Why To Buy NYSE: SQM Stock- Strategic Growth and Significant Upside in the Evolving Lithium Market

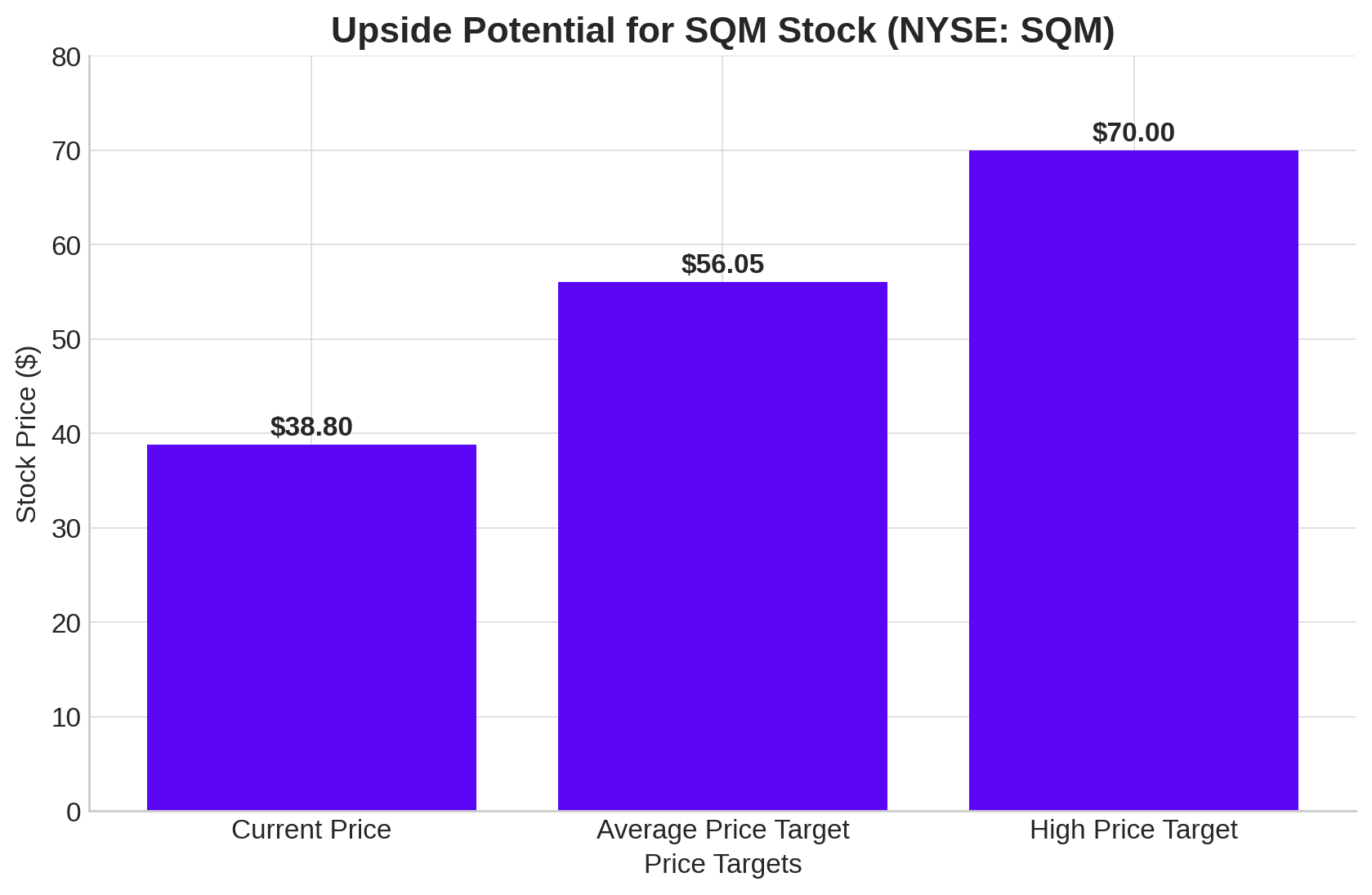

With Analyst Ratings Pointing to a 44.46% Upside, SQM's Strategic Ventures and Market Positioning Make It a Strong Contender in the Lithium Sector | That's TradingNEWS

Performance Overview: (NYSE: SQM) in a Volatile Market

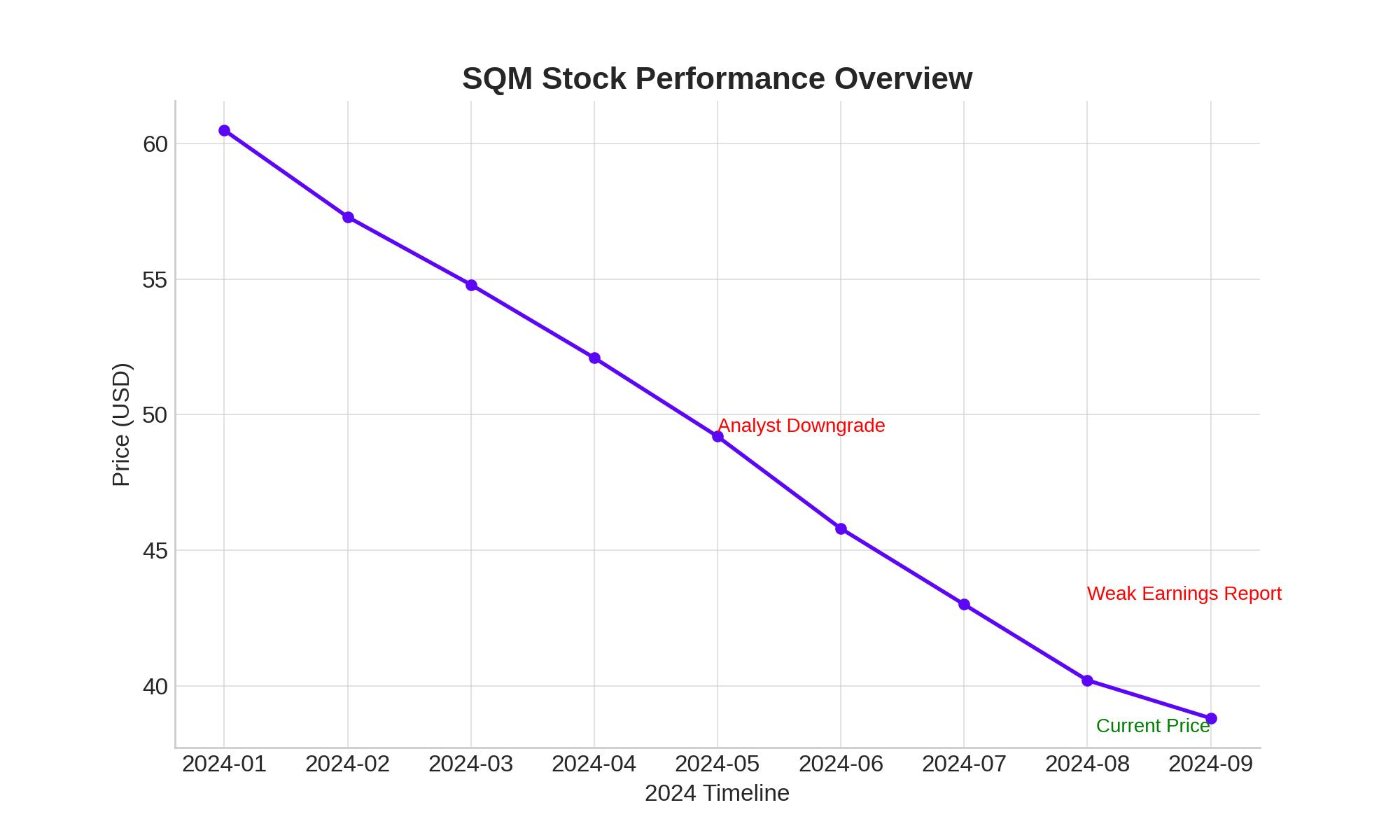

Sociedad Química y Minera de Chile (NYSE: SQM) has seen significant fluctuations in its stock price over the past year, reflecting the broader challenges in the lithium market. As of the latest trading session, shares of SQM closed at $38.80, marking a decline from its 52-week high of $64.62. This 39.73% drop in the stock price highlights the volatility and challenges facing the company in the current market environment.

Recent Financial Adjustments and Analyst Ratings

BMO Capital Markets recently maintained its "Outperform" rating on NYSE:SQM, though it revised its price target down to $55.00 from previous estimates. This adjustment comes on the back of a conservative outlook for lithium prices, with BMO reducing its 2024 EBITDA forecast by 18% to $1.6 billion. The lowered expectations are based on an anticipated average selling price (ASP) for lithium of around $10,900 per ton in the second half of 2024. Despite these revisions, BMO continues to view SQM positively, underpinned by the company’s strategic positioning in the lithium market.

On the other hand, Deutsche Bank adjusted its price target for SQM to $35.00 following a weaker-than-expected earnings report for Q2 2024. SQM reported revenues of approximately $1.3 billion, slightly above analyst expectations but offset by higher costs, resulting in a miss on earnings per share (EPS), which came in at $0.75 against a consensus estimate of $0.99.

Strategic Ventures and Market Positioning

SQM has been active in solidifying its market position through strategic ventures. The company's joint venture with Codelco, dubbed "Newco," is nearing finalization. Analysts believe this partnership will help stabilize lithium prices and reduce uncertainties surrounding SQM’s operations. Additionally, SQM launched SQM International Lithium, a new venture aimed at expanding its lithium business outside of Chile, a move that could diversify its revenue streams and reduce dependency on the Chilean market.

Furthermore, Chile’s inclusion under the U.S. Inflation Reduction Act (IRA) is expected to boost SQM’s competitiveness by enhancing exports of its lithium products. This development is likely to provide a tailwind for the company as it navigates through the current market challenges.

Institutional Ownership and Insider Transactions

Institutional investors currently hold 22.64% of SQM shares, indicating a strong belief in the company’s long-term prospects despite recent volatility. Notably, several institutional investors have adjusted their positions in SQM recently. For example, EverSource Wealth Advisors LLC increased its stake in the company by 133.8% in the fourth quarter, reflecting confidence in the stock's potential upside. On the other hand, there have been some sell-offs, as indicated by Deutsche Bank's downgrade of the stock.

Insider transactions can be a telling sign of a company’s future prospects. Investors can track these transactions through platforms such as SQM's Insider Transaction Profile, where detailed information on recent insider activity is available.

Lithium Market Dynamics and SQM’s Future Prospects

The lithium market has been under pressure due to an oversupply situation and weaker-than-expected demand from the electric vehicle (EV) sector. BMO Capital's revised forecast anticipates a gradual recovery in lithium prices, beginning with $13,000 per ton in Q1 2025 and potentially reaching $18,000 per ton by Q4 2025. This anticipated recovery could be a crucial factor for SQM, which has maintained a full-year sales volume estimate of 253,000 tons for 2025.

Despite the current challenges, the outlook for lithium remains positive in the long term, driven by the ongoing transition to renewable energy and the increasing adoption of EVs. SQM, as a leading producer of lithium, is well-positioned to benefit from these trends, provided it can navigate the near-term headwinds effectively.

Technical Analysis and Market Sentiment

Technically, SQM is trading below its 200-day moving average of $43.91, which may indicate continued downward pressure on the stock. The stock’s P/E ratio stands at 27.90, reflecting investor concerns about future earnings growth. However, with a quick ratio of 1.47 and a current ratio of 2.19, the company remains financially stable, capable of meeting its short-term obligations.

Market sentiment, as reflected in recent analyst ratings, is mixed. While firms like Goldman Sachs have upgraded SQM to a "Buy" rating, others like Bank of America have downgraded the stock to "Underperform." The consensus target price currently hovers around $53.94, suggesting a potential upside from the current trading levels.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex