Analyzing the Current Oil Market Dynamics

Global Oil Prices: Trends and Triggers

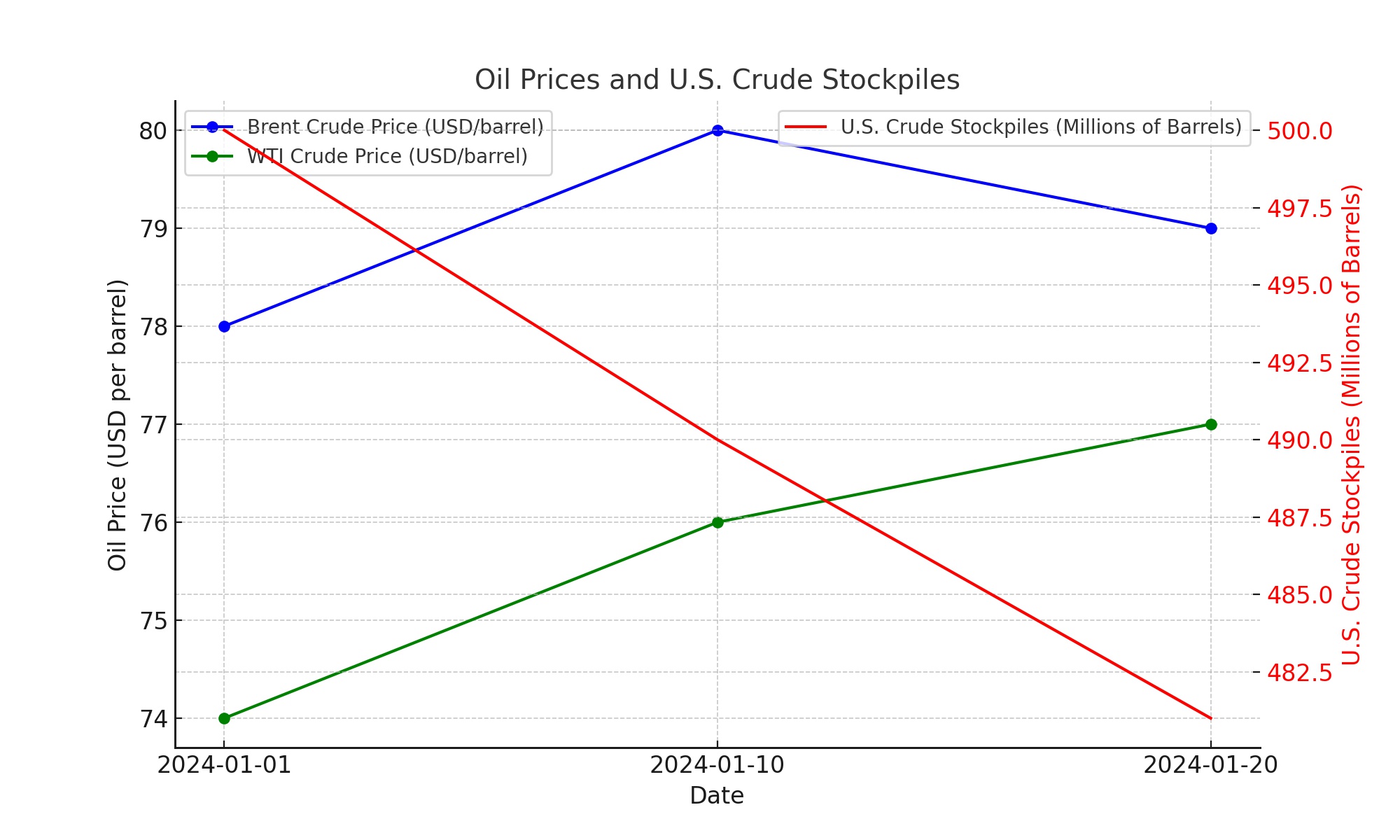

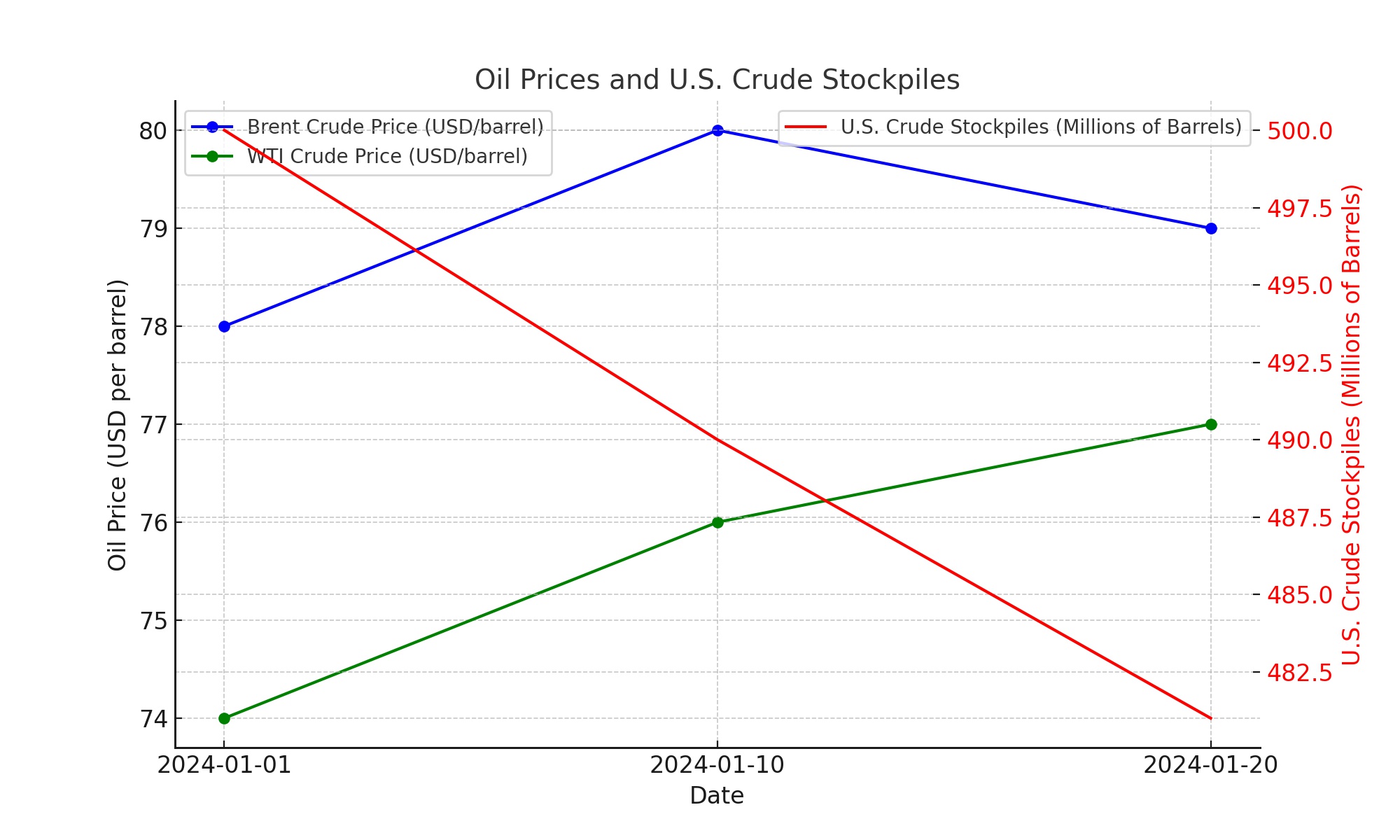

In recent weeks, the oil market has witnessed a notable uptick. Brent crude, the global benchmark, is nudging towards the $80 per barrel mark, buoyed by a combination of China's economic stimulation efforts and a weaker U.S. dollar. This movement signals a pivotal shift from the previously rangebound behavior of oil prices. Interestingly, the American Petroleum Institute's report highlighted a significant decrease in U.S. stockpiles, particularly at the crucial Cushing, Oklahoma hub, adding to the upward price momentum.

The Geopolitical Influence on Oil

Geopolitical tensions, especially in the Middle East, continue to exert a substantial impact on oil prices. The recent U.S.-led strikes targeting Iran-backed Houthis in Yemen have further complicated the scenario. These developments underscore the delicate balance in the oil market, where geopolitical risks are often offset by increased production outside OPEC. Analysts from Standard Chartered have pointed out that the market's oversupply concerns might be mitigated by a seasonal upswing in demand, potentially amplifying the impact of geopolitical events on oil pricing.

U.S. Economic Growth and Oil Demand

The United States has witnessed robust economic growth, with a reported 3.3% increase in the fourth quarter, surpassing expectations. This economic vigor is likely to bolster oil demand. Concurrently, China's move to reduce reserve requirements for banks by $139.8 billion is anticipated to invigorate its economy, potentially stimulating global oil demand.

Supply Side Constraints and Weather Impacts

On the supply side, a notable contraction in U.S. crude stockpiles (a 9.2 million barrel reduction for the week ending January 19) primarily attributed to winter storms, has tightened supply. This phenomenon is particularly pronounced in North Dakota, where production plummeted by 700,000 barrels per day during the peak of the weather disruption. Although analysts like Ryan Grabinski from Strategas Securities suggest that this disruption may be short-lived, it has nonetheless contributed to a tightening of the supply.

Market Trends and Technical Analysis

From a technical perspective, West Texas Intermediate (WTI) breaking above $76 per barrel indicates a bullish trend. The focus now shifts to whether WTI can surpass its 200-day moving average of $77.65. Similarly, Brent Crude is testing resistance levels, hinting at a potential breakout. Both benchmarks seem primed for an upward trajectory, especially if global economic conditions remain favorable.

Impact on Gasoline Prices

The ripple effect of these oil market dynamics is already evident in gasoline prices. Patrick De Haan from GasBuddy has flagged that the low gasoline prices experienced recently in the U.S. are likely behind us, with a spring surge anticipated. This expectation is reinforced by the recent rise in WTI crude oil prices, now hovering over $76 per barrel.

Global Developments and Future Outlook

The situation in the Middle East, particularly the Houthi attacks and the U.S. response, continues to be a focal point for market watchers. Furthermore, JPMorgan's revised oil market outlook suggests an average price of $83 per barrel in 2024, reflecting a shift towards a supply-led market.

Domestic Implications and Predictions

On the domestic front, there's an expectation of an increase in petrol and high-speed diesel rates in the upcoming bi-weekly review. This hike is likely a response to the recent surge in global oil rates, exacerbated by Middle Eastern tensions and U.S. and UK interventions in Yemen.

Russian Oil and Global Sanctions

The global sanctions on Russian oil, notably the price ceiling of $60 a barrel, have had mixed effectiveness. Despite the cap, Russian oil has been trading above this limit, indicating the challenges in enforcing these sanctions. The reluctance to revise the price ceiling suggests a cautious approach from the G7 nations, balancing the need to pressure Russia with the risk of disrupting global oil markets.

In summary, the current oil market is characterized by a complex interplay of economic growth, geopolitical tensions, supply-side constraints, and global policy responses. As we head into 2024, these factors will continue to shape the trajectory of oil prices, with implications for both global economies and individual consumers. For real-time chart analysis and deeper insights into stock movements, visit Trading News.