TradingNEWS Metal and Gold Markets 2024: An In-Depth Analysis

Unraveling the Complexities of Metal Prices and Gold Valuation in the Current Economic Landscape | That's TradingNEWS

Overview of the Metal Market Dynamics

Recent Metal Price Fluctuations and Economic Indicators

Recently, the metal markets exhibited mixed price movements, with copper and aluminum showing contrasting trends. Specifically, three-month copper prices declined by 0.4% to $8,510 per metric ton, while aluminum experienced a 0.4% increase, reaching $2,241.50 a ton. These fluctuations are occurring in a global economic context marked by strong data from the U.S. and China's intensified efforts to stimulate growth. The Chinese central bank's decision to cut reserve ratio requirements (RRR) and Beijing's stabilization measures have particularly influenced the base metals and iron ore sectors.

Gold Market Analysis

Gold Price Trends and Influencing Factors

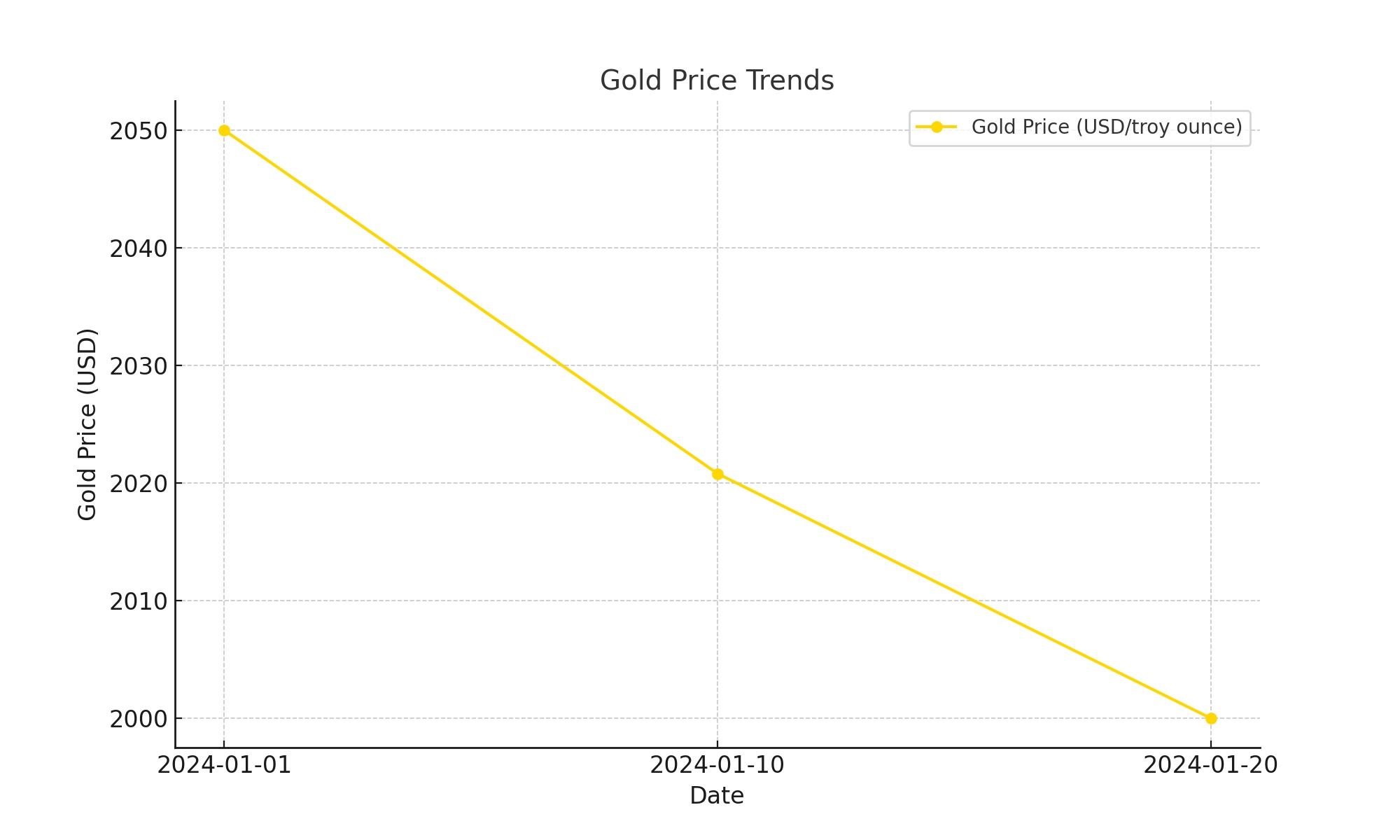

Gold, trading 0.1% higher at $2,020.80 a troy ounce, displays a nuanced picture. Despite a year-to-date decline of over 2%, gold’s price trajectory has lacked consistent direction, fluctuating over recent trading sessions. Factors like falling yields, despite robust U.S. GDP data, and expectations around the U.S. core PCE data release are pivotal in understanding these movements. The Federal Reserve’s preferred inflation gauge, the core PCE Price Index, is expected to show a year-over-year increase of 3.0%, down from 3.2%.

Technical Outlook for Gold

Resistance and Support Levels – A Technical Perspective

Gold’s performance is closely tied to various resistance and support levels, with significant attention on the 50-day and 200-day EMAs. The $2,040 mark is identified as a major resistance level, while support is found around $2,000-$1,980, coinciding with the 200-day EMA. These technical indicators suggest a bullish outlook, albeit with recognized volatility and susceptibility to global economic and geopolitical factors.

Interplay of Economic Indicators and Gold Prices

Impact of U.S. Economic Data on Gold Valuation

Recent U.S. economic data, indicating stronger-than-expected growth and moderating inflation, are exerting a considerable influence on gold prices. Specifically, the 3.3% annual growth in the U.S. economy for Q4 2023 surpasses forecasts, impacting U.S. Treasury yields and the dollar’s strength. These developments necessitate a careful analysis of gold’s future trajectory, especially in light of the upcoming Federal Reserve policy decisions.

Global Context and Gold’s Safe-Haven Appeal

Geopolitical Tensions and Economic Uncertainty

Amidst global geopolitical tensions and economic uncertainties, gold maintains its status as a safe-haven asset. Conflicts in the Middle East and anticipated global economic downturns in 2024 contribute to this perception. However, expectations of delayed interest rate cuts by the Federal Reserve could stabilize the U.S. dollar, affecting gold’s appeal.

Section 6: Short-Term Forecast and Technical Analysis for Gold

Current Trading Patterns and Predictive Indicators

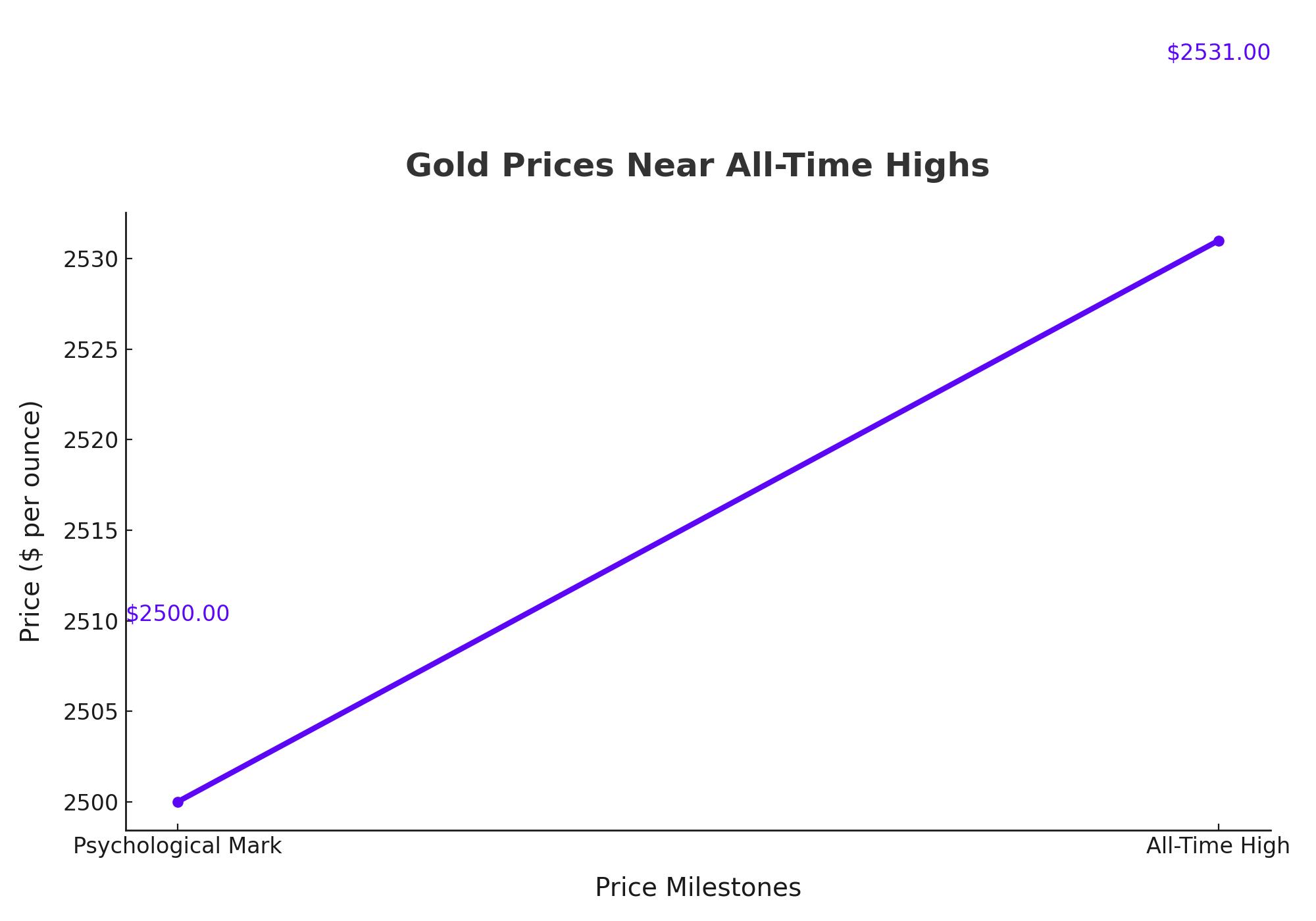

As of now, gold (XAU/USD) is navigating a complex landscape. Technical analysis points to key resistance and support levels, with a pivotal line at $2,026.968. The gold market is also influenced by the strength of the U.S. dollar and shifting investor risk appetites. Short-term sentiment is somewhat bearish, but underlying bullish factors persist, especially considering potential Federal Reserve rate cuts.

Long-Term Outlook for Gold

Fed Policy, Inflation, and Economic Dependency

The long-term outlook for gold hinges on the broader trajectory of the economy and Federal Reserve policies. Despite current rate hike speculations, the expectation of eventual rate cuts, given the economy's dependency on easy money, suggests a bullish future for gold. However, this is contingent on how the Fed addresses inflation and manages economic crises.

Market Sentiment and Investor Behavior

Analyzing Gold Futures and Central Bank Buying

Market sentiment is currently mixed. Recent movements in gold futures indicate a cautious approach among money managers, with a decrease in long positions but reluctance to build significant short positions. Central bank gold buying and Middle Eastern conflicts provide underlying support. Investors’ reactions to upcoming economic data releases and Fed policy decisions will be crucial in shaping gold’s short-term trajectory.

Central Bank Strategies and Gold Reserves

Influence of Central Bank Policies on Gold

Central banks worldwide are adjusting their strategies in response to the shifting economic landscape. This includes accumulating gold reserves, a trend that bolsters the metal's intrinsic value. For instance, data from the World Gold Council reveals a significant increase in gold reserves among central banks over recent years. These strategic moves reflect a hedging strategy against currency fluctuations and a buffer in uncertain economic times. The numbers show a net purchase of hundreds of tons of gold by central banks annually, underscoring their faith in gold's stability and potential for value preservation.

Geopolitical Dynamics and Gold's Role

Gold’s Response to Global Tensions

Geopolitical developments, particularly in the Middle East and other conflict-prone regions, have historically influenced gold prices. For instance, during times of heightened tensions, such as the ongoing Israel-Hamas conflict, gold often sees an uptick in demand as a safe-haven asset. This dynamic is evident in the price fluctuations corresponding to major geopolitical events. The increase in demand during these periods is a testament to gold's enduring status as a hedge against uncertainty.

Future Economic Indicators and Their Impact on Gold

Anticipated Economic Data and Gold Price Movements

Key economic indicators, such as the U.S. Personal Consumption Expenditures Price Index and GDP figures, are closely watched by investors for insights into gold's future trajectory. For example, a lower-than-expected PCE inflation figure can lead to a dip in the U.S. dollar strength, potentially boosting gold prices. Conversely, stronger economic growth indicators might bolster the dollar, applying downward pressure on gold. These indicators are crucial for understanding short-term price movements in the gold market.

Analyzing Gold's Technical Chart Patterns

Technical Analysis and Price Predictions

Gold's technical chart patterns offer insights into potential future movements. For instance, the presence of a resistance level around $2,038 per ounce and support levels near $2,000 and $1,985 per ounce provide key markers for traders. A breach of these technical levels could signal a shift in market sentiment. For example, breaking through resistance might indicate an upward trend, while falling below support levels could suggest a bearish outlook. Chart patterns and technical indicators thus play a significant role in predicting gold's price movements.

The Interplay of Currency Markets and Gold

Correlation Between the US Dollar and Gold Prices

The strength of the U.S. dollar has a significant inverse correlation with gold prices. A strong dollar typically leads to lower gold prices, as gold becomes more expensive in other currencies. This relationship is evident in the fluctuations of gold prices in response to changes in the dollar index. For example, when the dollar index rises, gold prices often fall, and vice versa. Monitoring currency market trends is therefore essential for understanding gold's price dynamics.

Investor Strategy and Gold Market Dynamics

Investor Behavior in the Gold Market

Investor strategy in the gold market is often dictated by a blend of technical analysis, economic indicators, and geopolitical news. For instance, increases in gold futures trading volumes can indicate growing investor interest or concern about future economic uncertainties. Moreover, the behavior of large institutional investors, who may adjust their portfolios based on macroeconomic forecasts and risk assessments, can significantly impact gold's price direction.

Conclusion

In conclusion, the gold market remains a complex and dynamic landscape, influenced by a myriad of factors including central bank policies, geopolitical tensions, economic data releases, technical chart patterns, currency market fluctuations, and investor behavior. Understanding these diverse influences is key to navigating the gold market effectively. As global economic scenarios evolve, closely monitoring these factors will remain essential for investors and analysts alike, providing valuable insights for making informed investment decisions in the gold market.

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex