Weekly TradingNEWS Insights into Gold's Market Dynamics

Analyzing Gold's Response to Geopolitical Shifts and Economic Indicators | That's TradingNEWS

4/28/2024 12:00:00 AM

Weekly Gold Market Analysis: Factors Influencing Gold Prices

Overview of Gold's Price Dynamics

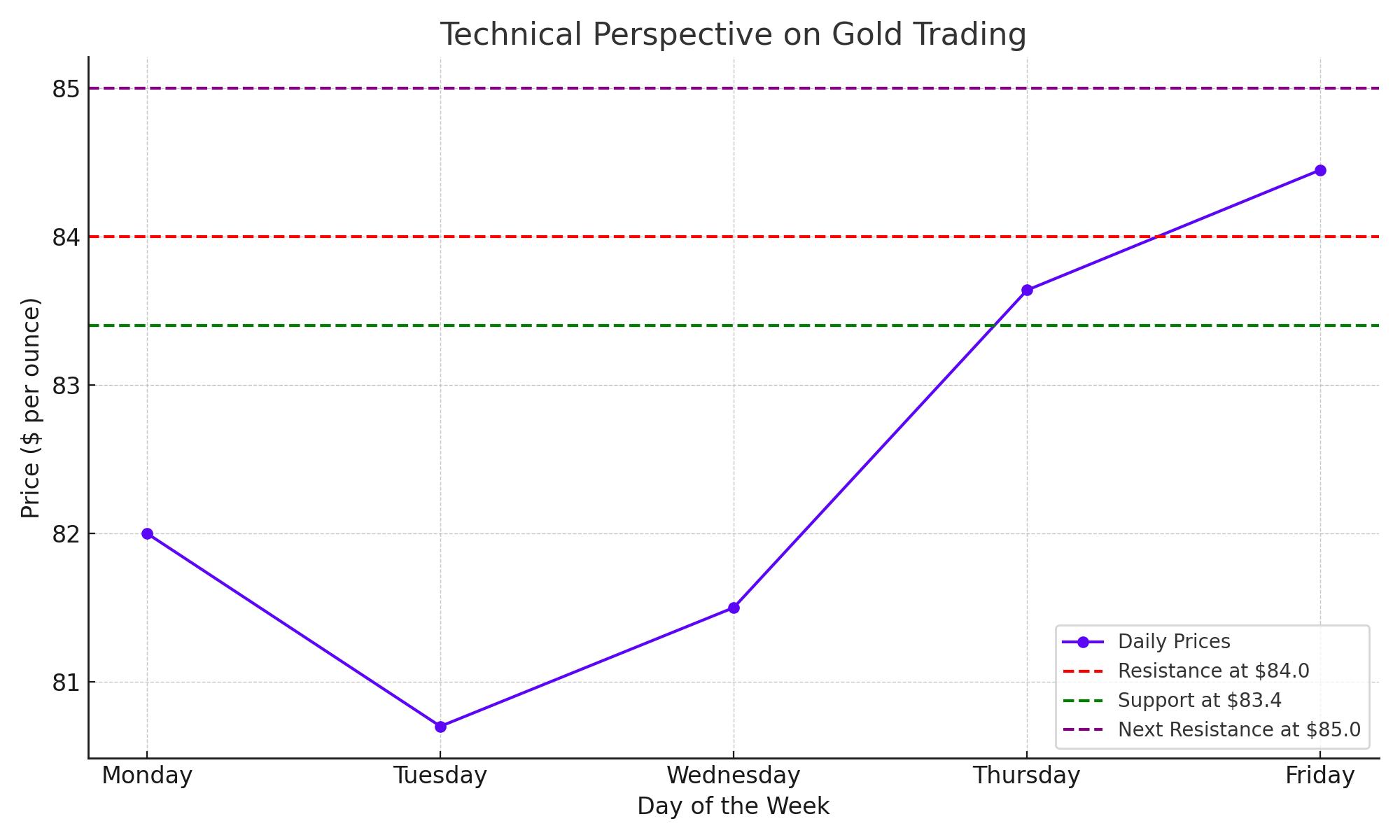

Last week, gold prices demonstrated a significant level of volatility, influenced primarily by geopolitical and macroeconomic developments. The precious metal opened the week under the $82.00 mark, reaching a weekly low near $80.70, only to recover and close the week around $83.64, with a peak at $84.45. Despite geopolitical tensions in the Middle East, gold's price trajectory managed a gradual ascent, staying comfortably within a one-month price mid-range, which raises potential inflationary concerns if this upward trend persists.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex