Will Bitcoin Push Beyond $108K or Correct Below $100K?

Bitcoin's rally to $108K sparks speculation—will strong whale demand and institutional interest sustain the price above $100K, or is a correction to $90K imminent? | That's TradingNEWS

Bitcoin Price Holds Above $100K Amid All-Time Highs and Volatility

Bitcoin Breaks Records Before Correcting

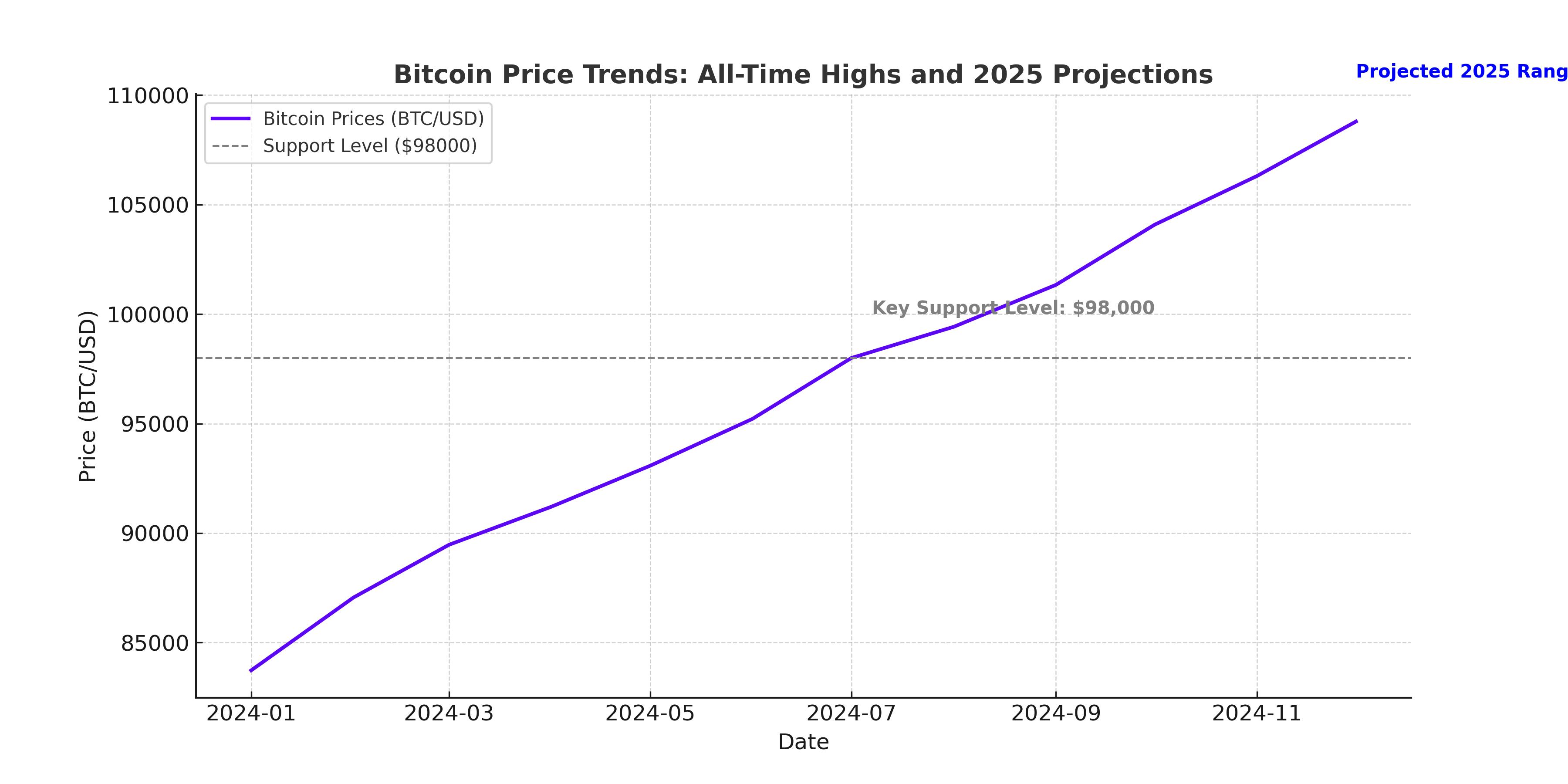

Bitcoin (BTC-USD) achieved a historic milestone, hitting an all-time high of $108,353 on December 17, before retreating slightly to trade near $105,000. The price surge followed strong whale activity and speculative bets fueled by pro-crypto sentiments from the incoming U.S. administration. The market witnessed a subsequent correction, erasing over $1.3 billion in open interest as Bitcoin’s value dropped below $104,000 temporarily. Whale clusters at $98,133 were highlighted as a significant support level, suggesting resilience in case of further declines.

Whale Accumulations and Supply Crunch

On-chain analytics revealed aggressive whale activity, with over 70,000 BTC purchased in a week, dwarfing the 900 bitcoins mined during the same period. This imbalance between demand and supply has driven Bitcoin’s sharp upward momentum, creating fears of an impending supply crunch. As Bitcoin remains scarce on exchanges, spot ETFs have accumulated $36 billion in assets, further intensifying the demand narrative.

Technical Patterns and Price Action

Bitcoin’s technical indicators underscore its current bullish trajectory. A cup-and-handle pattern emerged, signaling potential for further gains. However, a rising wedge on the daily chart suggests the possibility of a short-term reversal. The Relative Strength Index (RSI) recently rejected overbought levels and points downward, hinting at waning bullish momentum. Should BTC close below $101,109, a retest of the $90,000 support level could materialize.

Market Sentiment and Federal Reserve Impact

Bitcoin’s recent rally coincided with growing optimism over pro-crypto regulations under the Trump administration, including speculative discussions about a Strategic Bitcoin Reserve. However, caution remains as investors await the Federal Reserve's interest rate decision. A projected 25-basis-point rate cut could influence risk asset valuations, but a hawkish Fed tone may temper further price surges. Historically, Bitcoin thrives in environments of monetary easing, as investors shift away from low-yield traditional assets.

Liquidations and Market Corrections

The recent correction led to significant liquidations, with $420 million wiped out in 24 hours. Long traders bore the brunt, losing $54.1 million. This pattern reflects Bitcoin’s heightened volatility following record highs, with each significant price milestone triggering profit-taking and market resets. Despite the drop, Bitcoin quickly rebounded, signaling strong support above the $100K psychological level.

Institutional Activity and Corporate Demand

Institutional interest in Bitcoin continues to rise, with corporations like MicroStrategy bolstering their holdings amid price strength. Bitcoin's maturing narrative as a hedge against inflation and its increasing adoption as a reserve asset have driven demand from both corporations and governments. Spot ETFs and strategic accumulation strategies are reshaping the investment landscape, positioning Bitcoin as a competitor to traditional safe havens like gold.

Global Economic Drivers and Geopolitical Risks

Macro-economic factors such as inflationary pressures, dollar strength, and geopolitical tensions contribute to Bitcoin’s evolving price dynamics. China's looser monetary policies and the potential easing of U.S. sanctions on Iranian oil are expected to influence global risk sentiment, indirectly impacting Bitcoin. Concurrently, rising adoption in developing economies and the digital yuan rollout underline Bitcoin’s global appeal.

Outlook for 2025: Can Bitcoin Sustain Its Momentum?

Bitcoin’s trajectory in 2025 hinges on several factors, including Federal Reserve policies, whale activity, and corporate adoption. With analysts predicting a $200K target by year-end 2025, BTC remains an attractive long-term bet. The digital asset’s ability to weather corrections and swiftly recover bodes well for its upward potential. As BTC sustains levels above $100K, it sets the stage for increased prestige and broader adoption, making it a strong candidate for continued upside in the coming year.

Bitcoin remains resilient, supported by strong fundamentals and institutional backing, solidifying its status as the premier cryptocurrency.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex