Stock To Buy - Delta NYSE:DAL Strong Q1 Earnings

Comprehensive review of Delta's financial achievements, strategic efficiencies, and robust market demand setting the stage for a promising year ahead | That's TradingNEWS

Delta Air Lines (NYSE:DAL) Q1 Earnings Analysis:

Surging Demand and Strategic Financial Moves Signal Strong Market Position

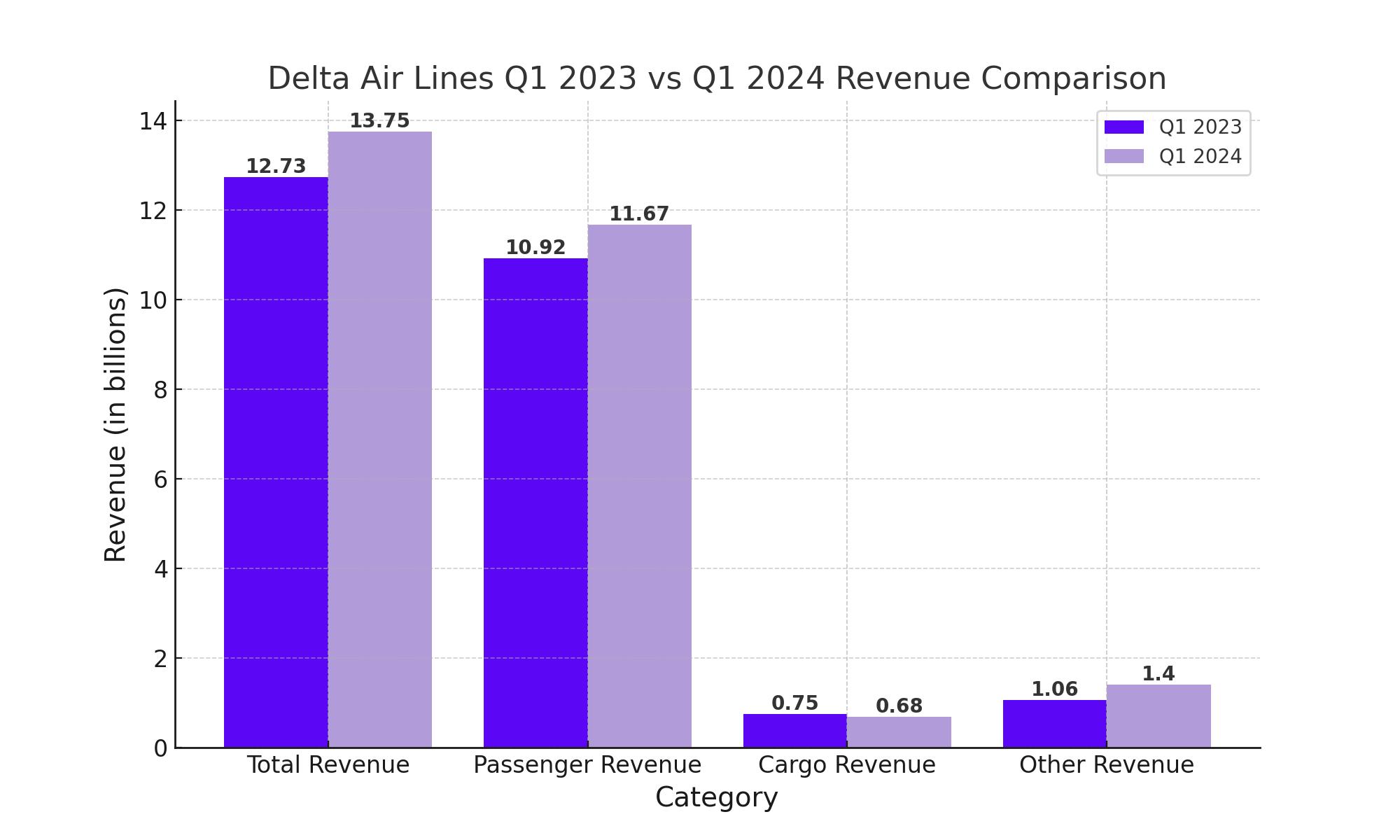

Delta Air Lines (NYSE:DAL) has started 2024 on a strong note, with its Q1 earnings reflecting significant gains amid a recovering travel sector. The company's revenue surged by 8% year-over-year to $13.75 billion, outperforming analyst expectations and underscoring a robust demand for air travel.

Q1 Performance: Financial Metrics and Achievements

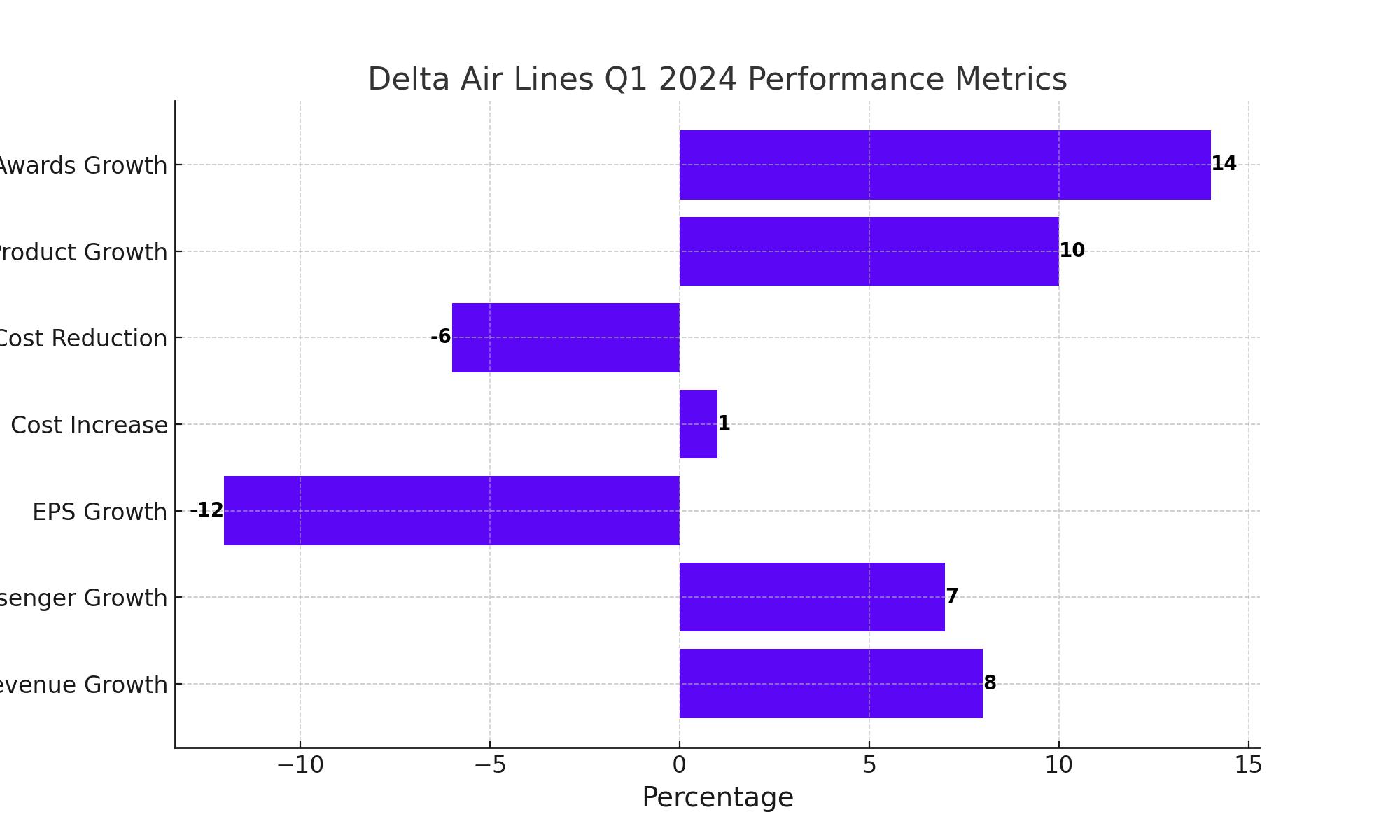

Delta reported a notable increase in operating revenue, attributing this growth to a 7% increase in passenger numbers, a clear indicator of robust market demand. The adjusted earnings per share (EPS) also saw a rise, climbing to $2.36 from $2.68 in the same quarter last year, indicating improved profitability despite prevailing economic challenges.

Cost Management and Operational Efficiency

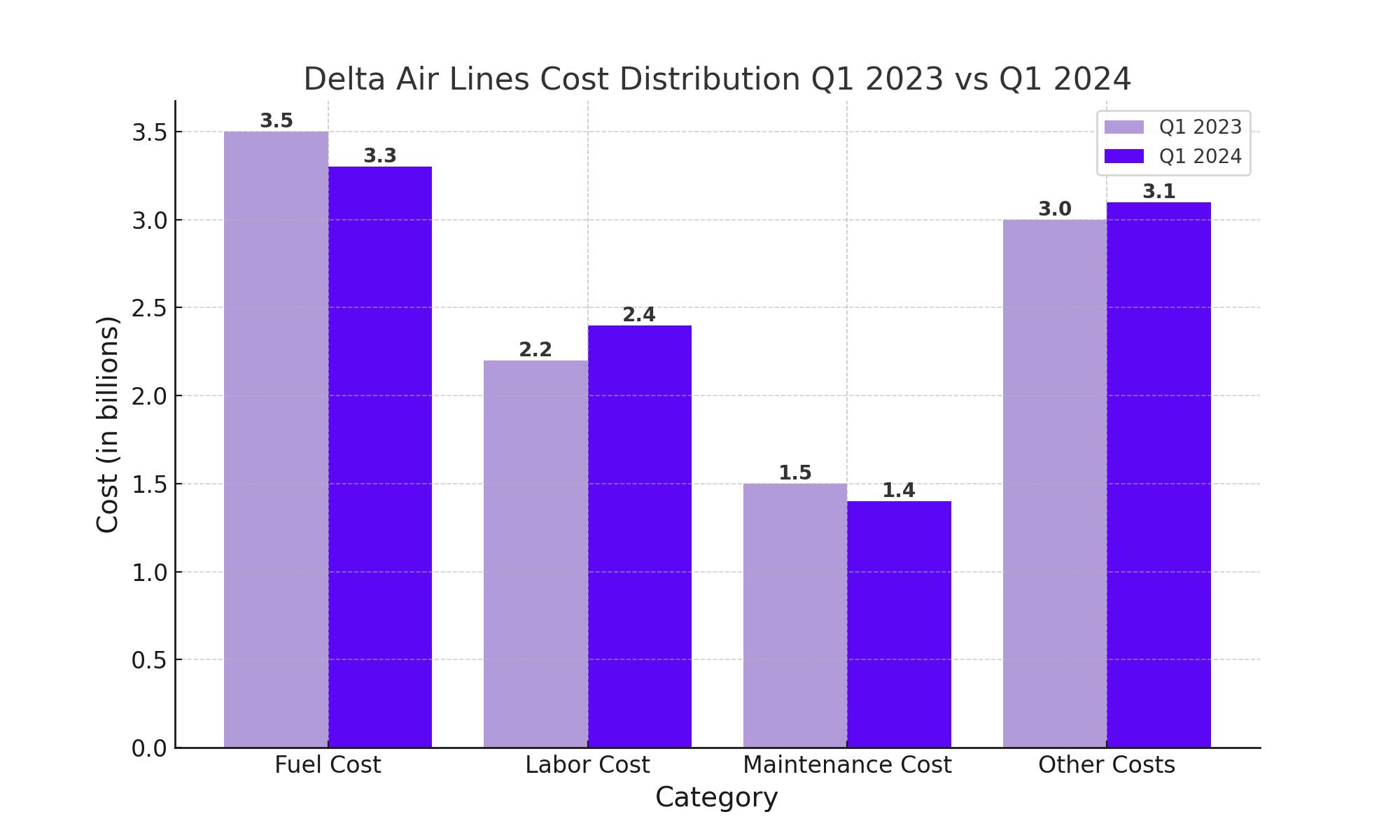

Delta’s strategic cost management has been evident, with a focus on optimizing fuel usage and operational efficiency. The airline's total expenses only saw a marginal increase of 1% compared to the previous year, despite a 7% increase in capacity, showcasing effective cost containment strategies. This was further complemented by a 6% reduction in unit costs, driven by economies of scale and efficient fuel management.

Revenue Streams and Growth Factors

The breakdown of Delta’s revenue streams highlights a 10% growth in premium product tickets and a 14% increase in loyalty travel awards, underscoring the airline’s ability to attract high-value customers. Geographically, notable revenue growth was reported in the Latin American and Pacific markets, though unit revenues in these regions declined by 12% and 4% respectively due to aggressive capacity expansion.

Market Sentiment and Stock Performance

Delta Air Lines' stock (NYSE:DAL) has demonstrated strong market performance in the wake of its first-quarter earnings, with investor sentiment buoyed by the airline's robust recovery indicators. The stock has appreciated by about 20% year-to-date, reflecting positive reactions to the company's financial health and its projections for sustained travel demand. For instance, Delta's revenue growth outpaced industry averages, with a reported increase in operating revenue by 8% year-over-year to $13.75 billion, surpassing market expectations.

Investment Considerations and Analyst Ratings

The optimism around Delta is echoed in its analyst ratings. Currently, the consensus target price for Delta's stock stands at $55.25, which indicates a significant potential upside from the current levels. This bullish perspective is backed by Delta's ongoing investments in fleet upgrades and customer service enhancements, initiatives that are expected to enhance revenue streams and improve operational efficiency further. For example, Delta's focus on upgrading its fleet has led to a more efficient fuel usage and a better customer experience, factors that are critical in maintaining competitive advantage.

Risks and Challenges However, Delta faces several challenges, including volatile fuel prices and geopolitical uncertainties that could influence global travel patterns. The airline sector's susceptibility to economic fluctuations also poses a risk, potentially impacting passenger volumes and profitability. For instance, a sudden increase in oil prices could significantly raise operational costs, while economic downturns could reduce consumer spending on travel.

Conclusion: A Strategic Buy with Cautious Optimism

Given Delta's strong Q1 performance and strategic initiatives aimed at sustaining growth, the airline represents a compelling investment opportunity. The company's revenue for Q1 2024 showed a healthy increase, driven by a 7% rise in passenger traffic and effective cost management strategies that saw only a 1% increase in expenses despite capacity expansion. Moreover, Delta’s forward P/E ratio remains attractive at 8.2x, lower than the industry average, suggesting undervaluation relative to its growth potential.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex