In-Depth Analysis of NASDAQ:UBER's Stellar Q2 Performance

Robust Growth in Gross Bookings

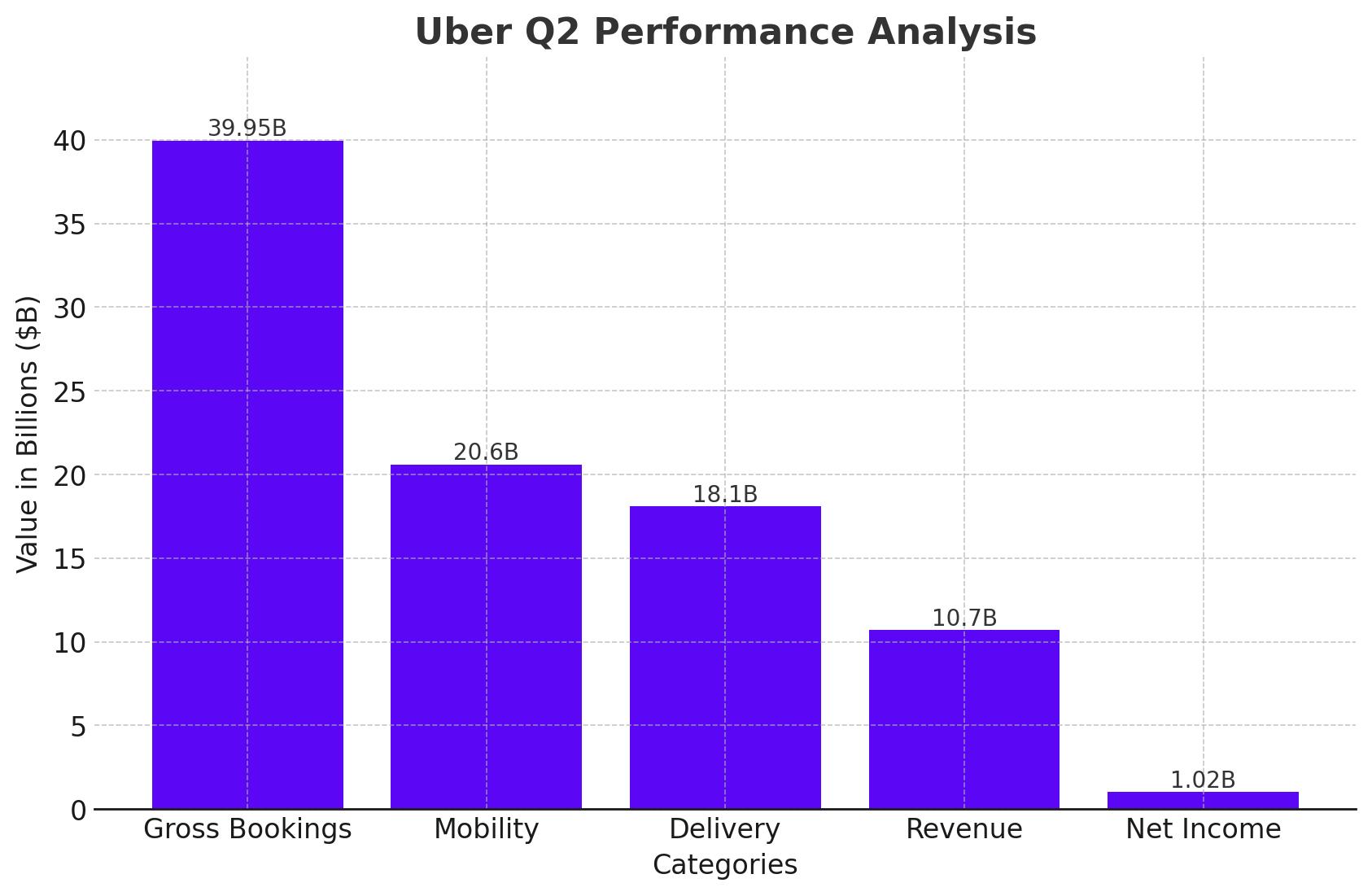

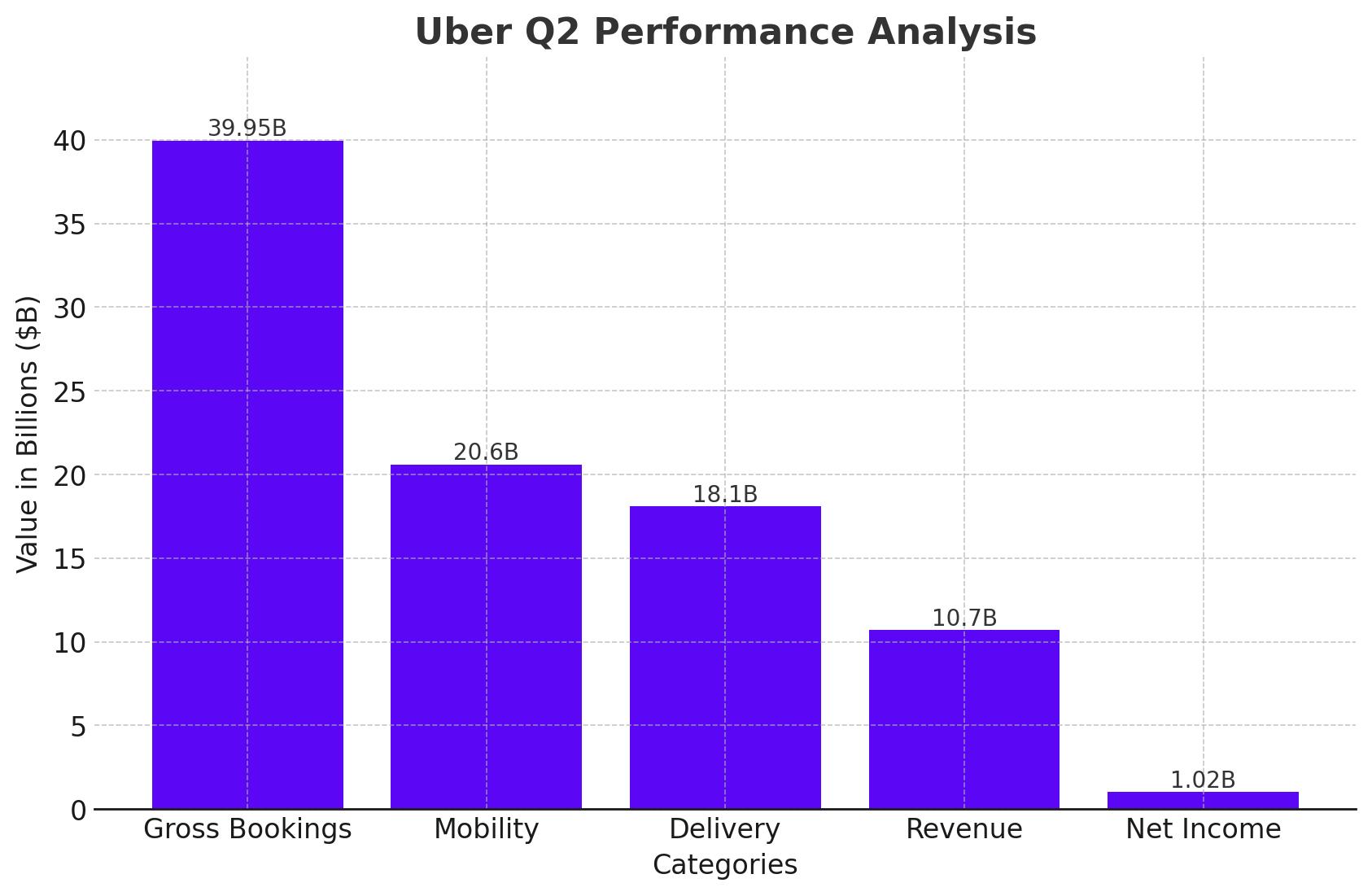

Uber Technologies Inc. (NASDAQ:UBER) has significantly outperformed expectations in the second quarter, demonstrating robust growth across its core business segments. Gross bookings surged to $39.95 billion, a 19% increase year-over-year, showcasing strong demand in both mobility and delivery services. The Mobility division alone accounted for $20.6 billion of this total, underscoring a reinvigorated market as global economies continue to recover and adapt post-pandemic. Similarly, the Delivery segment, including Uber Eats, contributed $18.1 billion, reflecting the sustained preference for home delivery services among consumers.

Financial Performance and Profitability

The revenue for the quarter stood at an impressive $10.7 billion, marking a 16% increase from the previous year and exceeding Visible Alpha consensus estimates. This top-line growth translated effectively to the bottom line, with net income soaring to $1.02 billion, more than doubling from last year's figure of $394 million. This leap in profitability is a clear indicator of Uber's effective cost management and operational efficiency. Additionally, the initiation of a substantial stock buyback program, with $325 million repurchased in Q2, signals strong confidence in the company's financial stability and future growth prospects.

Strategic Technological Collaborations

A significant highlight of the quarter was Uber’s strategic partnership with BYD to enhance its fleet with approximately 100,000 electric vehicles. This move not only aligns with global sustainability goals but also positions Uber at the forefront of the green revolution in transportation. Moreover, the collaboration extends to the development of autonomous vehicles, potentially integrating cutting-edge technology from Alphabet's Waymo and Tesla into Uber's service offerings. Such advancements could revolutionize the efficiency and safety of ridesharing services and fortify Uber’s market position against emerging competitors.

Market Reaction and Share Performance

The market reacted positively to Uber's quarterly report, with shares jumping 4.3% to $60.94 shortly after the earnings announcement. Despite this positive trend, shares have seen a slight decline over the year, reflecting the broader market volatility and economic uncertainties. However, the company's robust quarterly performance and strategic initiatives may continue to instill investor confidence.

Forward-Looking Projections

Looking ahead, Uber anticipates gross bookings for Q3 to be in the range of $40.25 billion to $41.75 billion, which would represent significant year-over-year growth. These projections are buoyed by an expected increase in demand across all service platforms, particularly as Uber expands its geographical footprint and enhances service offerings.

Long-Term Strategic Vision

Uber’s CEO Dara Khosrowshahi emphasized the company's ongoing momentum, noting a record number of trips and a strong uptick in Monthly Active Platform Consumers, which grew to 156 million, a 14% increase from the previous year. The company's focus remains on expanding its market leadership while exploring new avenues for growth, including further investments in autonomous and electric vehicle technologies.

Conclusion

In conclusion, NASDAQ:UBER's performance in the second quarter reflects a company that is not only recovering swiftly from global disruptions but is also proactively positioning itself for future technological shifts in the transportation and delivery sectors. Investors and stakeholders should watch closely as Uber continues to navigate market challenges and capitalize on emerging opportunities, potentially setting the stage for sustained growth and profitability in the evolving digital economy.

For ongoing updates and more detailed financial analysis, stakeholders are encouraged to consult the real-time chart and stock profile of Uber at TradingNews.

That's TradingNEWS