TradingNEWS Oil Market Dynamics Amid Middle East Conflict

From geopolitical upheavals to robust economic recovery, uncover how current trends are driving a bullish outlook for Brent Crude and WTI oil prices | That's TradingNEWS

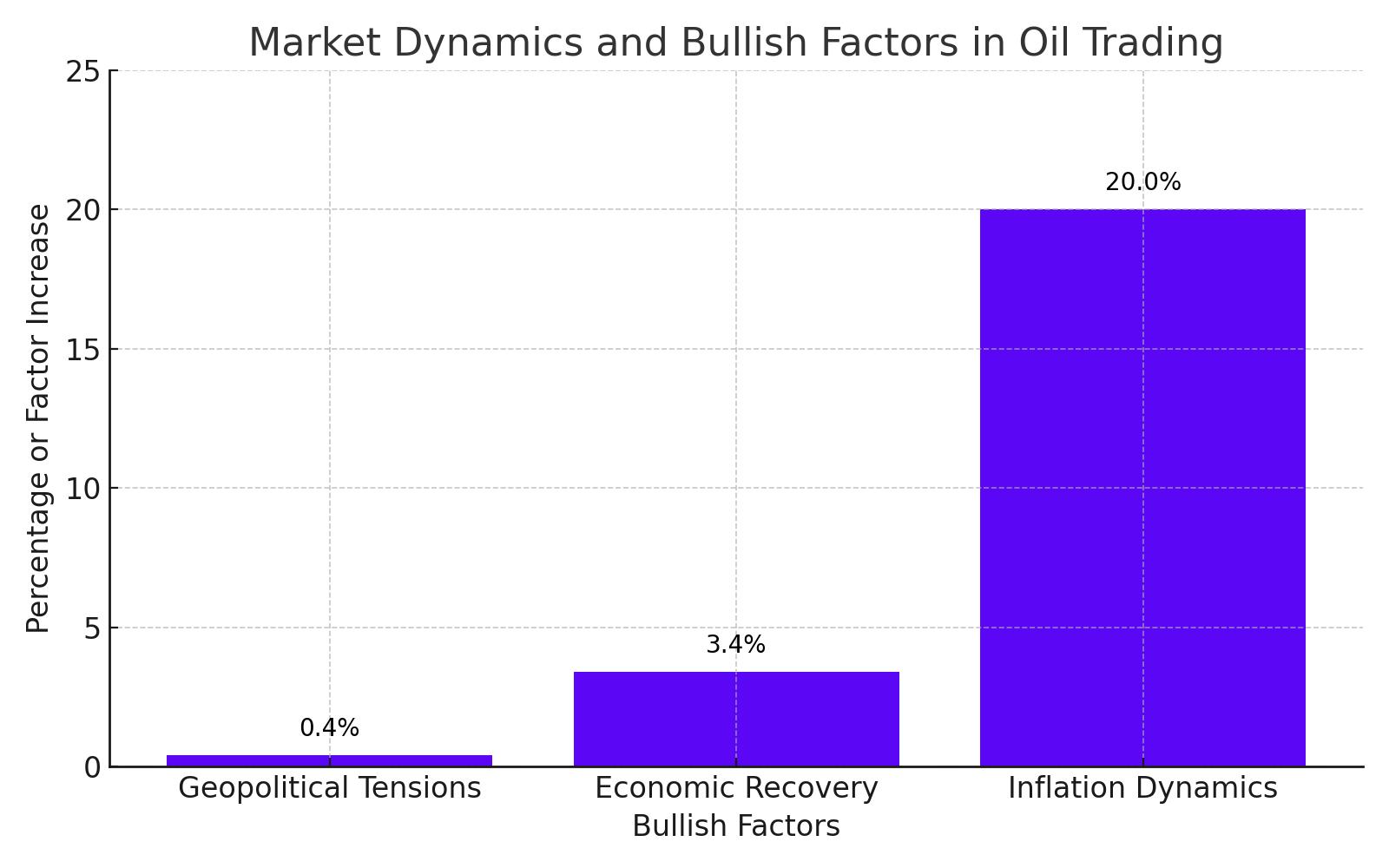

Market Dynamics and Bullish Factors in Oil Trading

Current Market Trends and Bullish Indications

The oil market is experiencing a discernible shift, driven by a complex interplay of geopolitical events, economic indicators, and strategic maneuvers by key market players. Recent trading has seen Brent Crude climb to $83.36 per barrel and West Texas Intermediate (WTI) to $78.51 per barrel. These adjustments represent a $0.4 increase in response to several pivotal factors that suggest a potentially bullish outlook for oil prices.

Geopolitical Tensions and Production Adjustments

Geopolitical instability, particularly in oil-rich regions, continues to play a critical role in the volatility of oil prices. The ongoing unrest and potential for escalated conflicts can significantly impact supply lines, making the market sensitive to any signs of stability or disruption. Additionally, major oil-producing nations have imposed production constraints, which have tightened supply and supported price increases.

Economic Recovery and Projected Increase in Oil Demand

As global economies rebound from the impacts of the COVID-19 pandemic, a significant revival in energy demand is observed, driven by a surge in industrial activities and the gradual return of travel and mobility sectors. This resurgence has been quantified with projections indicating a 3.4% increase in global oil demand for the upcoming year, according to the International Energy Agency (IEA). The anticipation of a busy driving season, particularly in North America and Europe, further supports these optimistic demand forecasts, suggesting robust consumption patterns that may continue to drive oil prices upward.

Inflation Dynamics and Commodity Investment Trends

With global inflation rates reaching multi-decade highs, investors are increasingly channeling their funds into commodities, including oil, as a strategic hedge against inflation. This trend is reflected in the growing volume of oil futures contracts, with trading volumes up by 20% from the previous year, as reported by the New York Mercantile Exchange. Such investment flows are not only a testament to oil's appeal as an inflation hedge but also contribute to the upward trajectory in oil prices, which have recently peaked at $78 per barrel, up from $65 at the start of the year.

Market Analysis and Strategic Outlook

Market analysts urge caution amidst the current bullish trends in oil prices, citing the unpredictable nature of the oil markets influenced by ongoing global issues like the COVID-19 pandemic's uncertain trajectory, geopolitical tensions, and volatile economic indicators. For instance, recent conflicts in oil-rich regions have led to sporadic spikes in oil prices, demonstrating the market's sensitivity to geopolitical events. Analysts recommend a vigilant approach, advising traders to keep abreast of international developments that could abruptly affect oil market dynamics.

Strategic Recommendations for Oil Market Participants

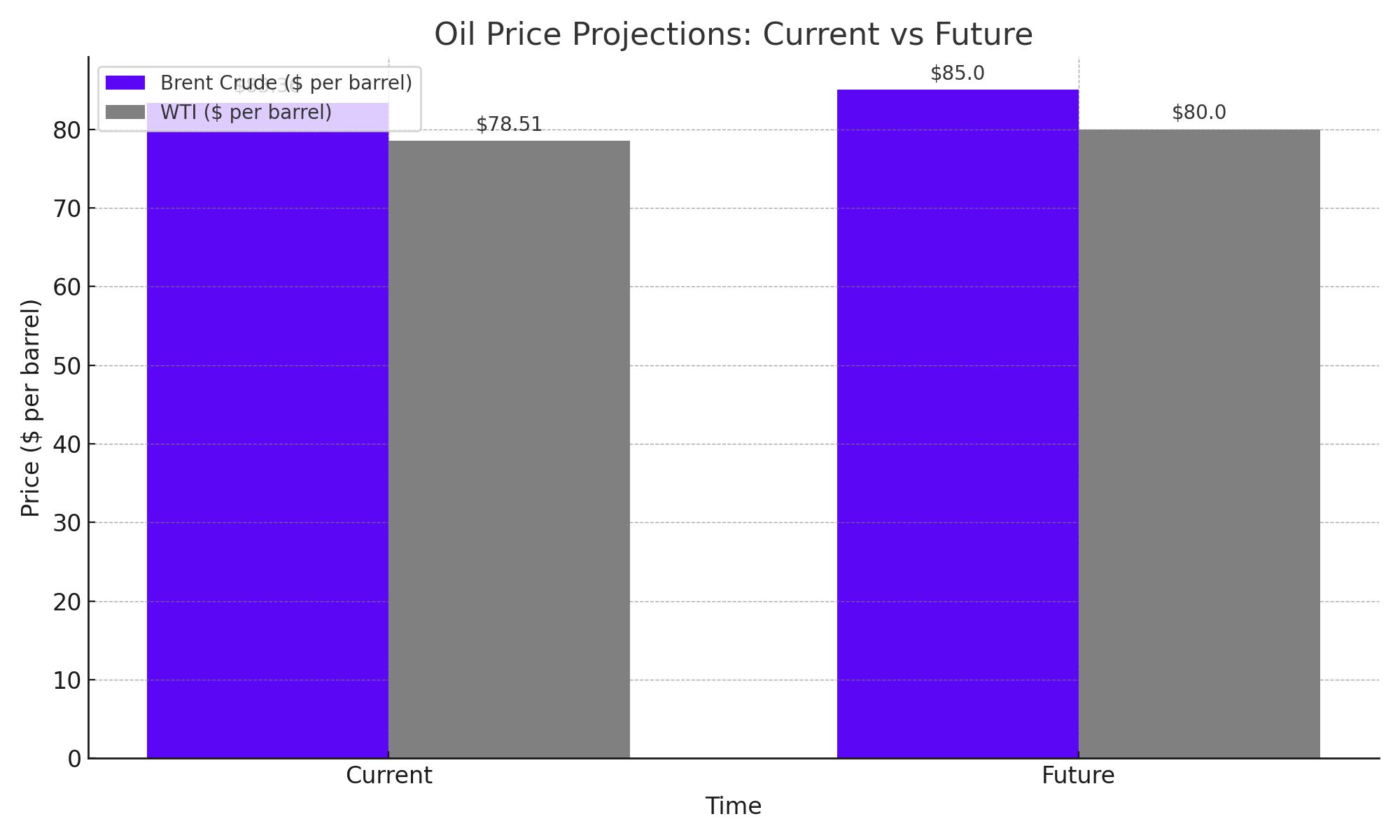

The strategic recommendations for oil market participants underscore a bullish outlook based on several interconnected dynamics currently influencing the oil market. Geopolitical instability, particularly in oil-rich regions, has historically led to significant fluctuations in oil prices. Recent increases in Brent Crude to $83.36 per barrel and West Texas Intermediate (WTI) to $78.51 reflect concerns over potential supply disruptions tied to ongoing unrest and production adjustments by major producers like OPEC+. These deliberate production cuts are designed to stabilize the market by managing supply, which in turn supports higher oil prices during times of constrained output.

The bullish sentiment is further reinforced by the robust recovery from the COVID-19 pandemic's economic impact, which has spurred a substantial resurgence in energy demand. This recovery is fueled by increased industrial activities and the easing of travel restrictions, leading to heightened oil consumption. The International Energy Agency projects a significant 3.4% rise in global oil demand over the next year, bolstered by the busy driving season in North America and Europe, suggesting continued upward pressure on prices due to sustained demand.

Moreover, the current global inflationary environment, which has seen inflation rates reach multi-decade highs, is prompting investors to turn to commodities like oil as effective hedges against inflation. This shift is evident in the marked increase in oil futures trading, which has risen by 20% year-over-year according to the New York Mercantile Exchange. Such investment flows into oil futures not only demonstrate the commodity's appeal as a hedge against inflation but also contribute to its price escalation—from $65 to $78 per barrel since the start of the year—underscoring a strong bullish trend in the oil market.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex