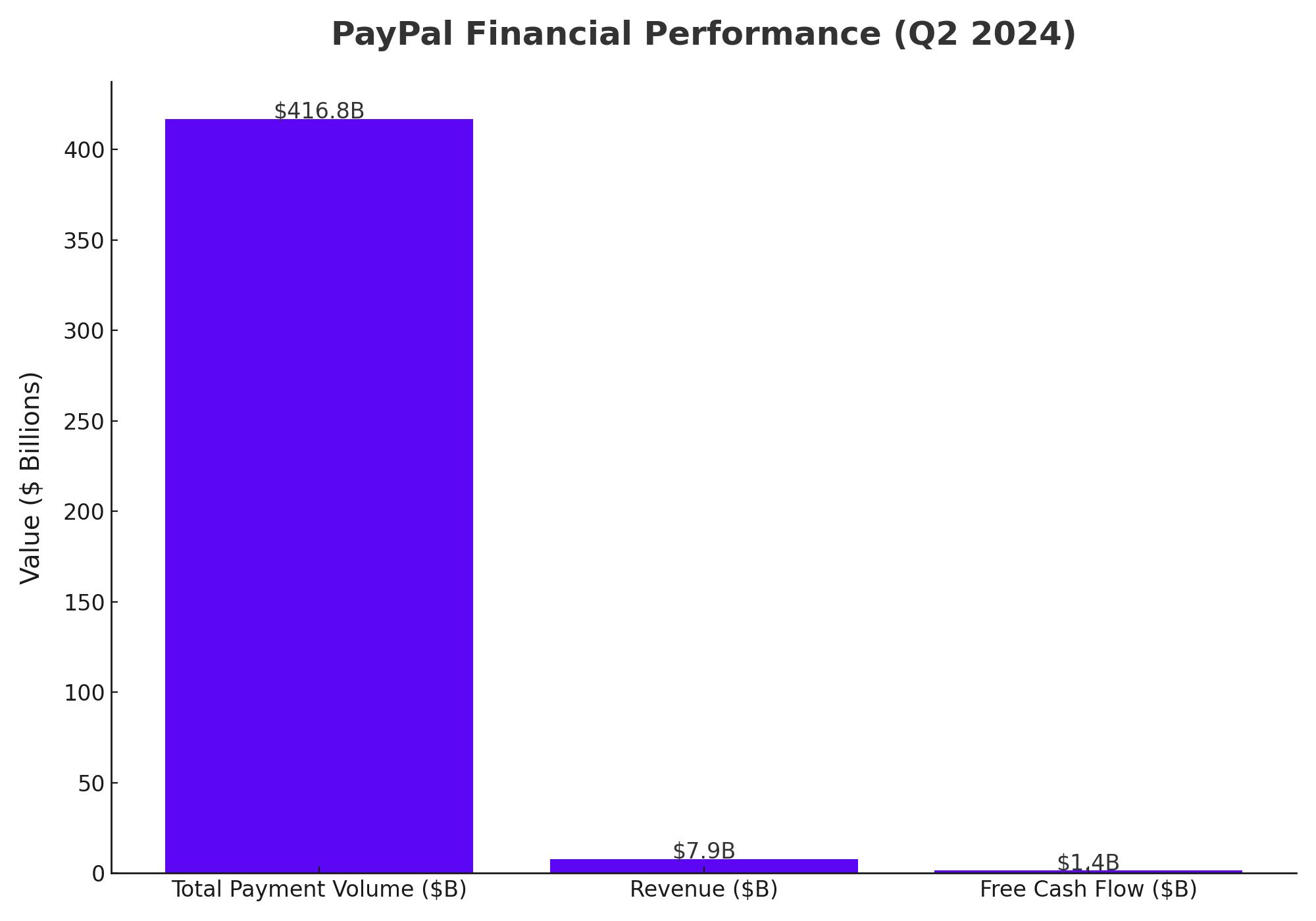

PayPal’s financial performance in Q2 2024 further solidifies its position as a compelling investment opportunity. The company reported a total payment volume (TPV) of $416.8 billion, marking a 10.7% year-over-year increase. This growth is significant, considering the intense competition PayPal faces from newer entrants in the digital payments space. Additionally, PayPal’s revenue for the quarter rose to $7.9 billion, up 8% year-over-year, demonstrating the company’s resilience and ability to generate substantial cash flows.

The company’s free cash flow (FCF) has been particularly noteworthy. PayPal generated $1.4 billion in free cash flow during Q2 2024, bringing its total for the first half of the year to $3.3 billion. This robust cash flow has enabled PayPal to execute an aggressive share buyback program, repurchasing 24 million shares and returning $1.5 billion to shareholders in Q2 alone. Over the trailing twelve months, PayPal has repurchased approximately $5 billion worth of shares, reflecting its commitment to enhancing shareholder value.

Moreover, PayPal’s balance sheet remains strong, with $18.3 billion in cash, cash equivalents, and investments, significantly outweighing its $9.8 billion debt. This financial stability provides PayPal with the liquidity needed to continue its capital return strategies and invest in growth initiatives, ensuring long-term sustainability and profitability.

Technical Analysis: Indicators Signal Continued Momentum

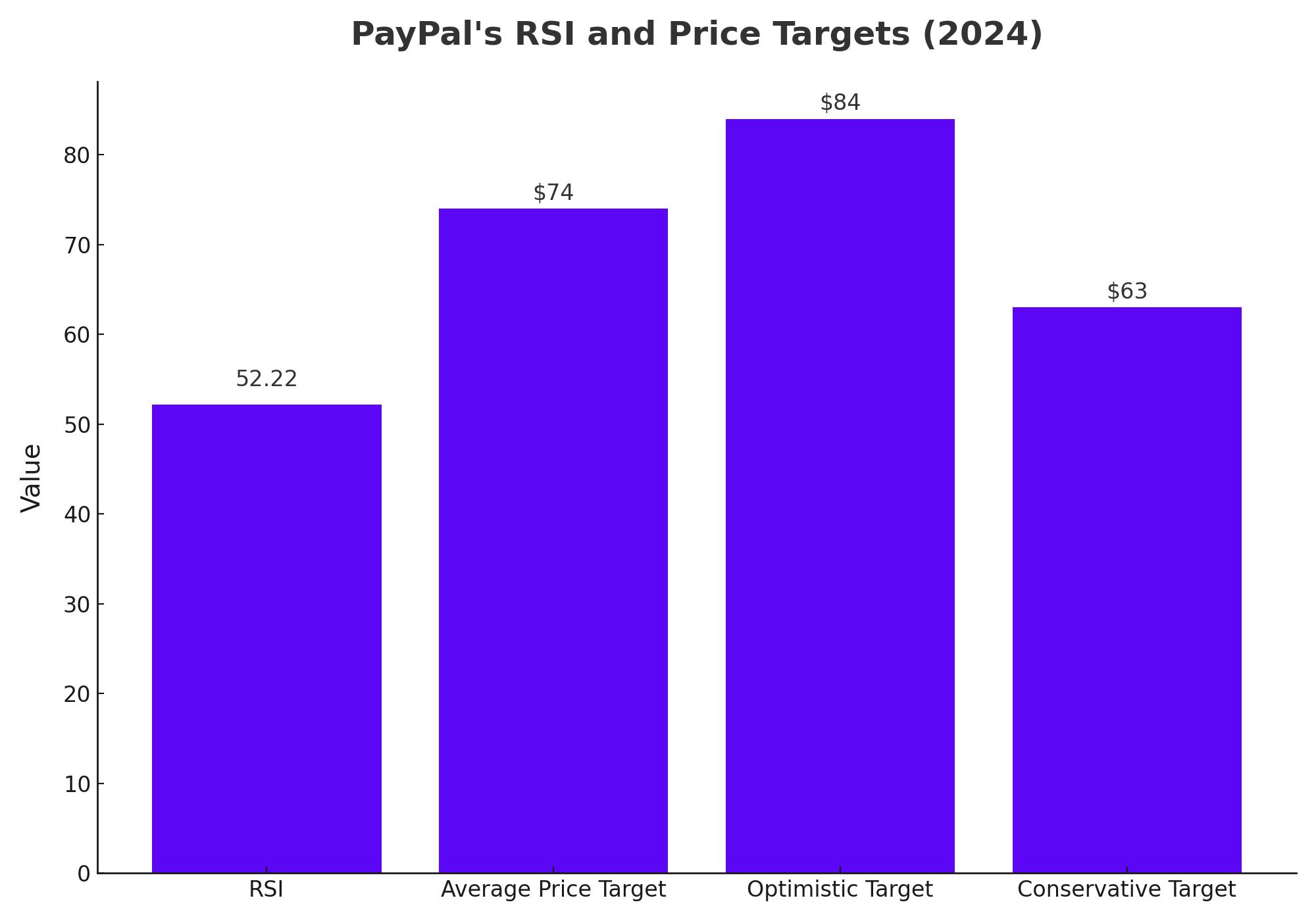

From a technical standpoint, PayPal’s stock appears poised for further gains. The stock is currently trading around $67, with strong momentum driving it above key resistance levels. The Relative Strength Index (RSI) for PayPal is at 52.22, indicating that the stock is neither overbought nor oversold, suggesting room for further upward movement. The RSI line’s upward trend, combined with the absence of significant divergences, supports the case for continued bullish momentum.

The stock’s price targets for 2024, based on Fibonacci retracement levels, suggest potential positive outcomes. The average price target of $74 aligns with the Fibonacci level 1, indicating moderate growth expectations. An optimistic target of $84, correlating with the 1.618 Fibonacci level, suggests a solid bullish trend if achieved. Conversely, a more conservative target of $63 aligns with the 0.382 Fibonacci level, indicating minimal downside risk should market conditions worsen.

The Volume Price Trend (VPT) also shows an upward trend, further reinforcing the potential for a bullish price volume momentum. Although the current VPT line value is slightly below its moving average, this suggests a possible buying opportunity as it crosses the moving average, providing an attractive entry point for investors.

Competitive Landscape: Navigating Market Challenges

Despite PayPal’s strong financial performance and strategic positioning, the company faces significant competition, particularly from tech giants like Apple Inc. (AAPL). Apple Pay, with its vast ecosystem and substantial user base, represents a formidable competitor. With approximately 510 million users worldwide, Apple Pay’s market presence cannot be underestimated. However, PayPal’s extensive user base and established brand in the digital payments space provide it with a competitive edge.

The coexistence of multiple payment solutions in an expanding digital payments market suggests that PayPal, alongside competitors like Apple Pay, can thrive. The increasing shift towards digital payments, coupled with PayPal’s strategic initiatives, positions the company well to capture a significant share of this growing market.

Challenges and Risks: Economic Uncertainty and Market Volatility

While PayPal’s recent performance has been impressive, the company is not immune to broader economic challenges. The potential for an upcoming recession poses a risk to PayPal’s business, as consumer spending typically declines during economic downturns, which could impact PayPal’s TPV and revenue growth. Additionally, market volatility could affect investor sentiment and the stock’s performance in the short to mid-term.

However, PayPal’s strong balance sheet, robust free cash flow, and aggressive share buyback program provide a cushion against potential economic headwinds. The company’s ability to generate significant cash flow, even in challenging environments, underscores its resilience and ability to weather economic downturns.

Intrinsic Value and Investment Thesis

To assess whether PayPal remains a compelling investment, it’s essential to consider its intrinsic value. Using a discounted cash flow (DCF) model, we can estimate PayPal’s intrinsic value based on its free cash flow, growth assumptions, and discount rate. Assuming a conservative free cash flow of $6 billion for fiscal 2024, a 10% discount rate, and 12% annual growth for the next decade, followed by 3% growth in perpetuity, we arrive at an intrinsic value of approximately $146.73 per share. This suggests that PayPal is deeply undervalued at its current trading price, offering significant upside potential for investors.

Even under more conservative assumptions, such as no growth in the next five years due to a potential recession, PayPal’s intrinsic value would still be around $97.80 per share, indicating that the stock remains undervalued. This conservative valuation underscores the investment thesis that PayPal’s strong fundamentals and strategic positioning make it a compelling long-term investment, despite short-term market challenges.

Conclusion

PayPal Holdings Inc. (NASDAQ:PYPL) has demonstrated a remarkable recovery, driven by strategic partnerships, robust financial performance, and effective leadership. Despite facing competitive pressures and broader economic challenges, PayPal’s strong fundamentals, including its significant free cash flow generation and aggressive capital return strategies, position it well for sustained growth. The company’s recent technical breakout and upward momentum further reinforce the potential for continued gains.

Investors looking for a resilient player in the digital payments space should consider PayPal as a compelling investment opportunity. With a deeply undervalued stock price relative to its intrinsic value and strong growth prospects, PayPal is well-positioned to navigate the evolving digital payments landscape and deliver long-term value to shareholders.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex