Market Reactions to Fed and ECB Rate Cut Expectations

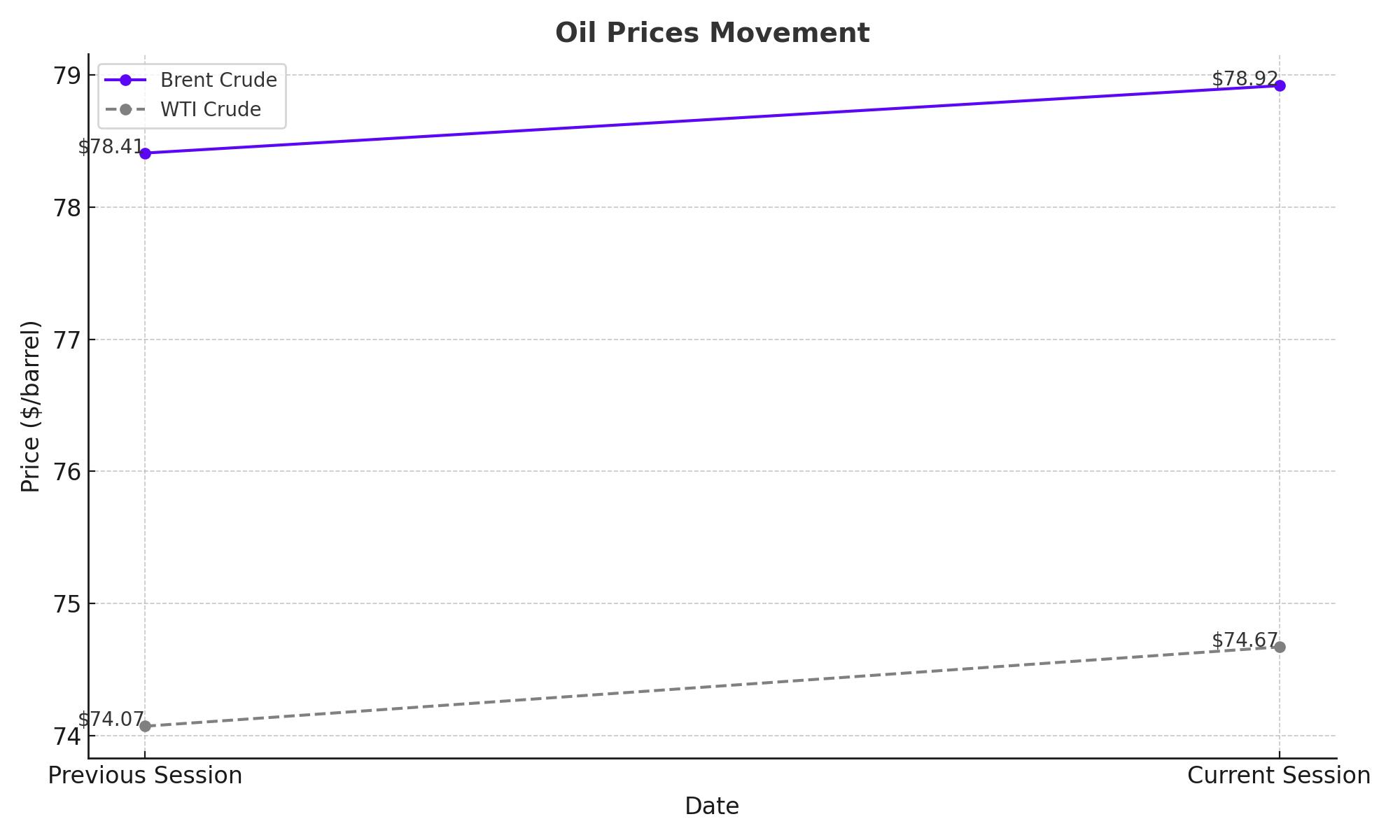

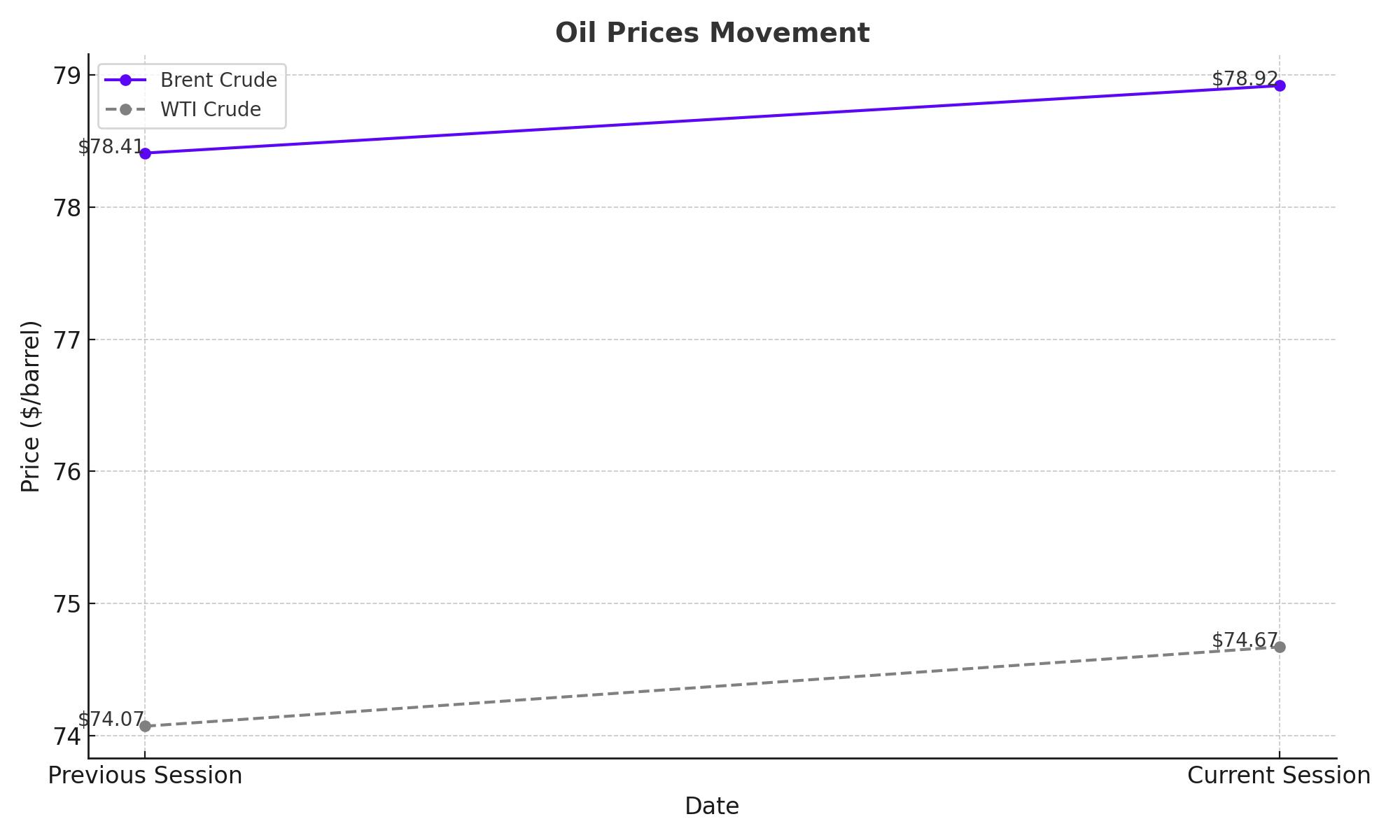

Oil prices saw a notable increase on Thursday due to growing expectations that the US Federal Reserve (Fed) will start cutting interest rates in the fourth quarter of the year. International benchmark Brent crude traded at $78.92 per barrel, up 0.65% from $78.41 per barrel in the previous session. Similarly, the American benchmark West Texas Intermediate (WTI) rose to $74.67 per barrel, marking a 0.81% increase from $74.07 per barrel. The anticipation of lower interest rates typically spurs economic activity, thereby increasing oil demand and supporting higher prices.

Economic Indicators and Their Influence

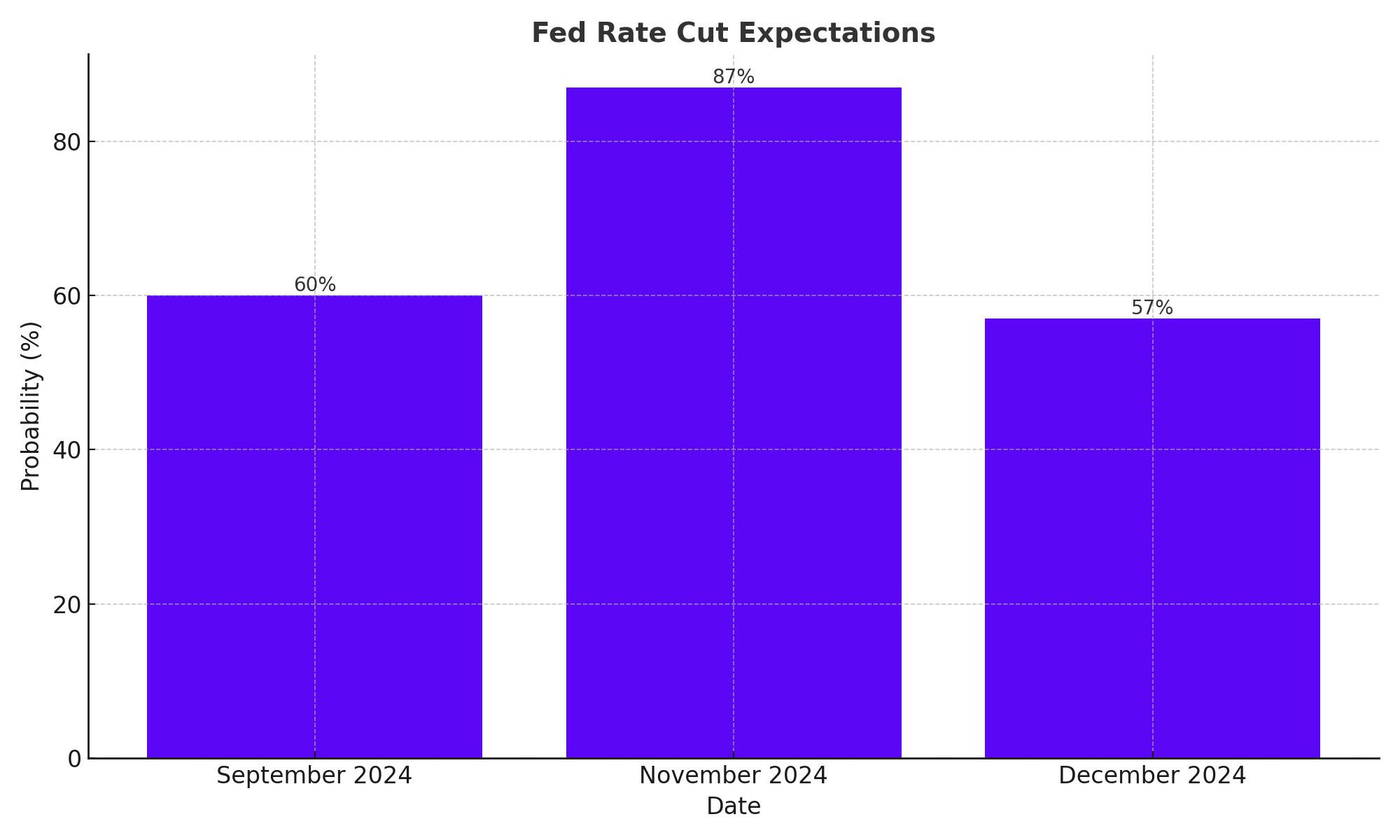

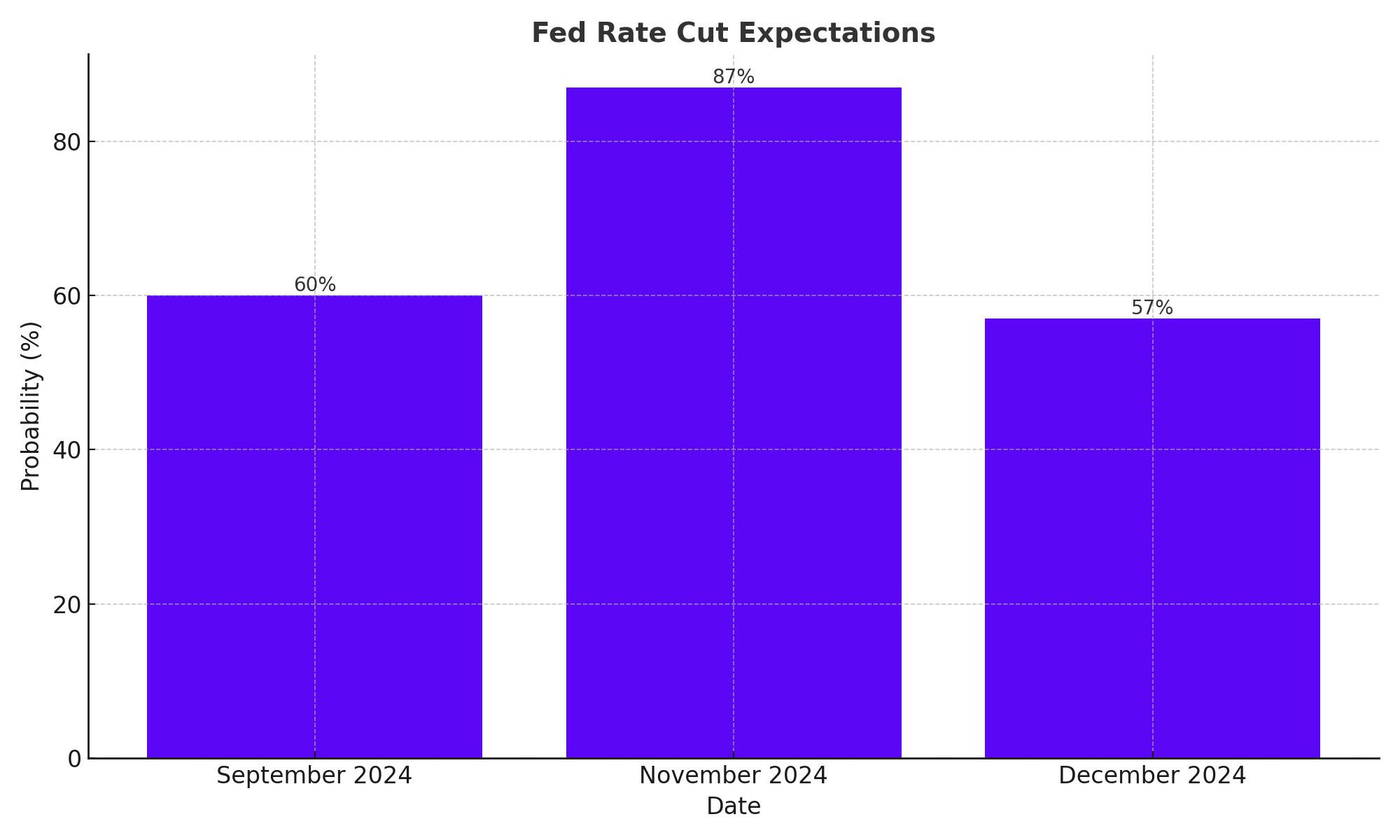

The potential for a Fed rate cut, suggested by financial market pricing, aims to combat inflation after rates peaked over a 23-year high. This speculation has spurred hopes of heightened economic activity and increased oil demand in the US. The probability of the Fed's first rate cut stands at 60% for September and rises to 87% for November, while 57% of market participants expect rates to remain unchanged in December after a potential cut in November. US employment data, particularly the non-farm payroll figures due on Friday, is anticipated to influence these expectations significantly. A stronger labor market might delay rate cuts, whereas weaker data could expedite them.

Impact of ECB Rate Cuts and US Inventory Data

The European Central Bank (ECB) is also expected to cut its benchmark interest rates for the first time in five years, addressing inflation concerns amid a weak economic growth outlook in the eurozone. Lower rates in Europe are likely to stimulate economic activity and, consequently, oil demand. Meanwhile, the Energy Information Administration (EIA) reported an unexpected rise in US oil inventories by 1.2 million barrels for the week ending May 31, against the market prediction of a 2.1 million barrel decrease. Gasoline inventories also increased by approximately 2.1 million barrels, impacting the potential for further price increases. This data suggests that while demand may be lower than expected, the overall market sentiment remains bullish due to the anticipated rate cuts.

Brent and WTI Price Analysis

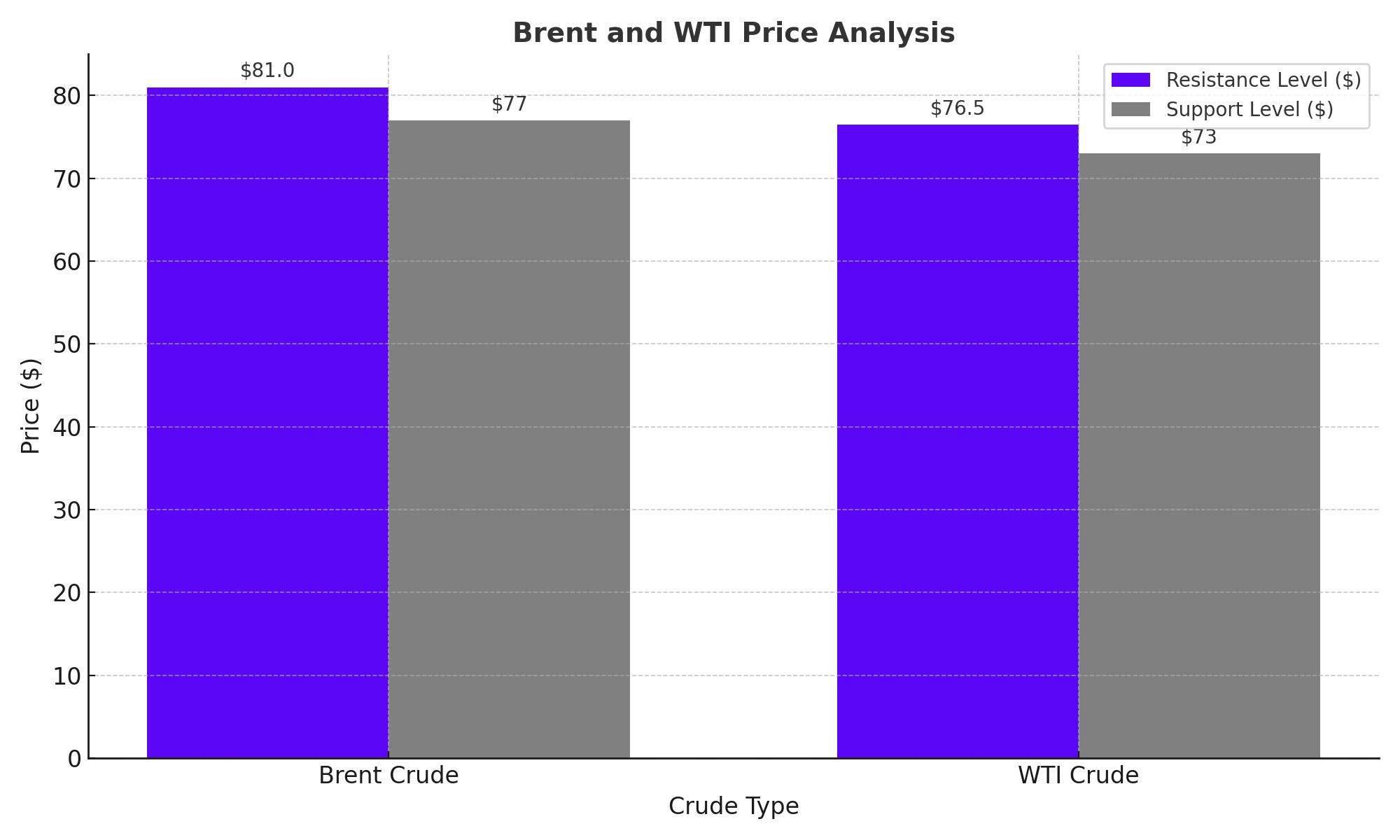

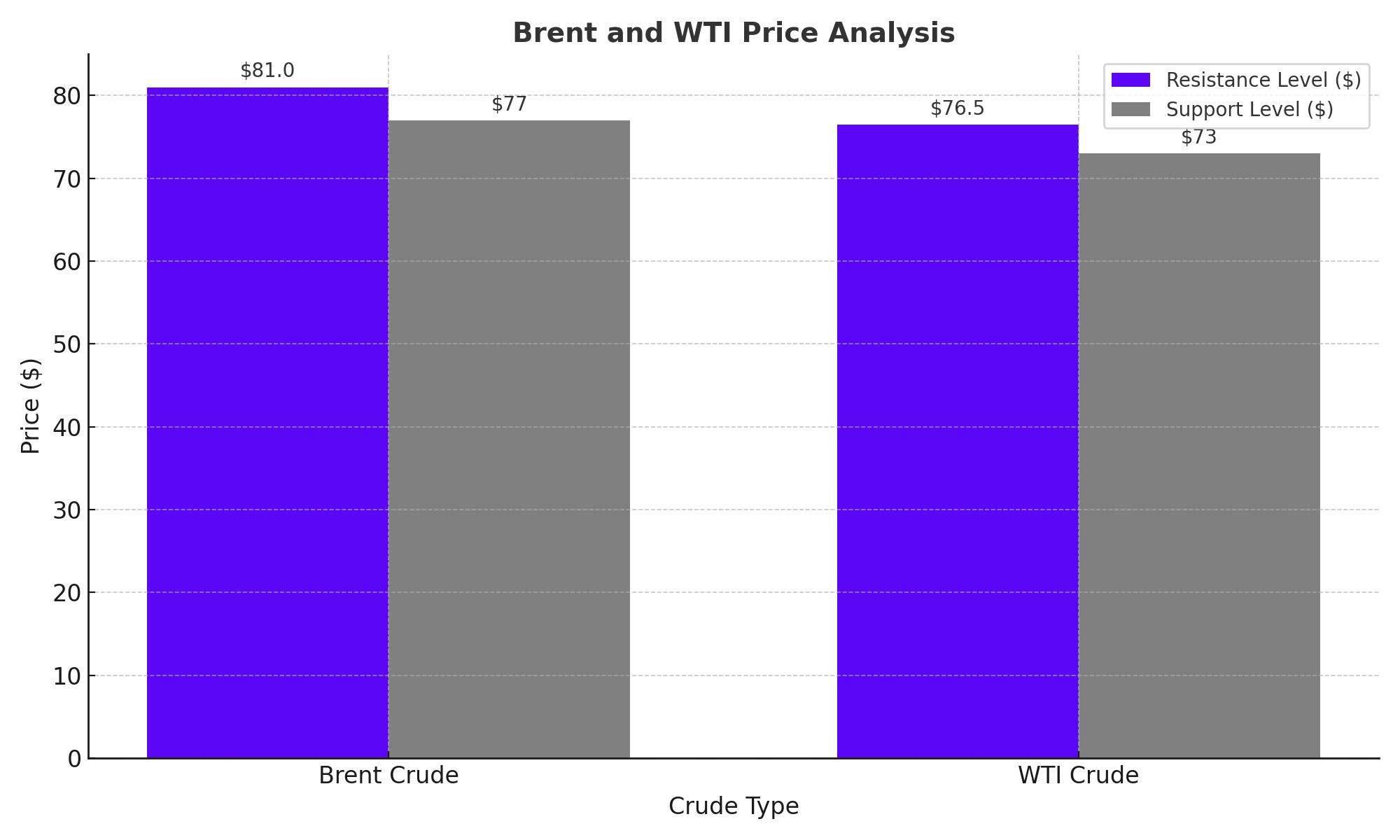

Brent crude futures climbed by $1.64 (2.09%) to $80.05 per barrel, while WTI crude futures rose by $1.68 (2.27%) to $75.75 per barrel. The ECB’s interest rate cut and optimism from OPEC+ ministers about tweaking the latest oil output agreement have boosted investor confidence. Despite a cooling labor market indicated by a rise in new unemployment claims, the Fed is unlikely to cut rates immediately. However, the OPEC+ decision to extend production cuts into 2025 and the potential for unwinding cuts later this year could further influence market dynamics. Analysts are closely watching the $81 resistance level for Brent and the $76.50 resistance level for WTI, with support levels at $77 and $73, respectively.

Technical Analysis and Forecast

West Texas Intermediate (WTI) crude oil showed signs of recovery from an oversold condition, with support at $73 and resistance at $76.50. Brent crude displayed similar patterns, potentially rallying to $81, with short-term pullbacks attracting value hunting. Analysts at BMI forecast Brent to average $85 per barrel this year and $82 next year. For this forecast to materialize, Brent needs to average $86 per barrel in the second half of the year. These technical levels are crucial for traders looking to capitalize on short-term fluctuations in oil prices.

Federal Reserve and Market Sentiments

Analysts at BMI expect the Fed to cut the key interest rate to 4.75% from 5.5% by year-end, supporting oil demand. The Fed's next FOMC meeting is anticipated to maintain current monetary policy, with a high probability of rate cuts beginning in September. Reuters poll indicates that nearly two-thirds of economists expect the first cut to bring the Fed funds rate down to 5.00%-5.25%. The Fed’s decision will significantly impact oil prices, as lower interest rates typically lead to increased economic activity and higher oil consumption.

Impact of OPEC+ Decisions

OPEC+, the Organization of the Petroleum Exporting Countries and allies, agreed on Sunday to extend most production cuts into 2025 but left room for voluntary cuts from eight members to be unwound gradually. On Thursday, top OPEC+ ministers said the cartel could tweak its latest output agreement later this year if needed to support the market. OPEC Secretary General Haitham Al Ghais and Russian Deputy Prime Minister Alexander Novak expressed optimism about continued strong demand for oil. "Oil markets have over-reacted to the mildly negative OPEC+ meeting outcome. Demand indicators have certainly softened somewhat recently, but are not falling off a cliff," Barclays analyst Amarpreet Singh wrote in a note.

Influence of Saudi and Russian Oil Strategies

Saudi Arabia and Russia, two of the largest oil producers within OPEC+, have significant influence over global oil prices. Saudi Arabia's decision to maintain production cuts into next year is aimed at stabilizing prices. Similarly, Russia's strategy involves careful management of its oil output to balance its budgetary needs against global market conditions. These strategic decisions are crucial as they directly impact oil supply and prices. For instance, Saudi Arabia recently raised the official selling prices of its crude for Asia, indicating healthy demand despite higher prices. This move supports higher global prices and reflects the country’s strategic focus on market share and price stability.

Inventory Levels and Market Sentiment

U.S. crude stocks jumped by 1.2 million barrels in the week to May 31, according to the U.S. Energy Information Administration. Analysts had expected a drawdown of 2.3 million barrels. Despite the rise in inventories, analysts believe that summer inventory draws should be enough to get Brent oil back into the high $80s-$90 range by September. However, prices could come under pressure in 2025 from slower demand and non-OPEC supply growth. The bank forecasts Brent to average $83 this year and $75 next year, reflecting a cautious but optimistic outlook.

Conclusion: Strategic Reassessment and Market Adaptation

Oil prices have been on a rollercoaster, influenced by central bank policies, economic indicators, and strategic decisions by major oil producers. The recent movements in Brent and WTI prices underscore the complex interplay of these factors. As the market navigates through these dynamics, the current recommendation is to hold oil investments. Monitoring upcoming economic indicators and policy decisions will be crucial for investors. If the Fed and ECB implement expected rate cuts and global economic activity picks up, this could shift the outlook to a buy. For now, the strategic reassessment and cautious optimism in the oil market suggest a period of stability with potential for future growth.