Spotify NYSE:SPOT The Future of Music Streaming in 2023

Delving into Spotify's Market Dynamics: A Look at Financial Performance, User Engagement, and Strategic Growth in the Music Streaming Industry | That's TradingNEWS

Analyzing Spotify Technology S.A. (NYSE: SPOT): A Comprehensive Overview

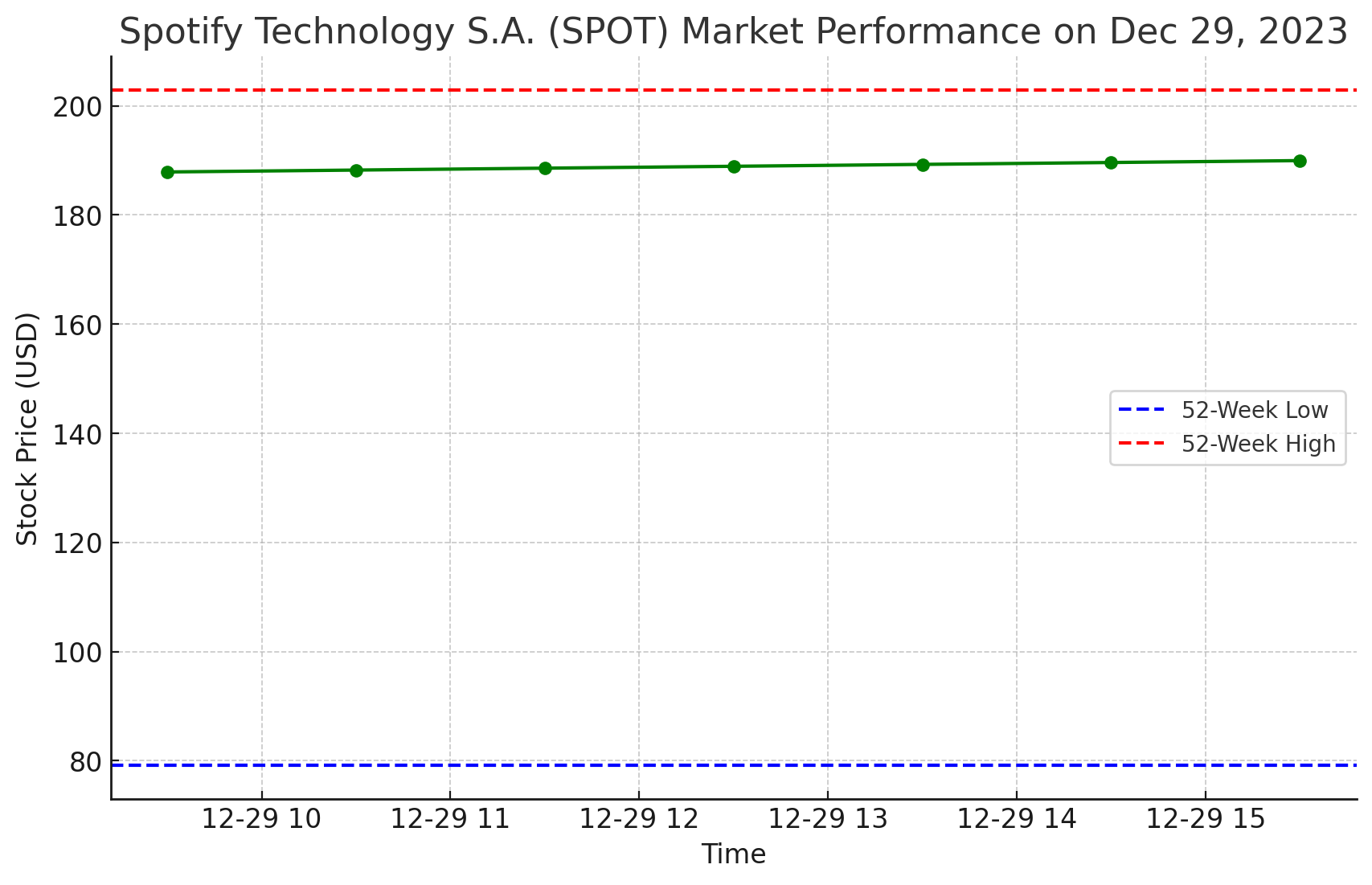

Current Market Performance

NYSE: SPOT, as of December 29, 2023, shows mixed signals in its stock performance. The closing price of $187.91 indicates a slight decline of 0.45%. This nuanced movement comes after a day's range fluctuation between $187.89 and $189.97, reflecting market volatility. Despite these short-term variances, the 52-week range reveals a broader trajectory from a low of $79.14 to a high of $202.88, underlining significant growth over the year. This is supported by a volume of 1,389,010, slightly below the average volume of 1,756,179, hinting at investor caution.

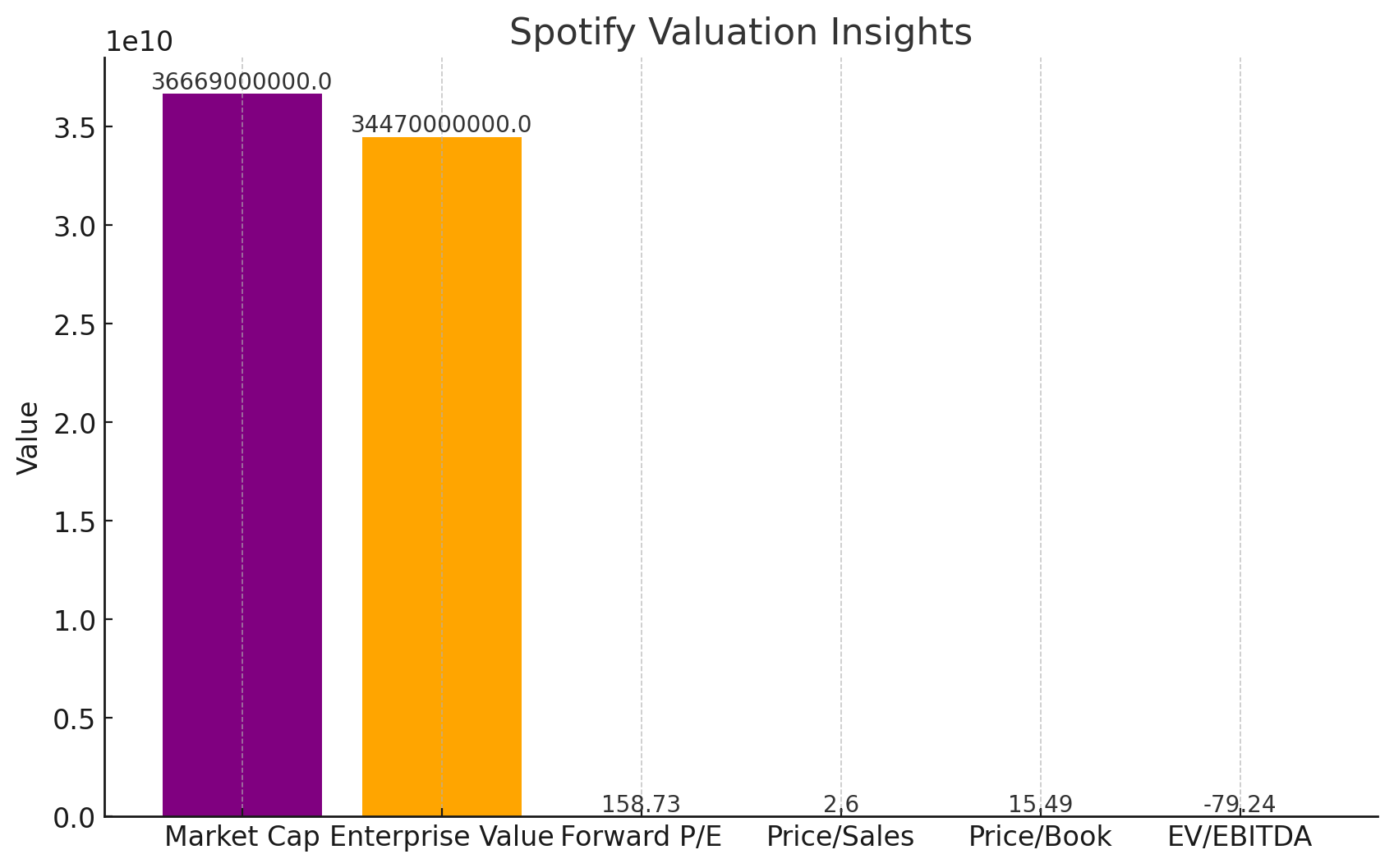

Valuation Insights

Spotify's valuation metrics present a complex picture. With a market capitalization of $36.669B and an enterprise value of $34.47B, the company showcases substantial size in its sector. The absence of a PE Ratio (TTM) and an EPS (TTM) of -4.19 suggest profitability challenges. However, a forward P/E of 158.73 and price/sales (ttm) of 2.60 point towards investor optimism about future growth. The high price/book ratio of 15.49 and a negative enterprise value/EBITDA of -79.24 further illustrate a market expectation of future profitability despite current underperformance.

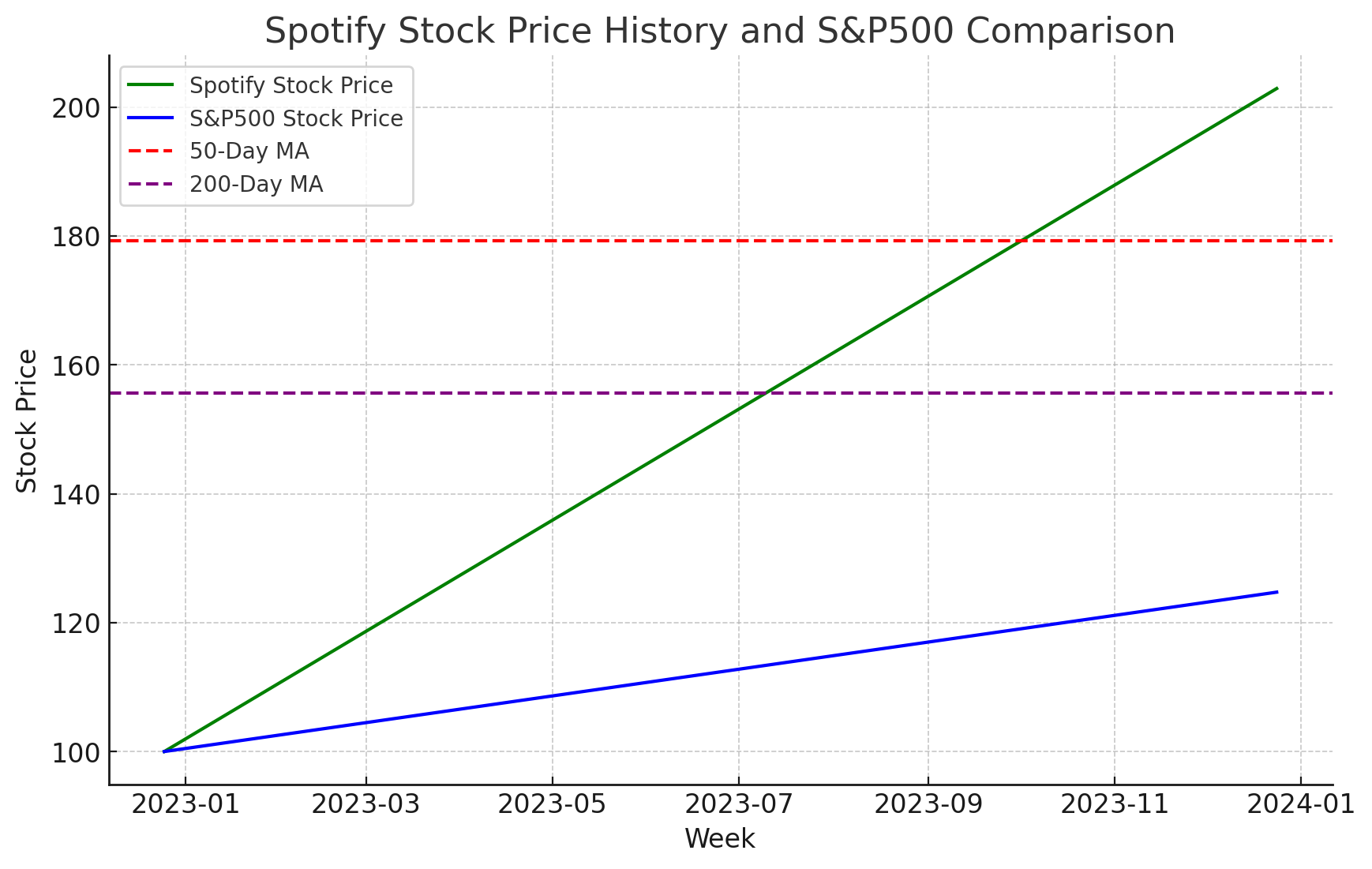

Stock Price History and Share Statistics

A Beta (5Y Monthly) of 1.65 suggests higher volatility compared to the market. The stock has outperformed the S&P500 with a 52-week change of 129.44% against the S&P500's 24.73%. This is reflected in its moving averages: a 50-Day Moving Average of 179.29 and a 200-Day Moving Average of 155.66. The insider and institutional holdings are substantial, with 27.38% and 60.72% respectively, indicating strong confidence from key stakeholders.

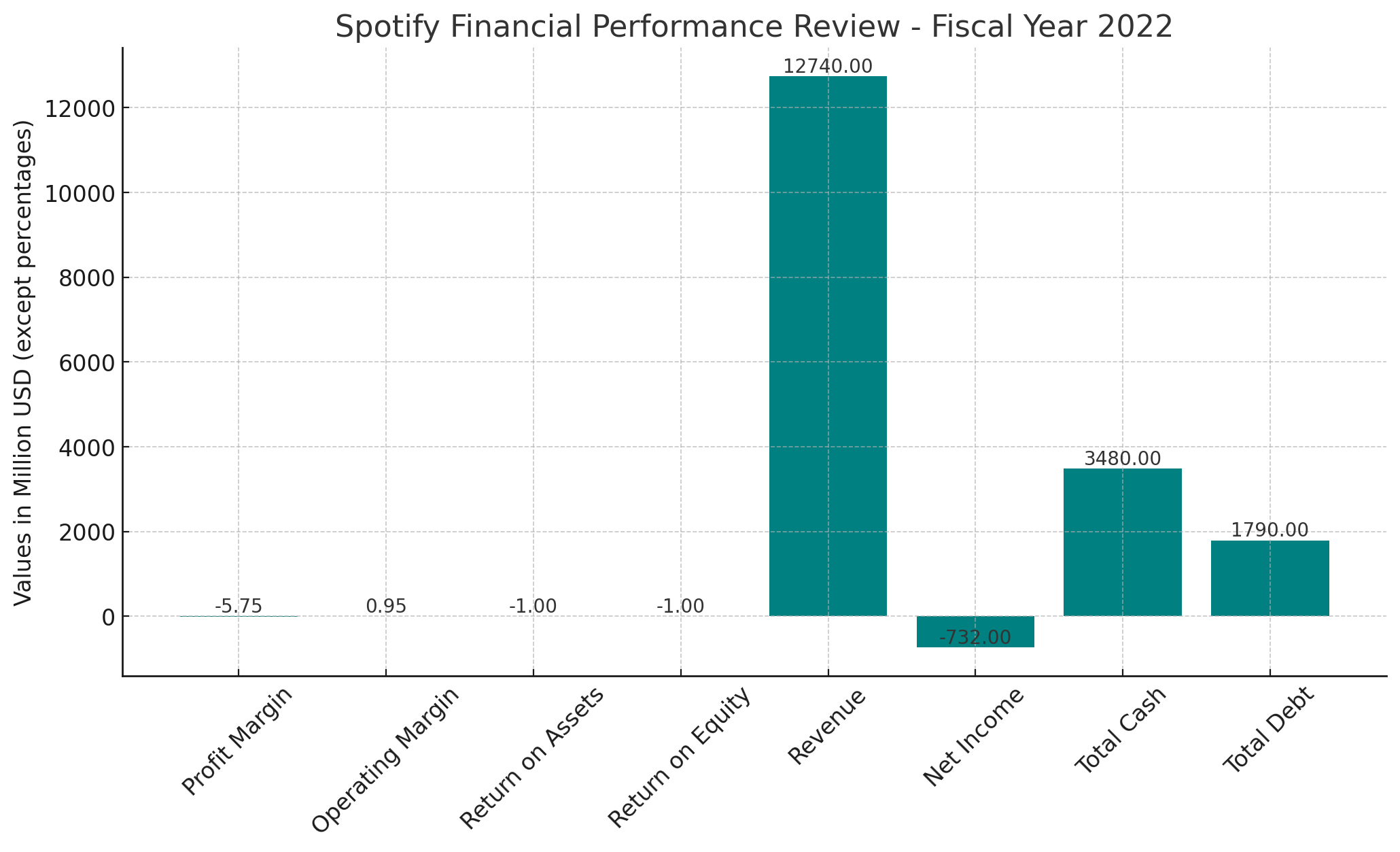

Financial Performance Review

For the fiscal year ending December 30, 2022, Spotify shows a profit margin of -5.75% and an operating margin of 0.95%. The negative return on assets and equity highlights challenges in leveraging its assets and equity for profitability. Revenue of $12.74B with a 10.60% quarterly growth yoy and a net income of -732M reflects a mixed financial health picture. The total cash of $3.48B against a total debt of $1.79B demonstrates a robust liquidity position.

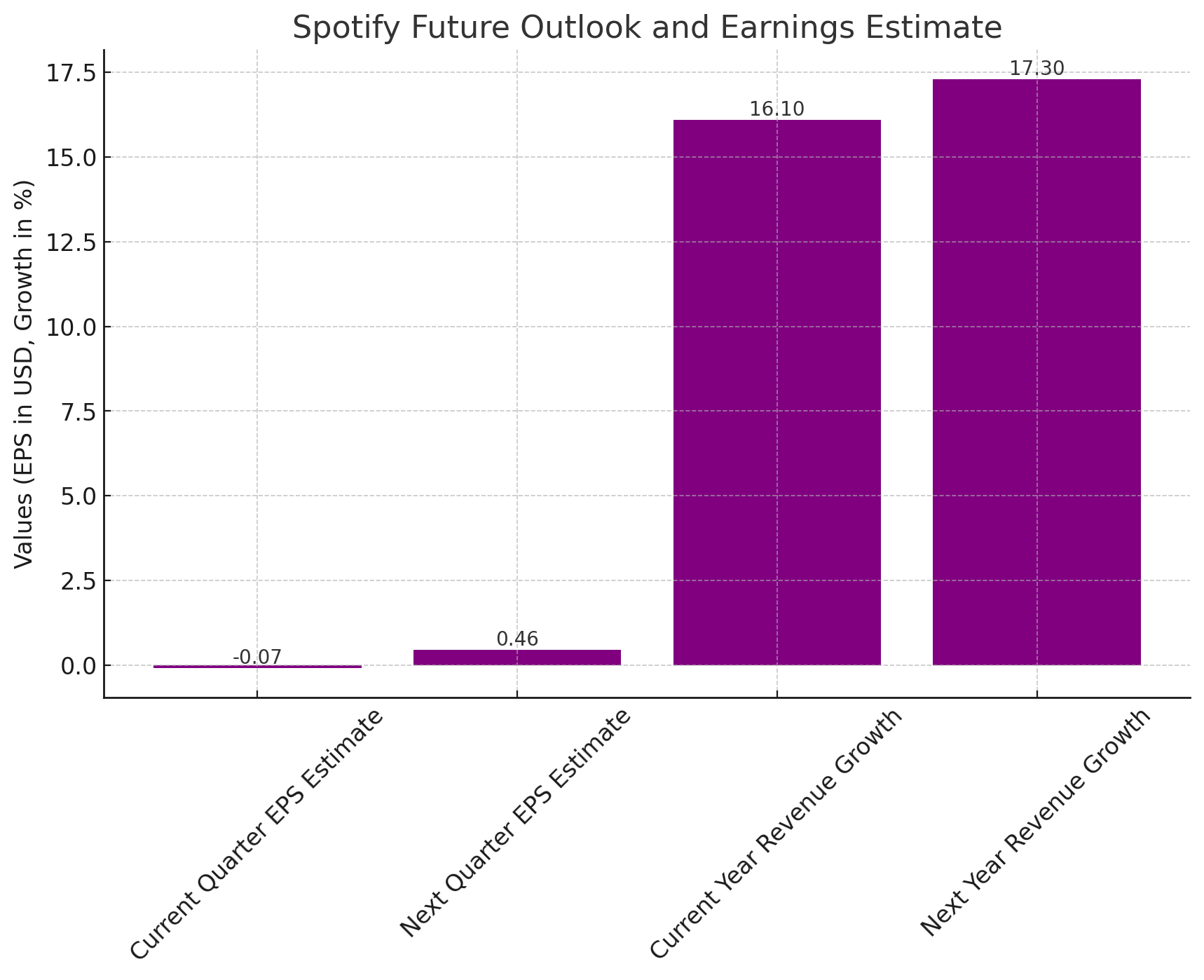

Future Outlook and Earnings Estimate

The future outlook, according to analysts, shows an average estimate of -0.07 for the current quarter and 0.46 for the next. The expected revenue growth (year/est) of 16.10% for the current year and 17.30% for the next indicates a positive trend. However, EPS trends and revisions exhibit uncertainty in analyst expectations.

Operational Strategy and Market Position

Spotify's surprise profit in Q3 and its outperformance in subscriber growth have bolstered its market position. Its focus on financial discipline and potential for price increases without significant churn highlight strategic strengths. The emphasis on efficient operations and a path to stronger profit and free cash flow growth is a critical factor in its future trajectory.

Strategic Moves and Efficiency

The company's recent decisions, such as the layoff of 17% of its workforce and the departure of CFO Paul Vogel, are indicative of a strategic pivot. These moves, though seemingly drastic, are aligned with a broader vision of cost optimization and resource reallocation. The focus on a leaner, more agile operational model positions Spotify well for sustainable growth.

Financial Discipline and Profitability Focus

Spotify’s commitment to financial discipline, as observed in its renewed focus on efficient operations and a path to stronger profit, is a decisive factor in its potential for long-term success. This approach is expected to result in higher medium- and long-term adjusted earnings and free cash flow, making Spotify an attractive prospect for investors seeking growth coupled with fiscal responsibility.

Subscriber Metrics and User Engagement

Diverse User Base and Engagement Strategies

With 226 million premium subscribers and a significant ad-supported user base, Spotify demonstrates a diversified approach to user engagement. The company's strategy of converting free users to paid subscribers has been remarkably successful, contributing to a steady revenue stream.

Ad-Supported Tier Potential

The ad-supported tier, though less profitable historically, shows signs of becoming a more significant contributor to the overall revenue mix. This shift, driven by strategic marketing and content diversification, could redefine Spotify's revenue dynamics in the coming years.

Content Strategy and Diversification

Expanding Beyond Mainstream Music

Spotify's foray into podcasts, audiobooks, and niche musical genres is altering its content landscape. This diversification not only enhances user engagement but also rebalances its reliance on major music labels, potentially improving negotiation leverage and margins.

Podcast Investments and Margin Improvement

Investments in podcasts and other non-music content are beginning to yield positive results, as evidenced by improving gross margins. This shift suggests a maturing content strategy that could redefine Spotify’s market position.

AI and Technological Innovations

AI-Driven Personalization and Efficiency

Spotify's investment in AI for user personalization and operational efficiency is a forward-thinking move. The AI DJ tools and voice translation features are not only enhancing the user experience but also expanding the company's market reach. These innovations could be key drivers in reducing customer acquisition and retention costs.

Advertising Efficiencies through AI

Utilizing AI in the advertising domain, particularly in automating voice advertisement production, presents a significant opportunity for cost reduction and increased profitability.

Competitive Landscape and Risks

Navigating Competitive Threats

While the threat from other major music streaming services persists, Spotify’s growth trajectory and ability to implement price increases without significant churn demonstrate robust competitive positioning and pricing power.

Margin Expansion and Content Costs

The company must continue to monitor and manage its content costs effectively to ensure ongoing margin expansion. The profitability of its diverse content offerings, particularly in newer segments like podcasts and audiobooks, will be critical in maintaining healthy margins.

Investment Analysis and Future Outlook

Valuation and Growth Potential

Spotify's current valuation, when compared to its growth potential and market positioning, appears attractive. The company’s focus on expanding its content offerings and improving operational efficiency, coupled with a strong user base, positions it well for future growth.

Monitoring Key Metrics for Continued Success

Investors should closely monitor Spotify’s premium subscriber growth, ad-supported tier performance, and margin trends in upcoming earnings reports. These metrics will be crucial in assessing the company’s ability to sustain its growth trajectory and achieve long-term profitability.

Linking to Further Information

For detailed stock insights and insider transaction information, refer to the following links:

Conclusion

In conclusion, Spotify’s strategic focus on diversifying its content offerings, leveraging AI for enhanced user experience and operational efficiency, and maintaining financial discipline positions it as a formidable player in the music streaming industry. The company’s adaptive strategies and strong market presence make it an attractive proposition for investors seeking a balance of growth and stability. As Spotify continues to navigate the dynamic digital media landscape, its ability to innovate and adapt will be key to its sustained success and long-term profitability.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex