Record Profitability for Bitcoin Supply as Market Remains Stable

Glassnode Reports High Profitability; Analysts Predict Strong Growth and Institutional Demand to Propel Bitcoin Prices Further | That's TradingNEWS

Record Bitcoin Supply Profitability

According to Glassnode, 87% of Bitcoin’s supply is currently in profit. Despite recent price fluctuations, Bitcoin is trading at $65,436, consolidating within a horizontal channel with resistance at $71,656 and support at $64,825. This stability has provided investors with more confidence in the asset's long-term value.

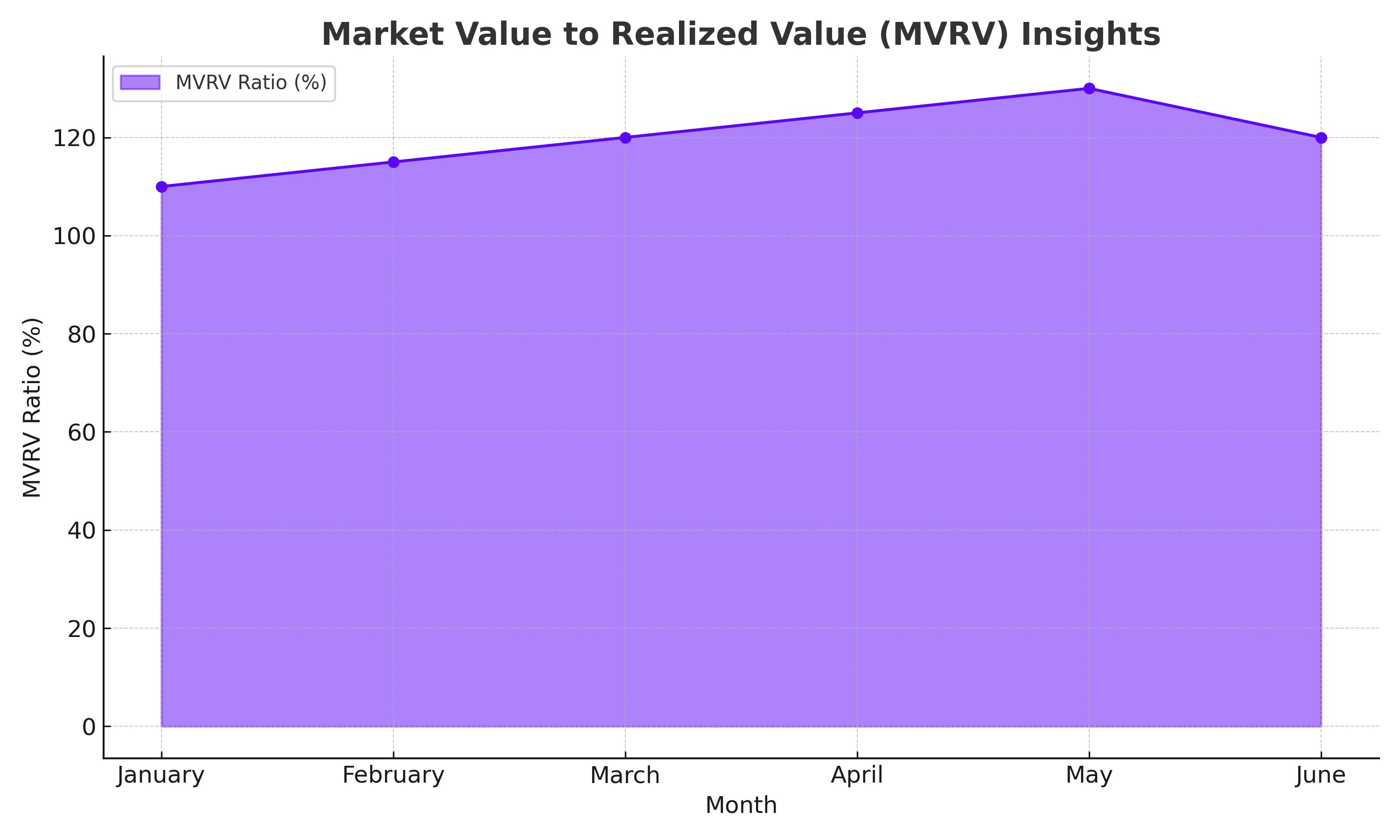

Market Value to Realized Value (MVRV) Insights

The Market Value to Realized Value (MVRV) ratio reveals that the average Bitcoin in circulation holds an unrealized profit of over 120%. Despite this profitability, the volume of transactions on the Bitcoin network has significantly decreased since the peak in March, indicating reduced speculative activity and increased market indecision.

Decline in Exchange Flows

The consolidation of Bitcoin’s price has led to a notable decrease in exchange flows. Currently, short-term holders (STHs) are sending approximately 17,400 BTC daily to exchanges, a 68% drop from the 55,000 BTC sent when Bitcoin peaked at $73,000 in March. Long-term holders (LTHs) show even less activity, sending around 1,000 BTC per day to exchanges, reflecting a stable market outlook.

Analysts' Optimistic Projections

Analysts at Bernstein have raised their Bitcoin price forecast to $200,000, up from a previous target of $150,000. They emphasize the growing institutional adoption of Bitcoin and the potential for increased demand from new market entrants. Bernstein also projects that Bitcoin ETFs, particularly those driven by institutional investors, are poised for significant growth in Q3 and Q4.

Bitcoin's Correlation with Fed Liquidity

Financial commentators highlight the close correlation between Bitcoin price movements and Federal Reserve liquidity. As Fed liquidity is projected to bottom out and rise again, a potential Bitcoin price rally could be imminent. This correlation underscores the significant impact of macroeconomic factors on Bitcoin’s market performance.

Impact of Whale Activity and Hedge Fund Exposure

Recent whale activities and a reduction in hedge fund exposure have contributed to Bitcoin's price decline. Whale Alert reported significant BTC deposits exceeding $1 billion, potentially indicating large sell orders. Additionally, hedge fund exposure to Bitcoin has dropped drastically, with the beta value of hedge funds’ performance relative to Bitcoin now at its lowest since December 2020.

Bitcoin's Short-Term Holder Realized Price

Glassnode data shows that the Short-Term Holder (STH) Realized Price, which reflects the average acquisition cost for recently acquired coins, is around $64,097. This metric has consistently provided strong support throughout the current bull market, indicating ongoing bullish momentum for Bitcoin.

Institutional Interest and ETF Inflows

Despite short-term headwinds, institutional interest in Bitcoin ETFs is expected to accelerate. Anticipation for U.S. wirehouses to gain access to spot ETF products is high, with significant inflows projected for the third quarter. This increased institutional participation is likely to drive further demand and support higher Bitcoin prices.

Conclusion: Navigating Market Dynamics

Bitcoin's market remains robust despite recent price volatility. The strong profitability of its supply, coupled with increasing institutional interest and supportive macroeconomic conditions, suggests a positive long-term outlook. As analysts predict higher price targets and anticipate significant ETF inflows, Bitcoin's market position continues to strengthen. Investors are advised to stay informed on market trends and institutional activities to navigate this dynamic environment effectively.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex