TSMC Stock Analysis: NYSE:TSM Beyond $100 Billion CapEx in 2025

Taiwan Semiconductor Manufacturing drives AI expansion with robust Q4 margins, $40B CapEx, and advanced 3nm tech. Is the market undervaluing TSM's AI momentum? | That's TradingNEWS

NYSE:TSM Strengthens AI Leadership Amid Market Volatility

Advanced Technology and Q4-24 Performance Drive Momentum

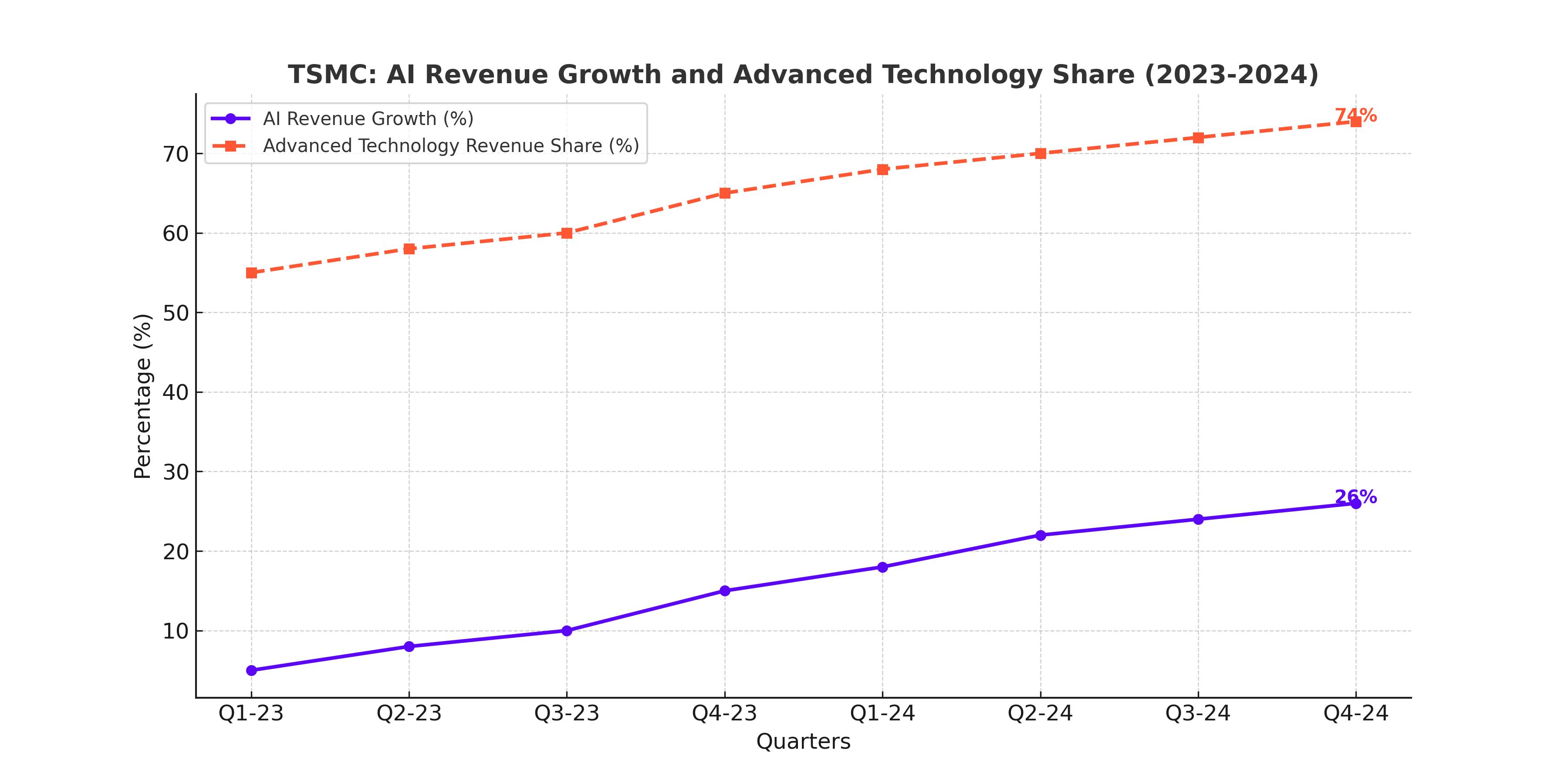

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) has cemented its position as a leader in semiconductor manufacturing, with AI-driven growth and 3nm technology adoption at the forefront of its success. In Q4-24, TSM posted a robust 14.3% sequential revenue growth in New Taiwan Dollars (NT), primarily fueled by advanced 3nm (N3) and 5nm (N5) nodes. These technologies contributed significantly to its wafer revenue, with N3 alone accounting for 26% of Q4 revenue compared to just 6% in Q3-23. Advanced technologies (defined as processes at 7nm or below) represented 74% of total wafer revenue in Q4-24, a remarkable jump from 58% in CY23.

Gross margins improved sequentially to 59%, while operating margins rose to 49%. Full-year CY24 margins also reflected strong performance, with gross margin increasing to 56.1% and operating margin growing to 45.7%. The HPC platform drove 53% of total revenue in Q4, showcasing the growing demand for advanced AI accelerators and GPUs. Meanwhile, the smartphone platform contributed 35%, further solidifying TSM’s diverse revenue streams.

CapEx Plans Highlight Confidence in AI and Advanced Nodes

TSMC’s $38-$42 billion CapEx for 2025 underscores its commitment to advanced semiconductor technologies. Approximately 70% of this investment will target nodes at 7nm or below, focusing heavily on AI accelerators and high-performance computing (HPC) applications. TSM’s forecast for mid-40% compound annual growth in AI-related revenue over the next five years demonstrates its bullish stance on AI infrastructure demand.

This aggressive CapEx allocation comes as global hyperscalers, including Amazon (AMZN), Microsoft (MSFT), and Google (GOOGL), ramp up data center expansion to support AI-driven services. These investments are essential for meeting the surging demand for semiconductors required for training and inference workloads in artificial intelligence.

DeepSeek Panic Creates Buying Opportunity

Recent fears surrounding the impact of DeepSeek, a Chinese AI startup, on AI hardware spending led to a sharp selloff in TSM stock. However, the concerns appear overstated. While DeepSeek’s innovations focus on optimizing supply chain processes, they do not diminish the growing demand for advanced chips powering AI workloads. TSMC remains indispensable to the production of GPUs, TPUs, and accelerators critical for AI development.

The market’s reaction to DeepSeek’s developments mispriced TSMC’s fundamentals. Despite the selloff, TSMC’s leadership in cutting-edge chip manufacturing and its pivotal role in the AI ecosystem remain unchallenged.

Geopolitical Risks and Overseas Expansion Challenges

TSMC faces ongoing geopolitical risks tied to Taiwan’s complex relations with China. The company’s strategy to expand its manufacturing footprint in the U.S. and Europe aims to mitigate these risks. However, overseas fabs in Arizona and Dresden have led to a 2%-3% margin dilution due to higher operating costs and smaller-scale production.

Despite these challenges, the strategic importance of TSMC’s U.S. and European operations cannot be overstated. These fabs are integral to diversifying global supply chains and addressing rising demand for advanced nodes outside Taiwan.

Strong Financials and Long-Term Growth Prospects

TSMC’s Q1-25 guidance projects revenue of $25-$25.8 billion, representing a 34.7% YoY increase at the midpoint. Gross margins are expected to range between 57% and 59%, with operating margins forecasted at 46.5%-48.5%. The company’s ability to achieve such strong financial performance highlights its resilience in a competitive and volatile industry.

Moreover, TSMC’s valuation remains attractive. The company trades at a forward P/E ratio of 21, with a PEG ratio of 0.63—well below the industry average. These metrics underline TSMC’s compelling growth-adjusted valuation, making it a strong buy for long-term investors.

Conclusion

Despite near-term market fears driven by DeepSeek and geopolitical tensions, TSMC remains a cornerstone of the AI revolution. With robust fundamentals, leading-edge technology, and strategic investments in advanced nodes, TSMC is poised to maintain its leadership in the semiconductor industry. Trading at attractive valuations and supported by strong growth prospects, NYSE:TSM offers a compelling buying opportunity for investors looking to capitalize on the AI-driven transformation of the global economy.

For real-time updates on TSMC stock, visit TSMC Stock Chart.

That's TradingNEWS

Read More

-

GPIQ ETF Rises on 10% Yield and AI Boom as Investors Brace for Tech Volatility

14.10.2025 · TradingNEWS ArchiveStocks

-

Ripple (XRP-USD) Stabilizes at $2.51 as Whales Buy $5.5B and ETF Outflows Shake Crypto

14.10.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Falls to $3.07 as Supply Glut and Weak Heating Outlook Hit Demand

14.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Slides to 151.80 as Trade Tensions Boost Yen Strength

14.10.2025 · TradingNEWS ArchiveForex