TraidngNEWS: Resurgence of Gold in the Global Economic Arena

How Central Bank Decisions Are Shaping Gold Market Dynamics and Investment Strategies | That's TradingNEWS

Navigating the Resurgence: Gold's Ascend Amid Global Economic Signals

Central Bank Policies and Gold's Reaction

The recent activities of global central banks, notably the Bank of Canada (BoC) and the European Central Bank (ECB), have ushered in a new era of monetary policy adjustments that significantly influence gold prices. The BoC's unexpected rate cut—the first in four years—prompted by growing concerns over economic slowdown, has set the tone for potential global easing cycles. Similarly, expectations loom large for the ECB to reduce its interest rates for the first time since March 2016, underlining a shift towards more accommodative monetary policies amidst subdued economic growth.

Market Anticipation and Rate Cut Projections

The anticipation of these rate cuts has stirred the financial markets, especially the gold market. Gold, traditionally seen as a hedge against currency devaluation and inflation, has found robust support from these monetary policy shifts. The BoC's move, coupled with expectations of a similar action from the ECB, has fueled bullish sentiments in the gold markets, with XAU/USD climbing to a two-week high of $2,375 during the European trading session.

USD Dynamics and Gold's Price Movement

Concurrently, these expectations have exerted pressure on the US Dollar, as reflected by the subdued US Treasury bond yields, lingering near their two-month lows. The weaker USD, unable to gain from its modest recovery attempts over the past two days, provides a conducive environment for gold prices to thrive. This scenario is further compounded by ongoing geopolitical tensions in the Middle East, enhancing gold’s appeal as a safe-haven asset.

Immediate Triggers and Technical Standpoints

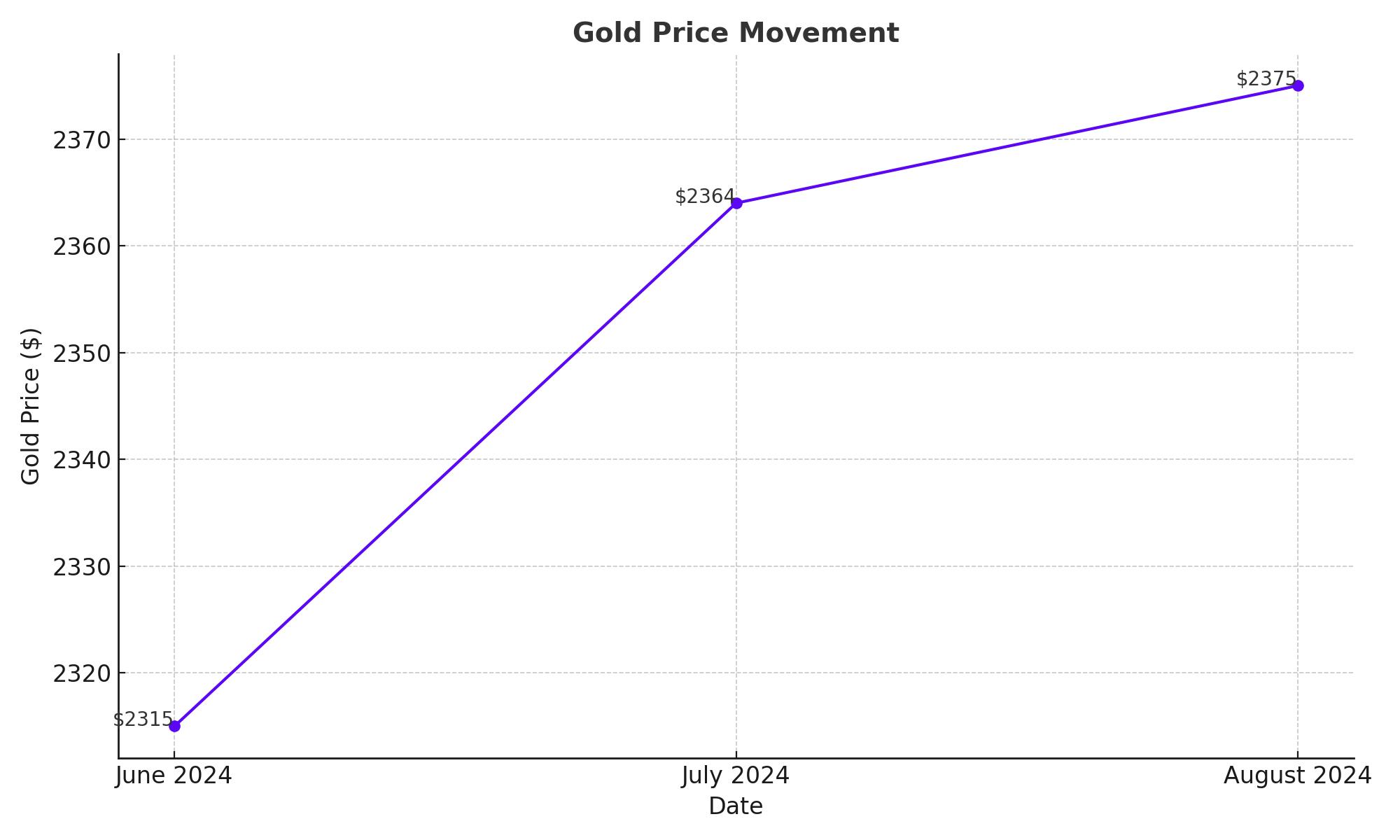

Despite the confluence of supporting factors, gold's upward trajectory is under scrutiny as traders await key economic releases, such as the US Nonfarm Payrolls (NFP) report due on Friday. Technical analysis suggests that while momentum for XAU/USD is bullish above last week’s high of $2,364, resistance near $2,400 could cap further gains. Should bullish momentum persist, the next significant resistance is pegged near the $2,425 zone, potentially extending to the all-time high of $2,450 reached in May.

Support Levels and Downside Risks

On the downside, immediate support is found at the $2,360 level. A breach below this could see gold prices testing further support around $2,340. The critical floor is set around the $2,315-$2,314 range, which if broken could signal a deeper pullback towards the $2,300 mark, challenging the 50-day Simple Moving Average (SMA) support.

Economic Indicators and Forward Outlook

The market's focus is not just on rate decisions but also on upcoming US labor market data, which could significantly influence the Federal Reserve's policy stance. Recent mixed signals from US economic data have reinforced the dovish outlook, suggesting that the Fed might commence rate cuts later this year. Such a scenario would likely bolster gold prices further as investors seek safety against currency devaluation and inflation concerns.

Conclusion: Strategic Positioning for Gold Investors

Investors in the gold market should closely track central bank activities, especially the upcoming decisions from key entities like the ECB and the BoC. With the BoC's recent rate cut to 3.75% and the ECB poised to potentially follow suit, these shifts suggest a bullish outlook for gold, traditionally a haven in times of monetary easing. The current support level for gold stands at $2,375 per ounce, reflecting increased investor interest. However, careful analysis is essential as factors such as the US NFP report could impact market conditions and influence the Federal Reserve's stance on interest rates, directly affecting gold's market performance.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex