Brent Surges to $72.88 as OPEC+ and U.S. Drawdowns Shake Oil Markets

Geopolitical shocks and bullish U.S. inventory data spark a crude oil rebound, with OPEC+ cuts and winter demand shaping Brent and WTI trajectories | That's TradingNEWS

Oil Prices Edge Higher Amid Geopolitical Shifts and OPEC+ Decisions

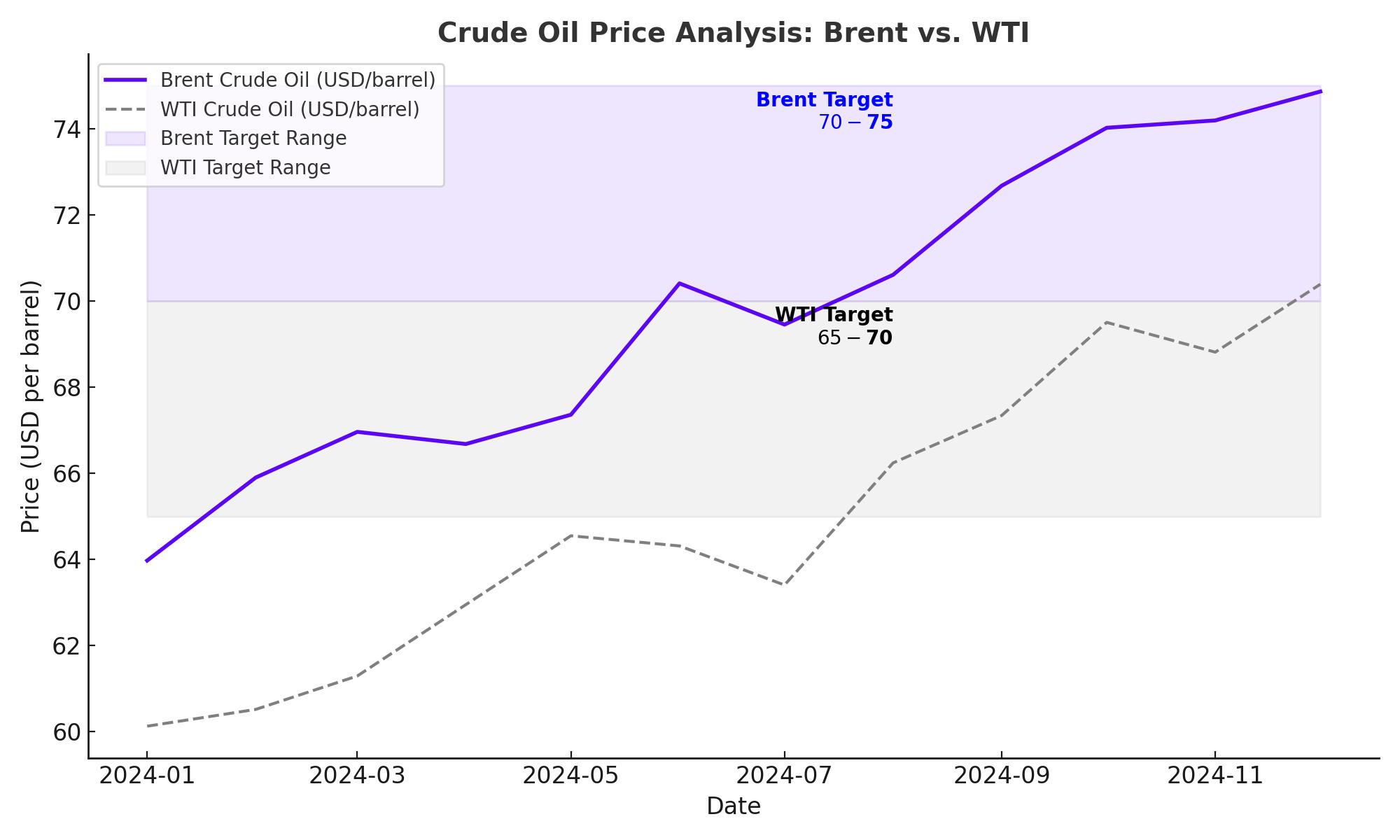

Crude oil prices are experiencing a period of fluctuation, influenced heavily by geopolitical events and upcoming OPEC+ decisions. As of today, Brent crude is trading at $72.88 per barrel, while West Texas Intermediate (WTI) stands at $68.80. This slight recovery comes on the heels of recent volatility tied to the Israel-Hezbollah ceasefire announcement, which raised both hopes and skepticism among market participants. Despite a temporary dip following the ceasefire declaration, subsequent Israeli airstrikes on Lebanon have injected uncertainty, dampening expectations of long-term regional stability. Market watchers are keenly assessing the ceasefire's viability, as sustained peace could alleviate risk premiums in oil prices. Hiroyuki Kikukawa of Nissan Securities anticipates WTI trading within a $65-$70 range, factoring in variables such as Northern Hemisphere winter conditions, potential shale production growth under the Trump administration, and demand recovery in China.

OPEC+ Meeting Looms: Production Cuts Under Scrutiny

The spotlight is now on OPEC+ as the group prepares for its December 1 meeting. Industry heavyweights like Goldman Sachs and Morgan Stanley argue that oil prices remain undervalued, citing market deficits and risks to Iranian supply amid potential sanctions. OPEC+ producers, led by Saudi Arabia and Russia, are expected to maintain their current 2.2 million barrels per day (bpd) voluntary cuts until Q1 2025, as weaker global demand and rising non-OPEC+ output cast doubt on any production increases. Goldman Sachs anticipates a "data-driven" approach to any production adjustments, suggesting gradual shifts contingent on market conditions. Similarly, commodity traders Vitol and Trafigura predict no immediate surge in OPEC+ output following the meeting, reinforcing a stable outlook for crude prices.

U.S. Inventory Drawdowns Provide Support Adding to the bullish sentiment

The American Petroleum Institute (API) reported a significant 5.94 million-barrel drop in U.S. crude inventories for the week ending November 22, exceeding analyst expectations of a 600,000-barrel decline. This marks the largest inventory draw since August and underscores tightening supply conditions. If corroborated by the Energy Information Administration (EIA), these figures could provide additional upward pressure on oil prices. Cushing, Oklahoma, the critical delivery hub for U.S. crude futures, also recorded a 734,000-barrel inventory decline, reflecting robust demand. However, Strategic Petroleum Reserve (SPR) inventories rose by 1.2 million barrels, signaling a nuanced supply picture. U.S. Policy and Tariff Implications for Oil Markets U.S. domestic policies are further complicating the global oil landscape. President-elect Donald Trump’s proposed 25% tariffs on imports from Mexico and Canada could potentially include crude oil, disrupting North American energy trade. Such measures would likely ripple through global markets, amplifying volatility. Meanwhile, U.S. shale producers are positioned to ramp up output, potentially offsetting OPEC+ production cuts. However, logistical and regulatory challenges may temper this growth, leaving the global supply-demand balance precariously poised.

Demand Dynamics: China and Seasonal Factors

China, the world's largest oil importer, remains a pivotal player in shaping crude demand. As the country’s economy shows signs of recovery, oil consumption is expected to rise, providing a tailwind for prices. Additionally, the onset of the Northern Hemisphere winter typically boosts energy demand, particularly for heating oil, further supporting the market. Conversely, weaker-than-expected demand from Europe and ongoing energy efficiency initiatives could act as headwinds, creating a tug-of-war dynamic in global consumption patterns.

Guyana's Role in Global Supply

On the supply side, ExxonMobil's operations in Guyana’s Stabroek block have emerged as a critical factor. With production exceeding 650,000 bpd and targets set to reach 1.3 million bpd by 2027, Guyana’s light sweet crude is attracting significant international interest. Indian Prime Minister Narendra Modi recently expressed a desire to secure Guyanese oil, underscoring the strategic importance of this emerging player. However, logistical hurdles and Exxon's existing commitments could delay new supply agreements.

Market Sentiment and Technical Outlook

From a technical perspective, Brent crude faces immediate resistance at $73.13 per barrel, while support levels are firm at $72. A break above this resistance could signal bullish momentum, potentially targeting $75. Conversely, a breach below $70 may open the door to further declines. WTI mirrors this pattern, with key resistance at $69.50 and support at $68. Should geopolitical tensions ease and OPEC+ maintain its current course, prices are likely to stabilize within the $65-$70 range in the short term.

Conclusion

Crude oil markets remain in a state of flux, influenced by an intricate web of geopolitical developments, policy shifts, and market fundamentals. With the OPEC+ meeting just days away and U.S. inventory data providing critical insights, all eyes are on whether the current stability will hold or give way to renewed volatility. Further analysis is necessary to determine the medium- to long-term trajectory of oil prices, factoring in evolving supply-demand dynamics and macroeconomic conditions.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex