WTI Crude Oil: Technical Analysis and Market Dynamics

Geopolitical Tensions and Economic Data Propel Oil Price Surge | That's TradingNEWS

WTI Crude Oil: Technical Analysis and Market Dynamics

Current Price Movements and Market Dynamics

Crude oil prices have experienced notable fluctuations recently, with West Texas Intermediate (WTI) trading around $75 per barrel and Brent crude slipping below $80 per barrel. As of the latest data, WTI is priced at $74.73, while Brent stands at $78.63. These declines are primarily driven by concerns over an economic slowdown in China, the world's largest oil importer. Analysts predict that China's manufacturing activity will shrink for the third consecutive month, with Citi lowering its GDP growth forecast for China to 4.8% from 5%.

Impact of Chinese Economic Data on Oil Demand

China's weakening economic data continues to exert pressure on oil prices. In the first half of 2024, China’s total fuel oil imports dropped by 11%, raising significant concerns about global demand. This decline has been a crucial factor in the recent price retreat, overshadowing other market influences such as U.S. shale production and geopolitical tensions.

Geopolitical Influences on Oil Prices

The recent election results in Venezuela have added another layer of complexity to the global oil market. Nicolas Maduro's victory might lead the United States to tighten sanctions on Caracas, potentially reducing Venezuelan oil output by 100,000 to 120,000 barrels per day. This geopolitical tension adds further uncertainty to a market already grappling with supply and demand challenges.

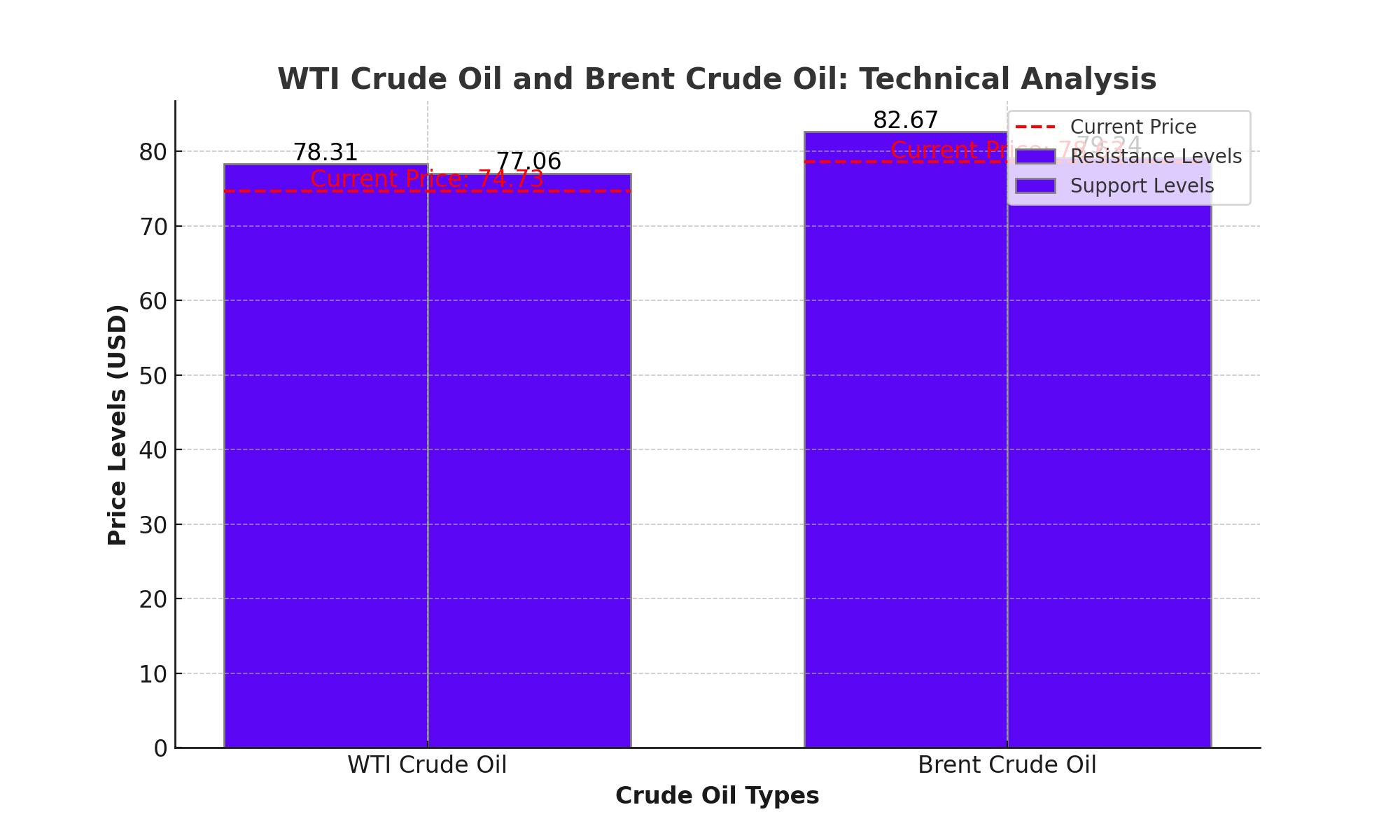

Technical Analysis of WTI and Brent Crude

From a technical perspective, WTI crude oil is testing the $75 level, a critical support area that may attract some buying interest. Similarly, Brent crude is hovering around $78.50, near the bottom of a significant symmetrical triangle on the charts. Both benchmarks are in a precarious position, with potential for either a bounce or further declines depending on upcoming economic data and geopolitical developments.

The Role of the U.S. Federal Reserve and OPEC

The Federal Reserve's upcoming meeting is anticipated to significantly influence oil prices. While there is speculation about potential interest rate cuts, any decisions will likely have a ripple effect on economic activity and oil demand. Additionally, OPEC's monitoring meeting could lead to market shifts. Despite expectations, it is unlikely that production cuts will be rolled back given the current price environment.

U.S. Shale Sector and M&A Activity

The U.S. shale sector has witnessed a wave of transactions, signaling strategic shifts among industry players. Recent deals include ConocoPhillips' $22.5 billion acquisition of Marathon Oil and Occidental Petroleum's sale of assets in Texas and New Mexico for $818 million. These moves underscore the industry’s focus on consolidating resources and optimizing production in a maturing market.

Middle East Tensions and Their Impact

Recent geopolitical tensions in the Middle East have significantly impacted global oil markets. The resurgence of conflict has been marked by Israeli airstrikes targeting key figures within Hezbollah and Hamas. The most notable event was the assassination of Hamas leader Ismail Haniyeh in Iran, which has heightened fears of a broader regional conflict. These tensions have immediate and profound implications for oil prices and supply security.

Following the assassination, Brent crude prices surged nearly 3%, reaching $80.81 per barrel. This price spike reflects market anxieties about potential disruptions to oil supplies, particularly through the Strait of Hormuz. The Strait is a critical chokepoint for global oil transit, with roughly a fifth of the world's oil supply passing through it daily. Any threats to this vital passage can cause substantial volatility in oil prices.

Saudi Arabia's Economic Contraction

Saudi Arabia's economy contracted again in the second quarter of 2024, driven by an 8.5% dip in oil activities as the Kingdom implements OPEC+ production cuts. The Saudi GDP shrank by 0.4% year-over-year, with oil exports still constituting the majority of government income. Despite efforts to diversify its economy, Saudi Arabia remains heavily dependent on crude production and exports.

Future Outlook for Oil Prices

The outlook for oil prices remains bullish amid ongoing geopolitical tensions in the Middle East. The recent surge in Brent crude prices to $80.81 per barrel, driven by heightened fears of broader regional conflict, underscores the potential for further increases. Analysts are optimistic that continued supply disruptions from the region, coupled with robust U.S. demand, will sustain upward pressure on prices. Additionally, potential actions from OPEC to manage output could further tighten supply. Despite the current volatility, these factors suggest a strong possibility for oil prices to maintain their upward trajectory, with the market closely monitoring geopolitical developments and economic indicators.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex