Analysis of Vanguard High Dividend Yield Index ETF (NYSEARCA:VYM)

Positioning Vanguard High Dividend Yield Index ETF as a Strategic Investment

At the close of FY2024, VYM's share price stood at $130, and its net assets under management reached an impressive $73.5 billion. This reflects its broad appeal and scalability in the ETF market. VYM’s benchmark, the FTSE High Dividend Yield Index, screens for dividend-paying stocks with reliable payout histories, excluding REITs, and ranks them by dividend yield. Its low expense ratio of 0.06% makes it one of the most cost-effective ETFs, offering investors a simple and efficient way to access a portfolio of high-quality dividend-paying stocks.

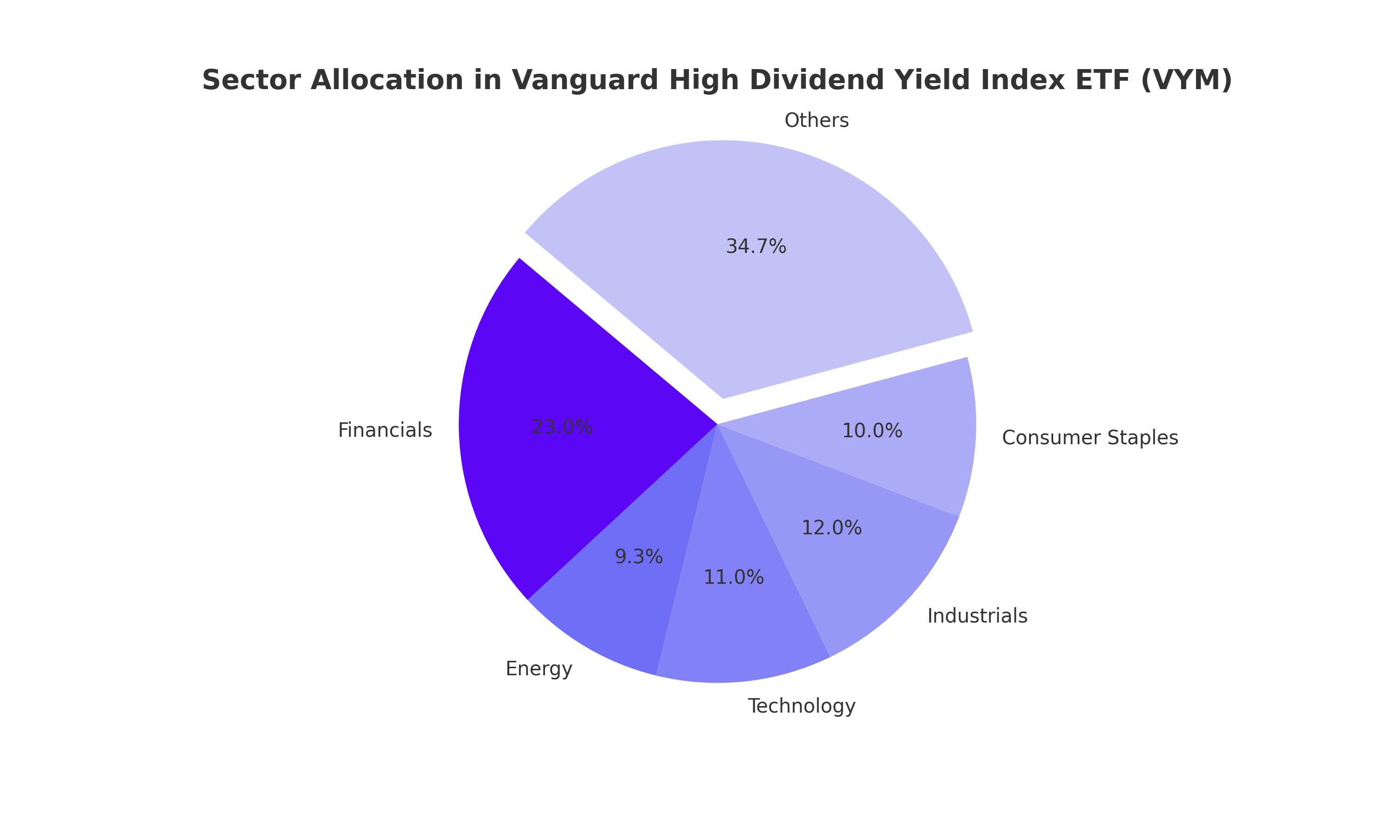

Sector Allocation and Portfolio Composition

VYM's portfolio is heavily weighted towards the Financials sector, which comprises 23% of its holdings. This overweighting in Financials provides a unique edge in the current macroeconomic environment. With the Federal Reserve’s stance on maintaining higher federal fund rates for longer periods, banks such as JPMorgan Chase (JPM) and Bank of America (BAC) are poised to benefit from increased net interest income, a key profitability driver for the sector. Notably, JPMorgan is a top holding in VYM’s portfolio, representing 4.5% of total assets.

Technology and Industrials also play significant roles, comprising 11% and 12% of the portfolio, respectively. Among Technology holdings, Broadcom (AVGO) takes the lead with a 6% weight, benefiting from robust AI-related demand as global AI investments gain momentum. Other key holdings include ExxonMobil (XOM) from the Energy sector, offering diversification with a 9.3% allocation, and Procter & Gamble (PG) from Consumer Staples, known for its market-leading 68-year dividend growth streak.

The ETF’s top ten holdings account for only 26.16% of the portfolio, ensuring reduced concentration risk compared to peers like the S&P 500 Index, which has 37% of its portfolio concentrated in its top ten stocks. With a total of 536 stocks, VYM offers unparalleled diversification, surpassing competing ETFs such as Schwab U.S. Dividend Equity ETF (SCHD) with 103 holdings and iShares Core High Dividend ETF (HDV) with 81 holdings.

Dividend Growth and Performance Metrics

VYM’s dividend yield of 2.69% may appear moderate when compared to HDV’s 3.62% and SCHD’s 3.57%. However, it compensates with its impressive 14-year dividend growth streak, underscoring its ability to sustain and grow payouts even during challenging market cycles. This consistency appeals to retirees and income-focused investors seeking predictable cash flows.

Performance-wise, VYM achieved a 17.6% NAV return in 2024, significantly outperforming its historical average since inception in 2006. Over a 5-year period, it delivered a 42% total return, closely matching SCHD’s 43%, showcasing its ability to generate strong total returns without sacrificing income.

In 2024, VYM’s exposure to Financials and Energy sectors boosted its performance, as higher federal fund rates and resilient energy prices provided tailwinds for earnings growth in these industries. Its ability to combine cyclical sector exposure with defensive holdings such as Procter & Gamble provides a balanced risk-return profile, appealing to conservative investors.

Competitive Analysis Against Peer ETFs

When compared to peers like HDV, DVY, and SCHD, VYM strikes a balance between total return and income generation. While SCHD and HDV have slightly higher dividend yields, VYM’s broader diversification reduces concentration risk and provides more consistent NAV performance over time. Additionally, VYM’s 0.06% expense ratio is lower than SCHD’s 0.06%, making it an efficient choice for long-term investors focused on cost efficiency.

While growth-focused ETFs like iShares Core Dividend Growth ETF (DGRO) outperformed VYM over the past decade with a 199% total return, VYM’s value-oriented tilt provides a more stable income stream, appealing to risk-averse investors seeking lower volatility. This distinction makes VYM particularly attractive in uncertain economic conditions or rising interest rate environments, where defensive stocks outperform.

Impact of Federal Reserve Policy on VYM

The Federal Reserve’s decision to maintain elevated federal fund rates has positively impacted VYM, particularly through its heavy allocation to Financials. Net interest income, a critical metric for banks, is expected to rise significantly in 2025. Banks such as JPMorgan Chase, Wells Fargo (WFC), and U.S. Bancorp (USB), all major components of VYM, have issued optimistic earnings forecasts for the upcoming year. This positions VYM as a potential outperformance candidate, provided interest rates remain elevated or decline gradually, supporting credit demand and loan growth.

However, a sharp decline in interest rates or unexpected Federal Reserve policy shifts could negatively impact the Financial sector’s profitability, presenting a key risk to VYM’s performance. Additionally, any significant downturn in the Energy sector could weigh on the ETF, given its 9.3% allocation to energy stocks.

Investment Case for Vanguard High Dividend Yield ETF

The Vanguard High Dividend Yield Index ETF (NYSEARCA:VYM) represents a compelling investment opportunity for income-focused investors seeking steady dividends and moderate capital appreciation. Trading at $130 per share with a 0.15% discount to NAV, VYM provides an efficient entry point for those looking to capitalize on its diversified portfolio and sector-leading dividend growth history.

VYM’s heavy allocation to Financials, coupled with its exposure to growth sectors like Technology, positions it well for 2025. Its inclusion of companies benefiting from macroeconomic trends, such as Broadcom’s AI-driven growth and JPMorgan’s rising net interest income, enhances its appeal. The ETF’s ability to balance cyclical growth with defensive stability makes it a versatile tool for portfolio diversification and income generation.

With consistent dividend growth, low fees, and strong long-term performance, VYM is a buy for conservative investors and retirees prioritizing income and stability. Its unique blend of value and yield ensures that it remains a standout choice in the competitive dividend ETF market. For real-time updates on VYM’s stock performance, visit VYM Real-Time Chart.