Will Bitcoin Rise Soon ? A Comprehensive Analysis of BTC's Future

Examining Market Trends, Historical Cycles, and Expert Predictions to Uncover Bitcoin's Growth Potential in 2024 | That's TradingNEWS

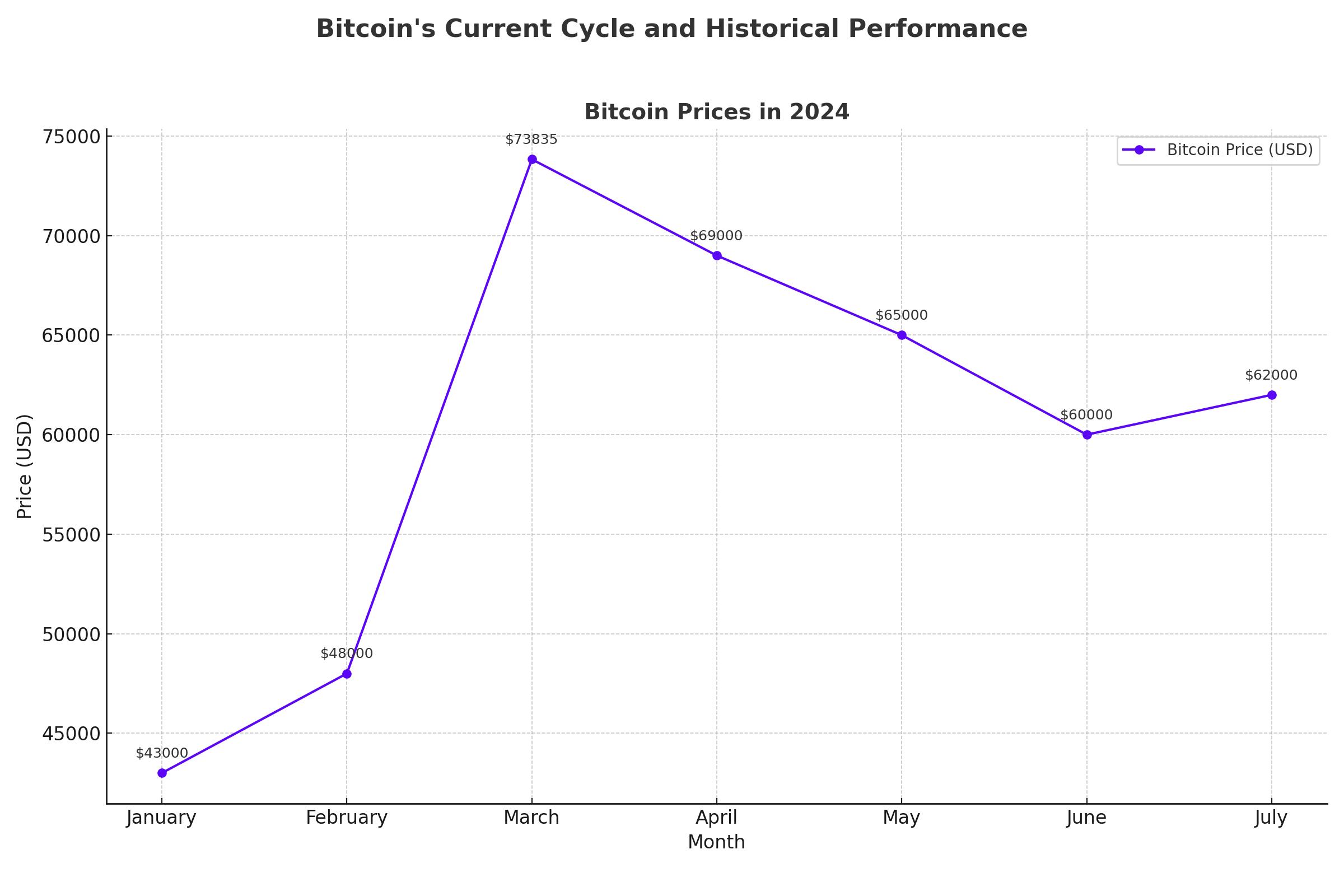

Bitcoin's Current Cycle and Historical Performance

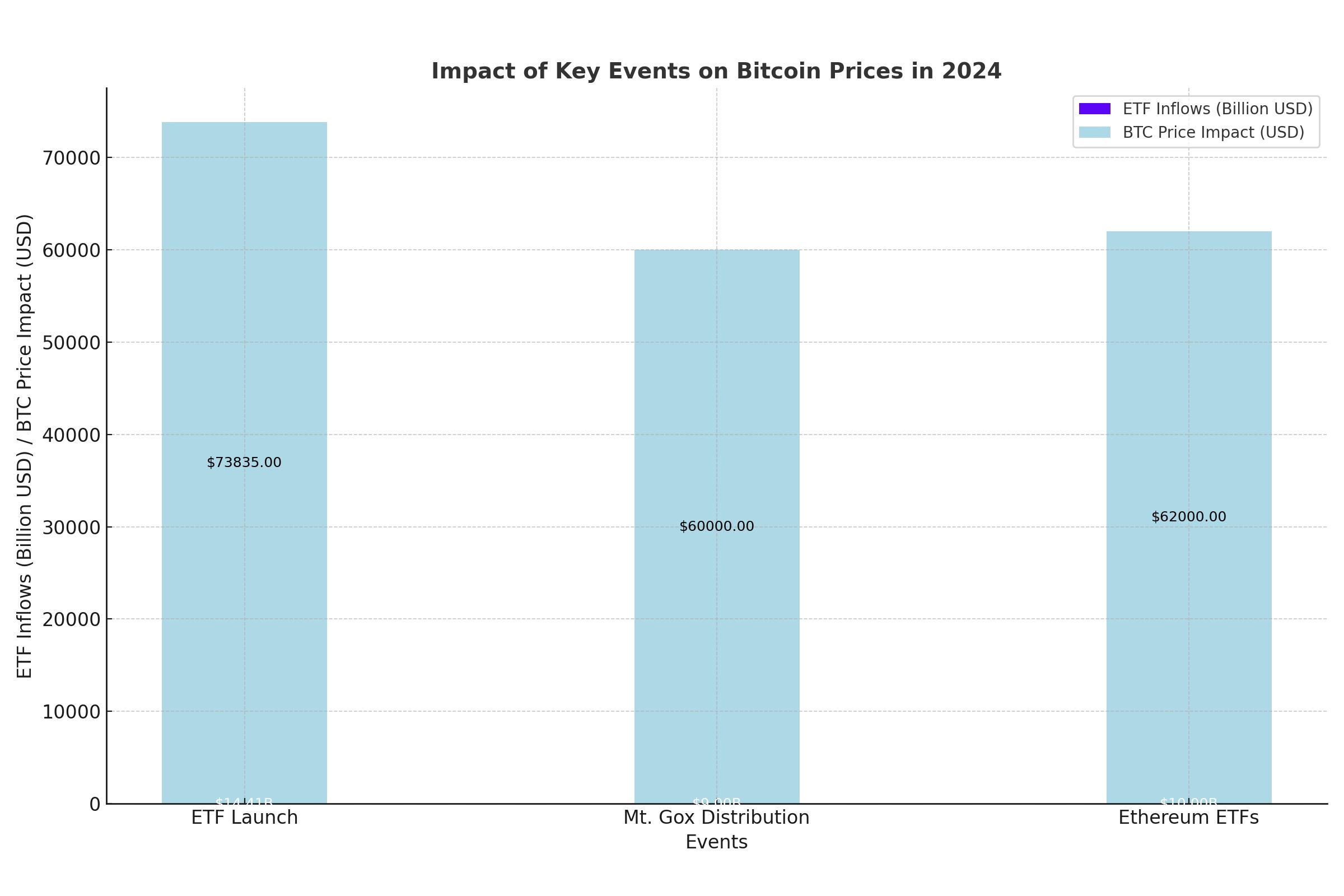

Bitcoin (BTC) has experienced a significant journey in 2024, with its price hitting an all-time high of $73,835 in March. Since then, Bitcoin has traded between $59,000 and $72,000. The primary driver behind this record high was the approval and launch of spot bitcoin exchange-traded funds (ETFs) in the U.S. in January, attracting net inflows of approximately $14.41 billion. These ETFs have provided an accessible way for investors to gain exposure to Bitcoin without directly owning the cryptocurrency, thereby legitimizing the asset class and facilitating larger institutional investments.

Impact of Halving and Historical Trends

Bitcoin's cycles have historically been influenced by the halving event, where the reward for mining new blocks is halved, reducing the supply of new bitcoins. Typically, Bitcoin reaches a new high months after a halving event. However, in this cycle, Bitcoin reached its peak before the halving due to the bullish sentiment around U.S. ETFs. According to CCData's research, historical patterns suggest that Bitcoin's price expansion period following halving can last from 366 to 548 days. Given that the last halving occurred on April 19, 2024, Bitcoin has yet to complete this potential growth period.

Institutional Influence and Market Dynamics

Institutional participation has significantly altered the trends in Bitcoin's current cycle. Despite low trading activity, as observed in the past two months following the halving, CCData suggests that any sideways price action is temporary, and Bitcoin is likely to breach previous all-time highs by the end of the year. The anticipated launch of Ethereum ETFs and other similar products globally is expected to inject further capital, liquidity, and demand into the crypto market.

Market Sentiment and Price Predictions

Market sentiment towards Bitcoin remains mixed. Concerns about large BTC sales from the defunct Mt. Gox exchange, set to distribute assets stolen in a 2014 hack, have created bearish sentiment. Mt. Gox will begin repayments in Bitcoin and Bitcoin Cash, which could add selling pressure to the market. Despite this, some analysts, such as Tom Lee from Fundstrat Global Advisors, maintain a bullish outlook, predicting Bitcoin could reach $150,000 after the Mt. Gox distributions are completed.

Federal Reserve Policies and Macroeconomic Factors

Bitcoin's price dynamics are also influenced by broader macroeconomic factors, including Federal Reserve policies. Recent discussions have centered around potential interest rate cuts, with the Fed indicating just one cut in 2024 and more in 2025. The Fed's decision-making, especially regarding rate cuts, is closely watched by crypto and stock market traders as it impacts liquidity and investment flows.

Short-Term Market Movements and Technical Analysis

In recent trading, Bitcoin experienced declines during Asian hours, dropping to $60,900 from over $62,000. This drop coincided with outflows from U.S.-listed ETFs tracking Bitcoin, breaking a five-day streak of inflows. The potential large BTC sales from Mt. Gox have contributed to this bearish sentiment. However, analysts like Tom Lee remain optimistic, suggesting that the removal of the Mt. Gox overhang could lead to a sharp rebound in the second half of the year.

Long-Term Predictions and Future Prospects

Looking ahead, Bitcoin's price is expected to reach new highs. Standard Chartered predicts Bitcoin could hit $100,000 by the U.S. presidential elections in November 2024, with further growth anticipated into 2025. Analyst Quinn Thompson from Lekker Capital also aligns with this prediction, indicating strong market confidence in Bitcoin's future performance.

On-Chain Metrics and Market Indicators

On-chain metrics provide additional insights into Bitcoin's market behavior. Charles Edwards from Capriole Investments highlighted the Bitcoin long-term holder (LTH) inflation rate and the Bitcoin Dormancy Flow as key indicators. The LTH inflation rate, currently at 1.9, suggests market inflation nearing a critical threshold, while the rising Bitcoin Dormancy Flow indicates increased coin spending relative to the overall trend. Historically, peaks in these metrics have preceded cycle tops by about three months, suggesting potential volatility ahead.

Conclusion

Bitcoin's market remains dynamic and influenced by a combination of historical trends, institutional activities, macroeconomic factors, and technical indicators. While short-term fluctuations are expected, the long-term outlook for Bitcoin remains positive, with potential for significant price appreciation driven by institutional adoption, macroeconomic conditions, and the broader acceptance of cryptocurrencies. Investors should stay informed about market developments and consider both the risks and opportunities presented by this evolving asset class.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex