Starbucks SBUX 24' Market Challenges and Growth Opportunities

Comprehensive Market Analysis: Examining Starbucks' Financial Performance, Operational Hurdles, and Investor Prospects in a Dynamic Market Environment | That's TradingNEWS

Comprehensive Analysis of Starbucks Corporation (NASDAQ: SBUX): Navigating Market Challenges and Growth Prospects

Market Dynamics and Starbucks' Position

As we venture into 2024, Starbucks, a renowned name in the global coffee industry, faces a critical juncture. The company's stock, currently approximately 14% below its peak, indicates a bearish sentiment among investors. Despite being a globally recognized brand, Starbucks confronts potential headwinds that could impact its attractiveness to investors. This analysis delves into the financial and operational aspects of Starbucks, examining its growth potential, challenges, and the implications for investors.

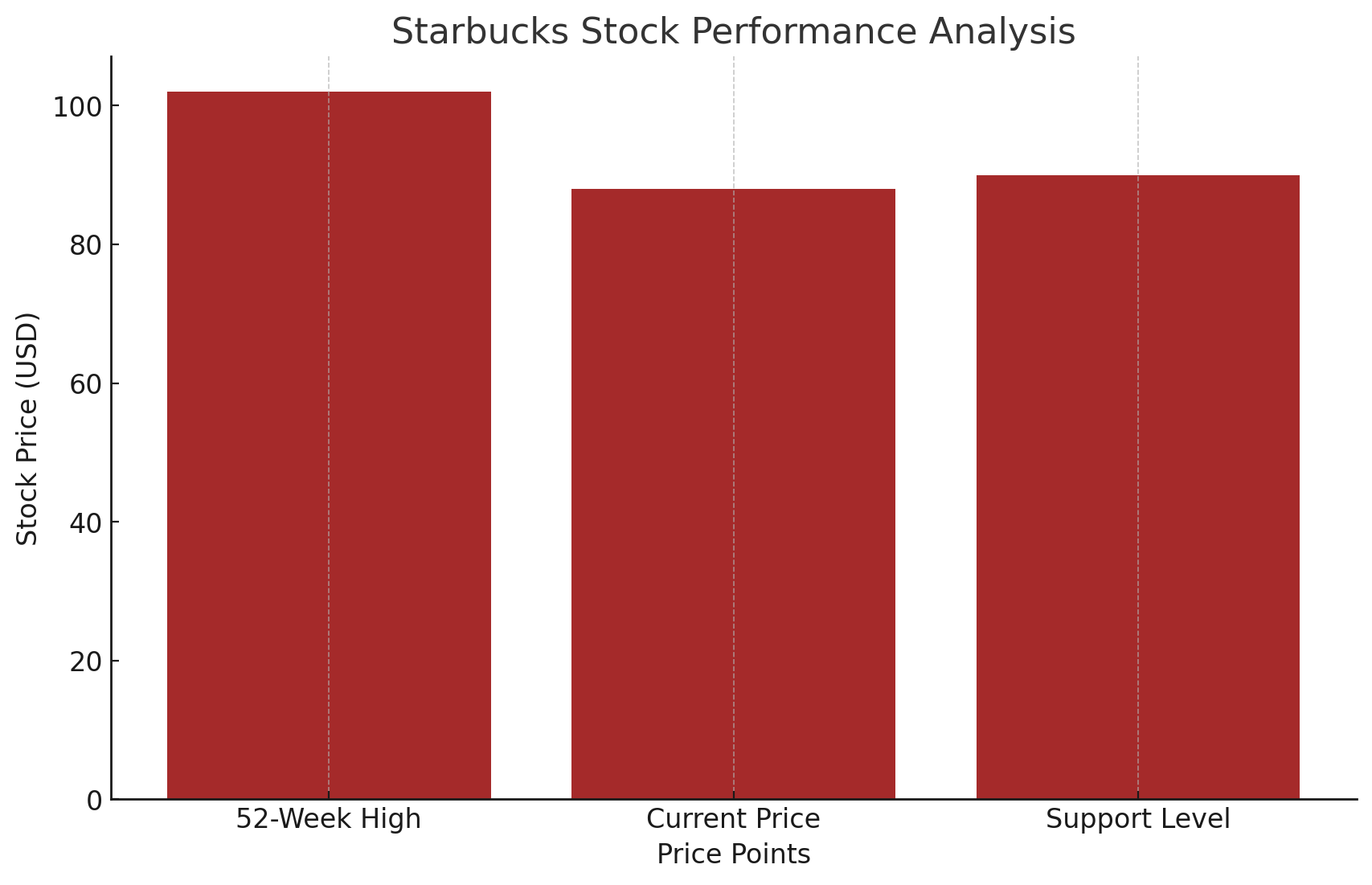

Assessing Starbucks' Stock Performance

The recent price trends of Starbucks' stock raise concerns. A significant gap observed in November was not countered by a bullish response, indicating potential weaknesses in the short to medium term. The stock is testing support levels, with a possibility of declining further to around $88-$90. The behavior of the stock at these levels will be crucial in determining its future trajectory.

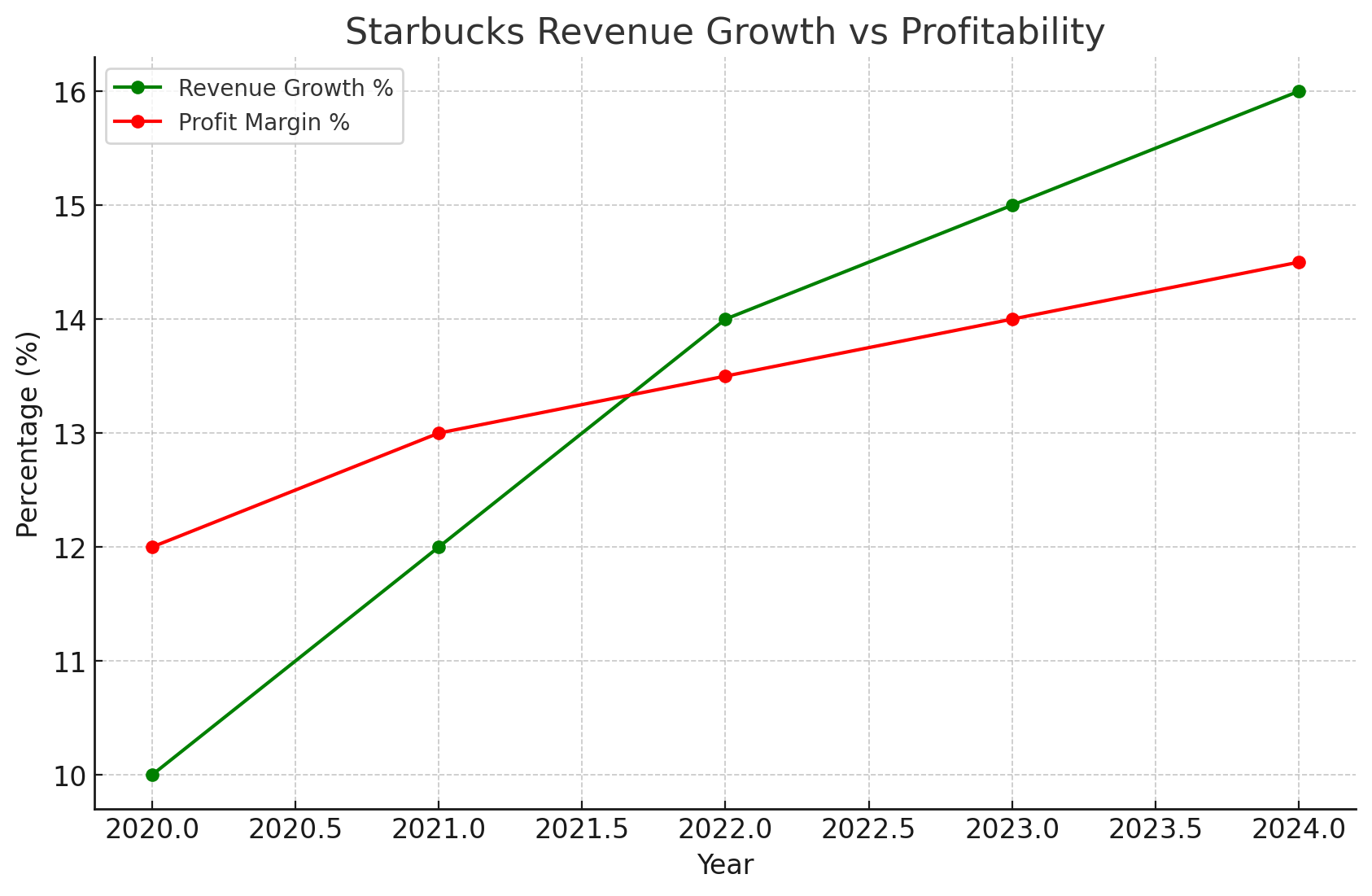

Revenue Growth Versus Profitability

Starbucks has consistently demonstrated robust revenue growth. However, translating this growth into significant margin expansion has been challenging. The company's guidance for 2024 forecasts commendable sales growth and high-teens EPS growth. Yet, the stock’s sluggish response to these projections suggests investor skepticism about Starbucks' ability to effectively leverage revenue growth into improved margins.

Operational and Margin Challenges

Starbucks faces operational challenges, including the introduction of personal cups and continuous investments in its workforce. While these initiatives align with the company's ethical and social responsibilities, they may also introduce potential inefficiencies and additional costs, thereby impacting margins.

Valuation Perspective

Currently, Starbucks trades at a forward P/E ratio of approximately 22.5, which is relatively low compared to its post-COVID valuations. This presents an attractive valuation, albeit with the caveat that margin pressures may persist.

Consumer Spending and Retail Sales Trends

Amid mixed market signals, including consumer savings and retail sales data, Starbucks' growth trajectory remains a subject of debate. The company's expansive global presence, particularly in China, faces challenges due to economic headwinds in the region.

Financial Performance and Forecasts

Starbucks' recent financial performance, including an 11% increase in revenue and 8% global comp-store sales growth, underlines its operational strength. The company's aggressive cost-saving initiatives and investment strategies are pivotal in shaping its future financial health.

Technical Analysis and Market Sentiment

Technically, Starbucks' stock exhibits a bearish trend with resistance observed around $115-$117. The stock's performance in the upcoming earnings report will be critical in determining investor sentiment and future price movements.

Dividend and Earnings Prospects

Starbucks' dividend prospects and earnings estimates suggest continued growth. However, the stock’s performance relative to earnings expectations and market conditions will be key to its valuation and attractiveness to investors.

Competitive Landscape and Growth Outlook

Comparatively, Starbucks stands strong in its industry with sound growth history and profitability trends. However, the technical momentum and market uncertainties require careful consideration.

Investment Thesis: A Cautious Stance

Given the mixed market indicators, technical analysis, and operational challenges, a cautious approach is recommended for investing in Starbucks. The company's efforts to navigate through margin pressures and operational challenges, coupled with its robust growth plans, make it a potentially resilient player in the long term. However, current market dynamics and uncertainties warrant a hold rating, with close monitoring of upcoming financial reports and market reactions.

For real-time stock information and insider transactions on Starbucks, visit SBUX Real-Time Chart and Insider Transactions.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex