NASDAQ:TSLA — Tape, context, and where the stock is trading right now

The post-print reaction told you everything about positioning in NASDAQ:TSLA: an ~8% slide on the Q2 release was almost entirely clawed back the next session, and since then the stock has chopped but refused to break. The live quote and intraday ladder are here: https://www.tradingnews.com/Stocks/TSLA/real_time_chart — use that tape for the precise print, but the key takeaway is that buyers keep showing up on weakness while macro and headlines remain noisy. That setup matters because the fundamentals you’re about to see are a blend of compression (autos) and expansion (software/energy/AI) that the market is trying to price simultaneously.

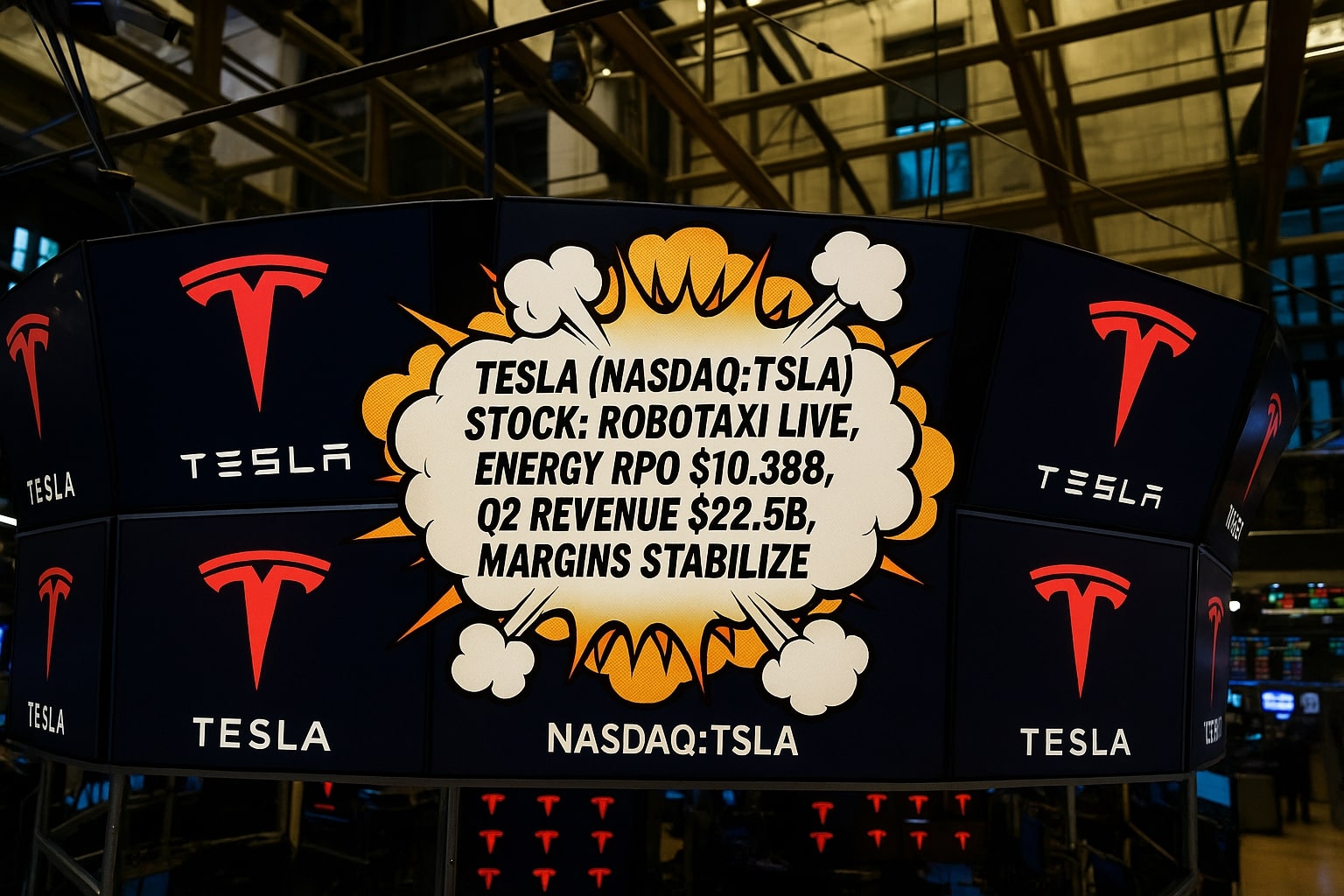

NASDAQ:TSLA — Revenue, mix, and margins: what Q2 2025 actually said

Quarterly revenue landed at $22.5 billion, down 12% year over year, with automotive sales pressured by deliveries that were lower by roughly 57,000 units in the quarter and by discounting to defend share. Auto gross margin, however, stabilized sequentially at a touch over 14% in Q2 versus 12.8% blended for 1H25, showing the early edge of pricing discipline returning even with incentives in the field. Regulatory credits fell by more than half to $439 million versus $890 million a year ago, stripping out a cushion that had juiced profitability in prior periods. Put together, you have the short-term P&L headwinds in hard numbers: fewer cars, lower credits, modestly firmer unit margin than 1H’s average, and a stock that declined only ~8% on the headline before the next-day reversal.

NASDAQ:TSLA — Price cuts, financing levers, and the IRA clock

Discounting is a double-edged sword. Standard rebates, low-rate financing, and model-specific incentives have supported throughput, but they risk training the customer to wait for deals. The added wrinkle is the phase dynamics around the $7,500 IRA credit; as that benefit rolls off for certain trims, the industry tends to lean harder on sticker and rate promos to smooth demand, which can tug auto gross margin back down from the 14% Q2 print. Expect more granular price engineering into quarter-end and model-year transitions; the company has some room, but not the mid-20s gross margin cushion of peak days.

NASDAQ:TSLA — Energy is becoming a second earnings engine

Call out the math, because it’s getting big. Energy just posted record profitability, backed by multi-gigawatt-hour deployments and a contractual backlog that adds visibility. Deferred revenue tied to energy sits at about $2.1 billion. Remaining performance obligations total $10.38 billion, with $5.47 billion expected to convert within the next 12 months. Capacity is stepping up: a Houston Megapack factory is slated for 2026 and the first LFP cell factory is in the queue, both intended to attack grid-scale storage where economics are improving. Macro helps here. Grid storage is on a multi-trillion-dollar capex glidepath through 2040, and AI-heavy data centers need precisely what Megapack plus fast-response storage provides: buffering volatile loads so plants can run closer to nameplate output. This is no longer side income; it’s an earnings stream with line of sight.

NASDAQ:TSLA — Autonomy, software economics, and the Austin robotaxi node

The commercial robotaxi pilot in Austin is the first visible node of a software revenue model the company has been flagging for years. Unit economics flip when there’s no driver in the cost stack. If a network scales to 100 billion autonomous miles annually, $0.50–$1.00 net per mile supports $50–$100 billion of high-margin software revenue; at system maturity, single-ride gross margin can mathematically run north of 70%. That’s the “why.” The “how” rests on the stack. Full Self-Driving (supervised) adoption stepped up ~25% post-V12, and the silicon cadence is moving quickly: Hardware 3 at ~144 TOPS (14 nm) gave way to Hardware 4 at ~300–500 TOPS (5 nm), with Hardware 5 discussed in industry channels at a staggering ~2,000–2,500 TOPS, alongside the in-house training pathway via Dojo. Re-introducing radar on the HW4-era fleet adds redundancy. The competitive angle is hardware simplicity and fleet scale—consumer cars already on the road collecting real-world miles—versus lidar-heavy robo-stacks that require bespoke vehicles. No, unsupervised FSD isn’t “done,” but the inches are now yards, and Austin’s paid rides are the proof-of-operations moment.

NASDAQ:TSLA — Cybercab, cost per mile, and the attack on personal car economics

Management’s target for Cybercab is operating costs in the $0.25–$0.30 per-mile lane, deliberately undercutting Uber/taxis and challenging the math of owning a depreciating asset plus insurance, fuel, parking, and maintenance. The lever here isn’t just capex utilization; it’s software utilization. Higher uptime per vehicle, centralized dispatch, and over-the-air updates translate to an expanding gross profit per unit of fleet capital. Even a partial achievement of those per-mile targets across a subset of metro areas would shift mix and narrative toward recurring software revenue from what has been a hardware-dominant model.

NASDAQ:TSLA — Optimus is out on the frontier, but the cadence is real

The humanoid program moved to its third generation and is already in internal factory workflows. Timelines will slip; they always do in robotics. But the slope of improvement is steep, and the market is large. If the company even approaches six-figure annual units by the back half of the decade, you’re looking at a product line with ASPs and gross margin potential more akin to enterprise hardware/software than metal-bending autos. Management has floated the ambition of 1 million units per year within ~five years; that’s aggressive, yet the option value is material even at a fraction of that run-rate.

NASDAQ:TSLA — Valuation cross-checks against peers and the long runway

At roughly 10× trailing sales, the stock screens expensive next to legacy autos but cheap against AI infrastructure names and premium robotics franchises that trade at far higher revenue multiples without durable free cash flow. Street scenarios that contemplate ~$950 billion of revenue by 2034 imply a forward sales multiple near ~1× if the company hits that lane, which is exactly why the market refuses to mark NASDAQ:TSLA like a carmaker. The mosaic—energy cash flows, autonomy software, training compute, and a humanoid option—argues for a hybrid multiple. Even simple thought experiments with robotaxi net revenue of $50–$100 billion and energy scaling from today’s base move the needle enough to justify a premium.

NASDAQ:TSLA — Catalysts and risks that actually move the stock

Near-term catalysts are software-led: wider robotaxi geography beyond Austin, higher FSD (supervised) take rates per active fleet, HW4/HW5 capability unlocks, and visible Megapack bookings translating into recognized revenue. Manufacturing cadence for energy capacity in Houston and LFP ramp milestones will matter on calls. Risks are as tangible: discounting to offset IRA step-downs can pressure the 14% Q2 auto margin; regulatory credit revenue already fell from $890 million to $439 million and can compress further; autonomy timelines are execution- and regulator-dependent; and capital intensity for storage and robotics must be matched with margin expansion to preserve cash generation.

NASDAQ:TSLA — Positioning call and price path

On a 12–24 month view, this skews Buy. The numbers justify it. Revenue of $22.5 billion in Q2 with a 12% YoY decline is the trough-like print you usually want to buy when the optionality is this thick. Auto gross margin stabilizing at ~14% is a base to build from if price discipline holds. Energy has $2.1 billion in deferred revenue and $10.38 billion in RPO with $5.47 billion converting in the next year, which supports consolidated gross profit even as vehicles cycle through promotions. The autonomy stack has a credible roadmap from HW3 (~144 TOPS) to HW4 (~300–500) to HW5 (~2,000–2,500), while the robotaxi model pencils to $0.50–$1.00 net per mile and $50–$100 billion at 100 billion miles—a scenario that only needs partial realization to re-rate the multiple. Use weak days on the NASDAQ:TSLA tape to add toward a core position and let software, storage, and robotics do the heavy lifting on the upside over the next eight quarters.