Trump Champions U.S. Bitcoin Mining to Bolster Economy

Analyzing the strategic benefits and price implications of expanded Bitcoin mining operations in the United States, as the country aims for technological and economic superiority in the global digital currency market | That's TradingNEWS

Economic and Price Implications of U.S. Bitcoin Mining Expansion

Current Bitcoin Mining Landscape:

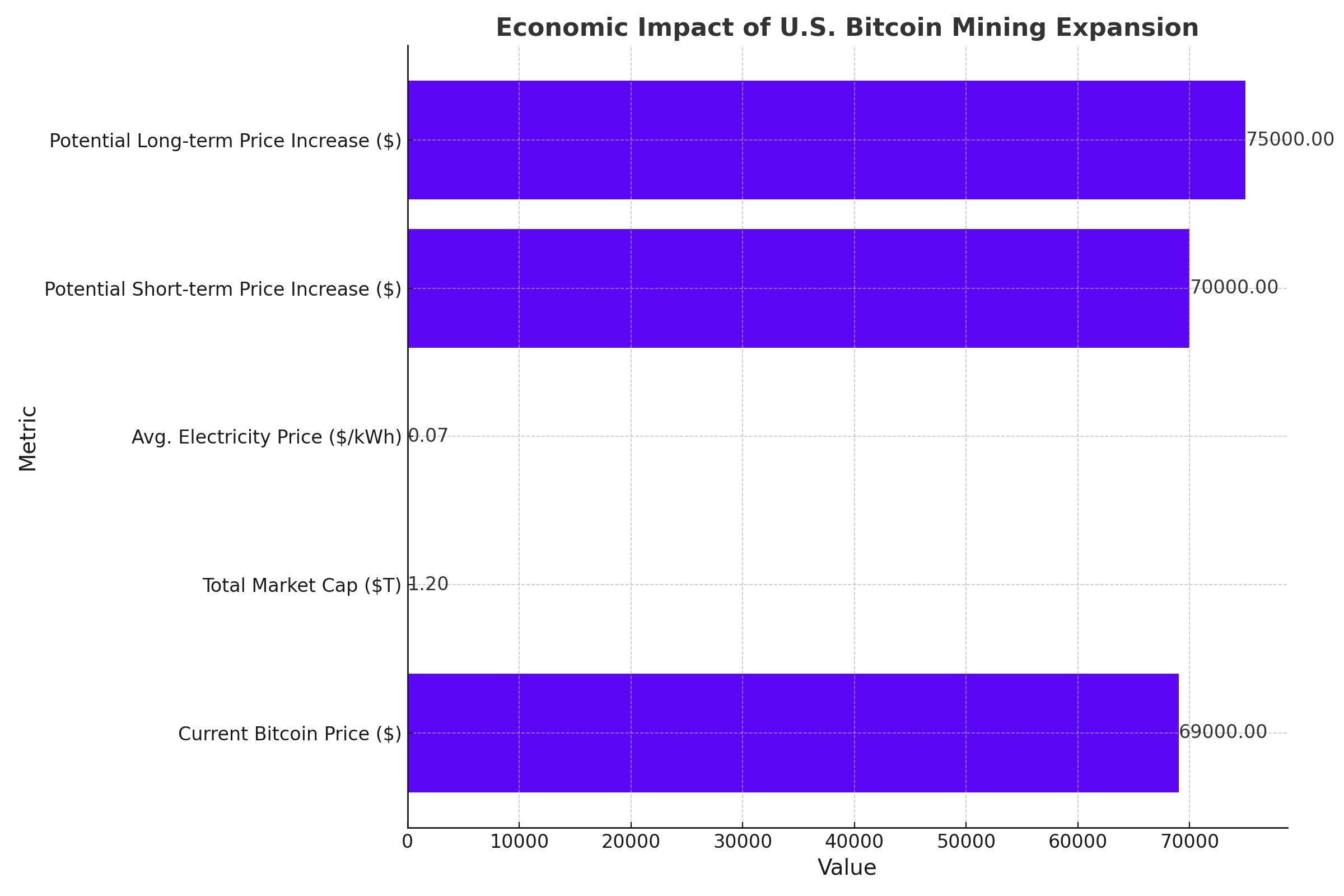

As of now, the U.S. is already a significant player in the global Bitcoin mining sector, but there is substantial room for growth. With Bitcoin's price currently fluctuating around $69,000, the economic incentive to increase mining operations is strong. The total market cap of Bitcoin remains over a trillion dollars, underscoring the substantial economic impact of mining activities.

Potential for Increased U.S. Mining Capacity:

Expanding U.S. mining operations could lead to several direct and indirect economic benefits. Directly, increased mining could stabilize and potentially increase Bitcoin's price by reducing the concentration of mining power in countries like China, which currently controls a significant portion of the mining network. Decentralizing this power could lead to more stability in Bitcoin prices, reducing the potential for manipulation and sudden price changes influenced by foreign regulatory actions.

Energy Sector Impact:

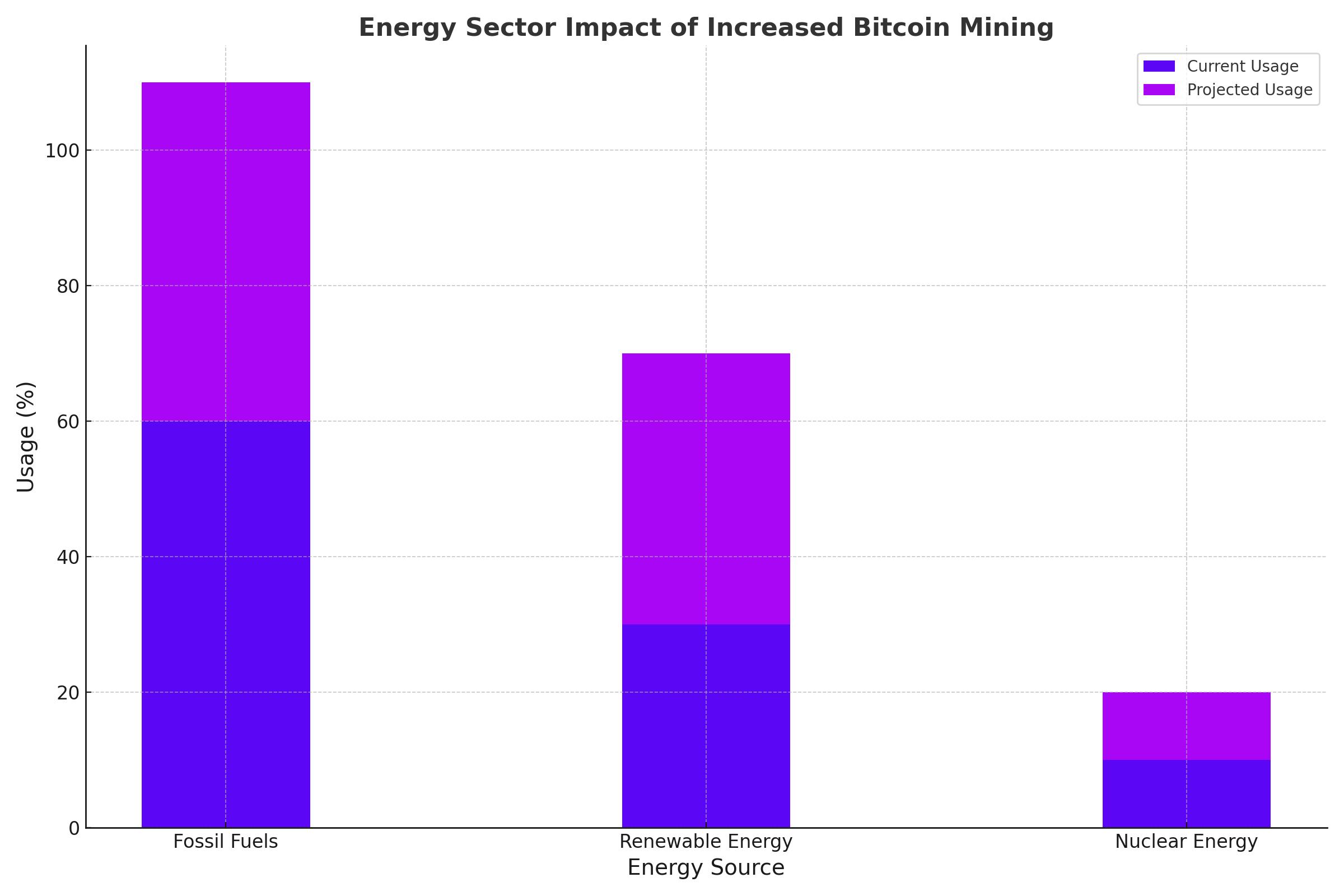

Indirectly, a surge in U.S.-based Bitcoin mining could increase demand for energy, potentially benefiting sectors within the U.S. that produce fossil fuels and renewable energy sources. If Trump's policy were to encourage the use of clean energy for mining operations, this could also accelerate the energy sector's shift towards more sustainable practices. The average price of electricity for industrial use in the U.S. hovers around $0.07 per kWh, but incentives or subsidies for renewable energy could lower operational costs for miners and make the U.S. a more attractive mining location.

Price Forecasting:

- Short-term Forecast: In the short term, Trump's support could lead to a speculative increase in Bitcoin prices, as market sentiment often reacts positively to news that suggests increased adoption or mainstream acceptance. This could push prices towards the $70,000 threshold, as seen during recent upticks following favorable news cycles.

- Long-term Forecast: Over the long term, the establishment of a robust U.S. mining infrastructure could lead to greater market stability and a gradual price increase. This stability comes from the assurance of a politically stable environment for Bitcoin operations, potentially making Bitcoin a more attractive asset for both individual and institutional investors. Forecasting exact numbers is challenging due to Bitcoin’s volatility, but a well-supported mining operation could help sustain and possibly increase its price above current levels, aiming towards higher resistance levels seen in past market cycles, potentially testing $75,000 or more depending on market conditions and regulatory developments.

Geopolitical Considerations:

Enhancing U.S. mining capabilities could shift global geopolitical power in digital currency control, reducing dependence on regions with lower political stability. This shift could lead to greater confidence among U.S. and global investors, driving up both demand and prices.

Strategic Policy Recommendations

To capitalize on the potential benefits of expanded Bitcoin mining, U.S. policy makers could consider:

- Incentives for Renewable Energy: Promote the use of renewable energy in Bitcoin mining to address environmental concerns and improve the sustainability of mining operations.

- Regulatory Clarity: Provide clear, supportive regulations for cryptocurrency operations to attract more investors and solidify the U.S. as a global leader in the digital finance sector.

- Infrastructure Investments: Support infrastructure developments that enhance the efficiency and cost-effectiveness of large-scale mining operations, such as data centers and network technologies.

Conclusion: Navigating the Future of U.S. Bitcoin Mining

Donald Trump's proposal to amplify Bitcoin mining in the U.S. reflects a strategic push to enhance national economic and technological competitiveness. By understanding and preparing for the associated economic impacts, price dynamics, and policy needs, the U.S. can position itself at the forefront of the evolving global digital economy.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex