TradingNEWS Global Energy 2024 Outlook

Unpacking the Complex Relationship Between Geopolitical Movements, Oil Prices, and the Global Economy in the Face of Uncertainty | That's TradingNEWS

The Interplay of Geopolitical Movements and Energy Prices

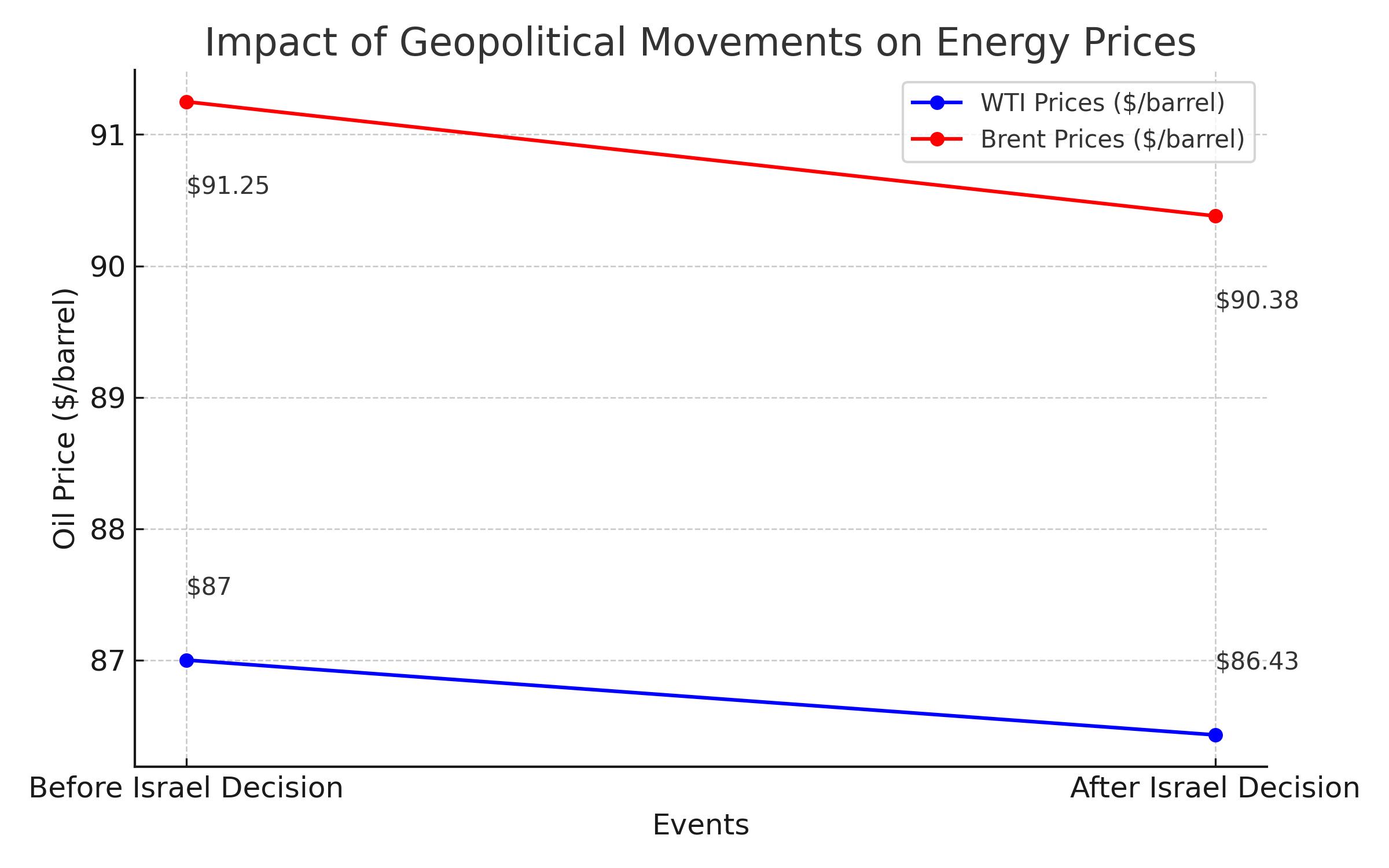

Recent geopolitical events have cast a significant shadow over global energy markets, with the focal point being the Middle East. A noticeable dip in oil prices was observed following Israel's decision to reduce its military presence in Gaza, signaling a potential ease in the region's tensions. Specifically, the West Texas Intermediate (WTI) for May delivery experienced a 0.55% decline, closing at $86.43 a barrel, while Brent crude for June delivery fell by 0.87% to settle at $90.38 a barrel.

This development came on the heels of heightened tensions between Israel and Iran, inciting fears of a direct conflict that could severely disrupt crude supplies. However, the prospect of a ceasefire between Israel and Hamas, discussed in Cairo, has temporarily alleviated these concerns, resulting in a downward adjustment of oil prices.

The Ripple Effect of Oil Price Fluctuations on the Global Economy

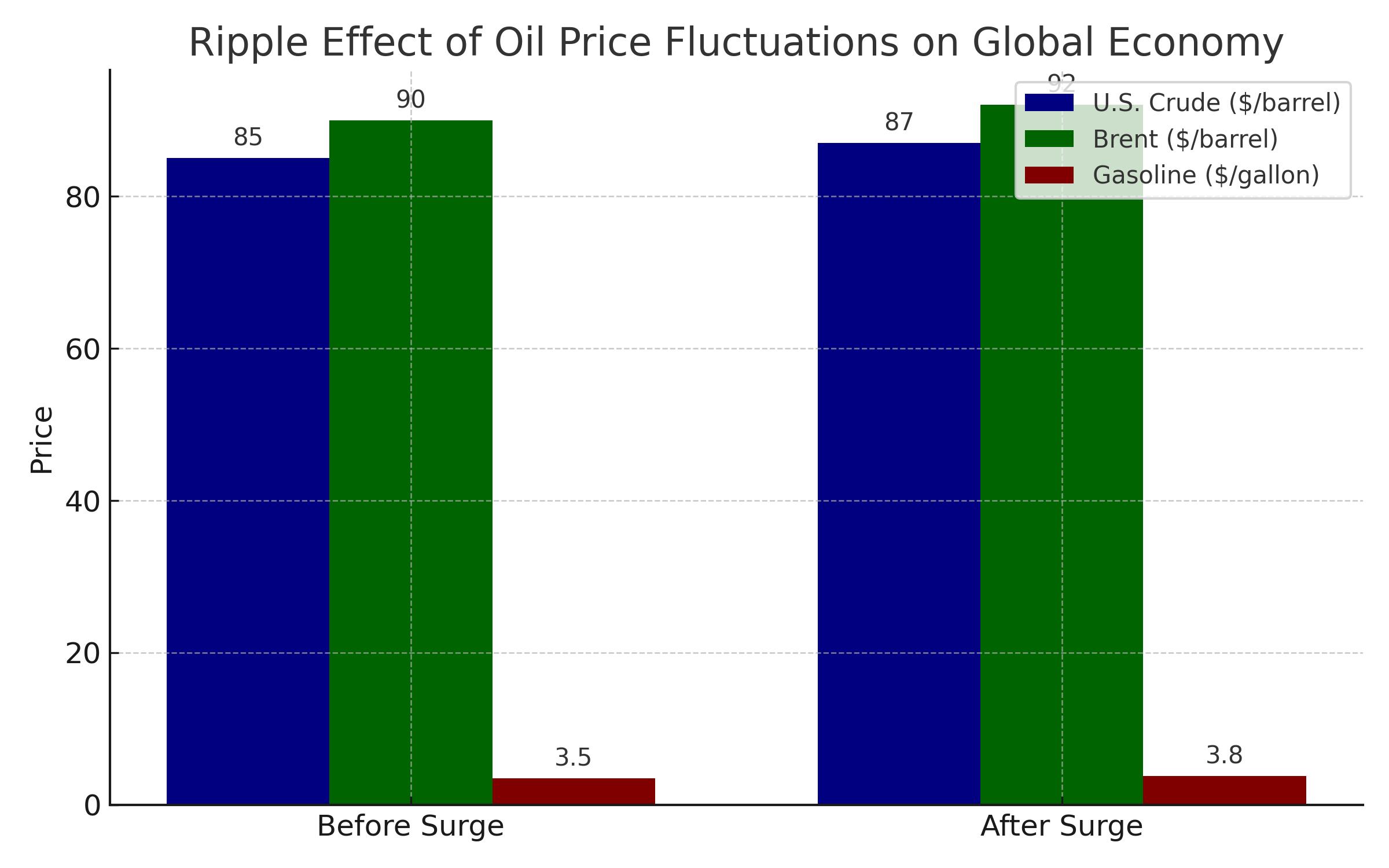

The global economy is currently in a delicate state, buoyed by a strong U.S. job market and consumer spending. Yet, the looming specter of rising oil prices threatens to destabilize this balance. The surge in U.S. crude to $87 a barrel and Brent nearing $92 a barrel has propelled gasoline prices to their highest in five months, posing a substantial risk to consumer spending and inflation progress.

Moody's has pinpointed rising oil prices as a paramount threat to economic stability, emphasizing the potential for higher gasoline prices to exceed $4 a gallon, a scenario that could shift political fortunes in the U.S. and exert immense pressure on the Federal Reserve's monetary policy.

Iran's Role in the Energy Market's Volatility

Iran's reaction to recent airstrikes has been a pivotal factor in the energy market's volatility. The targeting of Iran's consulate in Syria and subsequent threats of retaliation have injected a degree of uncertainty, prompting concerns over supply disruptions. This scenario has catalyzed a rally in oil prices, underscoring the fragility of global energy supplies in the face of geopolitical strife.

China's Energy Quandary: Coal Production and Imports

China, as a significant player in the global energy market, faces its challenges. The country's largest coal-producing province, Shanxi, anticipates a 4% reduction in coal output, marking the first decline in seven years. This adjustment, prompted by safety concerns and regulatory measures, coincides with a dip in coal production nationwide and softer coal prices due to diminished demand for cement and steel production.

Navigating the Market's Currents: The Indian Perspective

The Indian stock market has showcased resilience amidst global uncertainties, with domestic benchmarks recording gains. The anticipation of corporate earnings and macroeconomic data releases poses new challenges and opportunities for investors. The Reserve Bank of India's decision to maintain interest rates, coupled with sectoral performances and foreign investment flows, underscores the intricate balance between domestic policy and global economic forces.

Conclusion: A Confluence of Factors Influencing the Energy Sector

The global energy market is currently at a crossroads, influenced by geopolitical tensions, economic indicators, and strategic maneuvers within major producing nations. The potential for further disruptions in crude supplies, coupled with the economic implications of rising oil prices, necessitates a nuanced understanding of the underlying factors at play. As the situation unfolds, stakeholders across the spectrum will need to adapt to the evolving landscape, balancing short-term responses with long-term strategic planning.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex