Why AMD Stock Is a Buy ? TradingNEWS Analysis

A Comprehensive Look at AMD's Financial Health, Strategic Market Positioning, and Investment Potential | That's TradingNEWS

Advanced Micro Devices (NASDAQ: AMD): Strategic Market Analysis

Overview and Current Market Performance

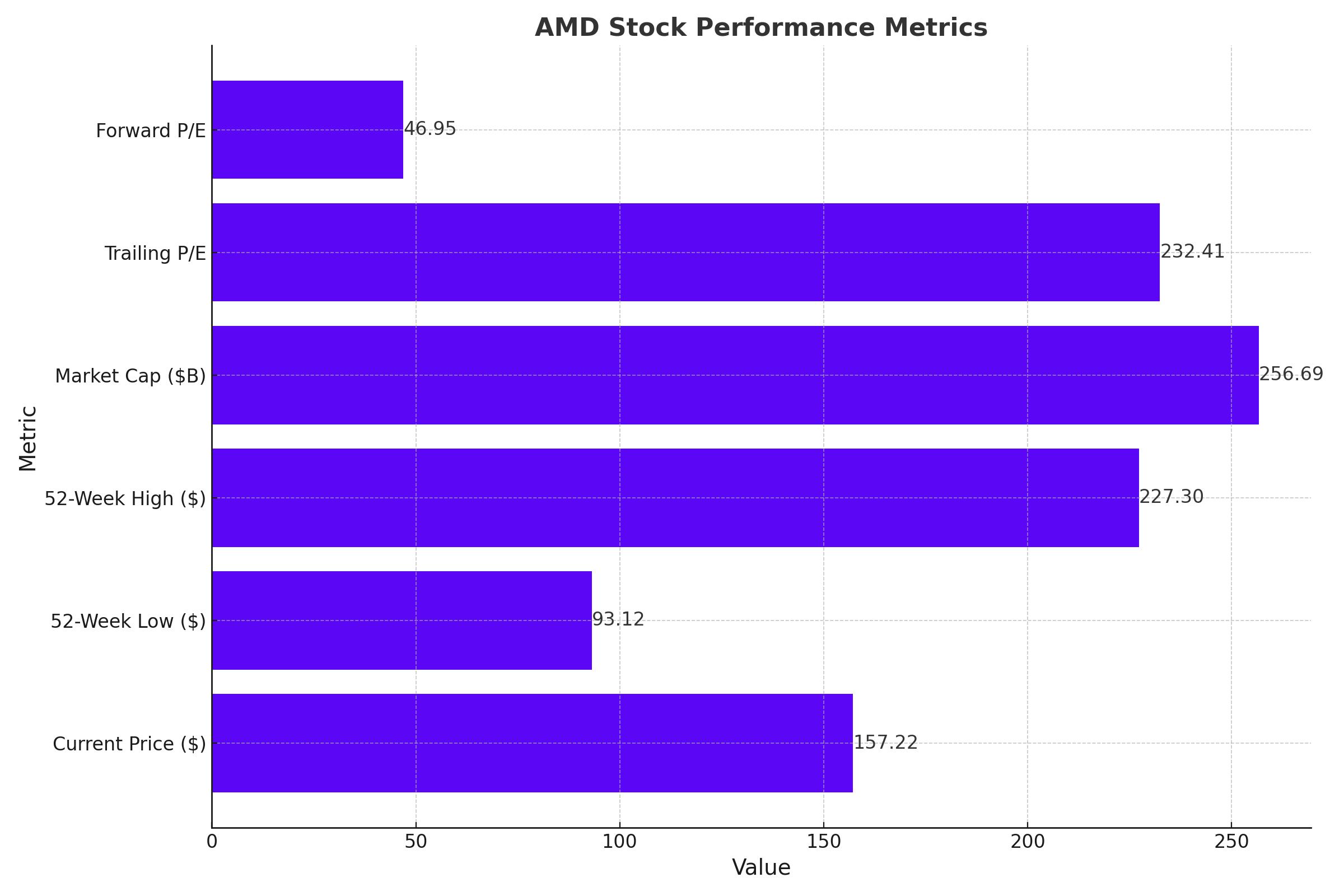

- Current Stock Status: As of the latest data, AMD's stock price stands at $157.22, reflecting a recent drop of 1.95%. Despite this dip, the company's year-to-date performance remains robust with significant recovery from a 52-week low of $93.12 to a high of $227.30. This volatility underscores the dynamic nature of the semiconductor industry and investor sensitivity to tech sector shifts.

- Valuation Metrics: AMD's market capitalization is approximately $256.686 billion, with a notably high trailing Price-to-Earnings (P/E) ratio of 232.41, suggesting high growth expectations from investors. The forward P/E ratio of 46.95, while still elevated, indicates expected improvements in earnings.

Financial Health and Profitability

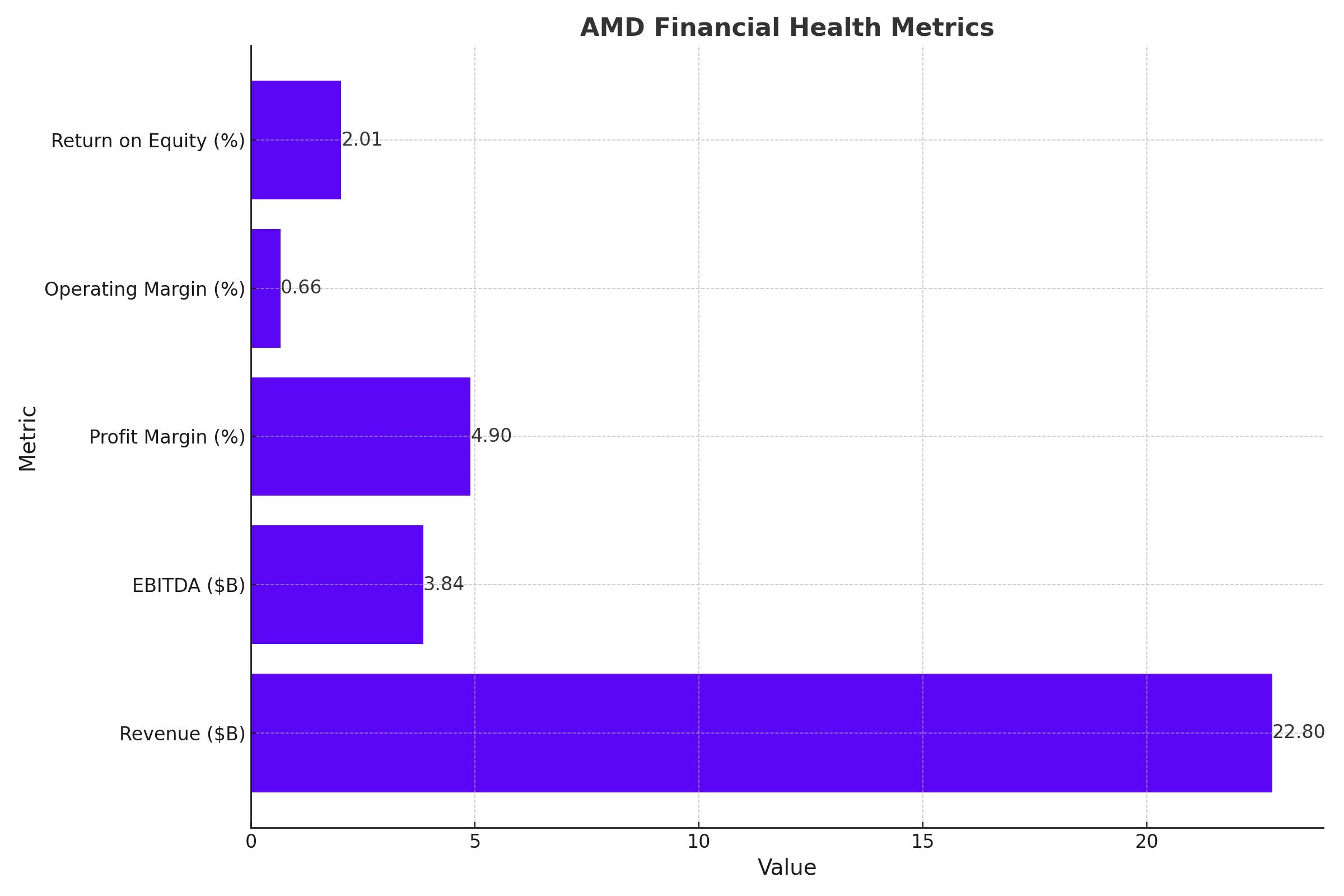

- Revenue and Earnings Performance: AMD reported a revenue of $22.8 billion for the trailing twelve months, with a modest year-over-year quarterly growth rate of 2.20%. The company’s EBITDA stands at $3.84 billion, highlighting operational profitability amidst challenging market conditions.

- Profit Margins and Returns: AMD maintains a profit margin of 4.90% and an operating margin of 0.66%. These figures, combined with a return on equity (ROE) of 2.01%, depict a scenario where AMD is generating positive returns, albeit with potential for enhancement to reach industry-leading standards.

Growth Prospects and Strategic Moves

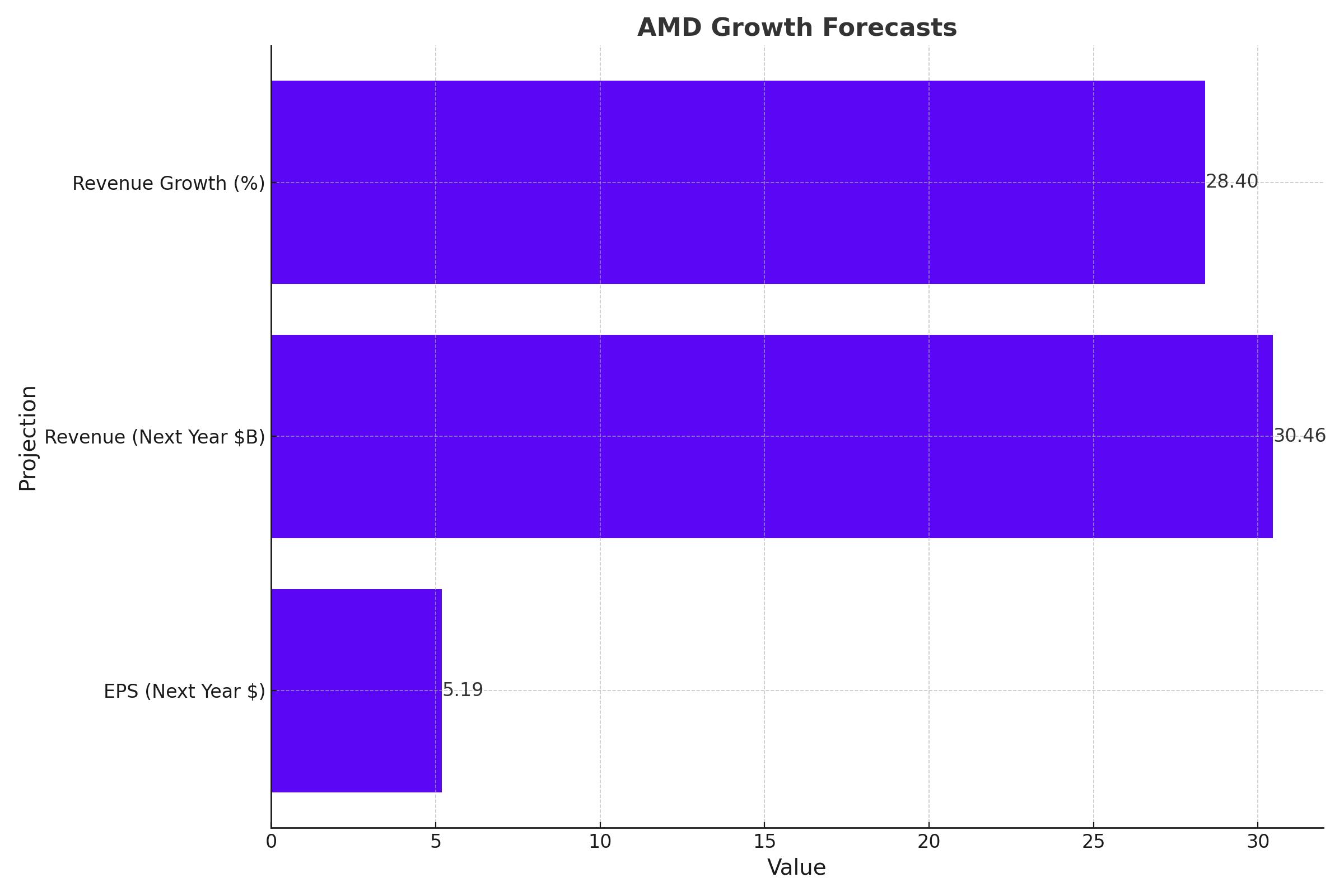

- Earnings Estimates and Forecasts: Analyst consensus points to an optimistic growth trajectory for AMD, with earnings per share (EPS) expected to rise from $3.25 this year to $5.19 next year. Revenue forecasts are also bullish, projecting an increase from $23.72 billion this year to $30.46 billion next year, representing a significant 28.40% growth.

- Innovation and Market Expansion: AMD is aggressively expanding its product lineup, notably with recent launches like the MI300 series chips. These products are designed to compete directly with Nvidia’s offerings, aiming to recapture market share in GPU and data center markets.

Strategic Market Positioning

- Expanding Influence in AI and Machine Learning: Advanced Micro Devices (AMD) is actively carving out a significant presence in critical growth areas like artificial intelligence (AI) and machine learning. By concentrating its R&D efforts on high-performance computing solutions, AMD is strategically positioning itself to enhance its market share in these sectors. This approach is crucial as it directly contests with Nvidia's dominance and Intel's broad hardware spectrum. The rollout of AMD's innovative products, such as the MI300 series processors, aims to match or surpass the computational capabilities that rivals currently offer, which is essential for applications ranging from data analytics to complex AI-driven simulations.

Operational Challenges and Strategic Opportunities

- Navigating Market Complexities: AMD faces operational challenges including supply chain disruptions and competitive pricing pressures. These obstacles are compounded by the global demand fluctuations and logistical constraints affecting the semiconductor industry at large. Despite these hurdles, AMD identifies substantial opportunities to extend its market influence. The company is poised to capitalize on emerging technological trends by advancing its AI chipsets, which are vital for driving growth in sectors like autonomous vehicles, healthcare diagnostics, and smart manufacturing. These innovations not only bolster AMD’s product portfolio but also strengthen its competitive edge.

Investment Perspective

Potential for Stock Performance

- Robust Growth Trajectory: AMD's current development pipeline and strategic market initiatives signal a potent growth trajectory. With a closing stock price of $157.22, despite recent market fluctuations, AMD maintains a strong position. The company's strategic emphasis on sectors like AI, where it plans to introduce more tailored solutions, underpins potential market share gains. For investors, the key metric to monitor is AMD’s consistency in innovation and execution within these high-value sectors. Success in these areas could significantly enhance AMD’s stock valuation, which currently reflects a forward-looking P/E ratio significantly higher than the industry average.

Considerations for Risk Management

- Evaluating Investment Risks: Investors considering AMD must weigh the inherent volatilities of the semiconductor sector, characterized by rapid technological shifts and economic cycles that can affect stock performance. The company's high P/E ratio of 232.41 indicates high investor expectations for future earnings growth. While this showcases confidence in AMD’s potential, it also highlights the risk of overvaluation if the company fails to meet these growth projections. Monitoring AMD’s quarterly performance, especially its revenue growth and market share expansion in competitive areas, will be crucial for assessing whether it continues to align with its valuation metrics.

Is AMD Stock a Buy?

Conclusion

Given AMD's strategic advancements and current market performance, the stock presents a compelling case for a Buy. Currently priced at $157.22, AMD has demonstrated significant resilience, bouncing back from its 52-week low of $93.12 to a high of $227.30. This volatility reflects the company's adaptability in a rapidly evolving tech landscape. Despite a high trailing P/E ratio of 232.41, indicating elevated growth expectations, the more moderate forward P/E of 46.95 suggests that earnings improvements are anticipated. AMD's aggressive foray into AI and machine learning, coupled with its strategic product launches like the MI300 series, positions it well against competitors like Nvidia and Intel. With analysts projecting substantial revenue growth from $23.72 billion to $30.46 billion next year, AMD is poised for robust upward momentum. However, potential investors should consider the cyclical nature of the semiconductor industry and AMD's current valuation levels, which may reflect optimism about its future performance. Monitoring AMD's ongoing market share expansion and innovation will be crucial to validating these growth expectations.

That's TradingNEWS

Read More

-

GDX ETF at $88 While Gold Tests $4,400: Are Gold Miners Poised for $100?

19.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Boom: XRPI at $10.94 and XRPR at $15.49 as XRP-USD Clings to the $1.80–$1.90 Zone

19.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovering Near $3.92 As Weather, LNG And Storage Collide

19.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Near 157 as BoJ’s 0.75% Rate Hike Backfires on the Yen

19.12.2025 · TradingNEWS ArchiveForex