Tesla (NASDAQ:TSLA) Surges After Q3: Why This Stock Could Skyrocket 50%

Strong Q3 margins, autonomous driving advancements, and Musk’s bold 2025 vision drive Tesla’s massive growth potential | That's TradingNEWS

Tesla (NASDAQ:TSLA) Surges After Strong Q3 Results: A Game-Changer for Investors

Tesla Inc. (NASDAQ:TSLA) has once again proved the skeptics wrong with its Q3 results, delivering a performance that silenced doubts about demand and profitability in the electric vehicle (EV) market. The company, led by Elon Musk, is showing no signs of slowing down, with a focus on autonomous driving technology, more affordable vehicles, and future expansion. This article will dive deep into Tesla’s performance, growth potential, risks, and valuation, backed by facts, numbers, and a unique analysis that sets Tesla apart as a strong buy.

Q3 Performance: Tesla's Resilience in a Tough Market

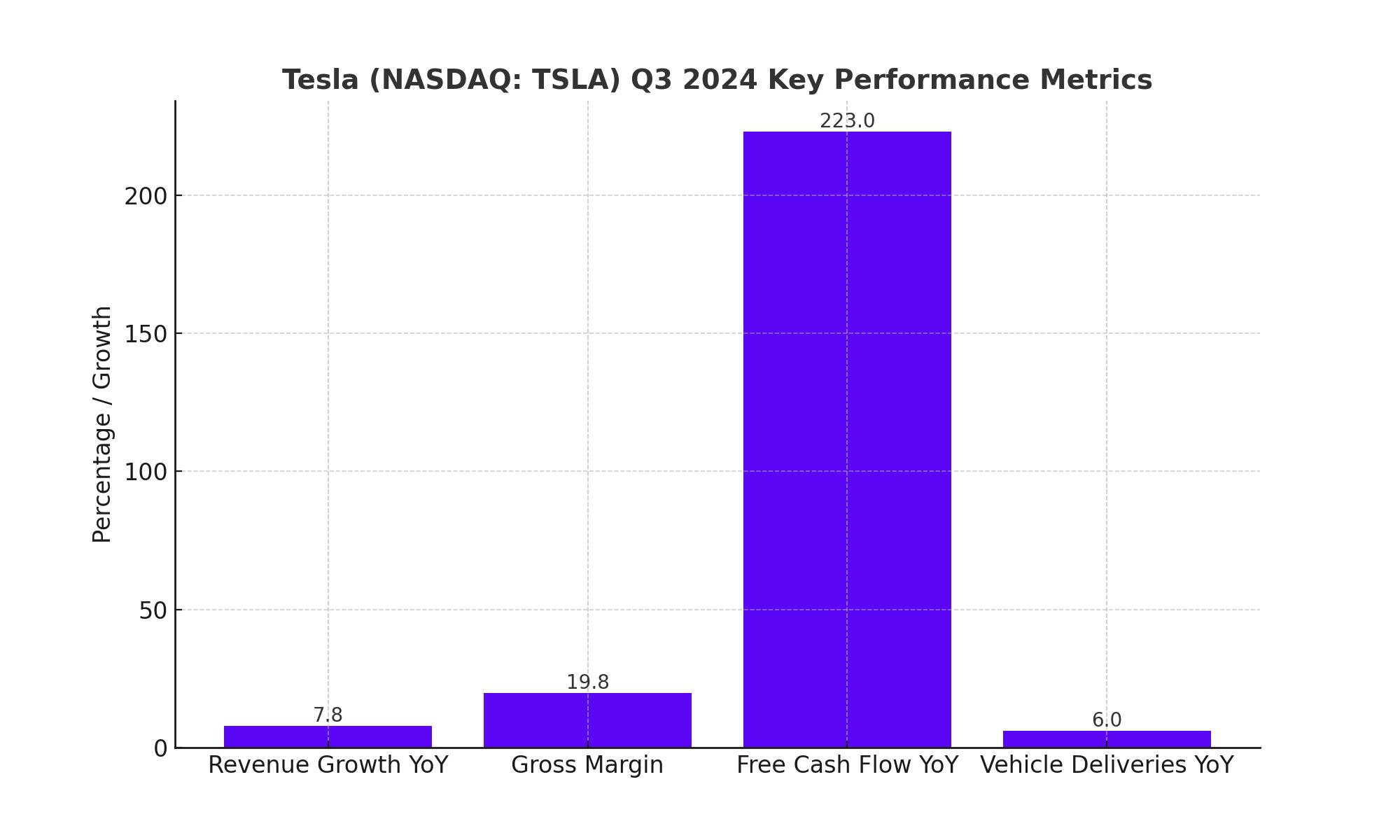

Tesla's Q3 2024 earnings report shattered bearish expectations, marking one of the most significant quarters in years. The company delivered an EPS of $0.72, beating estimates by $0.12, while revenue came in at $25.18 billion, reflecting a 7.85% year-over-year growth despite missing expectations by $314 million. Investors were particularly impressed with Tesla’s 19.8% gross margin, up from 17.9% a year ago, underscoring its ability to manage costs and maintain profitability in a challenging market.

Tesla’s automotive gross margin hit 16.4%, significantly up from 13.8% in the previous quarter, dispelling concerns that price cuts and increased competition would hurt the company’s profitability. Tesla's energy generation and storage division also showed promise, with a 30.5% gross margin, up from 24.5% last quarter. This broad margin expansion highlights Tesla’s operational efficiency and its ability to navigate industry challenges, such as price competition and rising production costs.

Strong Demand and Growing Production: Key Growth Catalysts

Tesla’s Q3 also marked the production of its 7-millionth vehicle, with Musk projecting 20-30% vehicle growth in 2025. Tesla’s ability to ramp up production while maintaining strong demand is a key growth driver. The company delivered 462,890 vehicles in the quarter, up 6% year-over-year, a significant achievement given the global challenges faced by the EV industry.

The Full Self-Driving (FSD) system continues to be a game-changer for Tesla, with 35,000 autonomous-enabled vehicles being produced weekly. The FSD technology is central to Tesla’s long-term vision, and as Musk said during the earnings call, it’s "blindingly obvious" that the future of transportation is electric and autonomous. Tesla’s investment in FSD will be a significant competitive advantage as other automakers lag behind in autonomous technology.

Tesla is also working on introducing a more affordable vehicle, expected to cost less than $30,000 after incentives, which is projected to hit the market in the first half of 2025. This new model will target a broader consumer base, significantly increasing Tesla's total addressable market (TAM) and making EVs more accessible to the masses.

Valuation and Future Outlook: A 50% Upside in Sight

Tesla’s forward Non-GAAP P/E ratio stands at 92.75, significantly higher than the sector median of 17.19. However, this premium is justified by Tesla’s superior growth potential. Tesla’s 2025 vehicle growth projection of 20-30% suggests a potential 25% increase in automotive revenue, pushing the value of Tesla’s automotive division to $597.18 billion. When combined with the estimated value of other Tesla divisions, including Tesla Energy and Optimus robots, Tesla’s overall valuation could reach $1.022 trillion, representing a 49.8% upside from the current market cap of $682.53 billion.

With Tesla shares already realizing part of this potential, the stock remains well-positioned for growth, driven by expanded production, new vehicle models, and increasing margins across all divisions. The company's current market cap does not fully account for its growth in autonomous technology, energy solutions, or the robotaxi business, all of which will contribute to long-term revenue expansion.

Tesla’s Margin Growth: A Positive Shift for Profitability

Tesla's ability to grow margins in a difficult environment was the standout feature of Q3. The Total GAAP Gross Margin Rate rose 10% quarter-over-quarter, while the Operating Margin Rate increased by 71%, and the Adjusted EBITDA Margin was up 28%. This marks the first time in two years that Tesla has reported quarter-over-quarter increases in all these key metrics, indicating that the company is successfully managing production costs while scaling up.

Tesla’s free cash flow surged by 223% year-over-year to $2.7 billion, further highlighting the company’s operational efficiency. Free cash flow margins more than doubled, increasing from 5.3% to 10.9%. This improvement comes at a time when Tesla continues to invest heavily in new production facilities, such as Giga Texas and Giga Berlin, and in innovative projects like the Cybertruck and Tesla's robotaxi network.

Risks to Consider: Musk’s Timelines and Competition

While Tesla’s future looks bright, there are risks to consider. Musk has a history of setting ambitious timelines that aren’t always met. The promise of a more affordable Tesla vehicle by early 2025 is exciting, but delays could hurt investor sentiment. Additionally, competition from legacy automakers and Chinese EV giants like BYD could impact Tesla’s market share, especially in key markets like China and Europe.

However, Tesla’s significant lead in autonomous technology, energy solutions, and EV production scale gives it a competitive edge that rivals will struggle to match. Even with these risks, Tesla’s forward-looking growth and profitability potential make it a compelling investment opportunity.

Investor Takeaway: A Strong Buy with Nearly 50% Upside

Tesla’s Q3 results and its outlook for 2025 have solidified its position as the dominant player in the EV market. With improving margins, strong free cash flow, and Musk’s projection of 20-30% vehicle growth, Tesla is poised for significant growth in the coming years. The introduction of more affordable models, the expansion of the FSD platform, and the continued build-out of Tesla’s energy and autonomous driving divisions all contribute to the company's long-term value proposition.

Based on current and projected financials, Tesla’s valuation could exceed $1 trillion, offering nearly 50% upside from today’s levels. The company is firing on all cylinders, making Tesla stock (NASDAQ:TSLA) a strong buy for investors seeking exposure to the EV revolution and the future of autonomous driving.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex