TSMC’s Explosive Growth: $23.5B Revenue, AI-Driven Surge, and 27% Upside

Dominating 56.4% of the global chip market, Taiwan Semiconductor (NYSE:TSM) powers the AI revolution with unmatched innovation, record margins, and unstoppable momentum | That's TradingNEWS

Taiwan Semiconductor Manufacturing Company (NYSE:TSM): Analyzing the Global Chip Powerhouse

Dominance in Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) has firmly established itself as the backbone of the global semiconductor supply chain. As the world's largest contract chipmaker, TSM controls approximately 56.4% of the semiconductor foundry market. In Q3 2024, TSM’s revenue surged by 36% year-over-year, reaching $23.5 billion, driven by robust demand for advanced 3-nanometer and 5-nanometer process technologies. High-performance computing (HPC) chips accounted for 51% of total revenue, reflecting TSM’s essential role in AI and data center growth. Smartphone-related semiconductors contributed another 34% to revenue, showing seasonal strength and continued demand for advanced chips.

TSM’s leadership in cutting-edge technologies, such as its dominant position in 7-nanometer and below nodes, underscores its technological advantage. During Q3 2024, 69% of wafer revenue came from processes at 7 nanometers or smaller, with 3-nanometer technology alone representing 20% of total wafer revenue. This places TSM far ahead of competitors like Intel and Samsung, both of whom face significant challenges in scaling their advanced nodes.

Strategic Partnerships and Key Client Relationships

TSMC’s extensive client base includes global tech giants like Apple (25% of revenue) and Nvidia (11% of revenue), showcasing its critical importance to the supply chains of market leaders. Nvidia’s recent AI-driven growth has significantly benefited TSM, with Nvidia contributing $7.73 billion to TSM's revenue in 2023. The company’s strategic relationships and ability to support next-generation technologies position it as an indispensable partner in the tech industry.

Financial Strength and Operational Efficiency

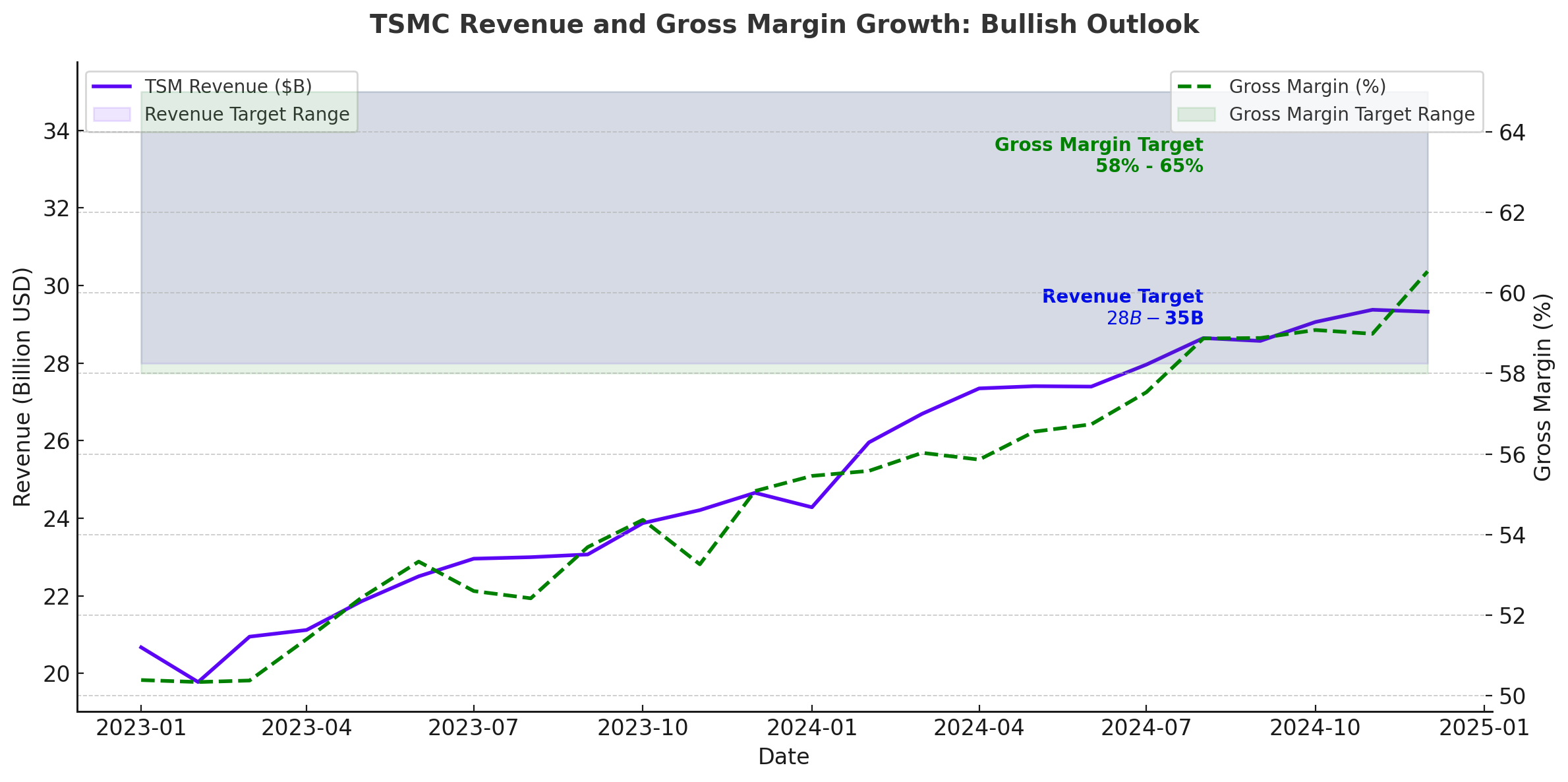

TSMC reported impressive profitability in Q3 2024, with gross margins climbing to 57.8%, up 4.6 percentage points sequentially. The operating margin also improved to 47.5%. These results demonstrate TSMC's exceptional cost management and pricing power, even in the face of global economic uncertainty. The company’s balance sheet remains robust, with $69 billion in cash and marketable securities, while long-term debt decreased by 1.6% sequentially. Operating cash flow for Q3 exceeded $12.3 billion, enabling TSM to fund its capital expenditures, shareholder dividends, and cash reserves simultaneously.

Capital expenditure for 2024 is projected at over $30 billion, with 70–80% allocated to cutting-edge technologies like 3-nanometer and 2-nanometer nodes. This investment reflects TSM’s commitment to maintaining its technological edge and addressing surging demand in AI and HPC sectors.

Expansion in International Markets

TSMC’s new Arizona plant has reached production yields comparable to facilities in Taiwan, bolstering its strategic importance in the U.S. semiconductor supply chain. This plant is expected to position TSM as the largest producer of advanced silicon in the U.S. by 2028. With U.S. support under the CHIPS Act and TSM’s advanced technologies, the company is well-positioned to meet geopolitical and regulatory challenges. However, TSM continues to face scrutiny as it navigates between U.S. and Chinese trade tensions.

AI and HPC: The Next Growth Drivers

The AI boom has catalyzed explosive demand for TSM’s advanced chips, particularly those used in GPUs and high-performance data centers. The firm is a critical enabler for AI leaders, with Nvidia, AMD, and Broadcom relying on TSM’s manufacturing capacity. In Q3 2024, HPC-related chip revenue grew by 11% sequentially, reflecting the growing adoption of generative AI technologies. Moreover, the commercialization of 2-nanometer technology, expected in 2025, could unlock significant profitability expansion for TSM.

Valuation: Undervalued for its Strategic Position

Despite its dominant market position, TSM trades at a forward price-to-earnings (P/E) ratio of just 19.6x for fiscal 2026, significantly below the semiconductor sector average. The PEG ratio (price/earnings-to-growth) remains under 1, underscoring TSM’s undervaluation given its robust EPS growth prospects. Analysts forecast TSM’s FY2026 EPS at $10.36, offering a potential upside of 27% from its current valuation, based on a fair P/E multiple of 25x.

Morningstar estimates TSM’s intrinsic value at 17% above its current price, highlighting the stock’s attractiveness. When factoring in its growth trajectory, TSM’s fair value estimate exceeds $233 per share, reinforcing its appeal as a high-quality investment in a critical industry.

Risks: Geopolitical and Client Concentration Challenges

TSMC faces significant geopolitical risks due to its location in Taiwan, with rising tensions between Taiwan and China presenting potential supply chain vulnerabilities. Additionally, client concentration poses risks, as Apple and Nvidia together account for over 35% of TSM’s revenue. Any disruption in these relationships could impact financial performance. The cyclical nature of the semiconductor industry also remains a key risk, particularly if AI-related demand slows unexpectedly.

Outlook: Bullish Growth Supported by AI and Technological Leadership

With Q4 2024 revenue guidance set at $26.5 billion (midpoint), reflecting 35% YoY growth, TSM’s outlook remains robust. The company's investments in cutting-edge technologies and its critical role in enabling AI and HPC industries solidify its position as a global leader. TSM’s commitment to innovation and market expansion supports its long-term growth prospects, making it a compelling "Buy" for investors seeking exposure to the semiconductor sector.

TSMC’s dominance in the semiconductor industry, its strategic client partnerships, and its undervalued stock price create a compelling investment opportunity. Despite geopolitical and cyclical risks, the company's technological leadership and growth trajectory justify a bullish outlook with significant upside potential.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex