Big Buy - Unleash Potential with Invesco RWJ SmallCap 600 ETF

Uncover the robust growth potential and strategic advantages of the Invesco NYSEarca:RWJ SmallCap 600 ETF in today's volatile market | That's TradingNEWS

In-Depth Analysis: Invesco S&P SmallCap 600 Revenue ETF (NYSEarca:RWJ) and Its Market Dynamics

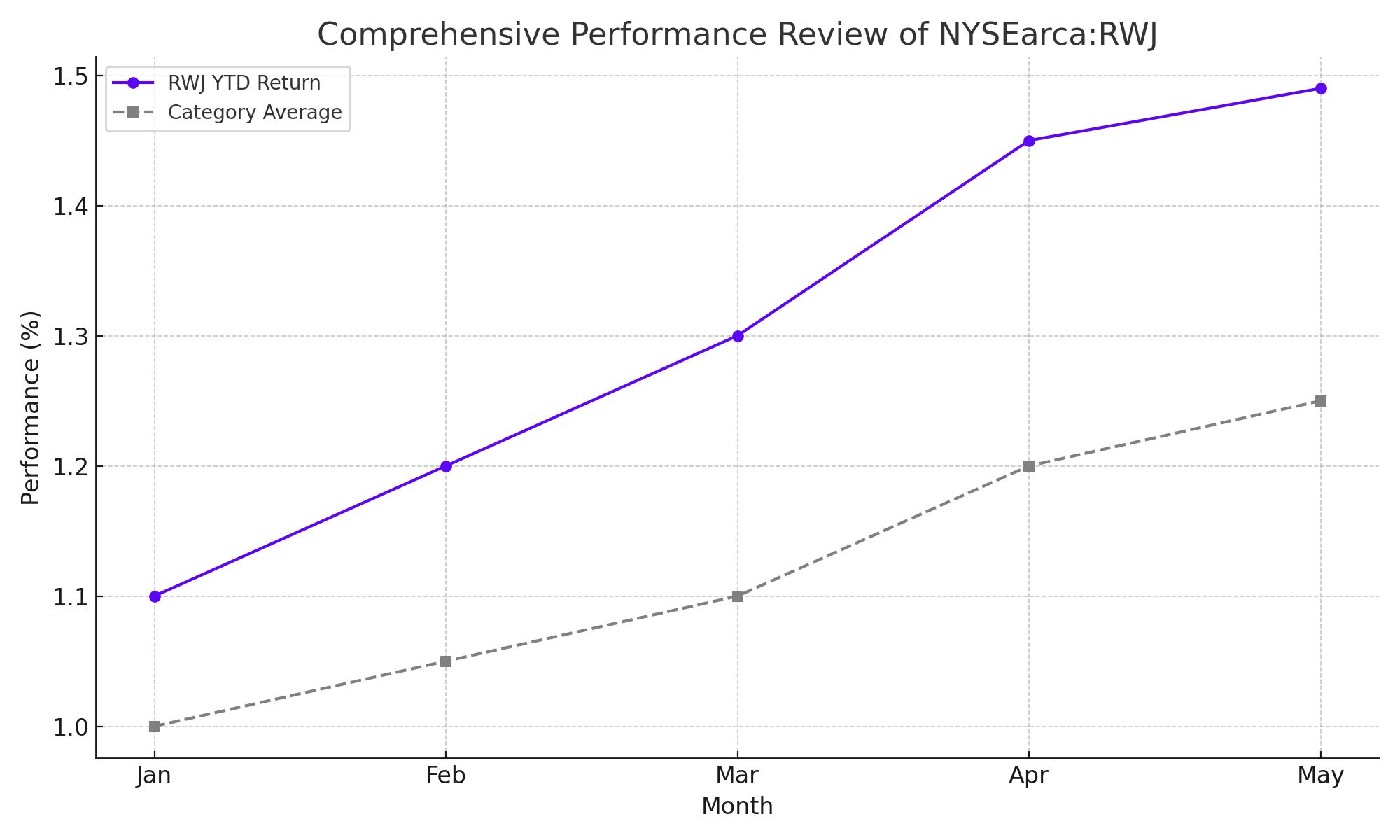

Comprehensive Performance Review of NYSEarca:RWJ

The Invesco S&P SmallCap 600 Revenue ETF (RWJ) represents a strategic approach to small-cap investing by focusing on companies within the S&P SmallCap 600 Index that demonstrate solid revenue generation. Despite recent market fluctuations that have impacted broader indices, RWJ has managed to post a YTD return of 1.49%, slightly outpacing its category average of 1.25%. Over the last year, the ETF has gained an impressive 16.37% compared to the category’s 15.77%, underscoring its resilience amidst economic uncertainties.

For a real-time analysis of RWJ's performance, visit the trading chart here.

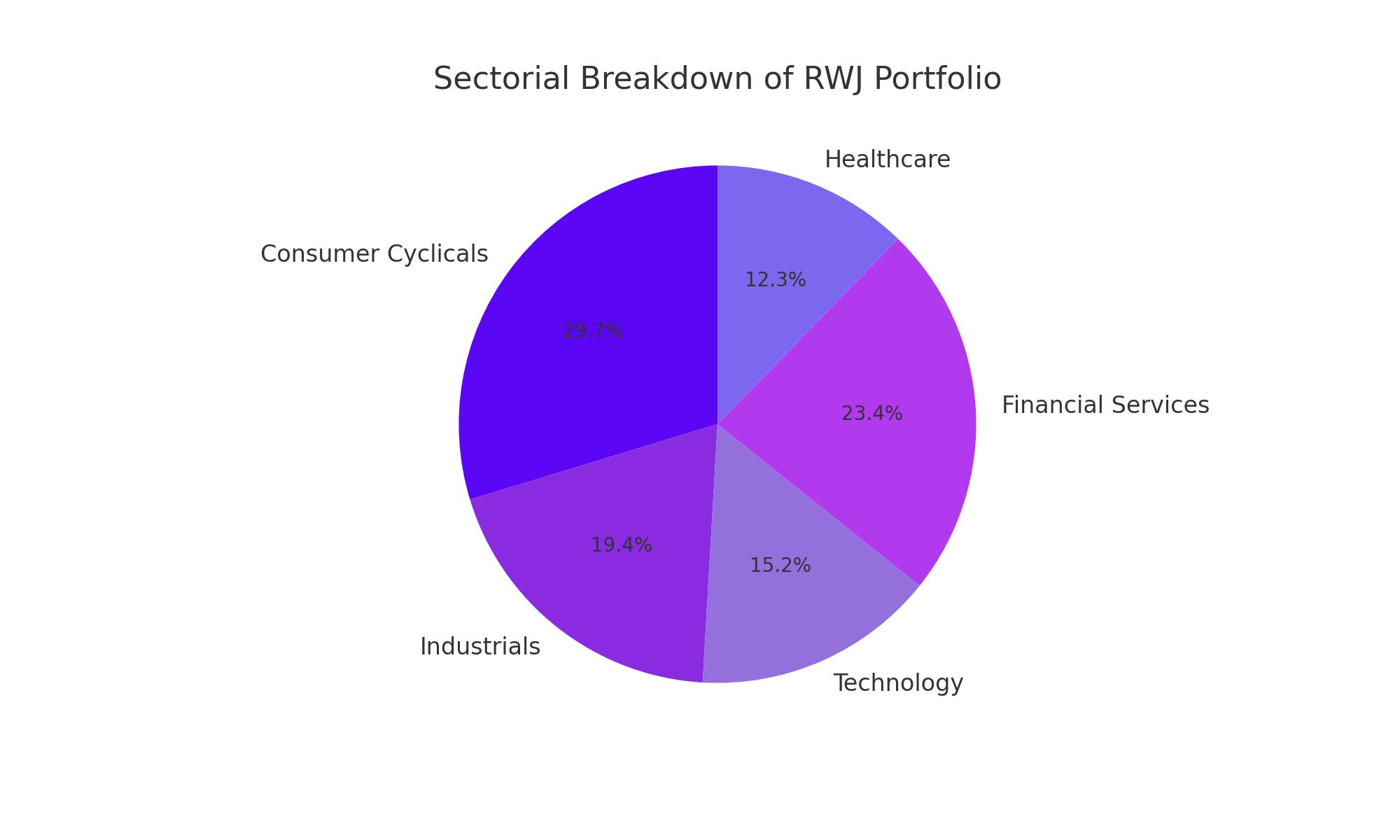

Sectorial Breakdown and Top Holdings Insights

RWJ is heavily invested in sectors that reflect the broader economic shifts, with significant allocations in consumer cyclicals and industrials, which account for 24.36% and 15.89% of its portfolio, respectively. Notably, the ETF's top holdings include prominent firms like World Kinect Corporation and United Natural Foods, emphasizing a diverse range of industries from automotive to technology, which enhances its risk management and potential for growth.

Check out detailed insider transactions and stock profiles for more insights.

Market Adaptability and Future Outlook

In response to evolving market conditions, RWJ has adopted a dynamic investment strategy. The ETF aims to mirror the performance of the S&P SmallCap 600 Revenue-Weighted Index, which involves quarterly rebalancing to maintain alignment with market movements. This adaptability is crucial for managing the shifts seen in small-cap markets, particularly in response to macroeconomic changes such as interest rate adjustments and inflationary pressures.

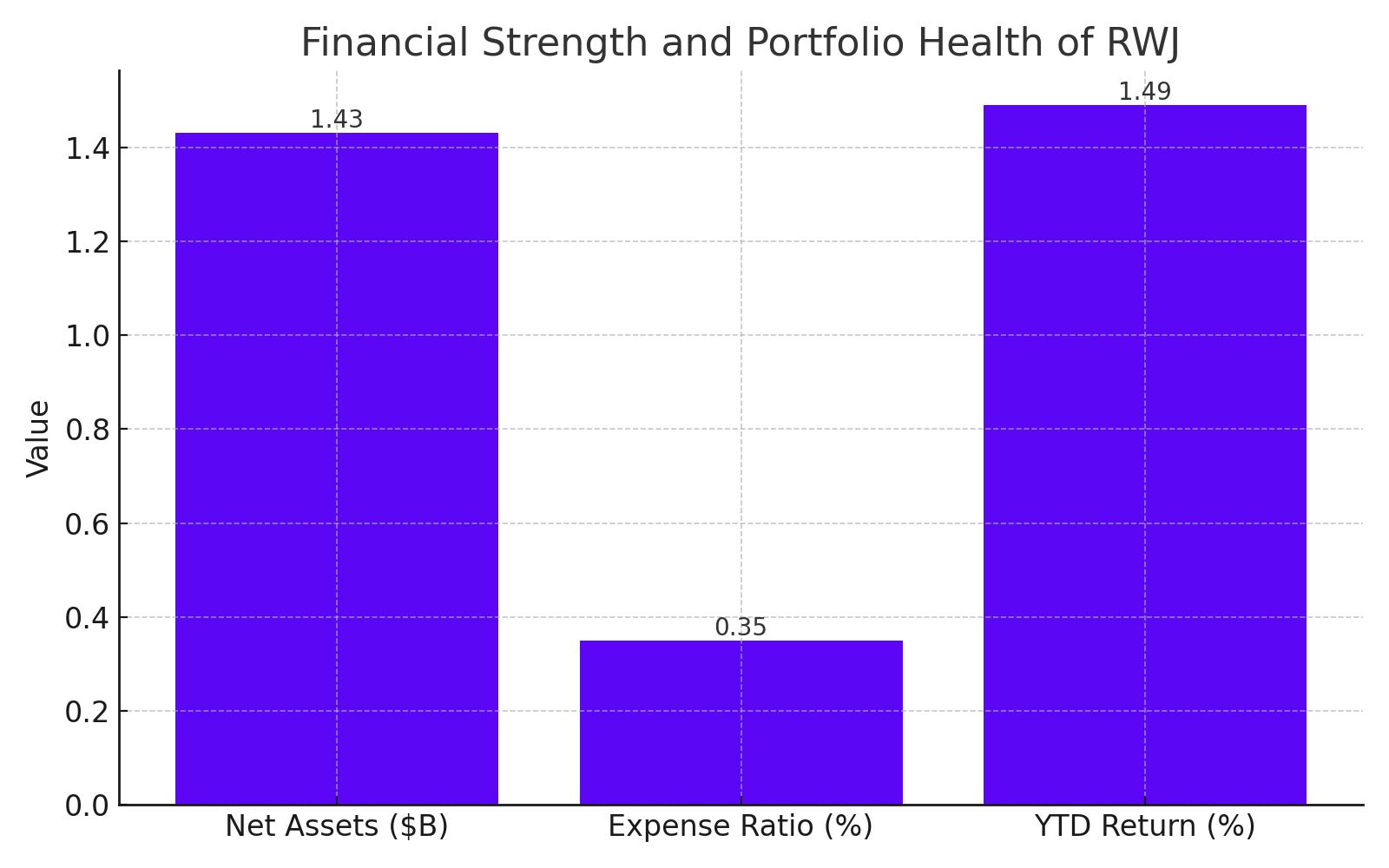

Financial Strength and Portfolio Health

RWJ's financial metrics reveal a robust framework geared towards sustained growth. With net assets of $1.43 billion and a moderate expense ratio, the ETF is positioned to leverage market opportunities effectively. Despite a slight decline in year-to-date returns, the ETF's strategic positioning and revenue-weighted approach provide a solid foundation for potential growth, especially in a recovering economy.

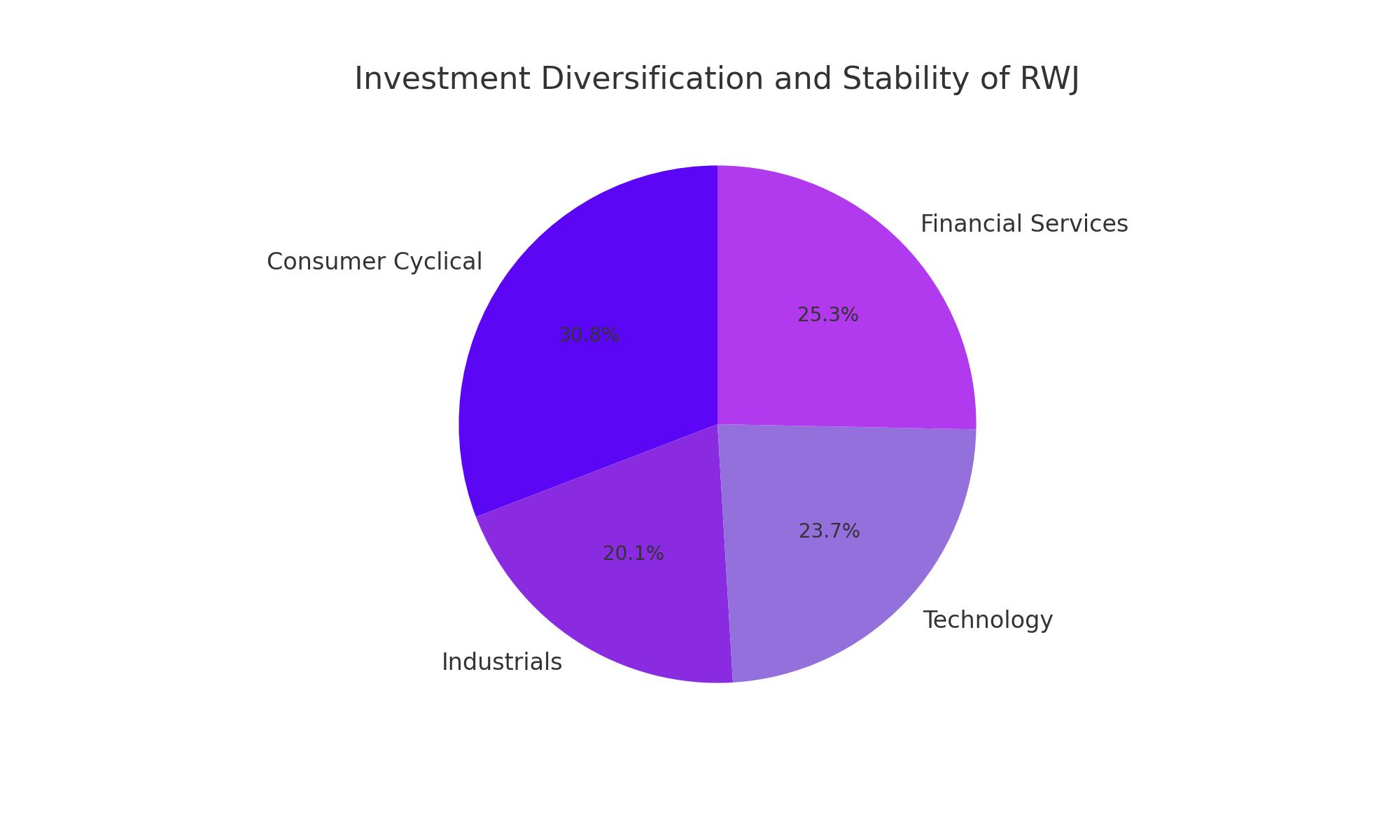

Evaluation of Investment Diversification and Stability

RWJ's strategic investment framework focuses on diversifying across various sectors to mitigate risks and capitalize on growth opportunities in different market segments. The ETF’s sector allocations include Consumer Cyclical (24.36%) and Industrials (15.89%), along with notable investments in Technology and Financial Services, which add layers of potential growth and stability to the portfolio. This diversified approach helps balance the fund's exposure to sector-specific downturns, making it a potentially resilient investment in fluctuating markets.

Price and Valuation Metrics

The fund's valuation metrics, such as its Price/Earnings ratio of 3.73 and Price/Sales ratio of 3.44, are indicative of its positioning in the market relative to its earnings capability and sales performance. These ratios suggest that RWJ may be undervalued compared to the broader market, presenting a potentially attractive entry point for investors seeking value in the small-cap space.

Yield and Return Analysis

With a yield of 1.32% and a trailing 1-year return of 16.37%, RWJ offers a compelling case for investors looking for steady income combined with capital appreciation. The ETF’s performance, particularly its ability to outperform its category average, highlights its effective strategy and management’s ability to navigate market challenges.

Risk Management and Performance Consistency

RWJ's beta of 1.07 signifies a moderate correlation with the market, suggesting that while it moves with the market to a degree, it does not typically experience the full extent of market volatility. This is crucial for investors who prefer investments that do not stray too far from market movements but still offer the potential for differential returns.

Long-term Performance and Market Trends

Over a more extended period, RWJ has demonstrated a capacity for robust returns, with a 5-year return of 13.38% and a 10-year return of 9.47%. These returns are significantly higher than the category averages, illustrating the fund’s strong performance in the small-cap sector over time. This consistent performance is indicative of a well-managed strategy that leverages long-term market trends and economic cycles effectively.

Liquidity and Market Accessibility

With an average trading volume of 167,130 shares, RWJ offers good liquidity, making it easier for investors to enter or exit positions without significant price impacts. This liquidity is essential for retail and institutional investors alike, providing the flexibility needed to adjust portfolio allocations in response to changes in investment strategy or market conditions.

Conclusion on Investment Viability

In conclusion, the Invesco S&P SmallCap 600 Revenue ETF (RWJ) stands out as a robust investment option within the small-cap universe. Its strategic focus on revenue-generating companies, combined with a disciplined approach to sector diversification and risk management, positions it well for potential growth amidst market uncertainties. The fund’s historical performance, attractive valuation metrics, and commitment to regular rebalancing reinforce its appeal to investors seeking diversified exposure to the small-cap sector with a revenue-focused investment philosophy.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex