TSMC (NYSE: TSM) Rides AI Wave to Record Q3 Sales—Is This Just the Beginning?

With a 39% YoY revenue surge and AI demand showing no signs of slowing, TSMC’s Q3 results prove it's dominating the semiconductor market | That's TradingNEWS

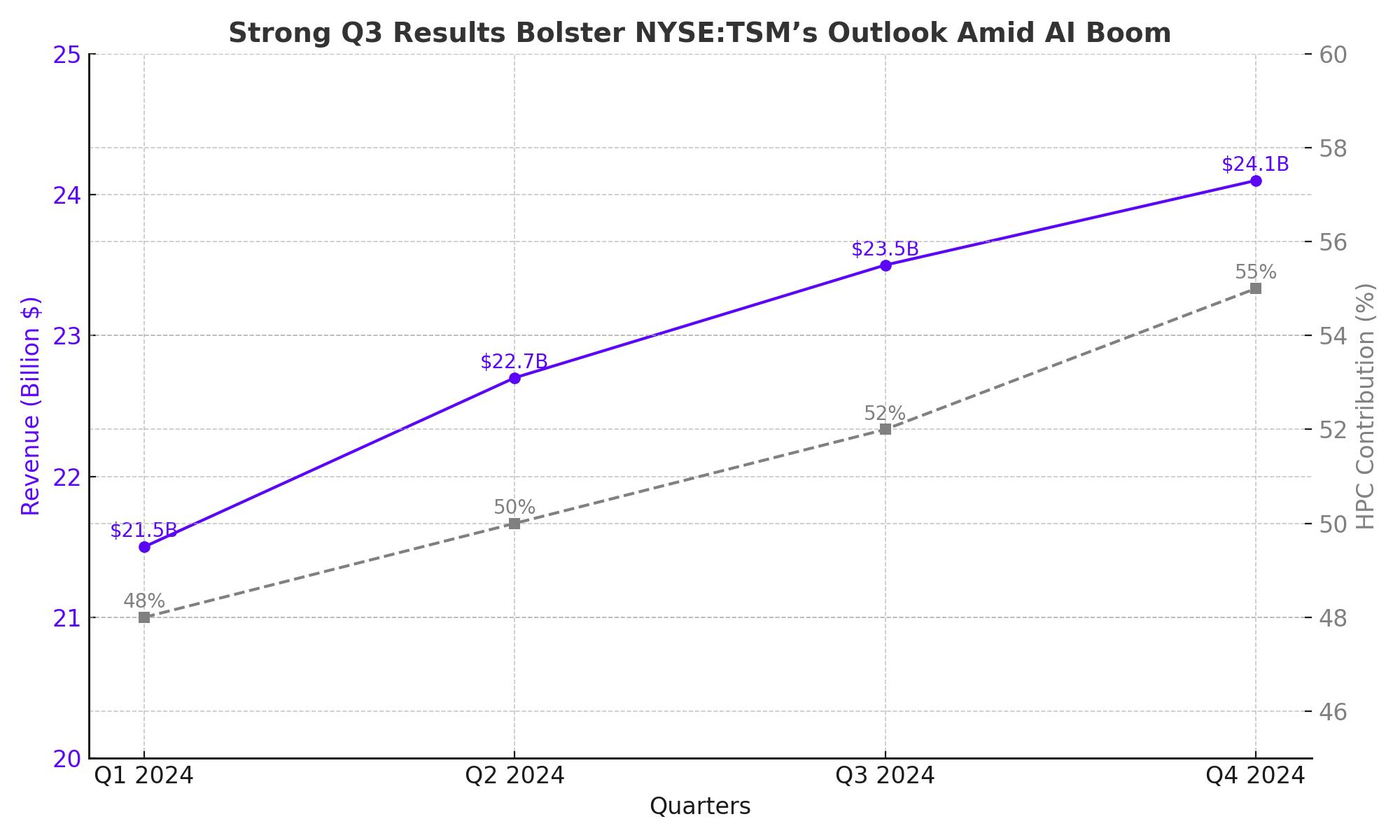

Strong Q3 Results Bolster NYSE:TSM’s Outlook Amid AI Boom

Robust Demand for Advanced Chips Drives Sales Surge

Taiwan Semiconductor Manufacturing Company (NYSE: TSM) has seen exceptional growth in the semiconductor market, driven largely by the growing demand for advanced chips from AI and high-performance computing sectors. With its third-quarter 2024 sales reaching NT$759.7 billion ($23.5 billion), TSM surpassed its projected range of $22.4 billion to $23.2 billion, beating estimates by $300 million at the high end. This surge highlights the strength of TSM's strategic positioning, particularly in the AI market, where giants like Nvidia (NVDA) and Apple (AAPL) are key customers.

Artificial Intelligence (AI) Fuels NYSE:TSM’s Explosive Growth

TSMC has benefited immensely from its involvement in AI chip production, primarily as the go-to supplier for Nvidia's cutting-edge AI chips. Nvidia's Blackwell chips, designed for AI applications, have been in high demand, with the latest reports confirming they are sold out. Meta (META), Amazon (AMZN), and Alphabet (GOOG), key players in hyperscale computing, are driving this demand, with significant orders placed for GPUs capable of managing AI workloads. This demand pushed TSM's high-performance computing (HPC) sector to contribute more than 50% of total sales in Q3, a figure that is expected to climb to 55% by the end of 2024.

Performance Review: September's Revenue Surge and Growth Outlook

September marked a significant acceleration for NYSE:TSM , with sales jumping 39.6% year-over-year, reaching a peak not seen since July 2024. This rapid growth positions TSMC for a stellar Q3 2024 earnings report, scheduled for October 17, 2024. Investors are keen to see how these numbers reflect in gross and operating margins, particularly as TSM forecasted operating margins to grow from 42.5% in Q2 to potentially over 44.5% in Q3. The company’s ability to capitalize on the growing AI market presents a promising outlook for both near-term and long-term profitability.

Key Revenue Drivers: AI, HPC, and Strategic Expansion

With AI at the forefront of TSM's growth, its ability to cater to AI chip manufacturing for leading technology firms has been a core driver. Nvidia’s success in the AI space has been mirrored by AMD’s push for market share, and both companies have leaned heavily on TSM for chip production. In Q2, high-performance computing represented over 50% of TSMC’s sales, and this figure is expected to climb further in Q4 as demand for advanced chips remains unrelenting. Moreover, TSM’s gross margins are forecasted to reflect this growth, with Wall Street anticipating margins above 54.5% for Q3.

Insider Transactions and Strategic Moves

For investors closely tracking insider movements, the latest insider transactions can be found at Insider Transactions for TSM. The insider activity aligns with broader market optimism surrounding TSM's long-term growth trajectory, supported by its leadership in AI chip manufacturing.

Advanced Packaging: Meeting AI Demand Ahead of Schedule

One of the major challenges TSM faces is managing capacity amid surging demand. Its advanced packaging technology, essential for producing AI chips, is already sold out until 2025. To meet this overwhelming demand, TSM has accelerated its capacity expansion, moving plans up by an entire year. Morgan Stanley recently reported that TSMC is set to meet AI chip demand faster than expected, improving the company's ability to capture more market share and fulfill orders from Nvidia, AMD, and others.

A Closer Look at NYSE:TSM’s Valuation

Despite the stock’s robust 2024 performance—up 77% year-to-date—NYSE:TSM remains attractively valued relative to its peers. At the time of writing, TSM trades at $185.78, representing a price-to-earnings ratio (P/E) of 28.2x for 2024, with earnings expected to hit $6.58 per share. Projections for 2025 show a further increase in earnings to $8.29 per share, reducing the forward P/E to 22.4x. In comparison, Nvidia trades at a much higher forward P/E of 33.5x, despite similar growth prospects. This makes TSM a more attractive option for investors seeking exposure to the AI revolution without paying a premium.

What Risks Does NYSE:TSM Face in the AI Frenzy?

While the AI boom is clearly a major growth driver, there are risks on the horizon for NYSE:TSM. The market’s current enthusiasm for AI could lead to potential overinvestment, particularly if companies fail to see a sufficient return on investment from their AI-related expenditures. Should this occur, TSM could face a contraction in orders and a slowdown in revenue growth, which would likely affect operating margins and investor sentiment.

Moreover, geopolitical risks tied to Taiwan and its delicate relationship with China remain a persistent concern. The Chinese People’s Liberation Army (PLA) recently conducted military exercises near Taiwan, raising questions about potential disruptions to TSMC’s manufacturing operations. While no immediate conflict appears imminent, investors are closely monitoring the situation as tensions between Taiwan and China could significantly impact TSM's future.

TSMC's Global Expansion: A Hedge Against Geopolitical Risk

In response to these geopolitical risks, TSMC has strategically expanded its global footprint. The company is constructing a new factory in Dresden, Germany, and is exploring further expansion in Europe and the Middle East. This diversification effort aims to reduce the company’s reliance on Taiwan-based production and mitigate the risks associated with a potential conflict in the region. However, this expansion also highlights the rising costs of setting up new facilities, which could pressure free cash flow in the near term.

TSM’s AI Leadership Solidifies Long-Term Growth Potential

TSM’s dominance in AI chip manufacturing places it in a unique position to benefit from the exponential growth in AI-related demand. Nvidia, AMD, and Intel continue to rely on TSM for their advanced AI chip production, and Apple’s continued investment in AI-driven smartphones further bolsters TSM’s growth outlook. With AI-related chip sales expected to continue their upward trajectory, TSMC’s ability to maintain high utilization rates for its advanced nodes ensures its long-term profitability.

Q3 2024 Earnings: What to Expect

As TSMC prepares to report its Q3 2024 earnings on October 17, 2024, all indicators suggest a strong performance. Analysts expect $1.80 per share in earnings, representing 40% growth year-over-year. The company’s impressive revenue growth in Q3, driven by surging AI demand, positions it to exceed these expectations. Investors will also be keen to see guidance for Q4, where TSMC is expected to maintain its momentum, particularly in the high-performance computing sector.

Final Thoughts on NYSE:TSM’s Outlook

With strong Q3 results, robust demand for AI chips, and a strategic global expansion, TSMC remains a key player in the semiconductor industry. Its ability to navigate the AI boom, meet rising demand, and manage geopolitical risks makes it an attractive investment. As the company continues to benefit from its leadership in advanced chip manufacturing, investors should remain bullish on NYSE:TSM’s long-term potential.

For the latest real-time chart and data on TSMC stock, check out the real-time stock profile and monitor insider transactions here.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex