Super Micro Computer (NASDAQ:SMCI): Positioned for Growth Amid Challenges and AI Market Tailwinds

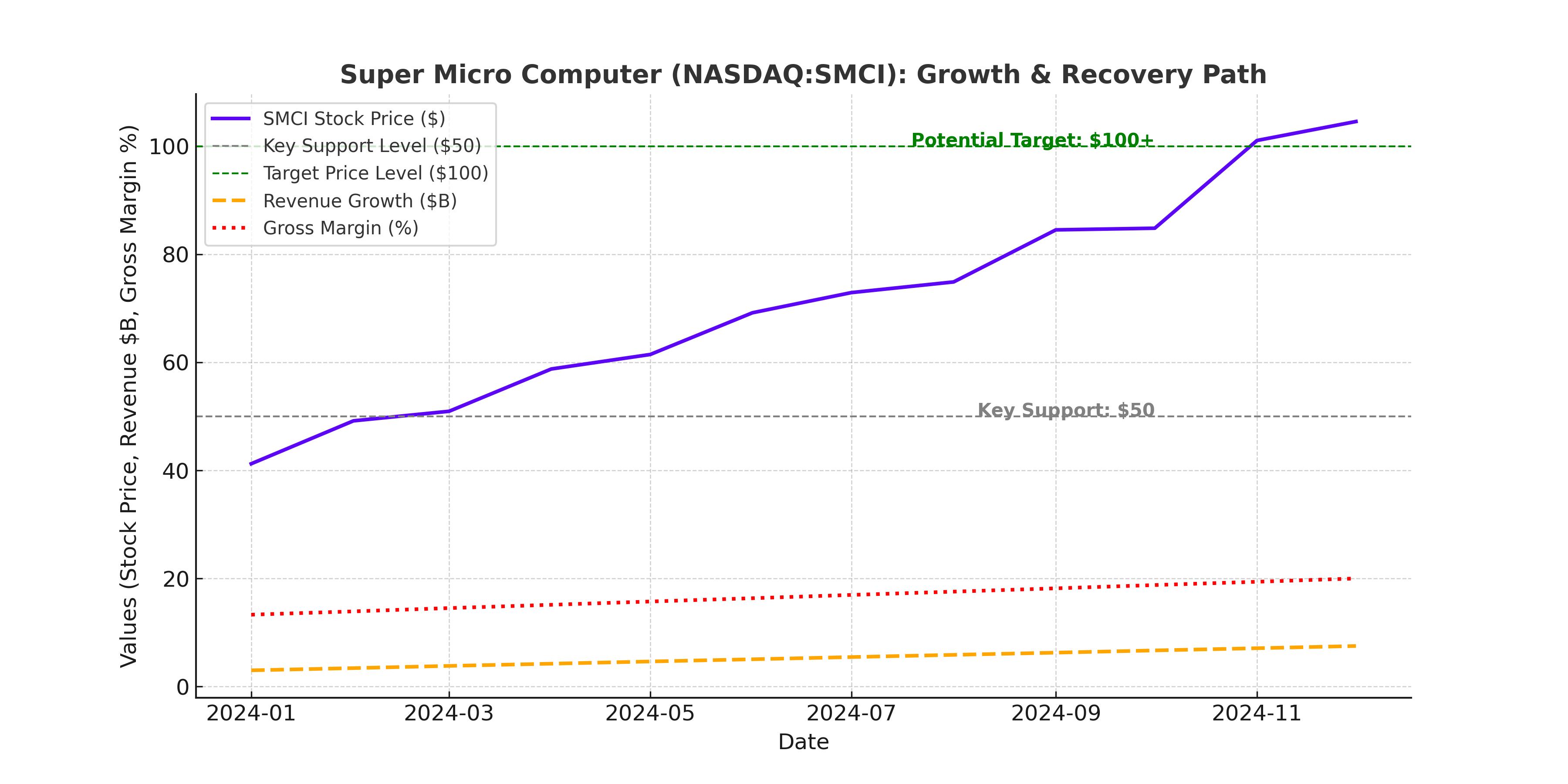

Super Micro Computer (NASDAQ:SMCI), currently trading at approximately $50, finds itself at a critical crossroads as it navigates a complex mix of challenges and opportunities. The stock has faced significant headwinds in 2024, including financial reporting delays and a temporary loss of investor confidence. However, its strategic positioning in the fast-expanding AI-driven data center hardware market and recent regulatory progress suggest the potential for a strong rebound in 2025. With a fair valuation target of $41-$44 based on current metrics, the company holds the potential to revisit its previous highs of over $100, provided it resolves lingering uncertainties.

Regulatory Progress and Nasdaq Compliance: A Key Catalyst

Super Micro Computer's 2024 narrative was heavily shaped by its financial reporting challenges, which culminated in delays in filing its 10-K report with the Securities and Exchange Commission (SEC). This issue, compounded by the resignation of Ernst & Young as its auditor, raised the specter of a potential delisting from the Nasdaq exchange. However, the company took decisive steps to address these concerns, including the appointment of BDO as its new auditor and the submission of a compliance plan to Nasdaq.

These measures have bought the company crucial time, with an extension granted until February 2025 to file its financials. The market has reacted positively to these developments, with SMCI's stock rebounding from its 2024 lows. While the immediate threat of delisting has been averted, the timely submission of audited financials remains a critical milestone. Success on this front could serve as a powerful catalyst for further stock revaluation, especially given the company’s strategic role in the AI hardware market.

AI Market Leadership and Demand for Liquid-Cooled Server Racks

Super Micro Computer’s core business of liquid-cooled server racks positions it as a leader in a niche market experiencing explosive growth. The proliferation of artificial intelligence applications and the increasing demands of high-performance computing have driven a surge in data center investments. According to Dell’Oro Group, the liquid-cooling segment of the data center market is projected to grow at an average annual rate of 60% through 2027. This aligns perfectly with SMCI’s focus, as the company continues to supply cutting-edge hardware solutions to meet the needs of AI-driven operations.

In its most recent quarterly earnings, SMCI reported a 143% year-over-year increase in revenue, significantly outpacing industry peers like NVIDIA (NVDA), which achieved a 94% growth rate during the same period. While SMCI's revenue trajectory is impressive, its gross margins remain a challenge. The company reported a GAAP gross margin of 13.3%, far below NVIDIA’s 75% and AMD’s 50%. Improving these margins is essential for SMCI to capitalize on its revenue growth and deliver enhanced shareholder value.

Stock Valuation and Competitive Position

At its current price of $50, SMCI trades at a forward price-to-earnings (P/E) ratio of 8.7x, a notable discount compared to NVIDIA’s 30.9x and AMD’s 24.5x. This valuation reflects investor caution surrounding the company’s financial reporting issues. However, it also underscores the significant upside potential if these challenges are resolved. Analysts estimate a fair value range of $41-$44 based on an 11-12x forward P/E multiple, with the potential for further gains as the company rebuilds investor confidence and demonstrates operational resilience.

SMCI's competitive edge lies in its focus on liquid-cooled server racks, a market expected to see secular growth driven by the expanding adoption of AI technologies. Unlike its competitors, SMCI’s growth has been decoupled from broader industry trends, allowing it to carve out a unique niche. This differentiation could prove invaluable as the company seeks to solidify its position as a leader in AI hardware.

Technical Analysis: Signs of Reversal and Momentum

From a technical perspective, SMCI appears to be forming a strong base for recovery. The stock has respected key support levels, with recent price action suggesting a potential reversal. Indicators such as the Moving Average Convergence Divergence (MACD) have turned bullish, pointing to a possible upward trajectory. Analysts believe a sustained move above $50 could pave the way for a rally toward $100, with further gains possible if the company successfully navigates its current challenges.

The stock’s recent performance also highlights the resilience of investor sentiment. Despite being excluded from the Nasdaq-100 index in favor of Palantir Technologies (PLTR), SMCI has maintained its valuation, reflecting market confidence in its long-term prospects. This confidence is further bolstered by the company’s strategic initiatives and alignment with industry growth drivers.

Risks and Mitigation Strategies

While the outlook for SMCI is increasingly positive, significant risks remain. The most immediate concern is the February 2025 deadline for submitting audited financials. Any delays or adverse findings could reignite fears of delisting, leading to a sharp decline in the stock price. Additionally, the competitive landscape in the AI hardware market is intense, with industry giants like NVIDIA and AMD commanding superior margins and broader market reach.

To mitigate these risks, SMCI has taken proactive steps, including the appointment of a new CFO and the engagement of BDO as its auditor. The company has also focused on diversifying its customer base and expanding its product offerings, ensuring it remains well-positioned to capitalize on AI-driven growth opportunities.

Path to $100 and Beyond

With a clear path to resolving its regulatory challenges and a strong position in the AI-driven data center market, SMCI is well-positioned for significant upside. Analysts predict that a combination of improved financial transparency, margin expansion, and continued revenue growth could propel the stock back toward $100 in 2025. Technical and fundamental indicators suggest that the worst may be behind the company, setting the stage for a robust recovery.

Conclusion

Super Micro Computer (NASDAQ:SMCI) finds itself at a decisive moment, where high stakes intersect with substantial upside potential. At its current price of approximately $50, SMCI trades at a significant discount compared to industry leaders like NVIDIA and AMD, offering a compelling opportunity for investors willing to embrace calculated risk. With the AI market projected to expand exponentially and demand for liquid-cooled server racks on the rise, SMCI is strategically positioned to capture robust growth. If the company resolves its financial reporting issues and sustains its operational momentum, the stock has a realistic path to revisiting $100 or higher. For live updates on SMCI’s performance, check NASDAQ:SMCI Real-Time Chart.