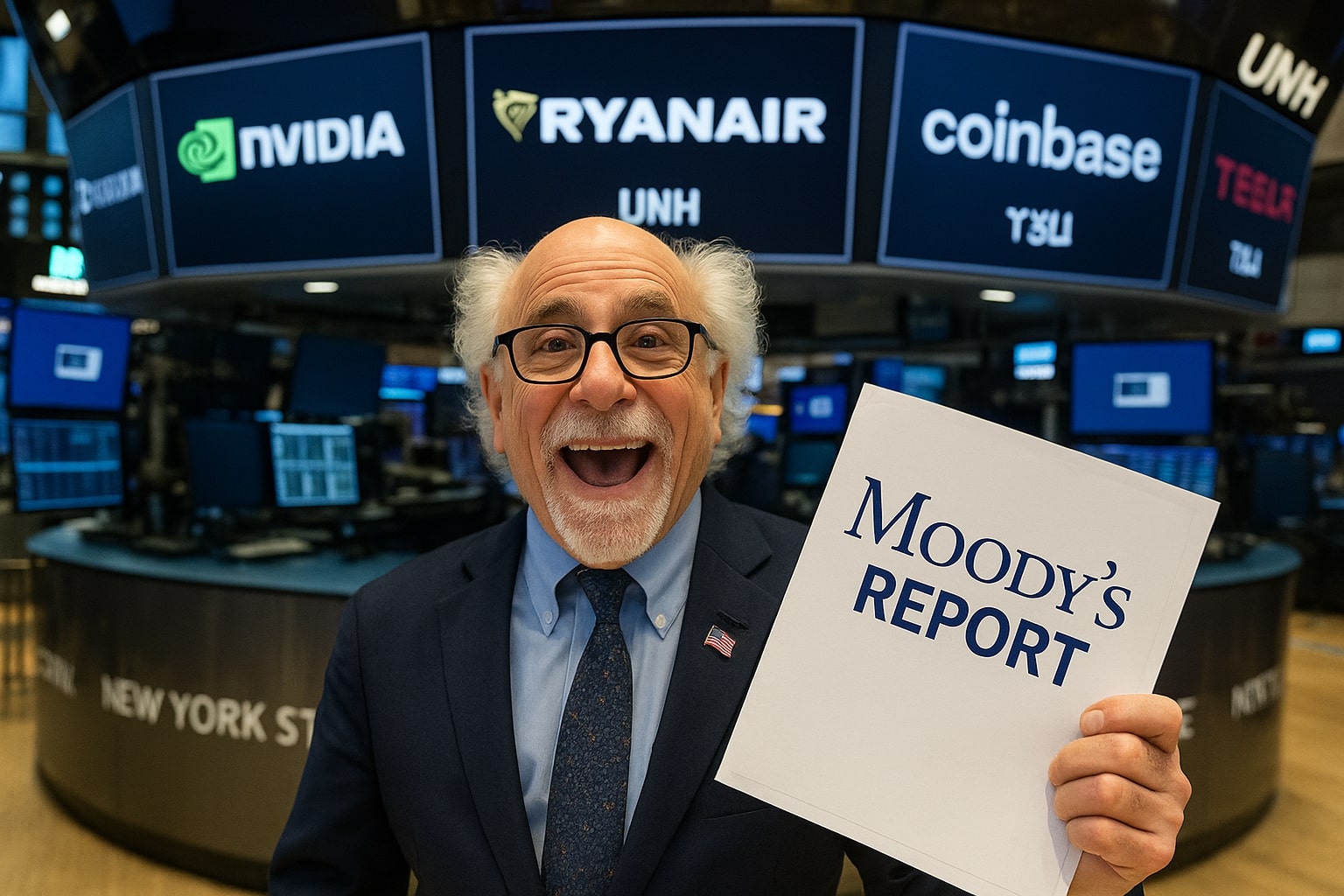

U.S. Stock Market Reaction to Moody’s Credit Downgrade: A Comprehensive Analysis

The stock market kicked off the new trading week with a mixed performance, driven by the market's response to Moody's decision to downgrade the U.S. credit rating from Aaa to Aa1. The S&P 500 showed a slight decline of 0.1%, while the Dow Jones Industrial Average climbed by 80 points, or 0.2%, and the Nasdaq Composite dropped 0.2%. The U.S. credit downgrade triggered a sharp increase in Treasury yields, putting downward pressure on equity markets. However, the overall market showed resilience by recovering from the initial losses, as investors seemed to shrug off the downgrade's potential long-term impact.

Moody’s Credit Downgrade: Implications for U.S. Debt and Equities

Moody’s lowered the U.S. credit rating due to concerns over the federal government’s increasing budget deficit and the challenges of refinancing U.S. debt amid rising borrowing costs. This downgrade aligned the rating agency with Fitch and S&P, which had previously downgraded the U.S. credit rating. The 30-year U.S. Treasury yield surpassed 5%, and the 10-year yield climbed above 4.5%, levels that are significantly higher than the rates experienced in previous years. These rising yields hurt bond prices and sparked concerns among investors, particularly in relation to the broader economic implications of the growing deficit and rising interest rates.

Despite the initial negative market reaction, analysts like Ross Mayfield from Baird emphasized that the downgrade did not reveal any new information about the U.S. fiscal situation. Mayfield noted that the downgrade merely provided the market with a temporary "breather" and maintained a bullish outlook on U.S. equities over the next six to twelve months. The consensus is that the downgrade will not have a lasting impact on stock prices, especially given the current momentum in earnings growth, particularly in sectors such as artificial intelligence (AI).

The Impact of Rising Yields on Mortgage and Consumer Borrowing Costs

The rise in Treasury yields has significant implications for consumer borrowing costs. The 10-year Treasury yield, which is closely tied to mortgage rates, car loans, and credit card rates, crossed the 4.5% threshold, signaling higher borrowing costs for consumers. This rise in yields is a concern for sectors like housing, automotive, and consumer finance, where high levels of consumer debt are prevalent. The Federal Reserve's future interest rate policy will continue to play a pivotal role in shaping investor sentiment and determining the cost of capital for businesses and consumers alike.

Digital Realty Trust: Bank of America's Top Data Center Pick

In the midst of broader market volatility, Digital Realty Trust (DLR) stood out as a key stock pick. Bank of America reinstated coverage of DLR with a buy rating, citing the company’s strong pipeline of bookings and significant exposure to AI training. Digital Realty Trust has been a major beneficiary of the growing demand for data centers, driven by the AI boom. Despite DLR's shares being down nearly 4% year-to-date, the firm remains optimistic about its long-term growth prospects, with analysts expecting strong results in 2025 due to the continued expansion of AI and cloud services.

UnitedHealth Group: A Strong Rebound

UnitedHealth Group (UNH) surged by 8% on Monday, marking an impressive two-day rally of more than 14%. This rebound follows a sharp decline of over 32% in the previous eight trading sessions. The recent rally, while notable, is still insufficient to recover from the May 6 close. Investors have shown renewed confidence in UnitedHealth, which had faced a series of challenges, including the suspension of its 2025 guidance and CEO changes. Despite these hurdles, UnitedHealth's recovery remains one of the most significant positive movements in the broader market.

IBM Hits New All-Time High

IBM continued its strong performance in 2025, surging to a new all-time high. The stock has gained nearly 22% year-to-date and outperformed many of its tech peers, including Tesla (TSLA), which saw a 90% gain, and Meta (META), which rose 36%. IBM's consistent growth has been driven by its strategic focus on AI and cloud services, positioning it as a key player in the evolving tech landscape.

The Small-Cap Struggle: Russell 2000’s Underperformance

While large-cap stocks have generally shown strength, small-cap stocks have continued to lag. The Russell 2000 index, which represents smaller companies, fell sharply on Monday, dropping nearly 1%. This underperformance highlights the struggles of small-cap stocks, which have faced a challenging year in 2025, with the Russell 2000 down more than 6% year-to-date. In contrast, the S&P 500 has gained more than 1%, reflecting the divergence in performance between large-cap and small-cap stocks.

Tesla’s Struggles Amidst Rising Competition

Tesla (TSLA) has faced a setback, with shares falling by 3.6% to start the week. This decline follows strong gains last week and reflects growing concerns about the competition in the electric vehicle (EV) market, particularly from Xiaomi's new YU7 electric crossover, set to rival Tesla’s popular Model Y in China. The increasing competitive pressure in China, along with uncertainties over demand in Europe, has contributed to Tesla’s recent stock weakness.

Nvidia’s Mixed Performance Amid Market Volatility

Nvidia (NVDA), a key player in the AI chip market, saw its stock price remain relatively flat on Monday. Despite unveiling new products, including humanoid robotics and AI server solutions, the Nvidia stock was affected by broader market turmoil. The company’s chip sales were significantly impacted by the ongoing U.S.-China trade tensions, with CEO Jensen Huang revealing that the Trump administration’s chip ban has cost Nvidia $15 billion in lost sales. This highlights the ongoing challenges faced by semiconductor companies in navigating the geopolitical landscape.

Walmart and the Impact of Tariffs

Walmart (WMT) faced additional headwinds after President Donald Trump criticized the company for passing on tariff costs to consumers. This comment came in the context of Trump's ongoing trade war with China, which has led to increased costs for retailers reliant on imports from China. Walmart shares dropped 1.7%, as the retailer acknowledged the potential for higher prices due to the newly enacted tariffs. The pressure on Walmart illustrates the growing impact of tariffs on consumer prices and the challenges faced by large retail chains.

Bitcoin's Resilience: Coinbase Joins the S&P 500

Despite broader market turbulence, Bitcoin (BTC-USD) held steady above $105,000 per token, buoyed by a crypto-friendly environment in the U.S. and increasing institutional adoption. Coinbase (COIN), the leading cryptocurrency exchange, made headlines by joining the S&P 500 index, becoming the first crypto platform to achieve this milestone. Coinbase’s entry into the S&P 500 symbolizes growing mainstream acceptance of cryptocurrencies and signals a potential shift in how investors view the future of digital assets.

Conclusion

The stock market has faced a turbulent start to the week, with a mix of positive and negative forces shaping investor sentiment. The S&P 500 is grappling with the implications of Moody's credit downgrade, while key stocks like UnitedHealth (UNH) and IBM (IBM) demonstrate resilience. However, challenges remain for small-cap stocks and companies like Tesla (TSLA) and Nvidia (NVDA), which are facing growing competition and geopolitical risks. The outlook remains uncertain, but key economic factors such as rising Treasury yields and tariff developments will continue to influence market direction in the coming months.