Why Broadcom NASDAQ:AVGO Stock a Buy After 220% AI Revenue Surge in 2024?

Broadcom's Custom Silicon, AI Networking Revenue, and VMware Synergy Drive 2024 Success—Is More Growth Ahead? | That's TradingNEWS

Broadcom (NASDAQ:AVGO): AI Growth, VMware Synergy, and Market Dynamics Shaping 2025 Prospects

Broadcom’s AI Revenue Surge and Custom Silicon Leadership

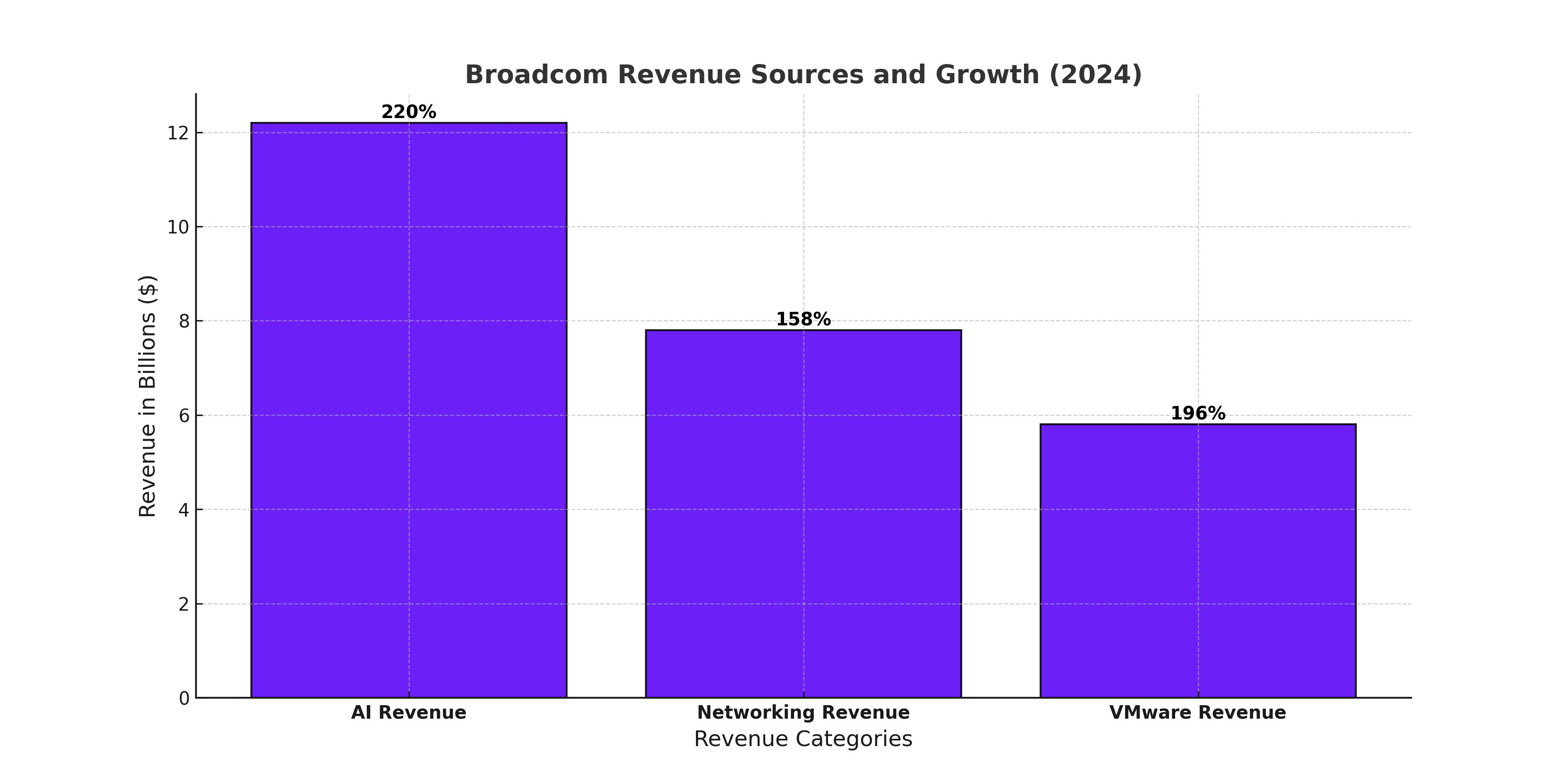

Broadcom (NASDAQ:AVGO) experienced a stellar 2024, ending the year with a remarkable 107% stock price increase, driven by its custom silicon initiatives and surging AI revenue. The company reported $51.6 billion in FY2024 revenue, a 44% year-over-year growth, with AI-related semiconductor revenue soaring by 220% to $12.2 billion. AI now accounts for 41% of Broadcom's semiconductor revenue, underscoring the company’s significant foothold in the evolving AI semiconductor market. Custom silicon contracts, notably with hyperscalers such as Google (GOOG), Meta Platforms (META), and Amazon (AMZN), are central to Broadcom's growth.

Broadcom’s unique position in designing application-specific integrated circuits (ASICs) tailored to client specifications enables it to compete effectively with Nvidia (NVDA). Unlike Nvidia’s standardized GPUs, Broadcom’s custom solutions optimize cost and performance for hyperscalers, leading to major design wins. Broadcom’s CEO, Hock Tan, has highlighted significant orders for its next-generation AI XPUs, with revenue projections for AI-related products expected to grow by 65% year-over-year in Q1 FY2025, reaching $3.8 billion.

VMware Integration Boosts Infrastructure Software Segment

Broadcom’s acquisition of VMware in FY2024 has substantially expanded its infrastructure software segment, which grew by 196% year-over-year. VMware contributed $5.8 billion in Q4 FY2024 revenue, with a 70% operating margin and a more than 50% reduction in operating expenses compared to pre-acquisition levels. VMware's strong performance is expected to drive further profitability, with Broadcom projecting a 41% year-over-year growth in infrastructure software revenue for Q1 FY2025.

VMware's integration has not only enhanced Broadcom’s revenue base but has also increased its recurring revenue potential through higher annualized booking value (ABV). By leveraging VMware’s strengths in data center virtualization, Broadcom has positioned itself to maintain strong margins and cash flow while meeting client demand for scalable cloud solutions.

The AI Semiconductor Market and Networking Expansion

Broadcom's custom AI accelerators and networking solutions are at the forefront of the AI semiconductor market. The company anticipates that the AI XPU and networking segment could represent a serviceable addressable market (SAM) of $60 billion to $90 billion by FY2027. Hyperscalers are expected to deploy up to one million AI XPU clusters within the next three years, fueling Broadcom's growth. Networking solutions, such as the Jericho3-AI and Tomahawk chips, are critical components of these deployments, driving a 45% year-over-year increase in networking revenue in Q4 FY2024.

AI networking revenue accounted for 76% of Broadcom's total networking revenue, which grew by 158% year-over-year. As demand for AI cluster connectivity grows, networking components could account for 15%-20% of total AI-related silicon content by FY2027, compared to the current 5%-10%.

Challenges: Heavy Client Reliance and Competitive Risks

Despite Broadcom’s strong performance, the company’s reliance on a narrow client base of three hyperscalers poses risks. Should these clients reduce spending or shift to alternative suppliers, Broadcom’s revenue growth could be adversely impacted. Nvidia’s recent moves to establish its own custom silicon division add competitive pressure, particularly as Nvidia’s software ecosystem, including CUDA, remains unparalleled in the market.

Broadcom’s limited exposure to broader AI market trends outside its core hyperscale clients may restrict its ability to capitalize on the overall growth of AI adoption. Furthermore, geopolitical risks, such as U.S.-China trade tensions, could affect Broadcom’s operations, given that more than 30% of its revenue is derived from China.

Valuation and Market Outlook

Broadcom’s current valuation reflects its strong growth prospects but also suggests some level of overvaluation. The company’s price-to-sales (P/S) ratio is at a three-year high of 21.32, while its price-to-free cash flow (P/FCF) ratio of 56.64 indicates that the stock is pricing in significant growth. Despite these concerns, Broadcom’s strong fundamentals, including a 63% operating margin and robust free cash flow generation, support its investment case.

Looking ahead, Broadcom is well-positioned to benefit from the ongoing AI infrastructure boom. The company’s leadership in custom silicon design, coupled with its expanding networking and infrastructure software capabilities, provides a solid foundation for sustained growth. However, diversification beyond its core hyperscale clients and continued innovation in AI hardware and software will be critical for maintaining competitive advantage.

Broadcom (NASDAQ:AVGO) remains a compelling investment for growth-oriented investors, with significant upside potential driven by favorable AI and cloud market dynamics. For real-time updates on AVGO, visit NASDAQ:AVGO Real-Time Chart. For insights on insider transactions, explore AVGO Stock Profile.

That's TradingNEWS

Read More

-

GPIQ ETF Rises on 10% Yield and AI Boom as Investors Brace for Tech Volatility

14.10.2025 · TradingNEWS ArchiveStocks

-

Ripple (XRP-USD) Stabilizes at $2.51 as Whales Buy $5.5B and ETF Outflows Shake Crypto

14.10.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Falls to $3.07 as Supply Glut and Weak Heating Outlook Hit Demand

14.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Slides to 151.80 as Trade Tensions Boost Yen Strength

14.10.2025 · TradingNEWS ArchiveForex