Robinhood NASDAQ:HOOD Future with Strategic Insight

Unveiling Robinhood's Q3 Performance: Revenue Dynamics, Market Sentiment, and Future Growth Pathways - A Deep Dive into the Fintech Giant's Prospects and Challenges in the Evolving Market Landscape | That's TradingNEWS

Robinhood Markets, Inc. (NASDAQ:HOOD): An In-Depth Financial and Strategic Analysis

Dissecting the Revenue Shortfall

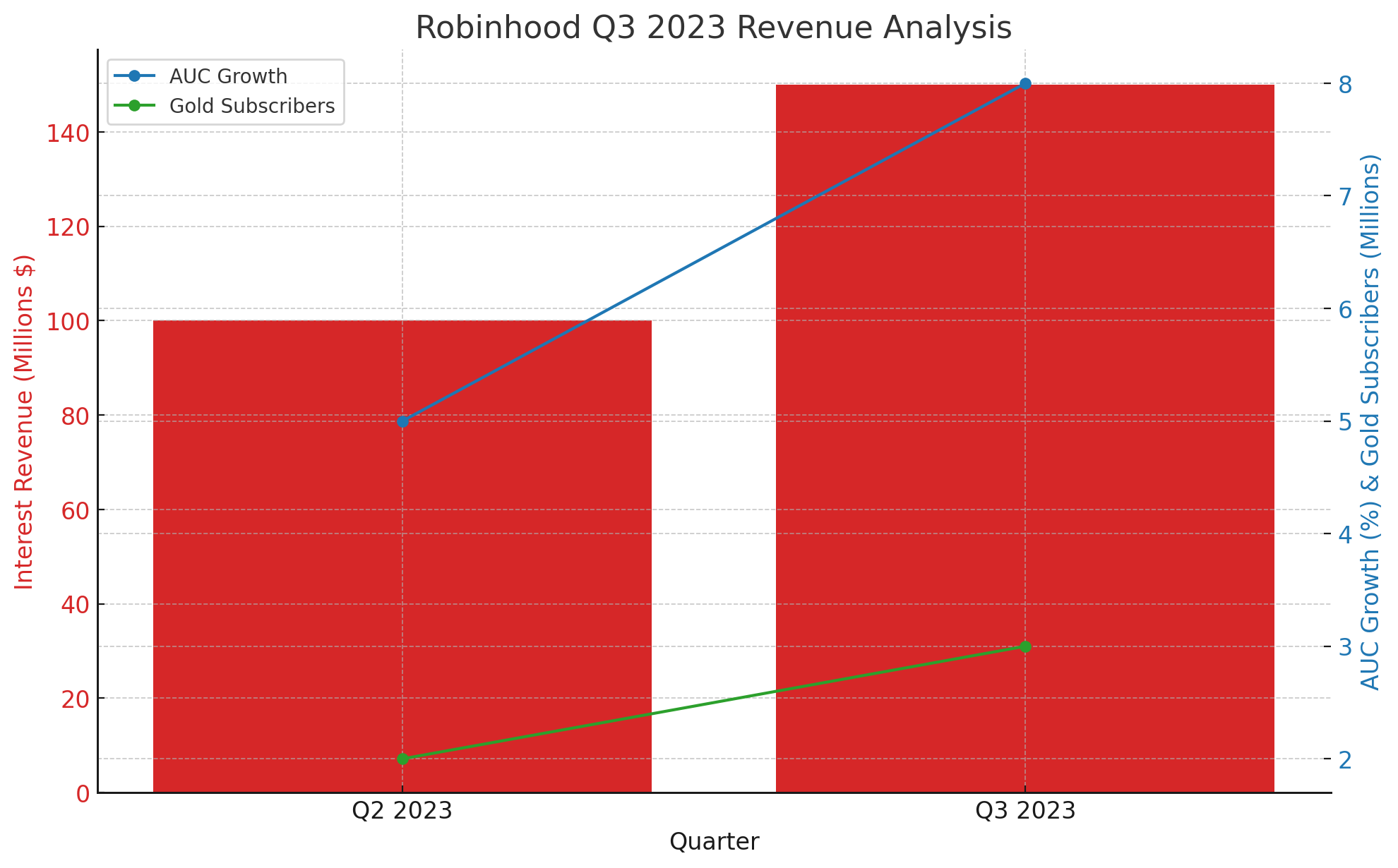

Robinhood's third-quarter report in 2023 unveiled a revenue shortfall, leading to a notable dip in stock price. However, this superficial glance masks the underlying strides in business health. The quarter witnessed a remarkable increase in interest revenue, signifying a robust income stream despite the revenue miss. Specifically, Robinhood's interest revenue escalated significantly, contributing a substantial part of the total revenue.

Growth in Key Business Areas

The quarter also saw a marked increase in assets under custody (AUC), a critical indicator of customer trust and platform use. The reported AUC growth, coupled with an uptick in Gold subscribers, points to a deepening customer engagement and diversification of revenue sources. These metrics collectively paint a picture of a company strategically investing in and fortifying its future.

Market Sentiment and Analyst Ratings: Deciphering Robinhood's Stock Trajectory

Analyst Outlook on Robinhood

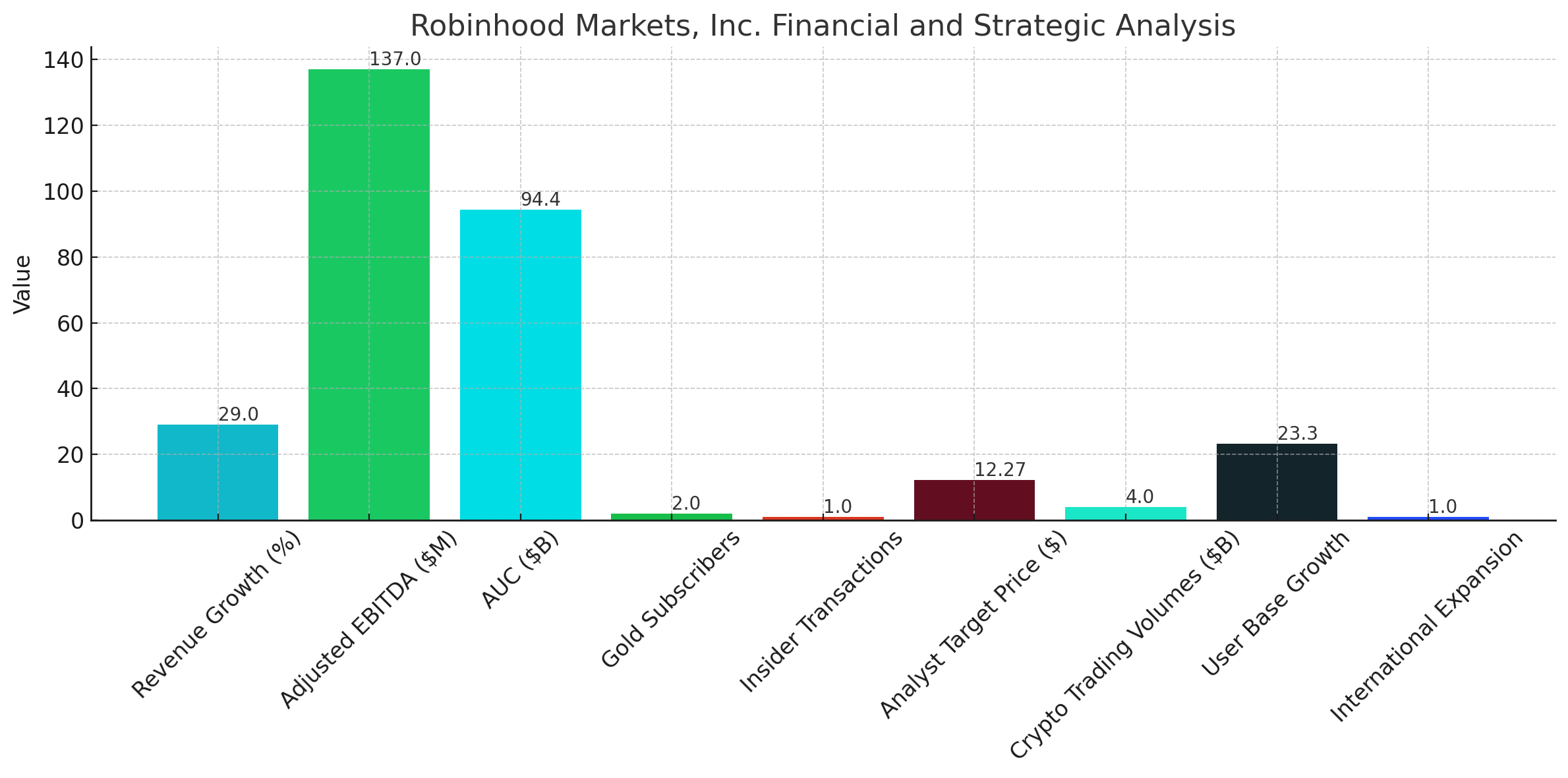

The financial market's perspective on Robinhood is varied. Analysts have set an average price target of approximately $12.27 for HOOD, indicating a cautiously optimistic outlook. This valuation reflects the analysts' measured confidence in the company's ability to rebound and grow amidst market uncertainties.

Understanding the Price Target Rationale

The projected target is derived from a comprehensive analysis of Robinhood's market position, growth potential, and the broader fintech landscape's volatility. It is an amalgamation of expectations for Robinhood's ability to harness its user base, innovate in product offerings, and capitalize on market trends.

Insider Activity and Institutional Trading: Evaluating Internal and External Confidence in Robinhood

Insider Transactions: A Dual Perspective

Recent activities by Robinhood's insiders, notably CEO Vladimir Tenev's sale of shares, offer a complex view of internal confidence. These actions might signal various strategic decisions or personal financial planning but are often scrutinized for insights into insider sentiments about the company's future.

Institutional Trust in Robinhood

On the institutional front, significant movements like Vanguard Group's increased stake in Robinhood demonstrate external confidence. Institutional investors' decisions to invest or divest are typically grounded in rigorous analysis and long-term projections, underscoring the importance of such transactions in assessing market sentiment.

Q3 Recap and Key Financial Highlights: Unpacking Robinhood's Recent Performance

Revenue Growth Amidst Challenges

Robinhood's Q3 performance showcased a commendable revenue increase, highlighting the company's resilience. However, the decline in transactional revenues, especially in the cryptocurrency sector, posed challenges. This reduction in one of Robinhood's historically strong revenue streams has prompted the company to explore and strengthen other areas.

Adjusted EBITDA Growth: A Positive Indicator

The substantial growth in adjusted EBITDA is a positive indicator of Robinhood's improving operational efficiency and cost management. This growth, despite the revenue miss, suggests that Robinhood is on a path to achieving a more sustainable and profitable business model.

The Perfect Storm of Tailwinds for Robinhood: Capitalizing on Market Dynamics

Factors Fuelling Robinhood's Stock Surge

Robinhood's recent stock uptick is attributed to a convergence of favorable factors. Key among these is the increased activity in the crypto market, driven largely by Bitcoin's resurgence. This has directly impacted Robinhood's trading volumes and revenue potential.

International Expansion as a Growth Lever

Moreover, Robinhood's strategic plan to expand into the UK market in 2024, followed by broader European Union market penetration, opens new avenues for growth. This international expansion strategy is expected to diversify Robinhood's user base and revenue streams, providing fresh opportunities in untapped markets.

Analyzing Risks and Opportunities: Navigating Robinhood's Future Path

Balancing Opportunities with Market Volatility

The resurgence in crypto trading and overall market recovery offers Robinhood substantial growth opportunities. However, the inherent volatility of the crypto market and the uncertainties surrounding international expansion present significant risks. Robinhood's ability to balance these factors and make strategic decisions will be pivotal in its future growth trajectory.

Valuation and Growth Potential: Assessing Robinhood's Market Position

Strong Buy Potential Amidst Financial Stability

Considering Robinhood's current market capitalization, robust cash reserves, and zero long-term debt, the stock presents a compelling buy opportunity. Projected sales reaching approximately $3 billion by 2025, combined with a conservative price-to-sales ratio, suggest a significant potential increase in market capitalization. This outlook positions Robinhood as an attractive investment option, particularly given its efforts towards profitability and market expansion.

Trading Volumes and User Growth: Indicators of Robinhood's Market Penetration

Steady User Base Expansion

Robinhood's consistent increase in net cumulative funded accounts reflects steady user base growth. This metric, crucial for a trading platform, indicates user trust and platform stickiness.

Diversifying Revenue Streams

The significant jump in crypto trading volumes, alongside stable equities and options activity, points to a diversifying and robust revenue base. This diversification is critical for Robinhood's long-term stability and growth in the volatile fintech sector.

Market Sentiment and Analyst Ratings: Deciphering Robinhood's Stock Trajectory

Analyst Outlook on Robinhood

The financial market's perspective on Robinhood is varied. Analysts have set an average price target of approximately $12.27 for HOOD, indicating a cautiously optimistic outlook. This valuation reflects the analysts' measured confidence in the company's ability to rebound and grow amidst market uncertainties.

Understanding the Price Target Rationale

The projected target is derived from a comprehensive analysis of Robinhood's market position, growth potential, and the broader fintech landscape's volatility. It is an amalgamation of expectations for Robinhood's ability to harness its user base, innovate in product offerings, and capitalize on market trends.

Insider Activity and Institutional Trading: Evaluating Internal and External Confidence in Robinhood

Insider Transactions: A Dual Perspective

Recent activities by Robinhood's insiders, notably CEO Vladimir Tenev's sale of shares, offer a complex view of internal confidence. These actions might signal various strategic decisions or personal financial planning but are often scrutinized for insights into insider sentiments about the company's future.

Institutional Trust in Robinhood

On the institutional front, significant movements like Vanguard Group's increased stake in Robinhood demonstrate external confidence. Institutional investors' decisions to invest or divest are typically grounded in rigorous analysis and long-term projections, underscoring the importance of such transactions in assessing market sentiment.

Q3 Recap and Key Financial Highlights: Unpacking Robinhood's Recent Performance

Revenue Growth Amidst Challenges

Robinhood's Q3 performance showcased a commendable revenue increase, highlighting the company's resilience. However, the decline in transactional revenues, especially in the cryptocurrency sector, posed challenges. This reduction in one of Robinhood's historically strong revenue streams has prompted the company to explore and strengthen other areas.

Adjusted EBITDA Growth: A Positive Indicator

The substantial growth in adjusted EBITDA is a positive indicator of Robinhood's improving operational efficiency and cost management. This growth, despite the revenue miss, suggests that Robinhood is on a path to achieving a more sustainable and profitable business model.

The Perfect Storm of Tailwinds for Robinhood: Capitalizing on Market Dynamics

Factors Fuelling Robinhood's Stock Surge

Robinhood's recent stock uptick is attributed to a convergence of favorable factors. Key among these is the increased activity in the crypto market, driven largely by Bitcoin's resurgence. This has directly impacted Robinhood's trading volumes and revenue potential.

International Expansion as a Growth Lever

Moreover, Robinhood's strategic plan to expand into the UK market in 2024, followed by broader European Union market penetration, opens new avenues for growth. This international expansion strategy is expected to diversify Robinhood's user base and revenue streams, providing fresh opportunities in untapped markets.

Analyzing Risks and Opportunities: Navigating Robinhood's Future Path

Balancing Opportunities with Market Volatility

The resurgence in crypto trading and overall market recovery offers Robinhood substantial growth opportunities. However, the inherent volatility of the crypto market and the uncertainties surrounding international expansion present significant risks. Robinhood's ability to balance these factors and make strategic decisions will be pivotal in its future growth trajectory.

Valuation and Growth Potential: Assessing Robinhood's Market Position

Strong Buy Potential Amidst Financial Stability

Considering Robinhood's current market capitalization, robust cash reserves, and zero long-term debt, the stock presents a compelling buy opportunity. Projected sales reaching approximately $3 billion by 2025, combined with a conservative price-to-sales ratio, suggest a significant potential increase in market capitalization. This outlook positions Robinhood as an attractive investment option, particularly given its efforts towards profitability and market expansion.

Trading Volumes and User Growth: Indicators of Robinhood's Market Penetration

Steady User Base Expansion

Robinhood's consistent increase in net cumulative funded accounts reflects steady user base growth. This metric, crucial for a trading platform, indicates user trust and platform stickiness.

Diversifying Revenue Streams

The significant jump in crypto trading volumes, alongside stable equities and options activity, points to a diversifying and robust revenue base. This diversification is critical for Robinhood's long-term stability and growth in the volatile fintech sector.

Conclusion

Robinhood Markets, Inc. (NASDAQ:HOOD) stands at a pivotal juncture. With its innovative approach, expanding user base, and strategic forays into new markets, the company is poised for a potential rebound. However, navigating the volatile fintech landscape with strategic agility will be key to realizing its full potential. For real-time insights and comprehensive stock analysis, investors and analysts should closely monitor Robinhood's performance on platforms like Trading News.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex