Taiwan Semiconductor Manufacturing Company (NYSE:TSM): Unrivaled Dominance in the Semiconductor Industry

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) has cemented its position as the undisputed leader in the semiconductor sector, capturing over 64% of the global foundry market and maintaining an unparalleled grip on advanced manufacturing technologies. As the driving force behind nearly every technological advancement, from AI accelerators to premium smartphones, TSMC serves as the backbone of innovation for industry giants like NVIDIA (NVDA), AMD (AMD), and Apple (AAPL). Even hyperscalers, including Amazon (AMZN) and Microsoft (MSFT), depend on TSMC for their AI-specific custom chip needs. This symbiotic relationship underscores TSMC’s dominance, making it not just a partner but a critical enabler of the modern digital ecosystem.

Surging AI Demand: A Game-Changing Catalyst

The explosion of AI-driven applications is reshaping the semiconductor landscape, and TSMC is squarely at the center of this transformation. The emergence of sophisticated models like OpenAI's "o3" has accelerated the demand for high-performance computing (HPC) chips. TSMC’s HPC segment, now its largest revenue contributor, accounted for over 51% of wafer sales in the latest quarter, reflecting an 11% sequential growth. This trend is poised to continue as AI workflows transition from training to inference, creating an insatiable need for advanced chip designs.

TSMC’s cutting-edge 3nm technology has become the gold standard for AI and HPC applications. With customers like NVIDIA relying on TSMC for its Blackwell GPUs and AMD deploying TSMC’s nodes for its MI350X GPUs, TSMC has cemented its role as the semiconductor industry's foundation. Upcoming advancements in 2nm technology, featuring game-changing GAA nanosheet transistors, promise further performance and efficiency gains, ensuring TSMC's continued leadership.

Advanced Packaging: The Hidden Strength

Beyond manufacturing, TSMC’s advanced packaging technologies, particularly CoWoS (Chips-on-Wafer-on-Substrate), are pivotal for enhancing AI chip performance. These innovations integrate compute and memory more effectively, offering higher bandwidth and lower latency—key requirements for demanding AI workloads. With demand for CoWoS outpacing supply, TSMC has prioritized packaging investments, dedicating 10%-20% of its annual CapEx to expanding this capability. This strategic focus positions TSMC to dominate the AI chiplet and multi-die solutions market, creating another significant growth driver.

Financial Resilience and Strategic Discipline

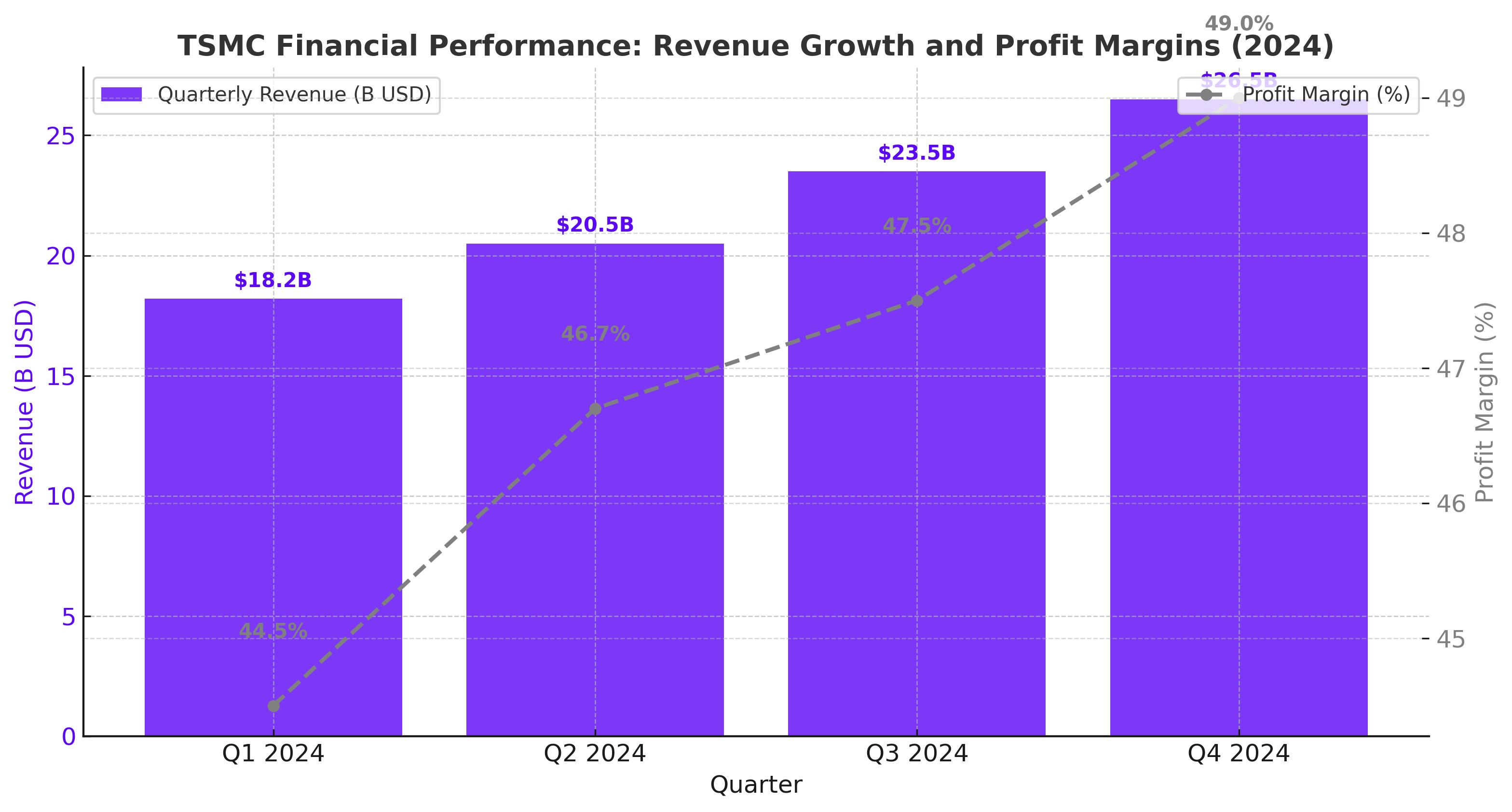

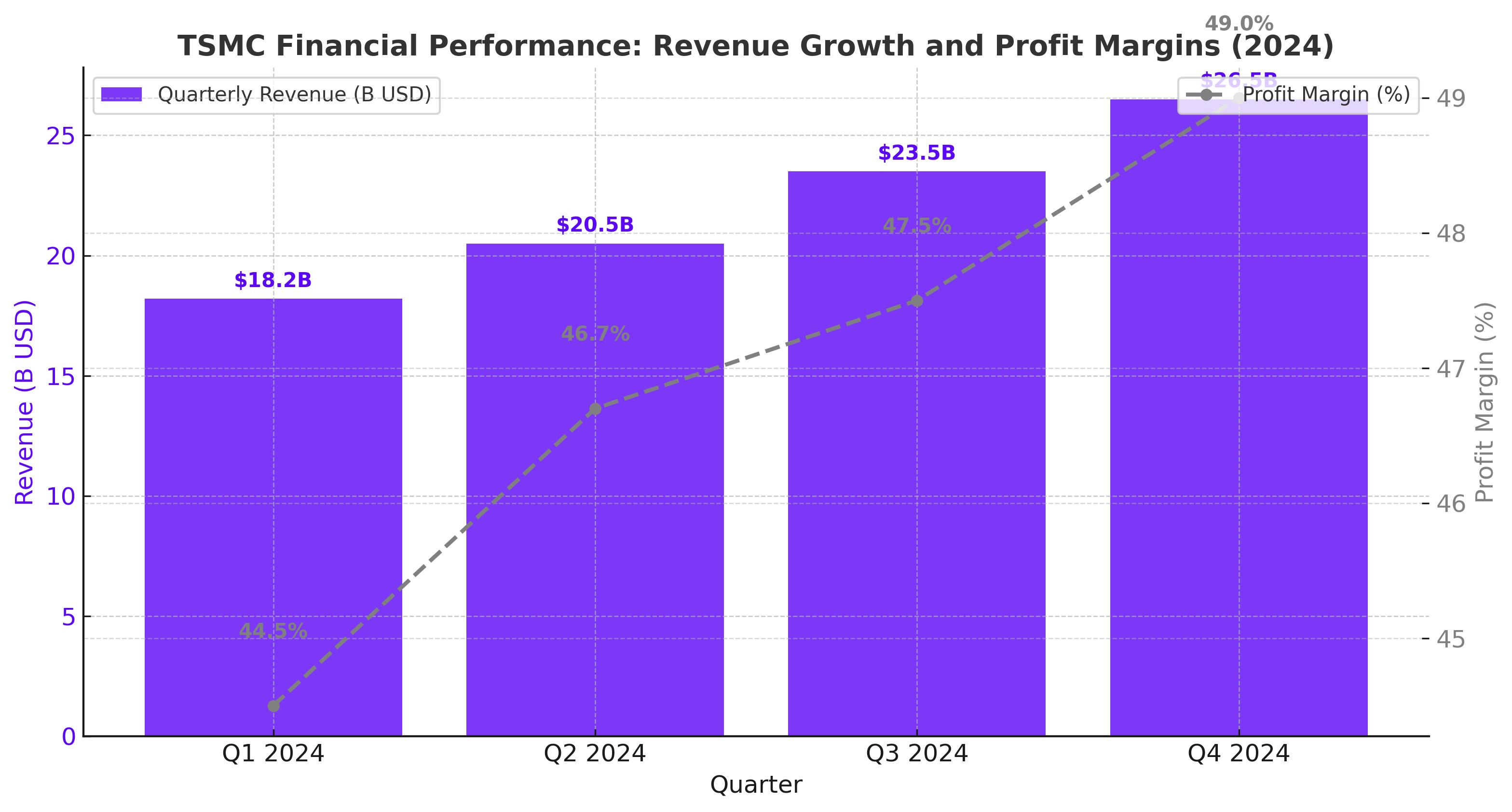

TSMC's financial results for Q3 2024 highlight its operational excellence. The company reported $23.5 billion in revenue, a 36% year-over-year increase, with a gross margin of 57.8% and an operating margin of 47.5%. With Q4 revenue guidance ranging from $26.1 billion to $26.9 billion and gross margins expected to remain robust at 57%-59%, TSMC is poised to cap off another record-breaking year.

TSMC's balance sheet is equally robust, boasting $69 billion in cash and marketable securities. Despite allocating over $30 billion in CapEx this year, primarily for advanced nodes and packaging, the company maintains a strong free cash flow. TSMC also returned $2.8 billion to shareholders in Q3 through dividends, reflecting its disciplined capital allocation strategy.

Geopolitical Risks and Mitigation Efforts

While TSMC’s Taiwan-centric operations present geopolitical risks, the company has taken proactive measures to diversify its footprint. The ramp-up of its Arizona fab for 4nm production, coupled with new facilities in Japan and Germany, reflects a strategic effort to mitigate exposure to regional uncertainties. These investments not only reduce geopolitical risk but also position TSMC to capitalize on regional demand, particularly in North America, where 71% of its revenue is generated.

Pricing Power and Market Leadership

TSMC’s dominance in advanced nodes translates into substantial pricing power. The company has announced a 10%-20% price hike for its 3nm and 2nm wafers starting in 2025, with prices expected to range from $25,000 to $30,000 per wafer. These increases will help offset the higher costs associated with overseas fabs and ensure continued margin stability. With a market share projected to rise to 67% in 2025, TSMC is well-positioned to capture the growing demand for cutting-edge semiconductor technologies.

Valuation: A Compelling Opportunity

At a forward P/E ratio of approximately 18.5x for its Taiwan-listed shares and 22x for ADRs, TSMC offers significant value relative to its peers. NVIDIA, for example, trades at a forward P/E of 34x, highlighting the disparity. With analysts projecting over 25% revenue growth in 2025, driven by AI accelerators and advanced packaging, TSMC’s valuation is undeniably attractive. A target price of $240 per share, representing a 20% upside, underscores the stock's potential.