Teva NYSE:TEVA Surpassing Debt Hurdles through Innovation and Growth

A Deep Dive into Teva's Financial Resurgence and Strategic Direction: Navigating from Debt Reduction to Market Leadership | That's TradingNEWS

Teva Pharmaceutical Industries: A Turnaround Tale Amid Debt and Innovation

Introduction to Teva Pharmaceutical Industries (NYSE:TEVA)

Teva Pharmaceutical Industries has marked its position in the global pharmaceutical sector as a leading manufacturer of generic medicines. Despite facing challenges, including a significant debt load and legal controversies under previous management, Teva shows signs of a promising turnaround under its new leadership. This analysis explores Teva's financial health, strategic direction, and future prospects.

Financial Overview: Navigating Through Debt

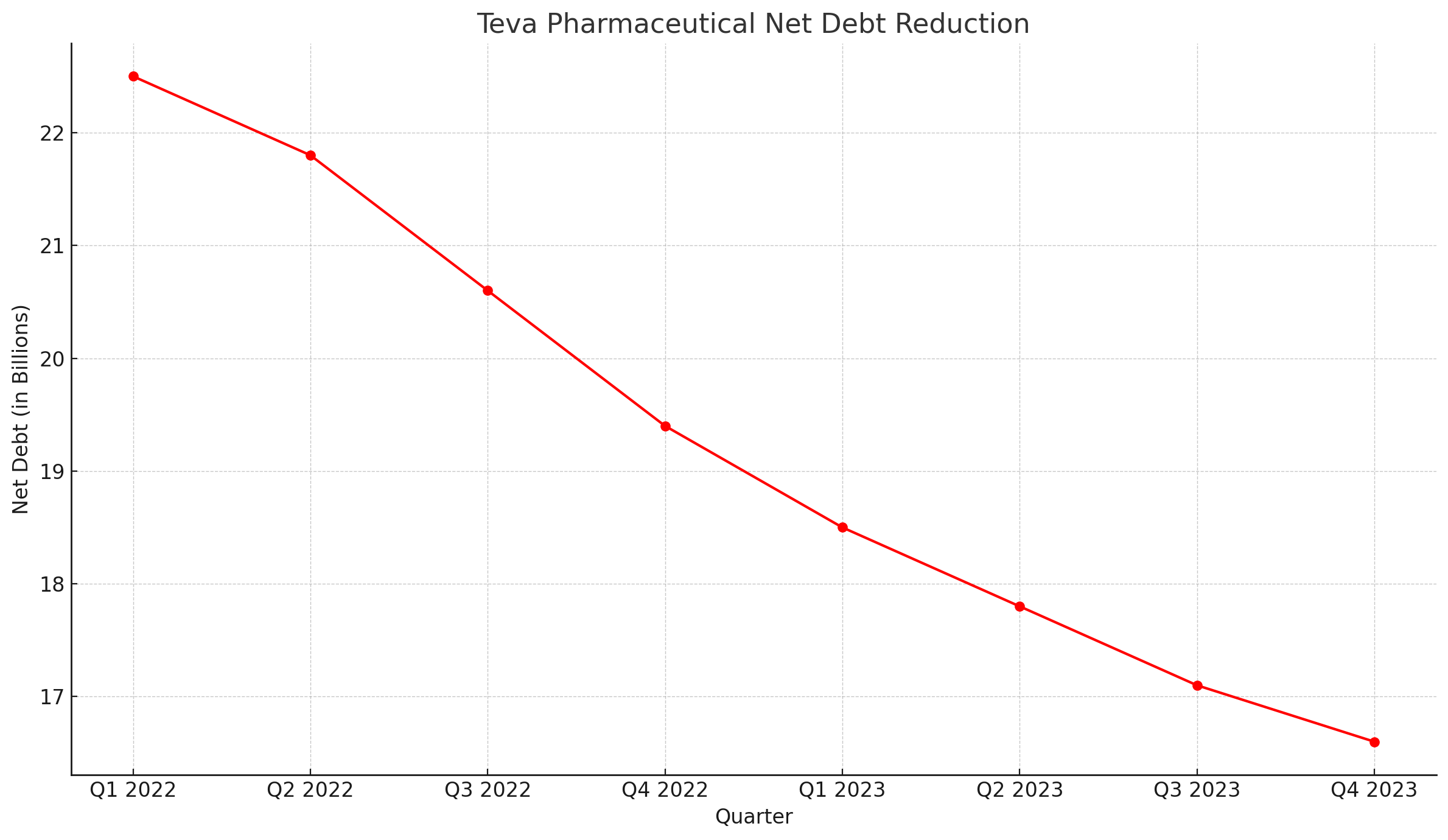

Teva's financial landscape has been characterized by a substantial debt burden, with a net debt of approximately $16.6 billion as of December 2023. However, recent efforts under the new CEO, Richard Francis, have shown a commitment to reducing this debt while simultaneously investing in growth avenues. This section would delve into Teva's debt structure, analyzing its impact on financial stability and shareholder value.

Strategic Initiatives: Pivoting Towards Growth

In 2023, Teva embarked on a strategic "Pivot to Growth" plan aimed at revitalizing the company. Focusing on expanding its generic medicine portfolio and diving into innovative pharmaceuticals, Teva seeks to leverage its global footprint for sustainable growth. Key aspects of this strategy include enhancing operational efficiencies, reducing debt, and investing in R&D for long-term innovation.

Market Performance and Shareholder Composition

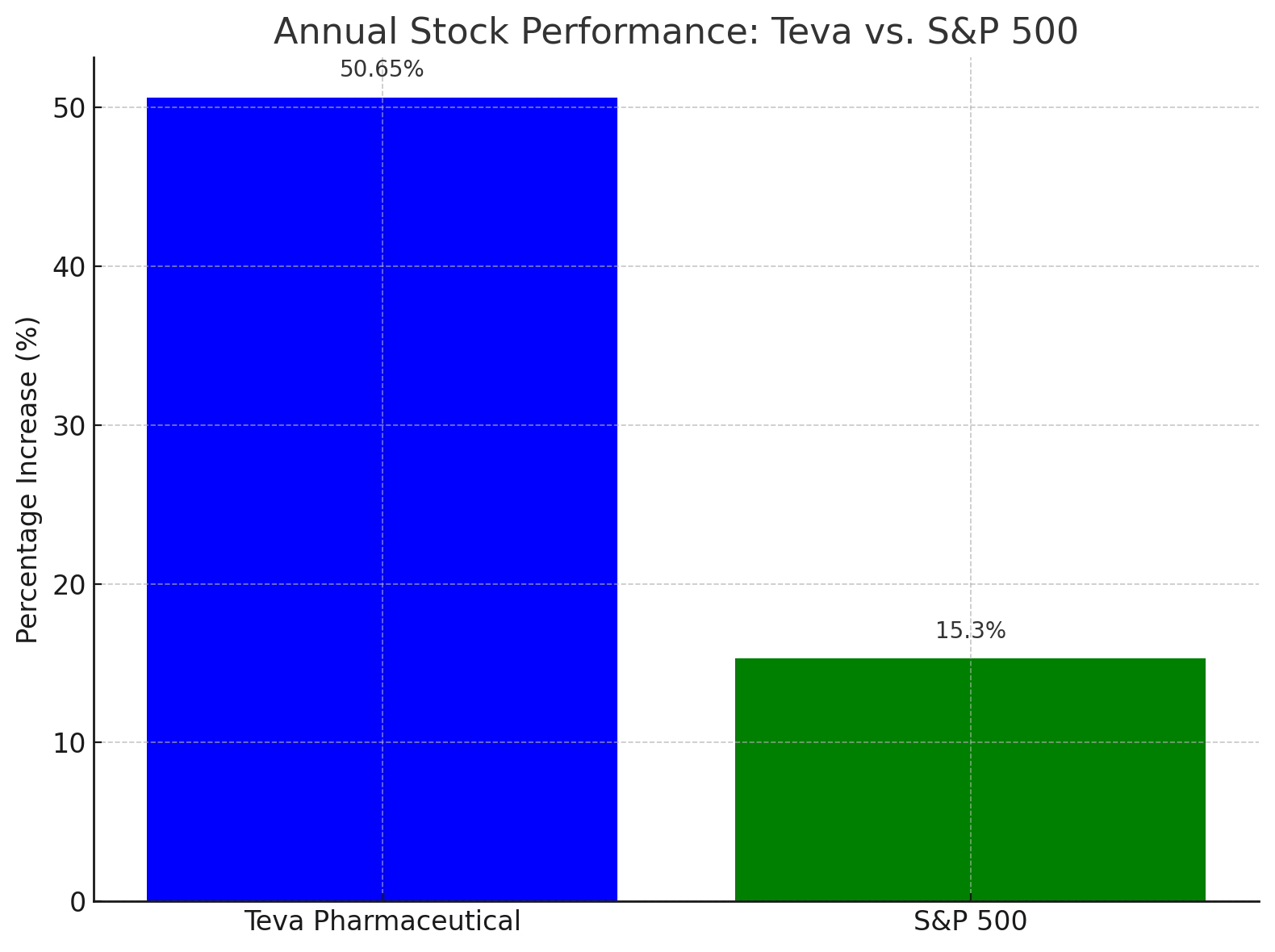

Despite the challenges, Teva's stock has shown resilience, with a 50.65% increase over the past year, outpacing the S&P 500. Institutional investors hold a significant portion of Teva's shares, indicating confidence in its turnaround strategy. This section would examine Teva's market performance, institutional ownership, and the implications for future stock movement.

Teva's Strategic Revival: A Closer Look at Financial Metrics

Under the leadership of CEO Richard Francis, Teva has embarked on a promising journey towards financial stability and growth. In the recent fiscal quarters, the company has reported a notable uptick in revenue, marking a year-over-year increase of 14.80% as of the latest quarter ending December 2023. This resurgence is particularly significant, considering the revenue stood at $15.85 billion for the trailing twelve months (TTM). Teva’s operational efficiency is also on the rise, with operating margins expanding to 28.05%, demonstrating the effectiveness of cost management strategies implemented by the new leadership.

Deleveraging Strategy and Financial Health Enhancement

Teva’s strategy to alleviate its debt burden, which amounted to a net debt of approximately $16.6 billion by the end of December 2023, has been a cornerstone of its turnaround efforts. The company's focus on boosting free cash flow, which was reported at $1.37 billion TTM, aims to facilitate accelerated debt repayment. Teva's strategic financial planning anticipates significant debt reduction, highlighted by a decrease from $21.2 billion a year prior, showing a tangible commitment to improving its balance sheet solidity.

Investment Perspective: Analyzing Teva’s Market Position and Risks

Investing in Teva necessitates a balanced consideration of its historical challenges against the backdrop of its current financial recuperation and strategic initiatives. Despite previous management missteps and a high debt profile, Teva's dominant stance in the generic pharmaceuticals sector and its strategic pivot under CEO Richard Francis illuminate a path with potential high returns. The forward Price/Earnings (P/E) ratio of 5.82 reflects a market anticipation of earnings growth, underscoring investor confidence in Teva’s recovery trajectory.

Teva’s Forward Momentum: Innovation and Market Adaptation

As Teva Pharmaceutical Industries forges ahead, the initial success markers of its strategic realignment offer a beacon of optimism. The company is not just focused on overcoming its financial and operational hurdles but is also poised to capitalize on innovation within the pharmaceutical industry. With a renewed emphasis on R&D and the expansion into innovative drug development, Teva is aligning with market demands and future growth sectors, indicating a robust path forward.

Continuous Monitoring and Future Insights

For investors, analysts, and stakeholders keen on tracking Teva’s progress, continuous monitoring of its stock performance here and insider transactions here will provide critical insights. These resources are pivotal for staying updated on Teva’s financial health, strategic milestones, and market positioning.

Expanding the Analysis: Teva's R&D Investment and Pipeline Strength

A pivotal element of Teva's turnaround strategy hinges on its investment in research and development (R&D), which is crucial for the pipeline expansion and launching of new, innovative products. By focusing on high-potential areas such as biologics and specialty drugs, Teva aims to diversify its portfolio beyond generic medications, thereby opening new revenue streams and enhancing its competitive edge.

Global Market Expansion and Strategic Partnerships

Another key aspect of Teva's growth strategy is its global market expansion and the cultivation of strategic partnerships. With operations spanning across significant markets, including North America, Europe, and emerging economies, Teva is well-positioned to leverage global trends and demands in the pharmaceutical industry. Collaborations with other pharmaceutical companies and healthcare providers could further strengthen Teva’s market presence and fuel its growth trajectory.

Conclusion: Navigating the Path to Renewal

Teva Pharmaceutical Industries stands at a critical juncture, with early indicators of a successful strategic overhaul fostering optimism. The concerted efforts in reducing debt, revitalizing its product lineup through R&D, and embracing market opportunities underline Teva's commitment to a sustainable and profitable future. As the company continues to navigate the complexities of the pharmaceutical landscape, the focus remains on delivering value to shareholders while advancing healthcare solutions worldwide.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex