SQM’s Lithium Journey: Challenges, Opportunities, and Strategic Upside NYSE:SQM Stock

Examining NYSE:SQM Amid Lithium Price Volatility and EV Market Dynamics | That's TradingNEWS

NYSE:SQM Navigates Lithium Volatility with Strategic Expansion

Sociedad Química y Minera de Chile (NYSE:SQM) stands at the crossroads of significant opportunity and pronounced challenges, as the lithium market faces intense scrutiny. This stock, a key player in the global lithium industry, has seen its fortunes tied closely to the volatility of lithium prices, fluctuating demand from the electric vehicle (EV) sector, and regulatory changes in Chile. Despite these headwinds, SQM’s robust strategy, low-cost operations, and growth ambitions position it as a fascinating stock for investors looking to capitalize on long-term trends in the lithium market.

Lithium Market Challenges and SQM’s Strategic Positioning

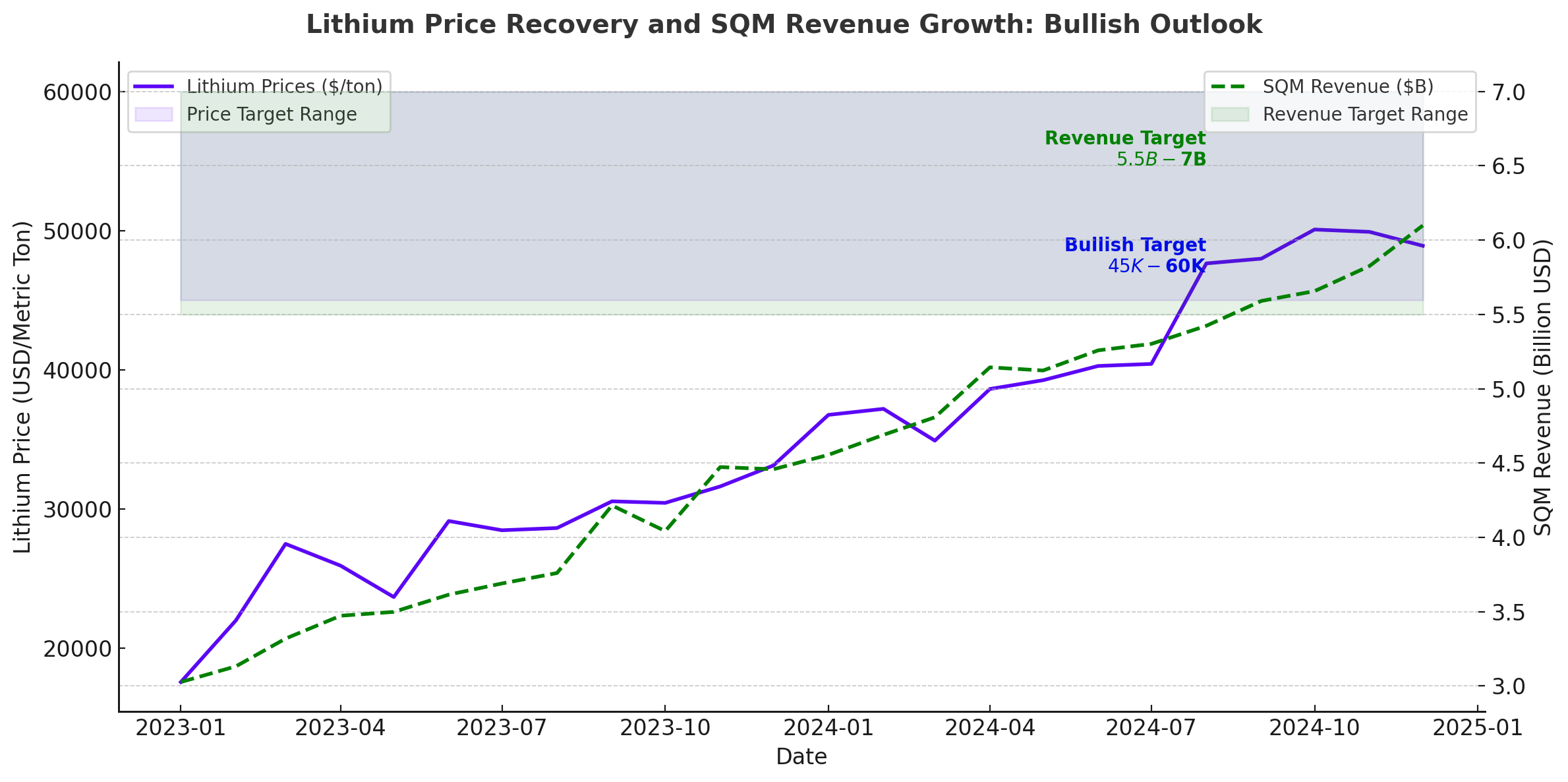

The collapse of lithium prices has been a defining factor for SQM over the past two years. Once trading above $80,000 per metric ton, lithium prices have plummeted to around $10,000 per metric ton. This has significantly impacted revenue for SQM, which derives over 70% of its income from lithium-related operations. Yet, instead of retreating, SQM has chosen to double down, expanding its production capacity while maintaining a strong focus on efficiency.

With a market share of approximately 18% in the global lithium industry, SQM is second only to Albemarle Corporation (NYSE:ALB). The company’s competitive edge lies in its low-cost operations in Chile’s Salar de Atacama, where evaporation-based lithium extraction gives it one of the lowest cost bases in the industry. This operational efficiency allows SQM to weather downturns better than many of its peers.

Regulatory Pressures and Codelco Partnership

A significant development for SQM has been the renegotiation of its contract with the Chilean government. This agreement, formalized in 2023, saw SQM relinquish majority control of its lithium operations in the Salar de Atacama to Codelco, the state-owned copper giant. While this raised concerns about reduced profitability—operating margins in the region are set to decline from 30% to 15% post-2031—it also secured SQM’s long-term presence in this critical mining area until 2060.

The partnership allows SQM to increase its production capacity in Chile from the current 200,000 metric tons to 300,000 metric tons annually. This expansion will help offset the margin pressure caused by the Codelco agreement. Additionally, the introduction of direct lithium extraction (DLE) technology, as required under the new deal, will enhance sustainability and align with the global push for greener extraction methods, albeit at higher costs.

Expansion into Australia and China

SQM’s growth strategy extends beyond Chile. The company has made significant investments in lithium hydroxide production, a compound critical for high-energy-density batteries used in EVs. Its joint venture with Wesfarmers (OTC:WFAFY) in Australia will add 50,000 metric tons of lithium hydroxide production capacity by 2025. Similarly, its operations in China, including the Sichuan refinery, position SQM to cater to the rapidly growing Asian EV market.

These expansions are crucial as the global lithium market undergoes a shift in demand dynamics. Lithium hydroxide is increasingly favored over lithium carbonate due to its application in advanced battery technologies. By ramping up its production of lithium hydroxide, SQM is aligning itself with market trends and securing its position as a key supplier to the EV industry.

EV Market Growth and Lithium Demand Outlook

Electric vehicles are expected to account for 75% of global lithium demand by 2025. However, the pace of EV adoption has shown regional variation. While countries like Norway and China are leading the transition, the U.S. lags behind. SQM’s significant exposure to Asia, where it generates over 70% of its revenue, insulates it from slower EV adoption rates in the U.S.

Recent developments, such as China’s EV subsidies and a potential rebound in consumer demand, point to a recovery in lithium pricing. Additionally, global automakers like Hyundai and Kia have signed long-term supply agreements with SQM, further solidifying its role in the EV supply chain.

Financial Resilience and Valuation

Despite the revenue decline caused by lower lithium prices, SQM’s financial health remains robust. The company reported $2.4 billion in cash and equivalents, with a current ratio of 2.94 and a manageable debt-to-equity ratio of 0.95. These metrics underscore SQM’s ability to fund its ambitious expansion plans without compromising financial stability.

In terms of valuation, SQM trades at a forward price-to-earnings ratio of 11x, significantly below its historical average of 20x and its peer Albemarle, which trades at 40x forward earnings. This discount reflects the market’s cautious stance on lithium prices but also presents an attractive entry point for long-term investors.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex