TradingNEWS Trends in Crude Oil Markets

Understanding Price Dynamics as EIA Inventory Report Looms: A Technical and Strategic Analysis | That's TradingNEWS

Current Market Overview of Crude Oil Prices

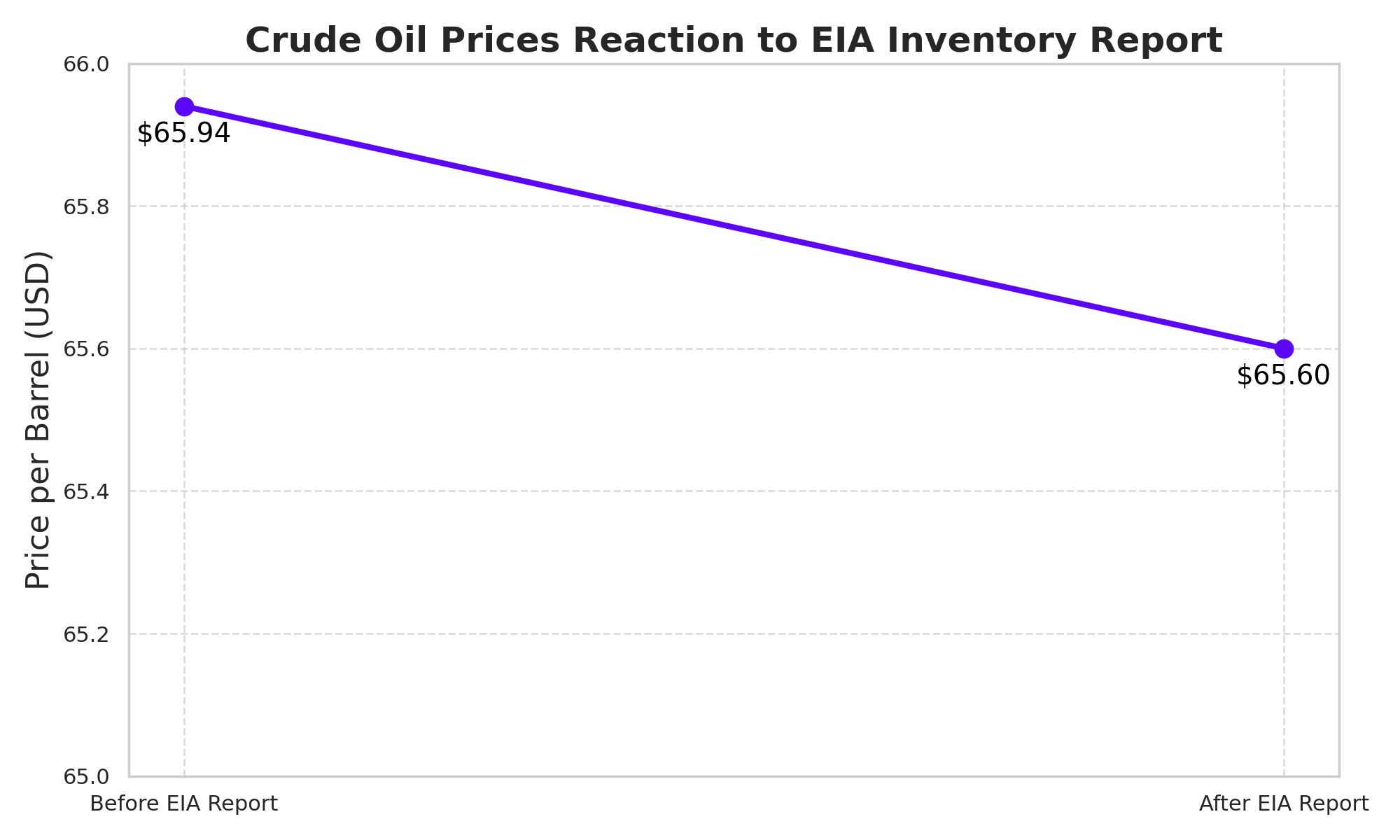

As of the latest updates before the U.S. Energy Information Administration's (EIA) inventory report, expected to detail a 1.4 million barrel decrease, West Texas Intermediate (WTI) crude oil prices stood at $65.94 per barrel, marking a decrease of $0.34 or 0.5%. This dip occurs amidst anticipation of the weekly inventories report scheduled for release at 1430 GMT.

Factors Influencing Crude Oil Prices

Mixed Signals from Inventory Reports:

Early session trading saw pressures from a recent American Petroleum Institute (API) report, which revealed a smaller-than-expected draw in crude oil inventories, contrasted by a larger build in gasoline stocks. Such mixed data inject uncertainty regarding the balance of supply and demand in the oil markets.

Technical Analysis Insights:

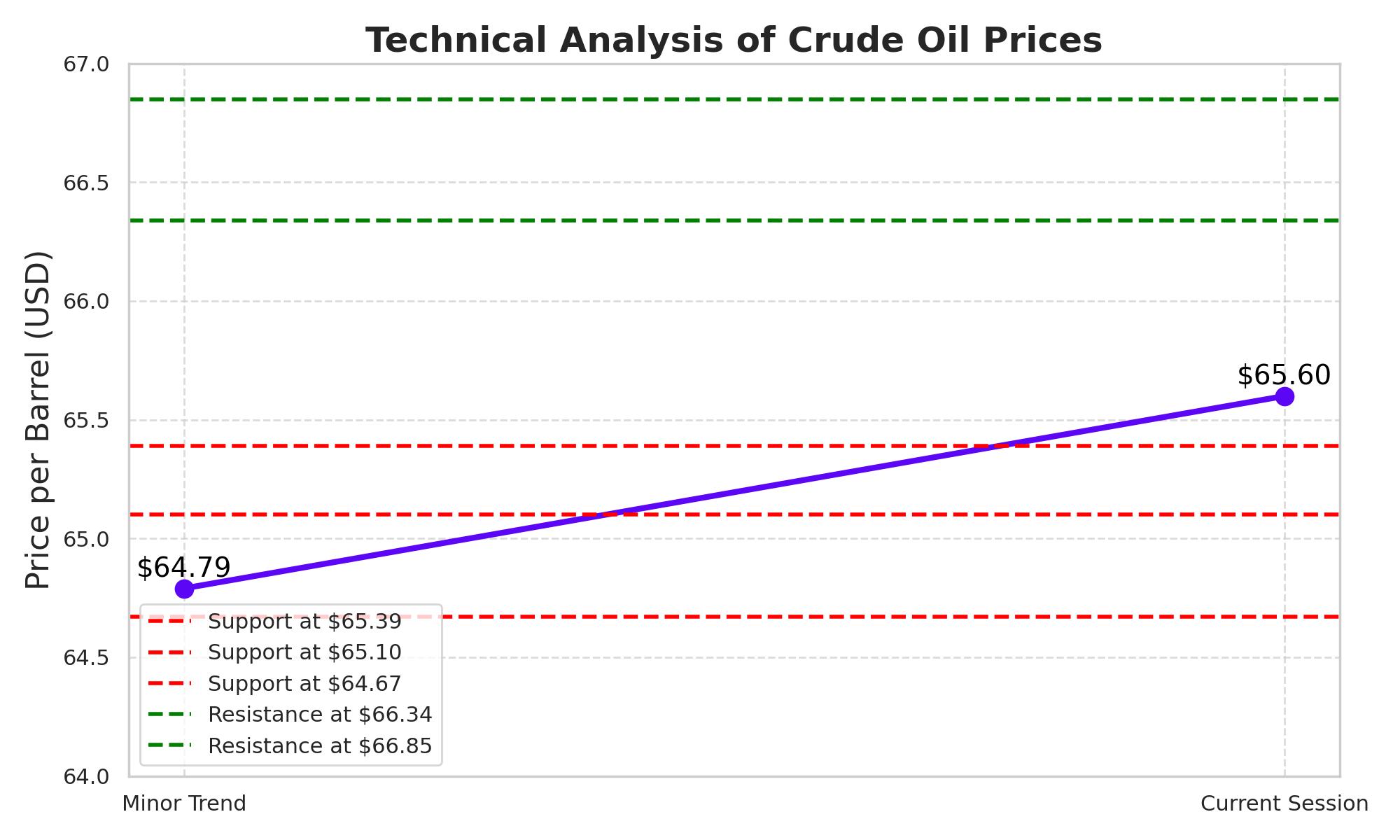

- Main Trend: The main trend for August WTI Crude Oil, as identified on the daily swing chart, remains downward, although there are signs of increasing momentum.

- Minor Trend and Momentum Shifts: The minor trend is currently upward, suggesting a shift in momentum. A fall through $64.79 could reverse this minor upward trend and reinforce the primary downward trajectory.

- Key Price Levels: Immediate support is identified at the retracement zone between $65.39 and $65.10. Below this, more substantial support lies at $64.67, closely associated with the 50% retracement level from the broader range of $64.15 to $66.62.

Market Resistance and Breakout Potential

- Intermediate Resistance: The zone between $66.34 and $66.85 is acting as current resistance, aligning with earlier trading peaks and the intermediate range from $68.52 to $64.15.

- Breakout Indicators: Should trading break above $66.85 with significant volume, there might be potential for an upward rally towards the $68.43 to $69.43 range, aligning with the main range's retracement zone from a high of $72.70.

Trading Forecast and Strategic Implications

Based on early trading behaviors and technical setups:

- Bearish Scenario: Continuation below the pivot level of $66.34 suggests the presence of sellers, potentially leading to tests of lower support levels at $65.39, and extending to $64.15 if downward momentum accelerates.

- Bullish Scenario: A sustained move above $66.34 could invite buyers, pushing the market towards the near-term resistance at $66.62 and potentially to $66.85.

Broader Market Trends Influencing Oil Prices

Global Economic Factors:

- Impact of U.S. Monetary Policy: Federal Reserve signals on interest rates play a crucial role. Statements suggesting rates might remain unchanged could strengthen the U.S. dollar, typically putting downward pressure on oil prices.

- Geopolitical Developments: Ongoing geopolitical tensions, particularly in oil-rich regions, could swiftly alter market dynamics, creating spikes in oil prices due to perceived risks to supply.

Long-Term Outlook and Investment Implications

Renewable Energy Shifts: As the global energy sector increasingly pivots towards renewables, the demand dynamics for oil may undergo significant long-term changes. Investors should monitor the pace of renewable energy adoption as it could diminish the role of oil in the global energy mix, potentially suppressing prices over the extended period.

Market Sentiment and Investor Behavior: The sentiment in the oil market can be swayed by a range of factors from macroeconomic indicators to regulatory changes and technological advancements in energy extraction and consumption. Keeping a pulse on market sentiment through trading volumes and investor communications will provide additional insights into potential price directions.

Investors and traders navigating the crude oil market must maintain a vigilant and informed approach, adapting strategies to the swiftly changing economic indicators and market sentiments. By understanding both the immediate technical factors and broader market influences, market participants can better position themselves in this volatile trading environment.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex